What is Comprehensive Auto Insurance Coverage?

When shopping for auto insurance, especially for the first time, it’s easy to get lost in a sea of unfamiliar terms. One that often gets overlooked or misunderstood is comprehensive auto insurance. Despite its name, it doesn’t cover everything, but what it does protect you from might surprise you.

If you're comparing policies or buying auto insurance for the first time, this guide will help you understand exactly what comprehensive coverage is, what it includes, and how to decide if it’s the right fit for your vehicle and lifestyle.

What Is Comprehensive Auto Insurance Really About?

No jargon here. It’s coverage for the weird stuff, things that can damage your car when you’re not driving. Think natural disasters, theft, vandalism, and falling tree branches. Stuff that’s out of your control.

For example:

A woman had her car totaled when a fallen tree branch struck it during a thunderstorm. She wasn’t even in the car. Without comprehensive coverage? She’d have been stuck paying for the damage herself.

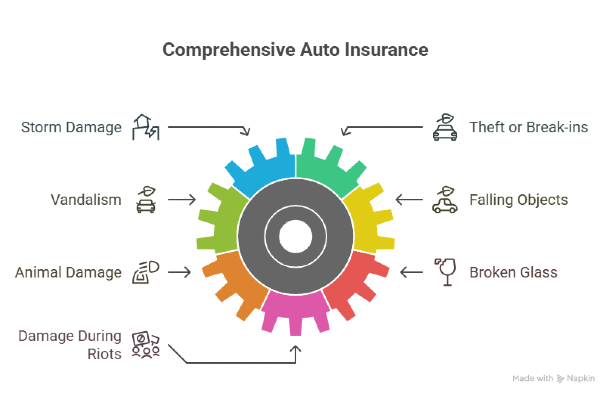

Here’s a simplified look at what’s usually included:

- Storm damage (hail, flooding, wildfires, etc.)

- Theft or car break-ins

- Vandalism (like keyed doors or broken windows)

- Falling objects (tree branches, debris)

- Animal damage (yes, hitting a deer counts!)

- Broken glass

- Damage during riots or protests

Of course, details vary by provider. Always read the fine print, even if it’s boring.

And What Doesn’t It Handle?

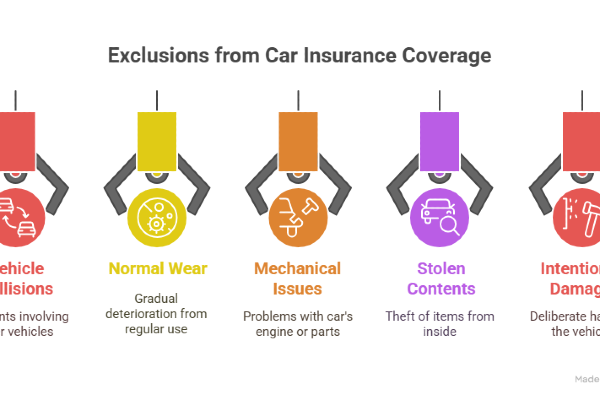

Let’s clear this up right away. It won’t cover:

- Crashes with other vehicles (you need collision for that)

- Routine wear and tear

- Mechanical problems

- Stuff stolen from inside your car (like a laptop or bag)

- Damage you caused on purpose (obviously)

Many people go for a combo of liability, collision, and comprehensive to feel fully protected, which most insurers casually call "full coverage."

Do You Have to Get It?

Nope. Not by law, anyway.

But if you’re leasing or financing your car, the lender will almost always require it. They want to protect their investment.

If you own your car outright, it’s your call. But ask yourself this: If your car got stolen tonight, could you afford to replace it tomorrow?

When Is It Worth Paying For?

