Can You Insure a Car You Don't Own? Here's What to Know

Many people find themselves driving a car that isn’t legally theirs. Maybe it belongs to a partner, a friend, or a family member, but you’re the one behind the wheel most of the time. Even if your name isn’t on the title, there are still ways to protect yourself on the road.

In this post, you’ll learn how to insure a car you don't own, what insurers look for, and the options available to you.

Can You Insure a Car That Isn’t Yours?

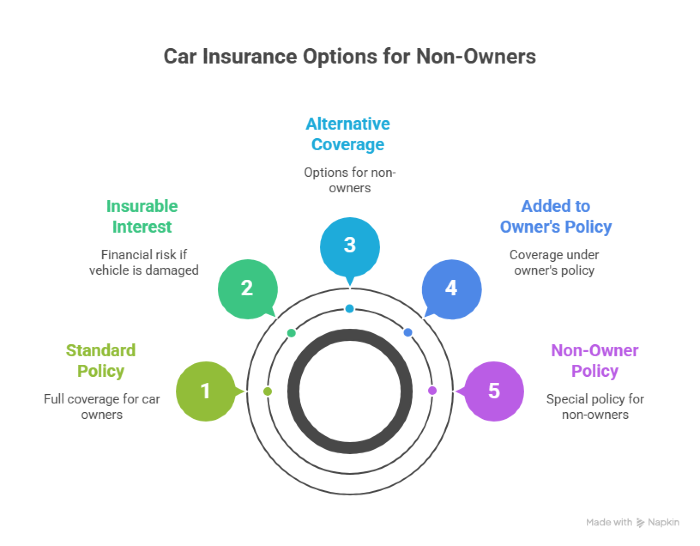

In most cases, insurance companies won’t let you buy a standard policy for a car you don’t legally own. Why? Because they need proof of something called insurable interest.

What’s insurable interest?

It means you’d suffer a financial loss if something happened to the vehicle. Without that connection, insurers see you as a higher risk.

So, is it a hard no?

Not necessarily. You can’t usually take out a full policy in your name, but there are still ways to stay protected.

For example:

- You might be added to the owner’s insurance

- Some companies offer special non-owner policies

- In certain cases, temporary insurance might work

If you regularly use a car that’s not yours, like your partner’s or a close family member’s, there’s a good chance you qualify for some form of coverage.

Ways to Get Covered When the Car Isn’t Yours

Even if you’re not listed on the car’s title, you still have choices. Depending on how often you drive the car and your relationship with the owner, one of these options might be the right fit.

1. Be added to the owner’s policy

This is often the easiest and most affordable solution. The owner can contact their insurer and include you as a named driver. It’s a good fit if:

- You live in the same household

- You use the car regularly

- The owner agrees to share the responsibility

2. Consider non-owner car insurance

This policy is made for people who often drive but don’t own a car themselves. It usually includes:

- Liability coverage for damage or injury you cause

- Sometimes, protection against uninsured drivers

3. Look into temporary or short-term insurance

Some insurers offer short-term policies that last from a few hours to a few weeks. They’re perfect for:

- Weekend trips

- Emergencies

- Helping a friend or family member with errands

When the Owner’s Insurer Won’t Add You

Sometimes, the easiest option, being added to the owner’s policy, just isn’t possible. Insurance companies have their own rules, and not all of them allow non-owners to be included, even with the owner's consent.

If that happens, here are a few things you can try:

- Check with other insurance providers: Some are more flexible than others. It’s worth getting a second or third opinion.

- Explore joint ownership: In some cases, the car can be co-registered, which may open the door to standard coverage.

- Get written permission: A letter from the owner, clearly stating that you have permission to drive and insure the car, might help with certain insurers.

What You Have to Know Before Insuring

Every state in the U.S. has its take on auto insurance, but in general, no law says you can’t be insured on a car you don’t legally own. That said, most insurance companies still follow their own rules, and those often require that your name be on the title or that you prove a valid connection to the car.

Some may accept a detailed explanation of your relationship to the vehicle, especially if you drive it regularly or help pay for its upkeep. Others might need written permission from the owner or refuse coverage altogether.

To keep things clear and avoid trouble later:

- Talk directly with the insurer about your situation

- Check with your state’s DMV if you’re unsure of any legal requirements

- Be honest in your application—accuracy matters when it’s time to file a claim

Are You Covered When You Borrow a Car Occasionally?

Driving a friend’s or family member’s car once in a while? You might already be covered under their insurance. Most policies include something called permissive use, which kicks in when a non-owner drives the car with permission.

In the U.S., permissive use generally applies if:

- You’re not listed as a regular driver

- You were permitted to use the car

- You have a valid driver’s license

This coverage is usually enough for quick errands, emergencies, or short trips. But it’s not universal; some insurers limit or exclude it completely. To stay safe:

- Have the car owner confirm that their policy includes permissive use

- Don’t assume coverage if you use the car regularly

- Look into additional options if you need long-term protection

Can You Be Insured on a Company or Leased Vehicle?

Cars owned by a business or leased from a dealer usually come with their insurance. That means you typically can’t take out a personal policy on them unless you're officially listed as a driver.

If you’re using a company car:

- The employer likely holds a commercial insurance policy

- You may be added as an authorized or named driver

- Personal use of the vehicle may not always be covered—check first

For leased cars:

- The leasing company usually requires full coverage

- The insurance must be in the name of the person on the lease

- You can’t insure it yourself unless the lease is in your name

In both cases, the best move is to speak with the owner, whether it’s your employer or the leasing company, and confirm what kind of coverage is in place and whether you’re protected.

Find the Right Insurance for Your Situation With Mila

Even if the car isn’t in your name, there are smart, legal ways to get insured and stay protected on the road. The key is to be upfront about your situation and work with the right insurer. You have options—yes, you can insure a car you don't own, and it doesn’t have to be complicated.

At Mila, we make it easy for you to compare insurance options and find coverage that fits your unique situation. Whether you drive a car you don’t own or just want to explore what’s out there, we’re here to help you do it with confidence.

Start with confidence, see what policies work for you with Mila’s easy comparison tool.

Frequently Asked Questions (FAQs) About Insuring a Car You Don't Own

Can I get insurance for my partner’s or roommate’s car if I use it daily?

Yes, but not through a policy in your name. The best option is to have the car’s owner contact their insurer and add you as a named driver. This lets you drive with full coverage and keeps everything transparent and legal.

What are the risks of trying to insure a car that’s not mine under my name?

If you're not listed on the title and don’t disclose the full situation, the insurer might cancel the policy or deny claims later. That can leave you with unexpected costs—or even legal trouble. It’s always safer to explain your situation clearly and ask what options are available.

Is non-owner car insurance a good option for someone who borrows cars regularly?

Yes. If you often rent or borrow vehicles but don’t own one, non-owner insurance provides basic liability coverage and helps keep your insurance history active. It won’t cover damage to the car you’re driving, but it’s great for protecting yourself and maintaining lower rates in the long term