Auto Insurance vs. Car Warranty: Key Differences & What They Cover

When you own a car, unexpected costs are almost guaranteed. But not all protection plans are created equal. Two of the most common terms you’ll hear, auto insurance and car warranty, are often confused, even though they cover very different things.

In this post, we’ll explain how each works, what they cover, and how to know which one you really need. Let’s clear up the confusion.

What’s the Difference Between Auto Insurance and a Car Warranty?

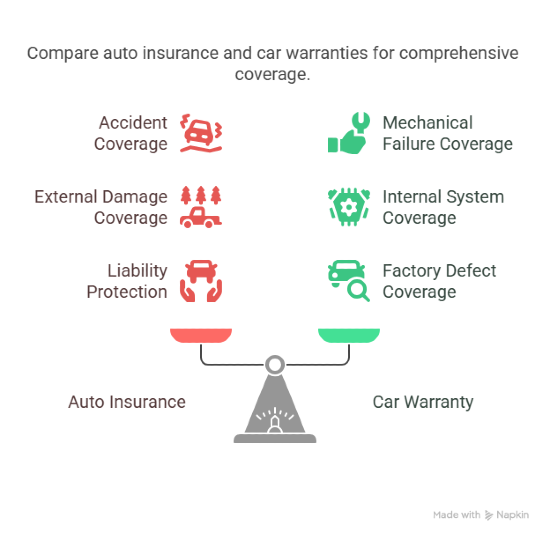

Auto insurance helps you when something happens to your car, like a crash, theft, or storm damage. A car warranty, on the other hand, steps in when something inside your car stops working properly, like the engine, transmission, or electrical system. They don’t overlap. One deals with accidents and outside events, the other with mechanical problems.

So even though both offer protection, they cover very different situations.

Think of it this way

- If you back into a pole, your insurance helps pay for repairs.

- If your engine dies out of nowhere, the warranty (if still active) might cover it.

What Does Auto Insurance Cover?

Auto insurance is something you’re legally required to have in most places, but beyond that, it’s pretty useful when things go wrong on the road. It’s there to help you cover the costs of accidents, not just with your car, but with other people too. Here’s a quick look at the main things it can cover:

Common Auto Insurance Coverages

- Liability: If you cause an accident, this pays for the other person’s car repairs or medical bills.

- Collision: Covers damage to your car, even if the accident was your fault.

- Comprehensive: Helps if your car is stolen, vandalized, or damaged by weather, like hail, floods, or falling trees.

- Medical payments or personal injury protection (PIP): Covers your medical costs after a crash.

- Uninsured/underinsured motorist: Protects you if someone hits you and doesn’t have enough or any insurance.

What Does a Car Warranty Cover?

A car warranty is about repairs when something in your car stops working the way it should. In simple terms, it helps you cover the cost of fixing mechanical problems that aren’t your fault.

🔧 Here’s what a warranty usually covers

- Engine issues: Like if your car won’t start or overheats without warning.

- Transmission failure: One of the most expensive repairs, and often covered.

- Electrical system problems: Power windows, dashboard lights, or sensors that go bad.

- Factory defects: If something was made wrong or breaks too soon.

But it won’t cover everything

- Accident damage? Nope, that’s for your insurance.

- Oil changes, tires, or brakes? Not covered, that’s regular maintenance.

- Neglect or lack of maintenance? Also, not covered.

Two types of warranties you might hear about

- Factory warranty: This is what comes with most new cars, usually lasting 3 to 5 years or up to a mileage limit.

- Extended warranty: This is optional, and you can buy it when your factory coverage ends.

If you're still unsure which one does what, here’s a quick side-by-side comparison to make it clearer. This will help you see exactly how auto insurance and car warranties differ in terms of coverage and purpose.

Do You Need Both Auto Insurance and a Car Warranty?

In short? Yes, because they cover completely different things. Most drivers think it’s either one or the other, but the truth is they work side by side to protect your car in different situations. Let’s break it down:

Why You Need Auto Insurance

- It’s required by law in most places.

- It covers accidents, theft, natural disasters, and injuries.

- It protects not just your car, but also other people and vehicles involved.

Why You Might Need a Car Warranty

- It helps you handle expensive repairs when something fails inside your car.

- It covers parts like your engine, transmission, and electronics.

- It gives you more control over unexpected repair costs, especially as your car gets older.

So while auto insurance protects you from the outside world, like crashes and weather, the car warranty protects you from what might go wrong inside the vehicle itself. They’re not interchangeable, they’re complementary.

When Is a Car Warranty Worth It?

