Auto Insurance: Key Questions to Ask for Better Coverage

When was the last time you really looked at your auto insurance policy? Most of us pay our premiums without giving much thought to what we're covered for. However, understanding your auto insurance is very important for protecting yourself financially and ensuring you have appropriate coverage for your specific needs.

In this post, we'll explore the key questions you should ask about your auto insurance policy, to have a clearer understanding of how to evaluate your coverage and make informed decisions about your protection.

Why Understanding Your Auto Insurance Matters

Auto insurance is more than just a legal requirement, it’s a financial safeguard that can prevent unexpected expenses after an accident. Many drivers assume they have the right coverage, only to find out too late that they’re unprotected or paying for features they don’t need. By understanding your policy, you can: ✔ Ensure you have enough coverage to protect your assets. ✔ Avoid overpaying for unnecessary add-ons. ✔ Identify gaps in coverage that could leave you exposed.

Questions you should ask about your auto insurance

The right auto insurance coverage is very important, but many drivers don’t take the time to review their policies. Asking the right questions can help you avoid costly mistakes and ensure you're fully protected in case of an accident. Below are key questions to ask your insurer to better understand your coverage and make informed decisions.

1. Essential Coverage Questions

1.1 What Types of Coverage Do I Have?

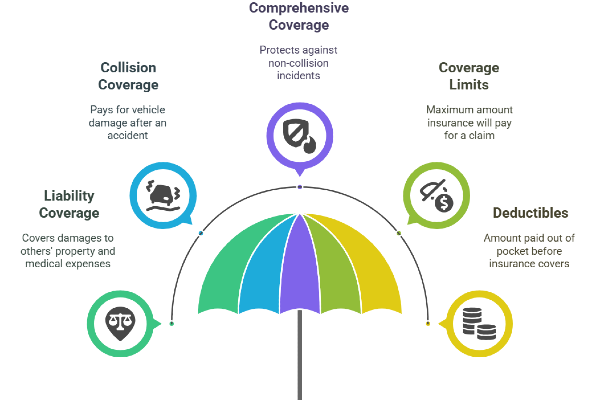

Auto insurance isn't one single, but a collection of different coverage types combined, each type protects you in different situations:

- Liability coverage: Pays for damage you cause to others, both their property and their medical expenses. This is the foundation of any auto insurance policy and is required in most states. However, the minimum required amount might not be enough to protect your assets in a serious accident.

- Collision coverage: Pays for damage to your vehicle after an accident, regardless of who was at fault. This becomes particularly important if you have a newer or more valuable vehicle.

- Comprehensive coverage: Protects your vehicle from non-collision incidents like theft, vandalism, fire, or natural disasters. If you live in an area prone to severe weather or have a higher-value vehicle, this coverage becomes especially important.

1.2 What Are My Coverage Limits?

Coverage limits represent the maximum amount your insurance will pay for a covered claim. These limits can vary significantly between policies and are typically expressed as three numbers, such as 100/300/50, which represents:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $50,000 property damage liability per accident

Ask yourself: Would these limits be enough if you caused a serious accident involving multiple vehicles or injuries? Many experts recommend carrying higher limits than your state's minimum requirements to adequately protect your assets.

1.3 What Is My Deductible, and How Does It Work?

Our deductible is the amount you pay out of pocket before insurance covers the rest.

- Higher deductibles: Lower monthly premiums but higher costs when filing a claim.

- Lower deductibles: Higher monthly premiums but lower out-of-pocket expenses in an accident.

Consider this example

If you have a $500 deductible and experience $2,000 in damage, you'll pay $500 and your insurance will cover the remaining $1,500. However, if the damage is only $400, it wouldn't make sense to file a claim since it's less than your deductible.

