Filing an Auto Insurance Claim? Here's How to Do It Right

Filing an auto insurance claim can feel overwhelming, especially after the stress of a car accident. Knowing the right steps can save you time, money, and hassle. Whether it’s a minor fender bender or a major collision, understanding the claim process ensures your situation is handled smoothly and efficiently.

In this post, you’ll learn everything from the accident to resolving your claim, helping you avoid common mistakes and get the best outcome from your auto insurance coverage.

Why Understanding the Auto Insurance Claim Process Matters

Many drivers find themselves unsure of how to proceed after a car accident. Filing an auto insurance claim correctly can mean the difference between a quick payout and a prolonged dispute with your insurer.

Understanding the claim process helps you avoid common pitfalls, ensures you maximize your coverage, and gives you peace of mind during a stressful situation. Whether you're dealing with vehicle damage, medical bills, or liability issues, being informed can save you both time and money.

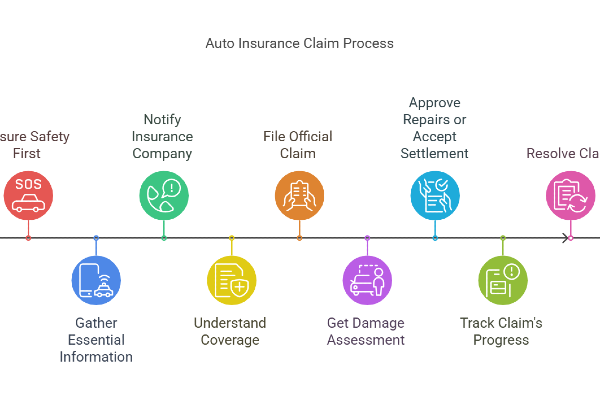

Follow these steps to file an auto insurance claim correctly:

Step 1: Ensure Safety First After an Accident

When an accident occurs, your top priority is safety. Before thinking about your auto insurance claim, take these immediate actions:

- Check for Injuries: Assess yourself and your passengers. Call 911 if anyone is hurt.

- Move to Safety: If possible, move your vehicle out of traffic to prevent further accidents. Turn on your hazard lights to alert other drivers.

- Avoid Admitting Fault: Do not discuss who caused the accident. Admitting fault could affect your claim later.

Once everyone is safe and emergency services are on the way (if needed), you can start gathering information for your insurance claim.

Step 2: Gather Essential Information at the Scene

The details you collect at the accident scene are critical for filing a successful auto insurance claim. Use your smartphone to document everything and take these steps:

- Exchange Information: Get the other driver’s name, contact details, insurance company, and policy number. Note their vehicle’s make, model, and license plate number.

- Take Photos: Capture images of the damage to all vehicles involved, the accident scene, road conditions, and any visible injuries.

- Collect Witness Statements: If there are bystanders, ask for their names and contact information. Their accounts could support your claim.

- File a Police Report: For accidents involving significant damage or injuries, call the police to file an official report. Request a copy for your records.

Step 3: Notify Your Insurance Company Promptly

Most insurance policies require you to report an accident “as soon as reasonably possible.” Delaying this step could jeopardize your claim. Here’s how to proceed:

- Contact Your Insurer: Call your insurance company’s claims department. Many providers, like Geico or Progressive, offer 24/7 hotlines or mobile apps for reporting claims.

- Provide Initial Details: Give a brief overview of the accident, including the date, time, location, and a general description of what happened. You don’t need to have all the details finalized yet.

- Get a Claim Number: Your insurer will assign a claim number to track your case. Write it down—it’s your key to following up.

Step 4: Understand Your Coverage

Before diving deeper into the claims process, review your auto insurance policy. If you’re unsure about your policy, call your insurance agent for clarification. This step ensures you’re not caught off guard by out-of-pocket costs. Common types of coverage include:

- Liability Coverage: Pays for damage or injuries you cause to others.

- Collision Coverage: Covers repairs to your vehicle, regardless of fault.

- Comprehensive Coverage: Handles non-collision damages (e.g., theft, vandalism, or weather-related incidents).

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver lacks sufficient insurance.

Step 5: File the Official Claim

Once you’ve reported the accident, it’s time to file your claim. Here’s what to expect:

- Submit Documentation: Provide your insurer with the police report, photos, witness statements, and any other evidence you collected.

- Complete Claim Forms: Your insurer may send you forms to fill out. Be thorough and accurate—mistakes can delay processing.

- Speak with an Adjuster: An insurance adjuster will be assigned to your case. They’ll review the evidence, inspect the damage, and determine fault and coverage.

Step 6: Get a Damage Assessment

The adjuster will evaluate your vehicle’s damage to estimate repair costs. Here’s how this typically works:

- Vehicle Inspection: You may need to take your car to an approved repair shop or have the adjuster visit you. Some insurers offer virtual inspections via video calls.

- Repair Estimates: The adjuster will provide an estimate based on the inspection. If you disagree, you can request a second opinion from an independent mechanic.

- Total Loss Determination: If repair costs exceed your car’s value, the insurer may declare it a “total loss” and offer a payout based on its market value.

Step 7: Approve Repairs or Accept a Settlement

Once the damage assessment is complete, you’ll have two main options:

- Repair Your Vehicle: If the damage is repairable, choose a shop (often from your insurer’s approved list) and authorize the work. Your insurer may pay the shop directly, minus your deductible.

