Top 9 Auto Insurance Myths That Could Cost You Money

Top 9 Auto Insurance Myths That Could Cost You Money

When it comes to auto insurance, false beliefs can cost you. I used to think red cars had higher premiums, until I owned one and realized it made no difference. Another time, I believed if someone else crashed my car, their insurance would pay. When my sister caused an accident with my car, I found out the hard way: my policy had to cover it.

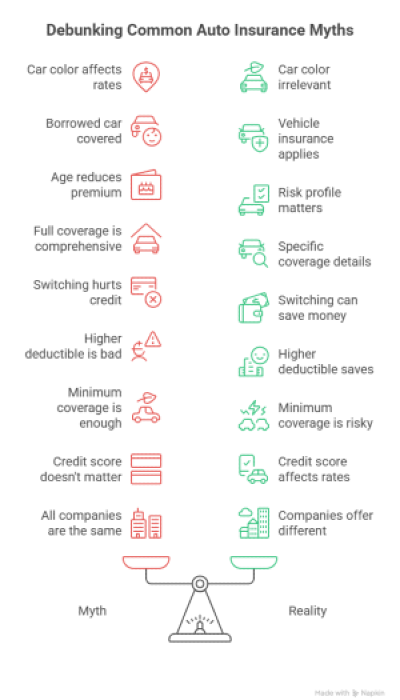

These kinds of myths are more common than you’d think. Let’s break down the most widespread misconceptions about auto insurance and discover the truth.

Top 9 Auto Insurance Myths You Need to Know

Auto insurance can feel confusing, especially when myths get passed around as facts. I’ve fallen for a few myself, and I know how costly those misunderstandings can be. These are the most common myths drivers believe and the reality behind each one.

1. The Color of Your Car Affects Your Insurance

Many people believe that red cars are more expensive to insure. I used to think the same and genuinely believed the color alone would raise my premium.

But here’s the truth: car color has absolutely no impact on insurance rates. Insurance companies don’t even ask about the color when calculating your premium. What they do care about includes:

- The make, model, and year of your vehicle

- Your driving record and history of claims

- Your location and how often you drive

- Safety features and cost of repairs

2. If Someone Borrows Your Car, Their Insurance Covers It

It’s a common belief that if someone else is driving your car and gets into an accident, their insurance will cover the damage. I used to believe that too, until it happened to me.

The truth is, insurance usually follows the vehicle, not the driver. So if a friend or family member borrows your car and gets into an accident, it’s your insurance that takes the first hit. Here’s how it typically works:

- Your liability coverage kicks in first.

- If your limits are exceeded, then their insurance may act as secondary (if applicable).

- If you gave permission, most insurers will still cover it.

📌There are exceptions, of course, especially with excluded drivers or commercial use, but in everyday situations, your car = your responsibility, no matter who’s behind the wheel.

3. Your Premium Will Automatically Drop at Age 25

Many drivers assume that the day they turn 25, their insurance premium will magically go down. I was counting on it as a kind of milestone benefit, until I turned 25 and saw no change.

The reality is more complicated. While age can influence your premium, it’s far from the only factor. Insurance companies look at the overall risk profile, not just a birthday. Factors that still affect your rate at 25 include:

- Your driving history (accidents, violations, claims)

- The type of vehicle you drive

- Your credit score (in most states)

- Your location and driving frequency

📌The truth? Age helps, but it’s not a free pass. Safe driving, a clean record, and no claims history are what truly lower your rates.

4. Full Coverage Means Everything is Covered

“Don’t worry, I’ve got full coverage.” We’ve all heard someone say it. I used to think the same thing. It sounds like it should cover everything, right? But that’s not how it works. In reality, “full coverage” isn’t a technical term. It usually refers to a combination of:

- Liability coverage for damage you cause to others.

- Collision coverage for damage to your car in an accident.

- Comprehensive coverage for theft, vandalism, weather damage.

But it doesn’t include things like:

- Medical bills beyond your injury protection (if applicable)

- Mechanical breakdowns

- Rental car coverage (unless you added it)

- Gap insurance (unless specifically included)

5. Changing Insurers Frequently Hurts Your Credit or Rates

Many people believe that switching auto insurance companies too often can damage your credit score or make you look risky to future insurers. I stayed with the same provider for years, even when my premiums kept going up.

But here’s the truth: changing insurers does not hurt your credit and usually doesn’t negatively impact your insurance rates. In fact, shopping around can save you money. Here’s why switching can be beneficial:

- Insurers often offer new customer discounts.

- Rate algorithms vary—one company might price you lower based on your profile.

- Loyalty doesn’t always pay; some providers use “price optimization” to slowly increase premiums over time.

Unless you’re canceling a policy mid-term and leaving gaps in coverage, changing providers is smart, not risky.

6. Raising Your Deductible Is Always a Bad Move

The idea that increasing your deductible is a bad financial decision is surprisingly common. I used to avoid touching mine, thinking it would only make things worse if I ever had to file a claim. But the truth is, raising your deductible can actually lower your monthly premium, sometimes by a noticeable amount. How it works:

- A higher deductible means you’ll pay more out of pocket if you file a claim...

- ...but it also makes you a lower-risk customer in the eyes of insurers.

- That risk reduction often translates into lower premiums.

It’s all about your financial situation. If you have savings to cover a higher deductible in case of an emergency, raising it can be a smart way to save in the long run.

7. Minimum Coverage Is Enough

Many drivers assume that meeting the state’s minimum insurance requirements means they’re fully protected. It’s a tempting thought, especially when you're trying to save money. But the reality is that state minimums often leave you dangerously underinsured. Here’s why:

- State-required liability limits are usually very low.

- If you cause an accident resulting in major damage or injuries, you may be personally responsible for any costs not covered by your policy.

- Minimum coverage doesn’t include your vehicle repairs or theft.

8. Your Credit Score Doesn’t Impact Your Insurance

It’s easy to assume that your credit score only matters for loans and credit cards. If you think that with a clean driving record, your insurance rates wouldn’t be affected, you’re wrong.

In most states, your credit score plays a major role in determining your premium. Why insurers care about credit:

- Studies show a correlation between lower credit scores and higher claims risk

- Insurers use a "credit-based insurance score" to help predict likelihood of future claims

- It’s legal in most states, though California, Hawaii, Massachusetts, and a few others restrict or ban the practice

9. All Car Insurance Companies Are the Same

It might seem like all insurance companies offer the same thing: liability, collision, comprehensive, but that’s only part of the picture. Here’s how insurers differ:

- Each has its rating formula, so the same coverage can cost very different amounts depending on the provider.

- Discounts and add-ons vary, including:

- Gap insurance

- Accident forgiveness

- Rideshare insurance

- Full glass coverage

- Rental car reimbursement

- Roadside assistance

📌That’s why it’s so important to compare multiple providers before choosing. Tools like Mila make this process incredibly easy, helping you identify the best coverage, price, and service all in one place.

Stop Trusting Insurance Myths and Start Comparing Smart With Mila

Auto insurance is deeply personal. The right coverage, the right provider, and the right price all depend on your unique needs and habits, not on myths or half-truths. So take a moment to question what you think you know. Review your current policy. Ask questions.

And most importantly, compare your options, because better coverage or lower rates might be just a few clicks away. Use trusted platforms like Mila to explore multiple options, access reliable information, and tailor a policy that fits your real needs, not outdated assumptions.

Start comparing with Mila today and take control of your auto insurance.