How Much Could You Save by Comparing Auto Insurance?

Looking into auto insurance may seem routine, but it can directly affect how much you spend each year. Prices and coverage can vary a lot between providers, and many people end up overpaying without realizing it.

In this post, you'll find out why comparing policies is important, what details to pay attention to, and how to find the right option for your car and your budget.

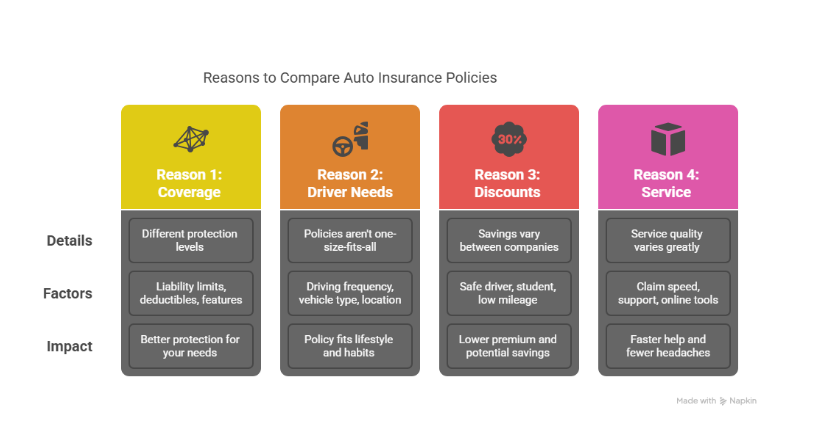

Why Comparing Auto Insurance Policies Matters

One of the most common mistakes drivers make is assuming all insurance plans cost the same. The truth is, two companies can offer very different rates for similar coverage. If you skip comparing, you might be paying hundreds more each year for no added benefit.

Taking the time to compare quotes also shows you what’s really out there. Some providers charge more simply because they can. Let’s break down why comparing is important:

1. Not All Coverage Is the Same: What to Check Before Choosing

Policies may seem similar, but details make a big difference when it comes to protection. A lower premium might mean less coverage than you think. When reviewing options, look closely at:

- Liability limits: Make sure they match your actual risk level.

- Collision and comprehensive coverage: These protect your vehicle in accidents and unexpected events.

- Deductibles: A higher deductible can lower your premium, but it also means more out-of-pocket cost if you file a claim.

- Extra features: Things like roadside assistance, rental car coverage, or glass repair matter when things go wrong.

2. Every Driver Has Different Needs

Auto insurance isn’t one-size-fits-all. What works for someone in a rural area may not suit a city driver, and new drivers often need different coverage than someone with years of experience. Think about your situation:

- How often do you drive?

- What type of vehicle do you own?

- Do you live in a high-traffic area?

- Have you installed safety features like dash cams or alarms?

Some companies offer better rates for low-mileage drivers or for those who meet specific profiles. Others might focus on families, students, or retirees.

📍Comparing quotes helps you spot which provider fits your lifestyle and habits, not just the average driver. Matching your policy to your real needs gives you better value and more relevant protection.

3. Discounts You Might Be Missing

Insurance companies don’t all offer the same discounts, and some of them can lower your premium by a lot. If you don’t compare, you might never know what savings you're leaving behind. Look out for these common discounts:

- Safe driver: For those with a clean record.

- Student or senior: Age-specific savings based on your profile.

- Low mileage: If you drive less than average.

- Bundling policies: Combining home and auto insurance with the same company.

📍Make sure you always ask what discounts apply to you. They’re not always advertised, but they can make a real difference.

4. It’s Not Just About Price, Service Matters Too

A cheaper policy might seem like the best deal, but what happens when you need to file a claim? Some companies take too long, offer poor communication, or make the process frustrating. Before you decide, consider:

- Claim handling speed

- Customer support quality

- Availability of online tools or mobile apps

- User reviews and real experiences

📍Sometimes, paying a little more means getting faster help and fewer headaches when things go wrong. Talking to friends or checking reviews can reveal a lot that a price tag doesn’t show.

5. Online Tools Make Comparing Easy

Years ago, checking insurance quotes meant calling different agents one by one. Now, you can compare multiple offers in minutes, all from your phone or laptop.

Some helpful platforms include:

📍Taking a few minutes with these tools makes comparing quotes faster and more accurate. It’s a simple way to stay informed and in control of your decision.