2. Personalization Questions

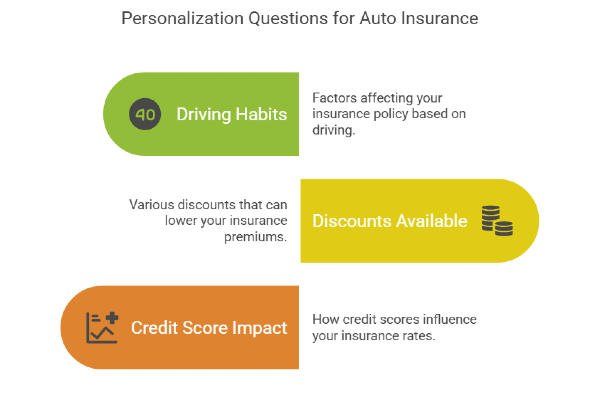

Auto insurance isn’t one-size-fits-all. Your policy should reflect your driving habits, lifestyle, and financial situation. Asking these questions will help you customize your coverage and maximize savings.

2.1 Does My Policy Reflect My Actual Driving Habits?

Your insurance rates are based on how much and how often you drive. If your habits have changed, your policy might need an update. Consider these factors:

- Low mileage: If you drive less than the average person, you may qualify for a low-mileage discount.

- Ride-sharing or business use: If you drive for Uber, Lyft, or deliver food, standard policies may not cover you. You might need a commercial or rideshare add-on.

- Long commutes vs. occasional driving: Frequent highway driving may increase your risk level, while occasional driving could qualify you for lower rates.

2.2 Am I Getting All the Discounts I Qualify For?

Insurance companies offer a variety of discounts that can lower your premiums. Common ones include:

- Safe driver discount: If you have a clean driving record.

- Multi-policy discount: For bundling auto insurance with home or renters insurance.

- Good student discount: For young drivers who maintain good grades.

- Vehicle safety discount: If your car has advanced safety features like anti-lock brakes or lane assist.

- Loyalty discount: Some insurers reward long-term customers with lower rates.

2.3 How Does My Credit Score Affect My Premium?

In most states, insurance companies use credit scores to help determine your premium. Studies show a correlation between credit scores and the likelihood of filing claims.

- Higher credit score = Lower insurance rates

- Lower credit score = Higher premiums

If your credit score has improved since your last policy renewal, you may qualify for better rates. If it has dropped, expect higher costs. Regularly monitoring your credit and maintaining a good score can help reduce your insurance expenses.

3. Claims and Coverage Questions

Knowing how your insurance policy handles claims can prevent surprises when you need to file one. These questions will help you understand what’s covered and what to expect in different situations.

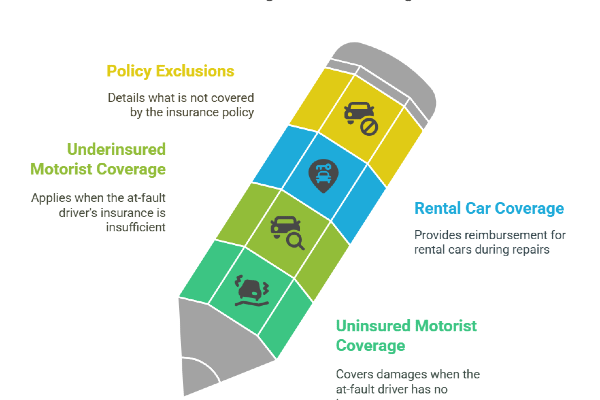

3.1 What Happens if Someone Without Insurance Hits Me?

Not all drivers carry insurance, and some may not have enough coverage to pay for damages.

- Uninsured Motorist Coverage (UM): Pays for your medical expenses and vehicle damage if the at-fault driver has no insurance.

- Underinsured Motorist Coverage (UIM): Kicks in when the at-fault driver’s coverage isn’t enough to cover all damages.

Example

If an uninsured driver causes $30,000 in medical bills, and you don’t have UM coverage, you’d be responsible for the full amount.

