What Happens If Your Car Insurance Lapses in Miami, FL?

For car owners in Miami, keeping active auto insurance is a legal and financial necessity. Yet, insurance lapses happen more often than people admit. A missed payment, a canceled credit card, switching providers at the wrong time, or assuming you have a grace period can all leave you uninsured.

In this post, you’ll learn the real consequences if your car insurance lapses in Miami, how much it can cost, how long it affects you, and what to do right now if your coverage has already ended.

What Does a Car Insurance Lapse Mean in Florida?

A car insurance lapse means any coverage gap, even if it lasts only one day. In Florida, insurance companies report coverage status electronically to the state. That means a lapse is often flagged automatically, without a traffic stop or accident.

If your policy expires or is canceled while your vehicle is registered, the Florida Department of Highway Safety and Motor Vehicles can take action quickly. For drivers dealing with a car insurance lapse in Miami, the timeline between losing coverage and facing penalties can be surprisingly short.

Florida’s Minimum Auto Insurance Requirements

Before understanding the penalties, it helps to know what Florida requires. Drivers must carry:

- $10,000 in Personal Injury Protection (PIP)

- $10,000 in Property Damage Liability (PDL)

If your insurance lapses and your vehicle remains registered, the state treats that as non-compliance—even if the car is parked and not driven.

Immediate Consequences of a Car Insurance Lapse in Miami

Once your insurance lapses, several things can happen:

1. License and Registration Suspension

Florida can suspend your driver’s license and vehicle registration. This applies whether you were driving or not.

2. Reinstatement Fees

To restore your driving privileges, you’ll need to pay a reinstatement fee:

- $150 for a first offense

- $250 for a second offense

- $500 for a third or subsequent offense

These fees must be paid before your license and registration are reinstated.

3. Proof of Insurance Requirement

You’ll need to submit proof of new coverage, often immediately. If you’ve had multiple lapses, you may be required to file an SR-22 or FR-44 form, which increases costs.

In busy areas like Brickell, Downtown Miami, and near Biscayne Boulevard, enforcement tends to be strict due to high traffic volume and accident rates.

How a Lapse Impacts Your Auto Insurance Rates

One of the most costly effects of a lapse isn’t the fine—it’s the long-term increase in premiums.

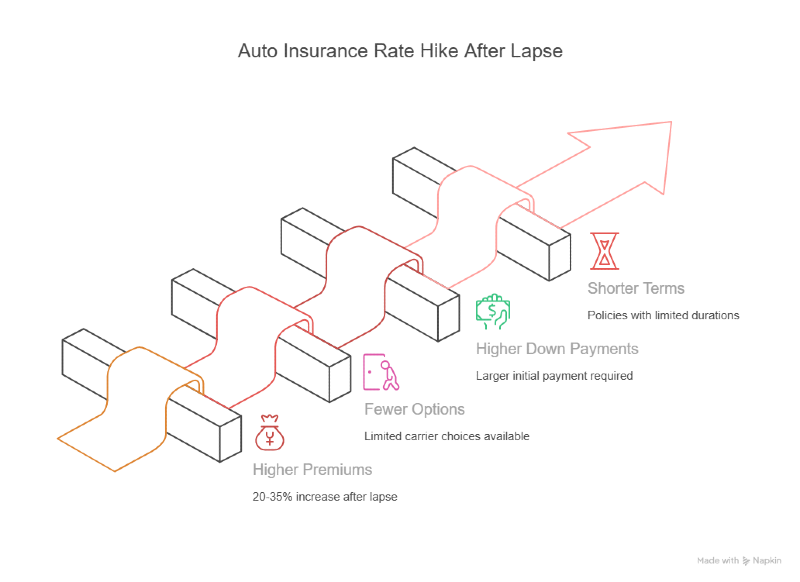

Insurance companies view a lapse as a sign of higher risk. As a result, many drivers in Miami see:

- 20%–35% higher premiums after a lapse

- Fewer carrier options

- Higher required down payments

- Shorter policy terms

According to data published by the Insurance Information Institute, drivers with coverage gaps consistently pay more than continuously insured drivers. You can review national insurance risk and pricing data directly from this trusted source: https://www.iii.org

In a city where insurance rates already trend higher due to traffic density and weather-related claims, a lapse can compound an already expensive policy.

What If You’re in an Accident During a Lapse?

Driving without insurance in Miami carries serious financial exposure. If you’re involved in an accident while uninsured:

- You pay 100% of repair costs out of pocket

- You may be personally liable for injuries

- You can be sued directly

- Your license suspension may be extended

Even a minor collision near places like Little Havana or Wynwood can lead to thousands of dollars in unexpected costs.