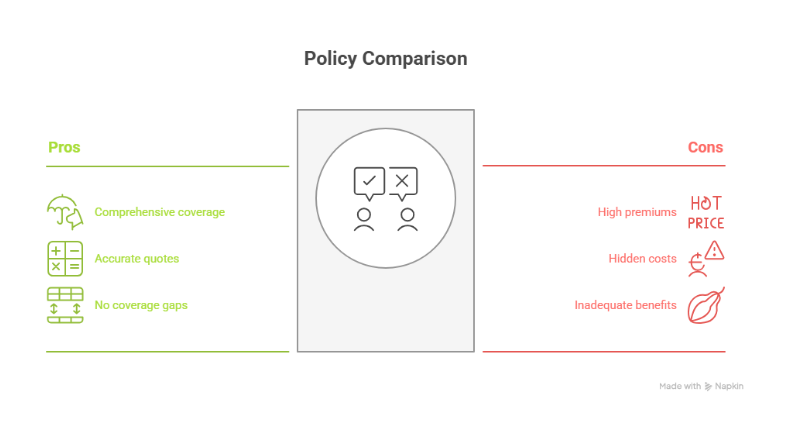

Common Mistakes to Avoid When Comparing Policies

Looking at prices is just the start. A few small oversights can lead to weak coverage or unexpected costs. Keep these tips in mind:

- Don’t focus only on the monthly premium; always check the deductible.

- Review the actual coverage included; some low-cost plans cut important benefits.

- Be honest about your driving history, incorrect details can mess up final quotes.

- Never cancel your current policy before the new one starts; it’s better to have a slight overlap than a coverage gap.

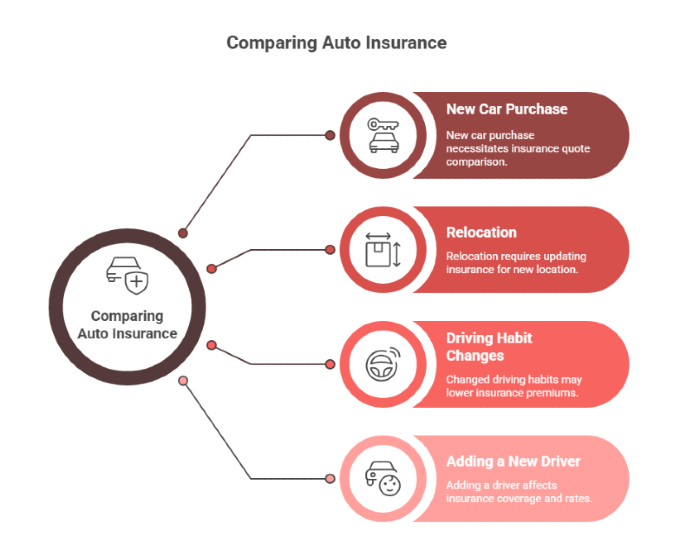

When Should You Compare Your Auto Insurance?

Checking your policy once a year is a good habit, but it’s not the only time to do it. Life changes can affect your rates and coverage needs. It’s worth comparing quotes if:

- You bought a new car

- You moved to a new city or state

- Your driving habits changed (like commuting less)

- You added a new driver to your household

Sticking with the same provider for years without checking others often means missing out on better deals. A periodic comparison can help you keep your costs low and your coverage up to date.

Find Better Auto Insurance in Minutes with Mila

Taking time to compare auto insurance policies helps you save money and avoid gaps in coverage. With numerous tools available, it’s easier than ever to find a plan that suits your needs. Check regularly, ask questions, and choose a policy that truly works for you.

One of the best platforms to start with is Mila, which gives you fast, side-by-side comparisons adapted to your profile. Check regularly, ask questions, and choose a policy that truly works for you.

Why Trust Mila to Find the Right Auto Insurance for You?

Overpaying for car insurance is more common than you think. Mila helps you skip the inflated rates by connecting you directly with trusted insurers that offer legal, affordable options tailored to your needs. Here’s what makes us a solid choice for you:

- Quick, free quotes: Answer a few questions and see your options in minutes.

- No middleman costs: Mila works efficiently, avoiding extra fees and passing the savings to you.

- Complete protection: With coverage that includes Collision, Liability, and Injury, you’ll avoid gaps and stay fully protected on the road.

Start comparing with Mila to get your free quotes today and see how much you could save.

Frequently Asked Questions (FAQs) About Comparing Car Insurance Policies

Why should I compare auto insurance quotes?

Comparing quotes helps you find better prices, more complete coverage, and discounts that you might miss with just one provider. It’s one of the easiest ways to save money each year.

What’s the most important thing to look for in a policy?

Look beyond the monthly price. Focus on liability limits, deductibles, and whether the coverage truly fits your needs. A cheaper plan isn’t better if it leaves you unprotected.

Can I switch insurance providers anytime?

Yes, you can switch at any time. Just make sure your new policy starts before the old one ends to avoid coverage gaps.

Do all companies offer the same discounts?

No. Discounts vary widely. Some providers offer bundling, student, or safe driver discounts, others don’t. That’s why comparing quotes is so important.

Can I buy my policy directly through Mila?

Yes. Once you choose the best offer, you can complete your purchase through the Mila platform, making the process simple and quick.