Full Coverage or Liability Auto Insurance: What to Pick?

Full Coverage or Liability Auto Insurance: What to Pick?

Deciding between liability and full-coverage auto insurance isn't always straightforward. The right choice depends on your car’s value, your budget, and how much peace of mind you want on the road. Whether you're driving an older car or a brand-new ride, understanding the pros and cons of each option can help you make a smart decision.

In this post, we’ll break down everything you need to know, share real-life examples, and guide you toward the best insurance choice for your situation.

What is Liability Insurance?

Liability insurance is the most basic type of auto insurance that covers damages you cause to others in an accident. It typically includes bodily injury liability (BI) and property damage liability (PD). For example, if you rear-end another car, liability insurance helps pay for the other driver's medical bills and car repairs.

Most U.S. states (except New Hampshire) require a minimum amount of liability coverage, often represented as numbers like 25/50/25. This means $25,000 per person for injuries, $50,000 total per accident, and $25,000 for property damage.

However, liability insurance only protects others, not you or your car. If your vehicle is damaged or you're injured, you'll have to cover those costs yourself. It’s like an umbrella that only keeps everyone around you dry while you get soaked.

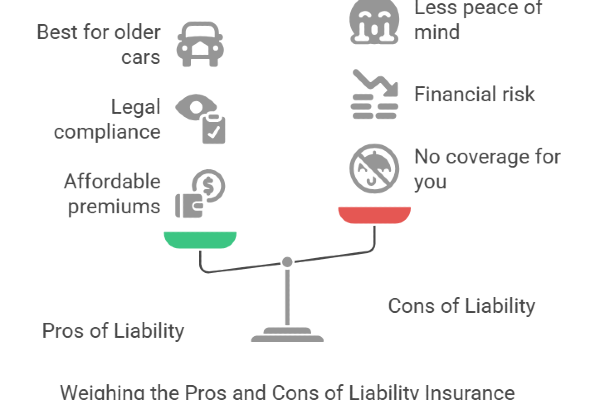

Liability Insurance: Pros and Cons

Pros

- It’s Cheaper—Way Cheaper If your budget’s tight, liability-only is your best friend. Since it only covers damage you cause to others, the premiums are lower. For example, let’s say you’re 30, with a clean driving record, insuring an older car like a 2015 Honda Civic. You might pay $50-$80 a month for liability, while full coverage could easily double or triple that.

- Meets Legal Requirements In most states, liability insurance checks the box for what you have to have to drive legally. No fuss, no frills—just enough to keep you on the right side of the law.

- Great for Older Cars If your car’s seen better days (think dents, rust, or a mileage odometer that’s basically a brag), liability might be all you need. Why? If your car’s worth $2,000 and repairs cost $3,000, insurance companies might “total” it anyway, and you’re not out much.

Cons

- No Protection for Your Car Here’s where it stings. Let’s say a deer jumps in front of your car, and you swerve into a ditch. With liability-only, you’re stuck paying for your crumpled hood out of pocket. Same goes if someone steals your ride or a storm floods it—zero coverage for you.

- Risky if You’re at Fault If you cause a big accident and the damages exceed your liability limits (say, $50,000 in medical bills but your policy caps at $25,000), you could be personally sued for the rest. Imagine that hanging over your head!

- Limited Peace of Mind Driving with liability-only can feel like walking a tightrope without a net. One wrong move, and your savings could take a hit.

Example

A man drives a 2008 Toyota Corolla worth about $1,500. He only carries liability insurance and pays about $45 per month. When he lightly bumped another car in a parking lot, his insurance covered the $800 in repairs for the other driver. His own car’s scratch wasn’t a big deal. For Jake, liability insurance works because his car has low value, and he has some savings as a safety net.

What is Full Coverage Insurance?

Full-coverage auto insurance isn’t a specific type of policy but rather a combination of coverages that provide broad protection for both you and others. It typically includes:

- Liability Insurance: Covers damages to others if you're at fault.

- Collision Coverage: Pays for repairs to your car if you're in an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, fire, or natural disasters.

Some insurers also offer add-ons like roadside assistance or rental car reimbursement, giving you even more peace of mind.

Imagine full coverage as a safety net that not only protects others but also catches you if things go wrong. Whether it's a fender bender or a tree branch crashing onto your windshield, full coverage has your back. However, this added protection often comes with a higher monthly premium.

