Auto Insurance Claims Without a Police Report: All You Need to Know

Accidents rarely happen when it’s convenient. Maybe you backed into a pole in a grocery-store parking lot, or someone sideswiped your bumper and sped off before you could call 911. Now you’re wondering whether the lack of an official report will derail your auto insurance claim.

The short answer: In most states, you can file a claim without a police report, but you’ll need to compensate for the missing document with extra evidence and prompt communication. Below you’ll find a friendly, step-by-step breakdown of what the rules say, why insurers still love police reports, and how to strengthen your claim if you don’t have one.

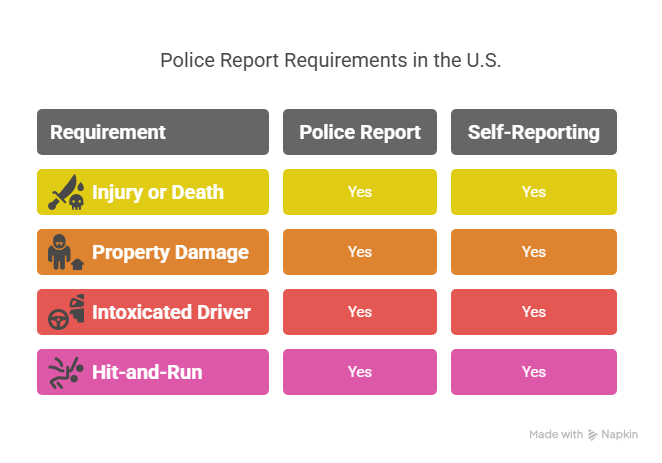

Do U.S. Laws Require a Police Report?

Generally, no, at least not for every accident. Most states only mandate a formal report when:

- Someone is injured or killed

- Property damage exceeds a dollar threshold (often $500–$1,500)

- A driver appears intoxicated

- It’s a hit-and-run

When Self-Reporting Is Mandatory

Even when cops aren’t required at the scene, many states still expect you to file a short accident form within 5–10 days. Failing to do so could lead to fines or even a suspended license. Check your DMV website for deadlines.

Why Insurers Love Police Reports

Insurers see police reports as an independent, time-stamped snapshot of what happened. Officers record:

- Location, weather, and road conditions

- Diagram of vehicle positions

- Statements from each driver and any witnesses

- Preliminary fault assessment

That outside perspective makes it harder for either party to change their story later, so claims adjusters can move faster. Without it, the insurer has to lean heavily on your documentation, and they’ll scrutinize every detail.

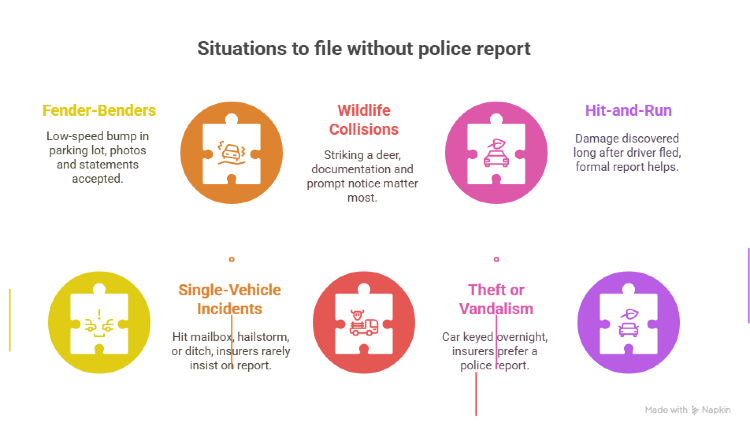

When Filing Without a Police Report Makes Sense

1. Minor Fender-Benders on Private Property

A low-speed bump in a parking lot may not trigger state reporting thresholds. Your auto insurance carrier usually accepts photos, witness names, and statements from both drivers instead of an officer’s report.

2. Single-Vehicle Incidents

Hit a mailbox, get stuck in a hailstorm, or slide into a ditch? Comprehensive or collision coverage can still apply, and insurers rarely insist on a police report, though many will ask for a claims form and clear photo evidence.

3. Wildlife Collisions

Striking a deer on a dark rural road often results in no police presence. Insurers treat it like any other comprehensive claim: documentation and prompt notice matter more than an official report.

4. Theft or Vandalism Found Later

If your car is keyed overnight, insurers strongly prefer a police report. But if you first file with your carrier and follow up with the report afterward, most companies will still process the loss.

