Insuring a Classic or Collector Car: What You Need to Know

Owning a classic or collector car comes with unique responsibilities, including how you insure it. Many car owners treat these vehicles like any other, using regular insurance, without realizing the risks. If something unexpected happens, that decision can lead to major setbacks.

Before something goes wrong, it’s worth understanding why collector Auto insurance exists and how it can offer better protection, often at a better price. Learning how this kind of auto insurance works helps you protect the true value of your vehicle.

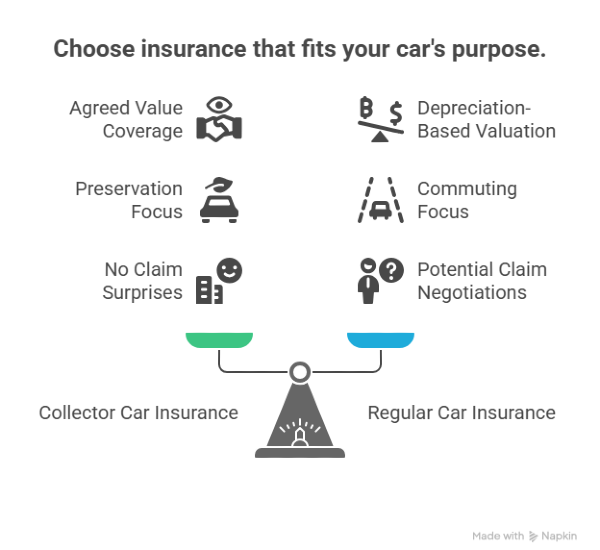

What Makes Collector Car Insurance Different?

Insuring a classic or collector car isn’t like adding another vehicle to your daily-use policy. Here’s why:

- Built for preservation, not commuting: Collector Auto insurance is specially developed for vehicles that are rarely driven and well-maintained.

- Different valuation method: Regular insurance uses depreciation to determine value over time.

- Agreed value coverage: With collector policies, you and the insurer agree on the car’s worth upfront, that’s the amount you’re paid in case of a total loss.

- No surprises during claims: You avoid negotiations or low payouts based on “book value.”

How Collector Car Insurance Values Your Vehicle Differently

One of the most important distinctions between collector car insurance and regular auto insurance is how the vehicle is valued in a claim.

- Regular auto insurance: Uses actual cash value, which takes depreciation into account. This often results in lower payouts, especially for older vehicles.

- Collector car insurance: Offers agreed value coverage. The vehicle’s worth is set in advance by mutual agreement between you and the insurer. If the car is totaled, you receive that full amount — no depreciation, no surprises.

This approach is ideal for cars that have been restored, customized, or simply hold greater market or sentimental value than what standard policies consider. If you are serious about preserving a vehicle’s investment, agreed value is a key feature to look for.

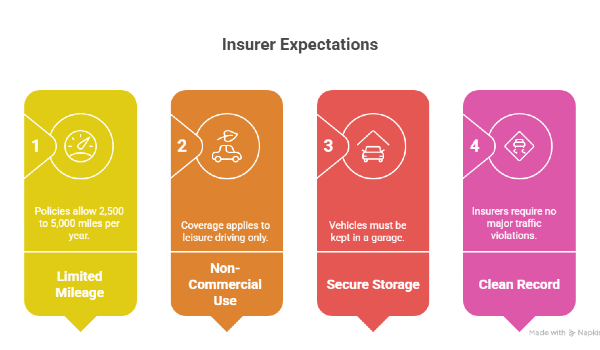

What Insurers Expect: Mileage Limits and Storage Rules

Collector auto insurance usually comes with certain conditions, but these align well with how most vintage vehicles are already used and maintained. Here are the common requirements:

- Limited mileage: Most policies allow 2,500 to 5,000 miles per year. They’re designed for occasional drives, not daily commutes.

- Non-commercial use only: Coverage applies to leisure driving, no ride-sharing, deliveries, or work commuting.

- Secure storage: Vehicles must be kept in a garage or approved facility when not in use.

- Clean driving record: Some insurers require no major traffic violations in recent years.

Why Collector Car Insurance Can Cost Less

It’s easy to assume that insuring a specialty vehicle means paying more. Surprisingly, collector car insurance is often cheaper than regular auto coverage, and for reasons that make perfect sense when you look closely. These vehicles are:

- Driven less frequently: Usually just a few thousand miles per year. That means fewer chances of accidents, traffic, or exposure to daily road risks.

- Stored more securely: Most policies require garage storage or enclosed facilities, lowering the chances of theft, vandalism, or weather damage.