Is There a Grace Period for Car Insurance in Miami?

Many drivers assume there’s a grace period. In Florida, this assumption causes problems.

While some insurers offer short internal payment grace periods, the state does not. Once your policy is canceled and reported, you’re considered uninsured. That’s why proactive auto insurance comparison is so important, especially before renewal dates.

If you’re researching how to avoid lapses by comparing coverage efficiently, this auto insurance comparison resource can help you review options before coverage ends:

How Long Does a Car Insurance Lapse Stay on Your Record?

A lapse can affect your insurance profile for three to five years, depending on the insurer. During that time, you may face:

- Higher premiums

- Limited eligibility for preferred carriers

- Increased scrutiny during underwriting

Drivers who commute daily on I-95 or the Palmetto Expressway often feel this impact more due to higher mileage risk factors.

How to Fix a Car Insurance Lapse Quickly

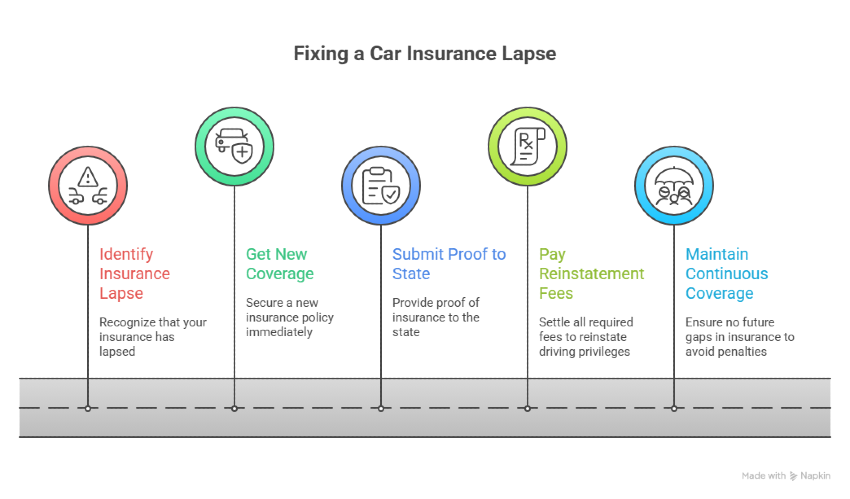

If your insurance already lapsed, time matters. Taking action fast can limit damage.

- Get New Coverage Immediately: Many insurers offer same-day policies, even for drivers with prior lapses.

- Submit Proof to the State: Once insured, submit proof to the Florida DHSMV to start reinstatement.

- Pay Reinstatement Fees: Fees must be paid in full before driving privileges return.

- Maintain Continuous Coverage: Future gaps will increase penalties and costs even more.

Why Lapses Are Especially Costly in Miami

Miami presents unique insurance challenges:

- High accident frequency

- Dense urban traffic

- Weather-related claims

- Elevated repair costs

A lapse magnifies all of these risk factors. Even drivers with clean records can see sharp increases after just one gap in coverage.

Tips to Prevent a Future Insurance Lapse

To avoid another car insurance lapse in Miami, consider these practical steps:

- Enable automatic payments

- Set renewal reminders 30 days in advance

- Update payment info immediately when cards change

- Review coverage before switching insurers

- Don’t cancel an old policy until the new one is active

These habits are especially helpful for drivers who rely on their vehicles daily for work or family obligations.

Stay Prepared for Insurance Lapses with Mila

At Mila, we help Miami car owners stay prepared when insurance lapses happen. Coverage gaps can lead to fines, suspensions, and higher rates, but acting quickly helps limit the impact.

Our focus is on helping drivers compare options, secure coverage fast, and avoid future lapses through better planning. Staying insured protects your finances and your ability to drive without interruptions, and Mila is here to support you every step of the way.

Get started online with Mila to compare options and secure coverage fast, so you can drive in Miami with confidence again.

Frequently Asked Questions (FAQs) About Auto Insurance Lapses

What are the most common reasons of auto insurance lapses in Miami?

Most lapses happen due to missed payments, expired cards on file, switching insurers without overlapping coverage, or assuming there’s a grace period when there isn’t.

Does a short lapse matter if it’s only a few days?

Yes. Even a short lapse can trigger reinstatement fees and higher insurance rates.

Will a lapse make it harder to get affordable insurance later?

Often yes. Some insurers may decline coverage or require higher down payments after a lapse.

Can I fix a lapse without going to the DMV in person?

In many cases, yes. Once you secure new insurance, proof can often be submitted electronically.