Best Auto Insurance Tips for Senior Drivers

Entering your senior year brings many changes, and your car insurance needs are certainly among them. Whether you've just turned 60 or you're approaching retirement, understanding how car insurance works for seniors can help you maintain the protection you need while potentially saving money.

In this post, you’ll learn everything you need to know about auto insurance for seniors, including available discounts, coverage recommendations, and tips for balancing cost and protection. Whether you're newly retired or just looking to save money, the right strategy can help you get the best coverage at the best price.

How Age Affects Your Car Insurance as a Senior

When you enter your 60s, you might notice some interesting changes in your car insurance rates. Many insurers view seniors in their early 60s as some of their safest drivers! This is because mature drivers typically have decades of driving experience, are more cautious on the road, and often drive fewer miles than their working-age counterparts.

However, as you continue to age, particularly beyond 70, you may see your rates gradually increase again. This isn't personal; insurance companies base these adjustments on statistical data. According to Merck, for every mile driven, older drivers have higher rates of traffic violations, accidents, and fatalities than most other age groups over 25.

Special Discounts Available to Senior Drivers

As a senior driver, you may qualify for exclusive discounts that can help lower your auto insurance premiums. Many insurance companies reward experienced drivers with special savings. Here are some of the top discounts to look for:

1. Senior-Specific Discounts

- Some insurers offer age-based discounts starting as early as 55 or 60.

- These discounts recognize your experience and typically safer driving habits.

- Not all companies advertise them, so be sure to ask your provider.

2. Retirement Discounts

- If you’ve retired and no longer commute daily, your risk level decreases.

- Many insurers lower premiums for drivers who log fewer miles per year.

- Make sure to inform your provider about your reduced driving habits.

3. Defensive Driving Course Discounts

- Taking a senior driving course can save you 5-15% on your insurance.

- Organizations like AARP, AAA, and state DMVs offer these programs.

- Most discounts last three years, after which you may need a refresher.

4. Low Mileage Discounts

- If you drive less than the average annual mileage, you may qualify.

- Some insurers have pay-per-mile policies, which can be ideal for retirees.

5. Bundling Discounts

- Save money by combining auto insurance with home or renters insurance.

- Bundling policies can reduce your overall costs significantly.

How to Maximize Your Savings

- Ask your insurer about all available senior discounts.

- Take a defensive driving course to qualify for extra savings.

- Reduce your annual mileage and notify your provider.

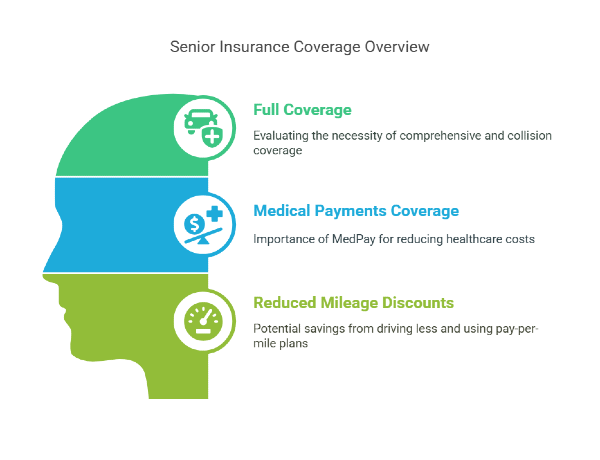

Coverage Considerations for Your Changing Lifestyle

As you enter your senior years, your insurance needs may shift based on your lifestyle and financial situation. Evaluating your coverage can help you save money while ensuring you stay protected.

1. Should You Keep Full Coverage?

- If your car is paid off, you have more flexibility in choosing coverage levels.

- Full coverage (comprehensive & collision) is ideal for newer vehicles.

- For older cars with low value, consider dropping full coverage to reduce costs.

- If your car’s value is less than 10 times your annual insurance premium, dropping full coverage might make sense.

2. The Importance of Medical Payments Coverage

- Medical expenses can become more costly and complex with age.

- Medical Payments Coverage (MedPay) helps with expenses regardless of fault.

- Having this protection can reduce out-of-pocket healthcare costs after an accident.

3. How Reduced Mileage Can Lower Your Premium

- Many retirees drive less than when they were working full-time.

- Insurance companies often offer low-mileage discounts for drivers who log fewer miles.

- Consider a pay-per-mile insurance plan if you rarely drive long distances.

How to Optimize Your Coverage

Adjusting your auto insurance to match your lifestyle ensures you get the best coverage at the best price.

- Review your vehicle’s value before deciding on full coverage.

- Increase MedPay coverage to protect against medical expenses.

- Notify your insurer if your mileage noticeably decreases.

How to Find the Right Balance: Coverage vs. Cost

While saving money on auto insurance is important, having adequate protection is a determinant, especially for a senior with valuable assets. Managing the right balance ensures you stay covered without overpaying.

1. Why Liability Coverage Matters More Than Ever

- As a senior, you’ve likely accumulated savings, property, or investments.

- If you're at fault in an accident, insufficient liability coverage could put your assets at risk.

- Recommended liability limits:

- $100,000 per person (bodily injury).

- $300,000 per accident (bodily injury).

- $100,000 for property damage.

