How to Avoid Hidden Fees in Your Auto Insurance Policy

Many drivers believe that once they choose an insurance plan and start paying premiums, the price they see is the price they pay. Unfortunately, that is not always true. Some auto insurance policies include small, unexpected fees that slowly increase the total cost of coverage without most people noticing.

The good news is that you can prevent those surprises. By understanding how hidden fees work and learning what to look for in your policy, you can make sure your insurance stays affordable and transparent. This guide will show you how to spot and avoid those extra costs step by step.

What Are Hidden Fees in Auto Insurance?

Hidden fees are additional charges that appear in your policy or billing but are not always clear at first. They can show up during payment processing, policy setup, or even when you decide to cancel or update your plan.

Insurance companies sometimes add these fees to cover administrative tasks or payment convenience options. While not always illegal, they can make your total cost much higher than expected. The problem is that many drivers never notice them until it is too late.

Common examples include service charges, installment fees, administrative costs, and cancellation penalties. Each one might look small on its own, but over a year, they can add up to a significant amount.

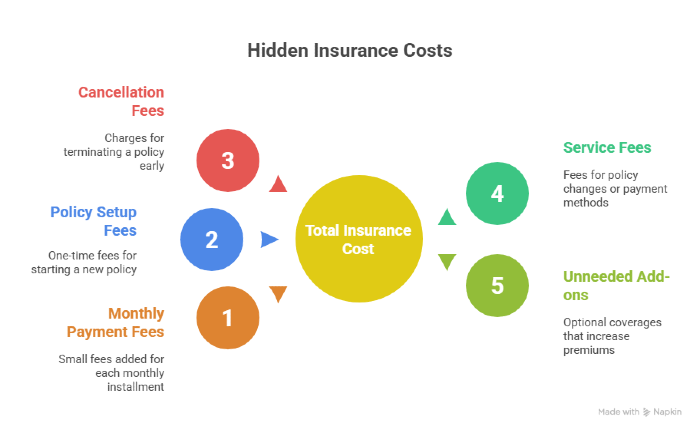

Common Hidden Costs You Might Be Paying

These are the most common hidden costs you need to know:

1. Monthly Payment Fees

Paying your insurance monthly may seem easier to manage, but many companies add a small service fee for each installment. It is usually a few dollars, yet by the end of the year, you could spend much more than if you had paid the annual premium in one payment.

Tip: Ask your provider for both annual and monthly quotes so you can compare the total difference before deciding.

2. Policy Setup or Administrative Fees

When you start a new policy, some companies charge a one-time administrative fee. It covers paperwork, account setup, and system processing. While it may sound standard, not every insurer includes it.

Tip: Ask directly if there are administrative costs and whether they can be waived. Some companies remove them for new customers or digital sign-ups.

3. Cancellation or Early Termination Fees

If you switch insurers before your contract ends, you might have to pay a cancellation fee. These charges vary by company and can be either a flat rate or a percentage of the remaining premium.

Tip: Always check the cancellation terms before signing. Some insurers offer prorated refunds without penalties if you leave early.

4. Service or Processing Fees

These fees appear when you make changes to your policy, such as updating your address, payment method, or vehicle details. Some providers also charge extra for paying by phone or using credit cards.

Tip: Manage your policy through the online portal or mobile app whenever possible. Digital self-service options often help you avoid these small but unnecessary costs.

5. Add-ons You Don’t Need

Sometimes your policy includes optional coverages you never requested, like roadside assistance or rental car protection. These add-ons can raise your premium quietly, and many people do not realize they are paying for them.

Tip: Review every line of your coverage summary and ask your agent to remove anything you do not use or truly need.

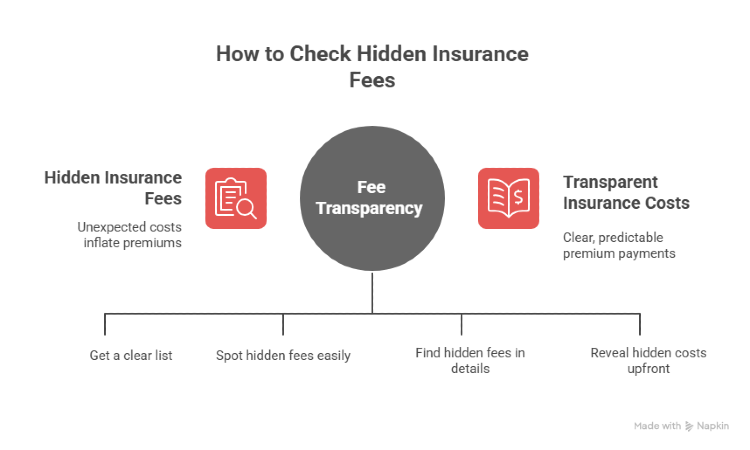

How to Check for Hidden Fees Before You Buy

Hidden fees can quietly increase the real cost of your policy. Before you buy, take a few minutes to review the details, compare options, and ask the right questions to avoid paying more than you expect.