5. Hit-and-Run Where Police Never Arrive

When you discover damage long after the at-fault driver has fled, a formal police report helps, but insurers will start a claim based on photos and your written statement if you file quickly.

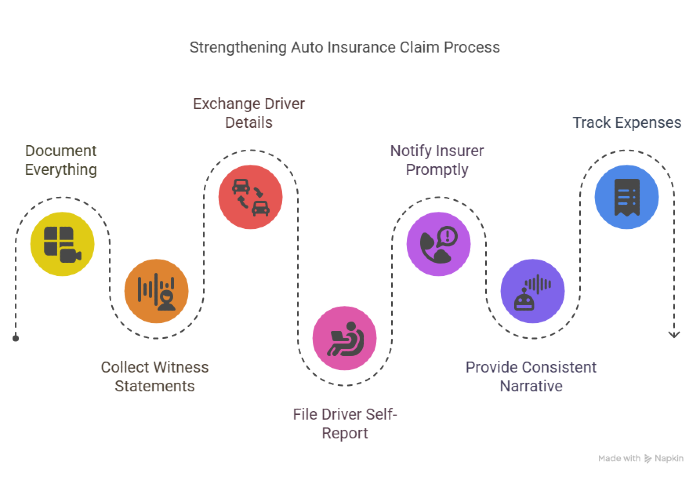

How to Support Your Auto Insurance Claim Without a Police Report

1. Document Everything Like a Journalist

- Snap wide-angle shots of each vehicle’s position, close-ups of every dent or scrape, and any skid marks.

- Film a quick video narrating the scene while the details are fresh.

- Capture weather conditions, street signs, and traffic lights for context.

2. Collect Witness Statements on the Spot

Ask bystanders to record a short voice memo on your phone that includes:

- What they saw

- Approximate time

- Their name and contact info

3. Exchange (and Double-Check) Driver Details

Write down, or take photos of, the other party’s:

- Full name and phone number

- Driver’s-license number

- License-plate number

- Auto insurance company and policy number

4. File Any Required Driver Self-Report Forms

Many DMVs let you print these online. Mail or upload the form within the deadline and keep a copy for your records.

5. Notify Your Insurer Promptly

Most policies oblige you to report any accident “within a reasonable time.” A simple phone call or mobile-app submission starts the clock and shows good faith.

6. Provide a Clear, Consistent Narrative

When the adjuster calls, stick to documented facts. If you’re unsure about a detail (“I think it was 3:45 p.m.”), say so rather than guessing. Inconsistent stories raise red flags.

7. Track Every Related Expense

Save towing receipts, repair estimates, medical bills, and even ride-share costs while your car is in the shop. These become part of your claim file.

Possible Downsides of Skipping the Police Report

While it’s possible to file a claim without a police report, it’s not always ideal. In some cases, the lack of official documentation can create challenges during the claims process. Here are a few things to keep in mind before deciding to skip the report:

When You Should Still Call the Police

- Injuries or Fatalities – Even minor soreness can become a medical claim. Let an officer document it.

- Significant Property Damage – If you suspect costs will exceed your state’s threshold.

- Hit-and-Run – Many insurers require proof that you reported the incident to activate uninsured-motorist property coverage.

- Stolen Vehicle – Every U.S. insurer demands a police report before paying for theft.

- Suspected Impairment – If alcohol or drugs are involved, a police record protects you legally and in the claim process.

The Right Coverage Starts with the Right Comparison. Try Mila

What matters most after an accident is knowing you're supported. Even without a police report, you can move forward if you’re clear on what steps to take. A calm, well-documented response makes all the difference.

Curious how much you could save, or if your current coverage fits your needs? In less than two minutes, Mila compares auto insurance offers from top U.S. providers side by side. No complicated terms, no pressure, just clear prices and coverage details to help you make the right choice with confidence.

Start today using Mila to find auto insurance that’s simple, reliable, and built for real life.

Frequently Asked Questions (FAQs) About Auto Insurance Claims Without a Police Report

Can I file a claim without a police report if the other driver was at fault?

Yes. As long as you have enough documentation—like photos, witness information, and the other driver’s details—you can file a claim even without a report. Still, some insurers may take longer to review the case if liability is unclear.

Is there a time limit to file the claim after the accident?

Most insurance companies expect you to report the accident as soon as possible—usually within 24 to 48 hours. Delays can complicate the process or even lead to denial in some cases.

What if the other driver gave false information, and there’s no police report?

Submit what you have anyway. Your insurer can still investigate using your documentation, photos, and any available witnesses. If you later discover the other driver was dishonest, it’s important to notify your insurer immediately.