How to Handle Auto Insurance After a Hit-and-Run Accident

When the unexpected happens, few situations are as frustrating as discovering your car has been damaged and the person responsible is nowhere to be found. A hit-and-run accident leaves you dealing with emotional stress, possible injuries, and the challenge of managing repairs and claims.

Fortunately, auto insurance and a solid car insurance policy can help you recover financially and protect you from major losses. In this post, we’ll explain how to handle your auto insurance claim after a hit-and-run, what steps to take immediately, and how to make sure your driver protection is strong if this ever happens again.

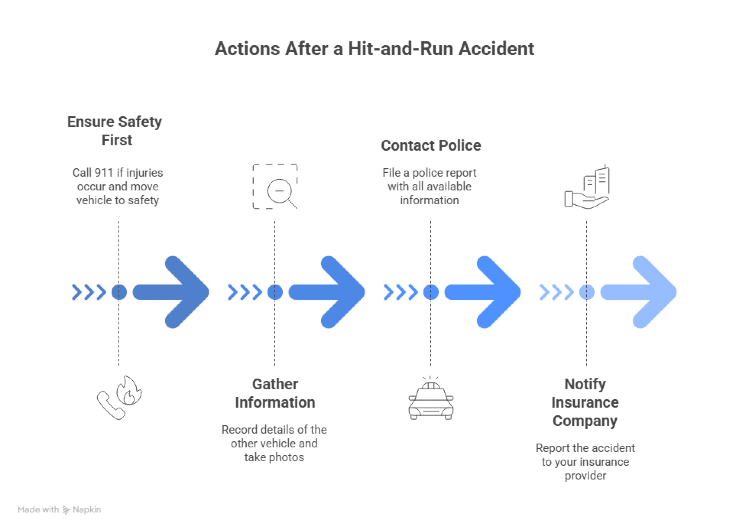

What to Do Right After a Hit-and-Run

The moments after a hit-and-run accident are often filled with confusion and frustration. Still, your actions can significantly affect how your auto insurance claim process is handled.

1. Ensure Safety First

If you or anyone else is injured, call 911 right away. Safety is the top priority before anything else. Move your vehicle out of traffic if possible, and wait for help in a safe area.

2. Gather as Much Information as Possible

Even if the other driver fled, try to record every detail you remember: the make, model, color, or part of the license plate. Take photos of the scene, your car’s damage, and any debris left behind. If witnesses are nearby, ask for their contact information. Their testimony can help support your auto insurance claim process.

3. Contact the Police

A police report is essential for filing your claim. When officers arrive, provide them with all available information. The report not only assists in investigations but also serves as official documentation for your car insurance policy provider.

4. Notify Your Insurance Company

Report the accident as soon as possible. The faster you contact your auto insurance company, the smoother the process will be. Most insurers offer 24/7 claims reporting through apps or phone lines. Be honest and provide detailed descriptions of the event.

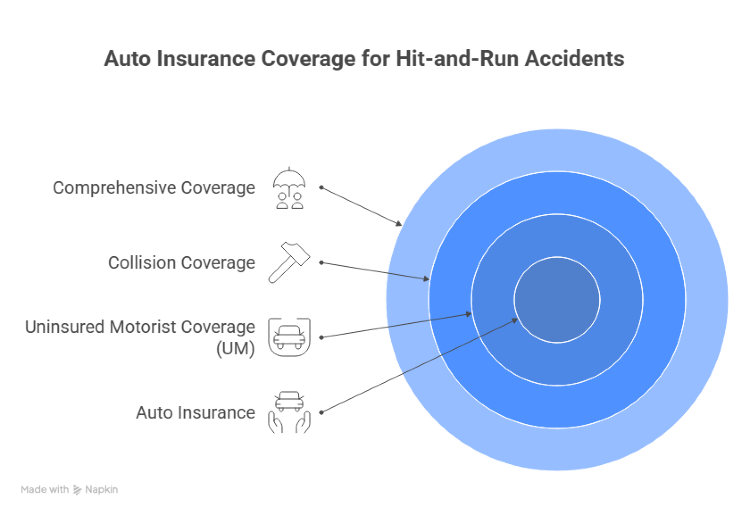

How Auto Insurance Covers Hit-and-Run Accidents

Understanding what parts of your car insurance policy apply can make a huge difference when you face unexpected damage.