1. Ask for a Full Fee Breakdown

Before committing to any policy, request a clear list of all fees and charges. A transparent company will have no problem providing it. Comparing this breakdown with other insurers can help you identify which ones hide costs under different names.

2. Compare Policies from Different Insurers

Hidden fees are easier to spot when you see multiple offers side by side. Online comparison tools, such as Mila, can show you differences in total cost, but make sure to look beyond the price. Read what each fee actually covers and whether it is optional or mandatory.

3. Read the Fine Print Carefully

The fine print is where hidden fees often hide. Look for words like “processing fee,” “installment charge,” or “administrative cost.” These are clues that your insurer may be adding extra amounts to your total premium. It takes a few minutes to check, but it can save you hundreds of dollars later.

4. Ask Questions Directly

Never hesitate to ask specific questions when talking to an agent. Simple phrases like “Are there any additional monthly or service fees not listed here?” or “Do you charge for policy changes or cancellations?” can reveal costs you might otherwise miss.

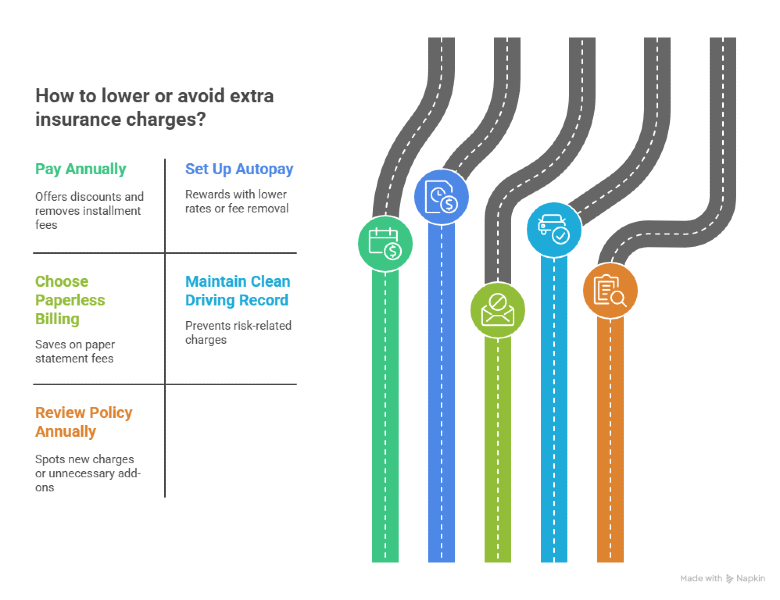

Tips to Lower or Avoid Extra Charges

There are practical ways to keep your insurance costs under control once you understand how hidden fees work.

- Paying annually instead of monthly is one of the easiest. It usually comes with a small discount and removes installment fees altogether.

- Setting up automatic payments is another good idea. Some insurers reward customers who choose autopay with lower rates or by removing processing fees.

- Choosing paperless billing also helps. Physical mail delivery sometimes includes “paper statement” fees, so switching to email notifications can save money and be more convenient.

- Keeping your driving record clean can also prevent hidden penalties. A good history means fewer risk-related charges and better renewal offers. Lastly, make it a habit to review your policy annually. Renewal time is perfect for spotting new charges or unnecessary add-ons.

Why Being an Informed Policyholder Saves You Money

Insurance companies rely on trust and convenience. Many drivers sign documents quickly, assuming everything is standard, and do not revisit their policy unless there is a problem. This is exactly why hidden fees go unnoticed.

Why Being an Informed Policyholder Saves You Money

Being informed is not about reading every line of fine print. It is about knowing what you are paying for, spotting unnecessary charges, and making smarter decisions before small fees add up to higher costs.

- Many drivers sign policies quickly and never review the details.

- That is where hidden fees usually go unnoticed.

- Understanding your coverage helps you avoid paying for things you do not use.

- Asking questions puts you in control of your costs.

- Nearly 4 out of 10 drivers pay at least one fee they do not understand.

Being informed means spending less and getting more value from your policy.

Take Control of Your Auto Insurance Costs

Understanding hidden fees is the first step toward making smarter insurance decisions. When you know what to ask and what to review, you protect both your budget and your vehicle.

That is exactly where Mila helps. By comparing quotes from different insurers, Mila makes it easier to spot unnecessary costs, understand what you are really paying for, and find coverage that fits your needs. Taking a few minutes to compare options can help you save hundreds of dollars. With Mila, exploring fair, transparent, and competitive auto insurance becomes simple and stress-free.

Take control of your auto insurance. Use Mila to compare quotes and avoid paying more than you should.

Frequently Asked Questions (FAQs) About Hidden Fees in Auto Insurance

How can I tell if my auto insurance has hidden fees?

Review your policy documents carefully and look for terms like “service fee,” “policy fee,” or “monthly installment charge.” Asking your insurer for a full fee breakdown also helps.

Can comparing quotes really help me avoid hidden fees?

Yes. Comparing quotes allows you to see the total cost side by side and identify fees that may be hidden or labelled differently across insurers.

How does Mila help with avoiding hidden fees?

Mila makes it easier to compare insurance options, understand pricing differences, and choose coverage that is transparent and fairly priced.