- Accept a Settlement: For totaled vehicles or minor repairs you handle yourself, the insurer will issue a check. Review the amount carefully to confirm it aligns with your policy.

Step 8: Track Your Claim’s Progress

Stay proactive by monitoring your claim. Most insurers provide online portals or apps to check the status. You can also call your adjuster for updates. If delays occur, ask for an explanation—claims typically take 1–4 weeks to resolve, depending on complexity.

Step 9: Resolve the Claim

Once repairs are completed or you’ve accepted a settlement, your claim is closed. Before signing any final documents, ensure the following:

- All repairs meet your satisfaction.

- The settlement covers your losses (e.g., rental car costs and medical bills, if applicable).

- You understand how the claim might affect your premiums.

If another party was at fault, your insurer may pursue subrogation—seeking reimbursement from the other driver’s insurance—without further action from you.

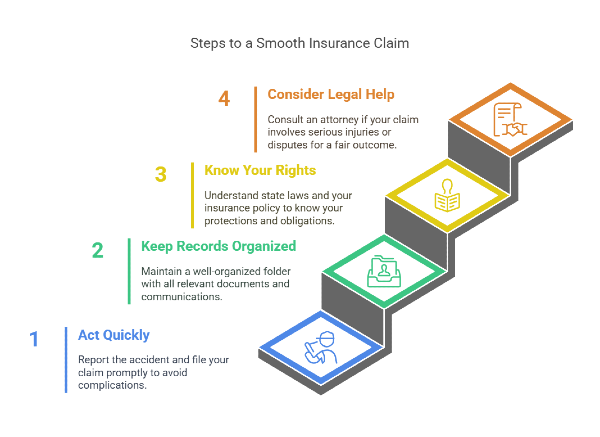

Tips for a Smooth Auto Insurance Claim Process

Going through an auto insurance claim doesn’t have to be stressful. Following these tips can help make the process as smooth as possible:

- Act Quickly: Report the accident and file your claim as soon as possible to avoid complications.

- Keep Records Organized: Maintain a folder (physical or digital) with all documents, emails, photos, and communication related to your claim.

- Know Your Rights: Familiarize yourself with state laws and your insurance policy to understand your protections and obligations.

- Consider Legal Help: If your claim involves serious injuries or disputes, consulting an attorney may be beneficial to ensure a fair outcome.

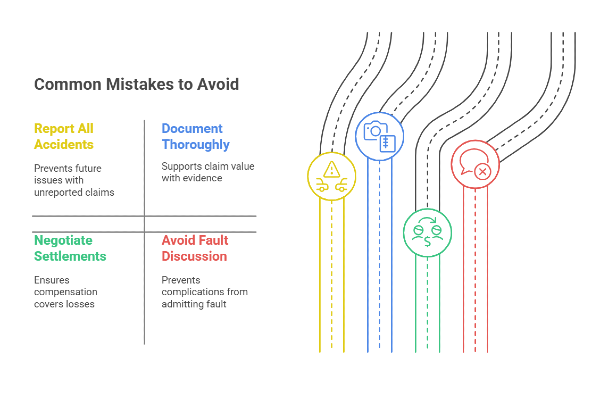

Common Mistakes to Avoid

Avoiding common mistakes can make a big difference in the outcome of your auto insurance claim. Here are some pitfalls to watch out for:

- Not Reporting Minor Accidents: Even if the damage seems small, reporting every accident can prevent issues if the other party files a claim later.

- Skipping Documentation: Without proper evidence (photos, witness statements, police reports), your claim could be denied or undervalued.

- Accepting the First Offer Too Quickly: Insurers may offer a low initial settlement. Don’t hesitate to negotiate if the amount doesn’t cover your losses.

- Discussing Fault at the Scene: Admitting fault at the accident scene can complicate your claim, even if you believe you were responsible.

From Accident to Resolution: Be Ready With Mila on Your Side

By following this step-by-step guide, you can handle the process confidently and ensure a fair outcome. Preparation and attention to detail are key to navigating everything from the accident scene to resolving your claim. Stay informed, keep this guide handy, get ready for whatever comes your way.

Tired of guessing which car insurance is best? With Mila, you can compare real-time quotes from top providers and save up to 30%. Start now and take control

Frequently Asked Questions (FAQ’s) About Filing an Auto Insurance Claim

How long does it take to process an auto insurance claim?

The time to process a claim varies depending on its complexity. Simple claims might be resolved within 1 to 2 weeks, while more complicated cases, like those involving injuries or disputes, could take a month or longer.

What should I do if my claim is denied?

If your claim is denied:

- Request a Written Explanation: Understand why the claim was not approved.

- Review Your Policy: Compare the denial reason with your policy terms.

- Gather Additional Evidence: Submit new photos, documents, or witness statements.

- Appeal the Decision: Many insurance companies have an appeal process.

- Consult an Attorney: If the denial seems unjustified, legal advice could help you navigate your options.

What if the other driver doesn't have insurance?

If the at-fault driver is uninsured, you can rely on your uninsured/underinsured motorist coverage (if included in your policy). This coverage can help pay for medical expenses, vehicle repairs, and other damages. Without this coverage, you might need to pursue compensation through legal action, which could be costly and time-consuming.