- Maintained to a high standard: Classic car owners tend to be detail-oriented. Regular upkeep and preservation reduce the likelihood of mechanical failure.

- Used under specific conditions: No commuting, no commercial driving, and often no winter roads. This greatly reduces the insurer's exposure.

What Happens When You File a Claim?

The real value of collector car insurance shows when it’s time to make a claim. Standard auto insurance often involves generic processes and limited repair options, not ideal when dealing with a rare or vintage car. With a collector policy, things work differently:

- You choose the repair shop: Most policies let you work with specialists familiar with classic vehicles, rather than sending you to a generic chain.

- Access to original or authentic parts: Insurers often help source parts that match the car’s original specs, preserving its integrity and value.

- Claims handled by experts: Adjusters are usually trained in classic and vintage models, so there’s less back-and-forth about what repairs are appropriate.

📌This kind of support is especially important when your vehicle is unique, rare, or has been meticulously restored. Instead of debating the cost of a chrome bumper or accepting after-market substitutions, you get a process that respects the car’s true character.

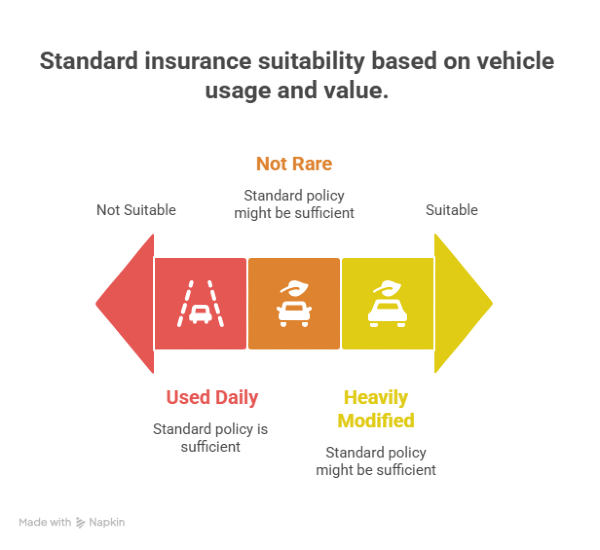

When Regular Insurance Might Still Be a Fit

Although collector car insurance offers specialized benefits, there are cases where a standard auto policy might be sufficient. Consider regular insurance if the vehicle is:

- Used every day: If you drive the car to work, school, or errands, a collector policy likely won’t apply.

- Not rare or highly valued: Older cars without significant market or restoration value might not qualify for agreed value coverage.

- Heavily modified: Some modifications, especially those that affect safety or emissions, may disqualify a car from collector coverage.

How Can You Customize a Collector Car Insurance Plan?

Collector car policies often include extras that align with how these vehicles are used and maintained, details that regular auto insurance tends to overlook. For example, spare parts coverage protects original or rare components, even if they’re not currently installed. This is especially helpful for ongoing restorations or hard-to-find items.

Some insurers offer inflation protection, adjusting the vehicle’s value over time based on market trends. This helps ensure your coverage keeps up if your car appreciates.

Other useful additions include:

- Trip interruption coverage, which covers expenses if your car breaks down during a show or long-distance drive.

- Event coverage, protecting the vehicle while it’s on display.

- No-deductible windshield repair for those fragile or expensive original windows.

Find the Collector Car Insurance That Matches What Your Vehicle Deserves With Mila

A classic or collector car needs insurance that matches its true value and purpose. Policies designed for these vehicles offer agreed value coverage, flexible use terms, and protection where it matters most. If you’ve invested time or money into your car, choosing collector insurance is a practical way to protect what makes it unique.

If you’re looking for the best way to compare plans, Mila offers a fast, effortless, and comprehensive comparison of customized insurance plans to help you identify the most suitable option for your vehicle.

Your classic car isn’t ordinary, and your insurance shouldn’t be either. Use Mila to find a policy built for the way you drive and protect your investment.

Frequently Asked Questions (FAQs) About Insuring a Classic or Collector Car

What qualifies a car for collector insurance?

To qualify, the vehicle typically needs to be at least 10–25 years old, in good condition, not used for daily commuting, and stored securely. Insurers may also require a clean driving record.

Can I use my classic car for daily driving?

Not under a collector car policy. These policies are designed for occasional use, like weekends, shows, or pleasure drives — not commuting or commercial use.

How do I find the best insurance for my collector car?

Start by comparing quotes from multiple insurers. Platforms like Mila specialize in helping you find the best classic car insurance based on your needs and vehicle type.