2. Choose the Right Deductible

- A higher deductible lowers your monthly premium but increases out-of-pocket costs in a claim.

- A lower deductible means higher premiums but less financial strain after an accident.

- Choose a deductible that matches your financial comfort level.

3. Additional Coverage to Consider

- Roadside assistance: Helpful for unexpected breakdowns.

- Rental reimbursement: This covers a rental car if yours is in the shop.

- Gap insurance: If you have a car loan, this covers the difference if your car is totaled.

Smart Ways to Balance Cost and Protection

- Raise your deductible if you have emergency savings.

- Increase liability limits to protect your assets.

- Drop unnecessary coverage on older vehicles.

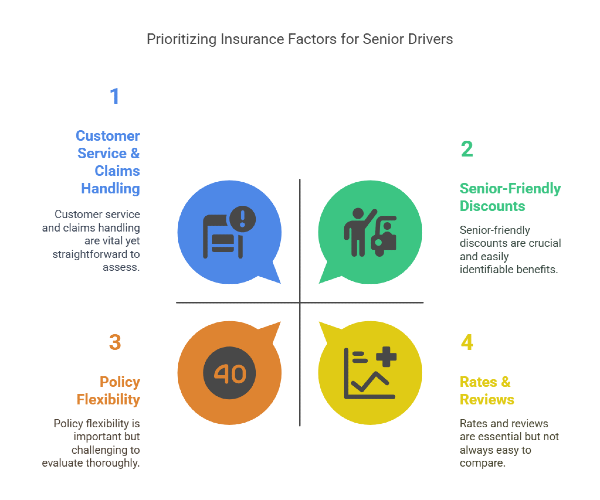

How to Choose the Best Insurer If You Are a Senior Driver

With so many insurance companies available, choosing the right one as a senior driver can feel overwhelming. Beyond just finding the lowest premium, it’s important to consider these factors:

1. Prioritize Senior-Friendly Discounts

Look for insurers that offer: ✔ Age-based discounts for drivers 55+ or 60+. ✔ Low-mileage discounts if you drive less in retirement. ✔ Defensive driving course savings for completing a refresher course.

2. Evaluate Customer Service & Claims Handling

Not all insurers offer the same level of support. Consider: ✔ Ease of filing claims – Can you file online or over the phone? ✔ Response time – Do they process claims quickly? ✔ Availability – Are customer service agents accessible when you need them?

3. Look for Policy Flexibility

As you age, your driving habits may change. The best insurers offer: ✔ Adjustable coverage options for reduced mileage. ✔ Roadside assistance for extra security. ✔ Continuous coverage guarantees to prevent policy cancellation based on age.

4. Compare Rates & Read Reviews

To ensure you're getting the best deal:

- Get multiple quotes to compare pricing and benefits.

- Read customer reviews to assess claim satisfaction.

- Ask about hidden fees or restrictions before signing a policy.

How Can You Plan for Long-Term Auto Insurance?

As your driving needs evolve, it’s important to adjust your auto insurance accordingly. Planning can help you reduce costs, maintain coverage, and ensure long-term protection.

1. Downsize to One Vehicle

- Many retirees find that owning two cars is no longer necessary.

- Reducing to one vehicle can significantly lower: ✔ Insurance premiums (fewer policies to maintain). ✔ Maintenance and fuel costs. ✔ Registration and tax expenses.

- Before making a decision, consider your lifestyle and transportation needs.

2. Choose an Insurer with a Renewable Guarantee.

- Some insurers offer policies that guarantee renewal, preventing cancellation due to age.

- This can provide peace of mind, ensuring you won’t lose coverage unexpectedly.

- If this is important to you, ask potential insurers if they offer this feature.

3. Review Your Policy Annually

- Your driving habits may change as you age, so it’s smart to review your policy every year.

- Key things to check: ✔ Are you still driving the same amount? If not, you may qualify for low-mileage discounts. ✔ Do you still need full coverage on your car? If it’s older, adjusting your coverage could save money. ✔ Are there new discounts available? Insurance companies frequently update their offerings.

Why Work with Insurance Professionals

Having the right professionals by your side for dealing with auto insurance as a senior can make the process easier and help you find the best coverage for your needs. Check these benefits of having an independent insurance agent:

- Independent agents can compare multiple insurance companies to find the best coverage at the best price.

- They understand senior-specific discounts and policy options that might not be widely advertised.

- If your needs change, they can help adjust your policy instead of locking you into one company.

How a Financial Advisor Can Help

- A financial advisor can ensure your auto insurance fits into your retirement budget.

- They help determine the right liability limits to protect your assets.

- If you're considering downsizing vehicles or adjusting coverage, they can guide you on what makes the most financial sense.

Embrace Your Senior Status for Better Coverage With Mila

Having the right auto insurance is essential at any stage of life. Accidents, unexpected repairs, and liability risks don’t disappear with age, making proper coverage just as important in your senior years.

Beyond legal requirements, insurance provides financial security and peace of mind, ensuring that one unexpected event doesn’t disrupt your stability. No matter how driving habits change over time, staying properly insured is a smart and necessary choice.

Real quotes. Real savings. With Mila, you can compare auto insurance offers in real time and keep up to 30% in your pocket without trading your data. Compare now and see how much you can save.