Not every driver needs an extended warranty, but in certain cases, it can be a smart move.

If your car is out of factory coverage, and you want to avoid surprise repair bills, it might be worth considering.

You might want a car warranty if

- Your factory warranty is about to expire: Repairs after that point come out of your pocket.

- You’re keeping your car for several more years: The older the car, the higher the risk of something failing.

- You’d rather pay a set amount now than a big repair later: Warranties can spread out your cost instead of one big, stressful bill.

- You’re not great at dealing with unexpected repairs: Some drivers just prefer knowing they’re covered in advance.

When Does Each One Kick In?

Sometimes the best way to understand the difference is to walk through a few everyday situations. Here are three clear examples:

1. You get into a fender bender

You're backing out of a parking space and accidentally hit another car.

- Auto insurance? ✅ Yes, your collision or liability coverage helps pay for the damage.

- Car warranty? ❌ No, this wasn’t a mechanical issue.

2. Your transmission suddenly fails

No warning, no accident, just a dead transmission on your way to work.

- Auto insurance? ❌ No, because it wasn’t related to an accident.

- Car warranty? ✅ Yes, if you’re still within the coverage terms, it could cover the repair.

3. A tree branch falls on your car during a storm

Your car is parked in the driveway, and a heavy branch smashes the windshield.

- Auto insurance? ✅ Yes, comprehensive coverage handles this.

- Car warranty? ❌ No, weather damage isn’t part of a warranty.

How to Get the Most Out of Your Coverage

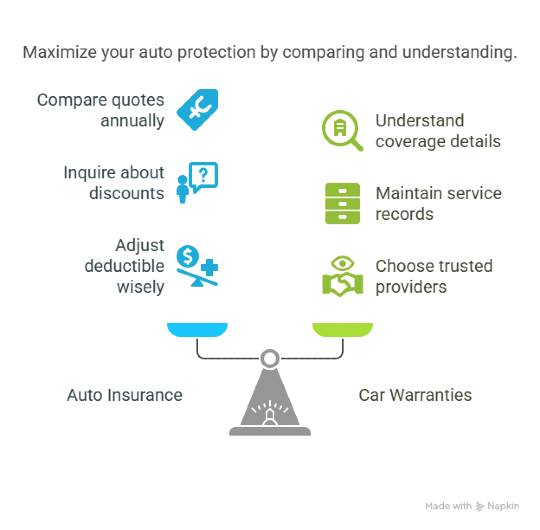

Whether you're paying for auto insurance, a car warranty, or both, it’s important to make sure you're getting value from what you’re paying for. Below are some practical tips to help you maximize your protection and avoid common pitfalls.

🧾 For Auto Insurance:

- Shop around once a year: Don’t just auto-renew. Comparing quotes could save you hundreds.

- Ask about discounts: Things like safe driver history, bundled policies, or low mileage can reduce your premium.

- Adjust your deductible: A higher deductible usually means lower monthly payments (just make sure you can afford it if something happens).

- Review your policy regularly: Life changes, and so should your coverage. Check that you’re not over- or under-insured.

🛠️ For Car Warranties:

- Know exactly what’s covered: Some warranties sound great, but exclude key systems. Read the fine print.

- Keep up with maintenance: Skipping oil changes or scheduled service can void your warranty.

- Save your service records: If you ever file a claim, having documentation helps you get approved faster.

- Stick with trusted providers: Not all extended warranties are equal. Choose companies with solid reputations and clear terms.

Make the Right Coverage Choice With Mila

Auto insurance and car warranties serve different purposes, but both play an important role in protecting your vehicle and your wallet. One helps you deal with accidents, theft, or weather damage. The other helps you manage unexpected repairs from mechanical failures or faulty parts.

Instead of choosing one or the other, the smart move is knowing how they work together. That way, you’re covered from every angle, whether it’s a bump in the road or something going wrong under the hood. At Mila, we help you compare coverage options that make sense for your life and your budget.

Frequently Asked Questions (FAQs) About Auto Insurance vs Car Warranty

Does full coverage auto insurance include mechanical repairs?

No. Even if you have full coverage, insurance won’t pay for repairs due to wear and tear or mechanical breakdowns. That’s where a car warranty comes in.

Is a car warranty required by law?

No, warranties are optional. Auto insurance is usually mandatory, but warranties are a personal choice to help manage repair costs after your factory coverage expires.

What happens if I drive without auto insurance?

In most states and countries, it’s illegal to drive without insurance. You could face fines, license suspension, or even legal trouble—not to mention being fully responsible for any damages or injuries you cause.