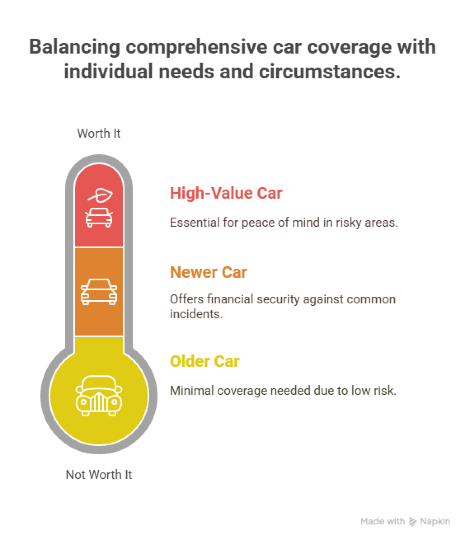

Here’s the thing: comprehensive coverage isn’t about checking a box. It’s about where you live, how you use your car, and what peace of mind is worth to you.

It’s probably a good idea if:

- Your car is newer or holds decent market value

- You live somewhere that sees a lot of storms, wildfires, or even break-ins

- You park your car outside most of the time

- You’d struggle to replace your vehicle out of pocket

But if your car is older and losing value fast, or it just sits in a locked garage most days? Then yeah, maybe that monthly premium would be better saved elsewhere.

💡Quick tip: Add up your deductible and annual premium. If the total is more than 10% of your car’s value, comprehensive might not be worth it.

How Much Does It Cost?

It’s not as expensive as people think. On average, comprehensive coverage costs somewhere between $10 and $30 a month. The exact price depends on:

- Your car’s age and market value

- Where you live (yes, even your zip code matters)

- Whether you park in a garage or on the street

- What deductible you choose (higher deductible = lower premium)

Also, if your car has anti-theft devices or if you bundle policies (like car + renters insurance), you might qualify for discounts.

If You Need to File a Claim, Here’s What to Expect

- Snap some photos of the damage

- Contact your insurer, either by phone or their app/website

- Send over the documents or info they ask for

- Get an estimate, they might direct you to a specific shop

- Pay your deductible, then they cover the rest

💡Just a heads up: even if it’s not your fault, filing too many claims can still raise your rates. It’s frustrating, but that’s how the system works.

Will Your Premium Go Up?

Usually not after one claim. Especially for something like hail or vandalism, which isn’t your fault.

But if you’re filing claims every few months, your insurer might start getting nervous. Some companies offer accident forgiveness, but it depends on your policy.

It never hurts to ask.

Clearing Up a Few Misconceptions

Let’s bust a couple of myths:

- "Comprehensive covers everything." Nope. The name is misleading. It doesn’t cover crashes or repairs from normal wear and tear.

- "Only luxury car owners need it." Not true. Even a used $8,000 car is a big loss if you don’t have coverage.

- "Home insurance will cover it if my car gets damaged in the driveway." It won’t. That’s what this coverage is for.

Take Control Before the Unexpected Hits

Comprehensive coverage isn’t about fear, it’s about preparation. If your car is exposed to risks like theft, storms, or vandalism, this coverage can be the difference between a quick solution and a financial headache.

If replacing your car would be a challenge, it makes sense to act now, not later. A small monthly cost can spare you from major out-of-pocket losses when life throws the unexpected your way. Check real quotes and see what fits your needs at MilaQuotes. The best time to prepare is before you need to.

FAQs About Comprehensive Auto Insurance

Can I get comprehensive coverage without collision coverage?

Yes, you can. Some people opt for comprehensive only, especially if they want protection from theft or weather damage, but aren't concerned about collision risks.

Will comprehensive coverage cover my personal belongings stolen from the car?

No. Items stolen from inside your car (like a laptop or phone) are usually covered by your homeowners or renters' insurance, not auto insurance.

How is my deductible applied in a comprehensive claim?

When you file a comprehensive claim, you’ll pay your deductible amount first. Then your insurer covers the rest, up to the policy limit.

Does comprehensive insurance cover rental cars?

It depends on your policy. Some insurers extend coverage to rental vehicles, but you should check directly with your provider, or consider adding a rental car rider.