1. Uninsured Motorist Coverage (UM)

This part of auto insurance is specifically designed to provide driver protection when the at-fault driver can’t be identified or has no insurance. If you have Uninsured Motorist Property Damage (UMPD) or Uninsured Motorist Bodily Injury (UMBI), your policy may pay for your repairs and medical costs.

2. Collision Coverage

If you don’t have UM coverage, your auto insurance collision coverage may still help. It typically covers repair costs, regardless of who is at fault for the accident. However, you’ll likely need to pay a deductible.

3. Comprehensive Coverage

Sometimes, what appears to be a hit-and-run could be vandalism or another non-collision event. Comprehensive auto insurance helps in these cases by covering damage caused by theft, fire, or even natural disasters.

How to File a Hit-and-Run Claim

Once you’ve gathered your information and filed a police report, it’s time to start your claim process.

- Contact Your Insurance Company: Provide your policy number, the police report, and photos of the damage. Mention if you suspect any injuries, even minor ones. Quick reporting improves your chances of approval.

- Meet with an Adjuster: Your auto insurance adjuster will review the damage, assess repair costs, and determine coverage. Stay proactive and provide all documents, and be ready to answer questions during the claim process.

- Get Repair Estimates: You may be required to use approved repair shops. Some insurers offer digital estimates, where you upload photos for faster processing.

- Follow Up Regularly: Keep in touch with your adjuster to track your claim’s progress. Document every interaction. It helps if disputes arise.

How to Prevent Financial Loss After a Hit-and-Run

Preparation can help you be ready before an accident happens. Here’s how to minimize risks and stay protected.

1. Review Your Auto Insurance Policy

Check if you have Uninsured Motorist and Collision coverage. Many drivers skip these options to save money, but they can be lifesavers in a hit-and-run scenario and provide valuable driver protection.

2. Install a Dash Camera

Dash cams are becoming increasingly popular among U.S. drivers. They record incidents automatically and can provide key evidence to both the police and your auto insurance company.

3. Park in Safe, Well-Lit Areas

Simple habits like parking in visible, high-traffic areas can deter potential hit-and-run drivers and reduce your chances of being a victim.

4. Keep Your Contact Info Updated

Ensure your insurer can reach you quickly. Outdated contact details can delay the claim process and payments.

Common Mistakes to Avoid After a Hit-and-Run

Even well-intentioned drivers can make mistakes that harm their auto insurance claim. Avoid these common pitfalls:

- Leaving the scene without reporting: Always call the police, even for minor damage.

- Failing to take photos: Visual evidence is powerful when proving your case.

- Waiting too long to file a claim: Most insurers have strict deadlines for reporting.

- Admitting fault prematurely: Let your insurer and the police determine liability.

Why Is Auto Insurance Important After a Hit-and-Run?

Hit-and-run accidents can happen to anyone, and they often leave victims feeling frustrated and uncertain. Having the right car insurance policy is essential because it offers financial relief and helps cover damages even when the responsible driver disappears.

Your auto insurance ensures ongoing driver protection by taking care of repairs, medical costs, and even rental vehicles when needed. In short, strong coverage transforms a stressful situation into a manageable one, allowing you to focus on recovery and safety.

Secure Your Recovery with the Right Auto Insurance Coverage

Recovering from a hit-and-run can be stressful, but understanding your auto insurance options and the claim process helps you move forward confidently. Always report the incident, document every detail, and review your coverage to ensure you’re protected for the future.

For U.S. drivers looking to compare plans and find tailored coverage, Mila offers a trusted platform to compare auto insurance quotes and get personalized rates easily.

Start comparing with Mila today and see how much you could save on your next auto insurance policy.

Frequently Asked Questions (FAQs) About Auto Insurance After a Hit-and-Run Accident

What should I do if the police never find the driver?

If the at-fault driver isn’t located, your auto insurance coverage, such as Uninsured Motorist or Collision, can still help pay for damages. Always keep a copy of the police report and provide it to your insurer.

Will a hit-and-run claim affect my insurance rates?

In many cases, yes. Your auto insurance premium might increase depending on your insurer’s policies. However, having proof that you weren’t at fault can sometimes limit rate changes.