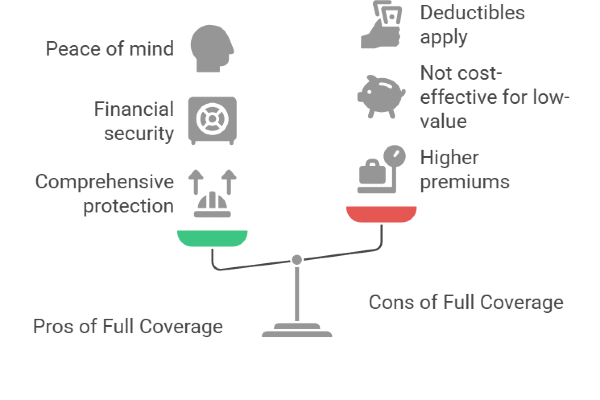

Full Coverage Insurance: Pros and Cons

Pros

- Comprehensive protection: Your car is covered in a wide range of situations.

- Financial security: Reducing the financial burden of repairs or replacement.

- Peace of mind: Especially valuable for newer or financed cars.

Cons

- Higher premiums: You might pay significantly more than liability-only policies.

- Not always cost-effective: It may not make sense for low-value vehicles.

- Deductibles apply: You’ll need to pay a deductible before insurance kicks in.

Example

A woman recently bought a 2023 Subaru Outback and still owes $25,000 on her loan. She chose full coverage with a $500 deductible, paying $180 per month. When her car was sideswiped in a hit-and-run, her collision coverage paid $3,200 for repairs (minus the $500 deductible). The full-coverage policy helped her avoid a huge financial setback, making it a smart choice given her situation.

How to Choose the Right Insurance for You

Selecting between liability and full-coverage auto insurance depends on your specific needs, budget, and vehicle. Here are key factors to consider when making your decision:

When Liability Insurance Makes Sense

- Your car’s value is low: If your vehicle is worth less than $4,000-$5,000, paying for full coverage might not be worth it.

- You can afford repairs or a replacement: If you have a solid emergency fund, you might not need the extra coverage.

- You’re a safe driver: A clean driving record reduces the risk of needing your own repairs covered.

- You want to save money now: Lower premiums free up cash for other priorities.

When Full Coverage is a Better Choice

- You have a loan or lease: Most lenders require full coverage until the car is paid off.

- Your car is new or valuable: Full coverage can prevent financial loss if the car is damaged or stolen.

- You live in a high-risk area: Busy cities, theft-prone neighborhoods, or places with extreme weather make full coverage a safer bet.

- You value peace of mind: If worrying about potential accidents or damage keeps you up at night, full coverage offers reassurance.

A Quick Tip to Decide

Check your car’s value on websites like Kelley Blue Book. If a year of full-coverage premiums costs close to (or more than) the car’s value, liability insurance might be the smarter choice. For instance, if your car is worth $3,000 and full coverage costs $1,800 annually, it might not make financial sense to invest in full coverage.

Find the Best Auto Insurance for Your Budget and Car With Mila

Choosing between liability and full-coverage auto insurance is all about balancing cost, risk, and peace of mind. If you’re driving an older car and need to keep expenses low, liability insurance might be all you need. However, if you have a new or financed vehicle, full coverage offers valuable protection.

Evaluate your situation, consider your budget, and choose the coverage that makes the most sense for you. Take control of your coverage with Mila. Compare live quotes from trusted insurers, save up to 30%, and choose the plan that fits your life, on your terms. Start now!

Frequently Asked Questions (FAQ’s) About Comparing Liability vs. Full-Coverage Auto Insurance

Why is full coverage so much more expensive?

It’s all about what’s covered. With full coverage, you’re paying for liability and collision and comprehensive protection for your car. More coverage means more risk for the insurance company, so they charge higher premiums. Think of it as upgrading from a basic phone plan to one with unlimited data—it costs more because you get more.

Compare. Save. Drive smart. Mila brings you real-time quotes from trusted insurers—up to 30% savings, zero data selling. Start comparing now!

Can I switch from full coverage to liability later?

Absolutely! You can adjust your policy anytime, say, if your car gets older and isn’t worth as much. Just call your insurer, and they’ll tweak it for you. Compare the savings to make sure it’s worth it.

Does full coverage protect me from everything?

Not quite. Full coverage typically includes liability, collision, and comprehensive, but it won’t cover stuff like mechanical breakdowns (that’s a warranty thing) or super high medical bills unless you add extras like personal injury protection (PIP). Read the fine print to know exactly what you’re getting!

What’s a deductible, and how does it affect my choice?

A deductible is what you pay out of pocket before insurance kicks in—like $500 or $1,000. It’s only part of full coverage (collision and comprehensive), not liability. Higher deductibles lower your premiums but mean more upfront cost if you file a claim. Pick one you can afford if disaster strikes!

How do I decide between the two?

Ask yourself: How much is my car worth? Can I afford repairs or a new one if it’s totaled? Do I owe money on it? If you’ve got an older car and some savings, liability might do. If it’s newer, financed, or you want peace of mind, lean toward full coverage. It’s all about what keeps you comfortable behind the wheel!