3.2 How Does My Policy Handle Rental Cars?

If your car is in the shop after an accident, will your insurance pay for a rental? Some policies include rental reimbursement coverage, while others require it as an add-on.

Key questions to ask: ✔ Does my policy cover a rental car while my vehicle is being repaired? ✔ What’s the daily reimbursement limit (e.g., $30 per day)? ✔ How long will insurance cover my rental?

3.3 What’s Not Covered by My Policy?

Just as important as knowing what’s covered is understanding what isn’t. Common exclusions include:

- Intentional damage: If you damage your car on purpose, insurance won’t cover it.

- Mechanical breakdowns: Normal wear and tear or maintenance issues aren’t covered.

- Commercial use: If you use your car for business purposes without proper coverage, claims could be denied.

- Driving under the influence: Accidents caused while intoxicated may not be covered, depending on state laws.

4. Financial Protection Questions

Your auto insurance policy plays a central role in protecting your finances. Asking these questions will help you ensure you’re not overpaying and that your coverage aligns with your car’s value.

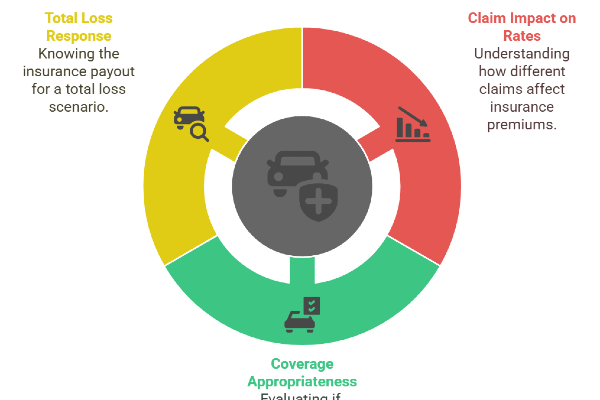

4.1 How Will Filing a Claim Affect My Rates?

Not all claims impact your insurance costs the same way. In general:

- At-fault accidents can significantly increase your premium.

- Comprehensive claims (e.g., weather damage or theft) may have minimal impact.

- Small claims can still lead to rate hikes, especially if you file multiple claims in a short time.

- Before filing a claim, compare the repair costs vs. potential rate increase. If the repair is minor, paying out of pocket might be cheaper in the long run.

4.2 Is My Coverage Appropriate for My Vehicle’s Value?

As your car ages, the cost of comprehensive and collision coverage might outweigh its benefits. Consider this:

- If your annual premium for these coverages exceeds 10% of your car’s value, consider dropping them.

- For older vehicles with low market value, liability coverage might be enough.

Example

If your car is worth $3,000, and you're paying $400 per year for comprehensive and collision, it may not be cost-effective.

4.3 How Would My Policy Respond to a Total Loss?

If your car is declared a total loss after an accident, your insurance will pay the actual cash value (ACV), not what you originally paid for it. Since cars depreciate quickly, this payout might be lower than expected.

- Gap Insurance can cover the difference between what you owe on a loan and your car’s ACV.

- If you lease or finance your car, check if gap insurance is included in your policy.

Example

If you owe $20,000 on your car loan but insurance values your totaled car at $15,000, gap insurance covers the $5,000 difference.

4. Service and Support Questions

Beyond coverage details, the quality of your insurance provider’s customer service can make a big difference when you need assistance. These questions will help you evaluate their responsiveness and support.

4.1 How Accessible Is My Insurance Company When I Need Help?

Accidents and emergencies don’t follow a schedule, so it’s essential to know how quickly you can get assistance. Ask your insurer about:

- 24/7 claims reporting: Can you file a claim at any time?

- Mobile app features: Can you access your policy, file claims, or request roadside assistance through an app?

- Local agent support: Do they have agents available for in-person consultations?

- Claim processing time: How long does it take to settle claims on average?

4.2 What Resources Does My Insurer Offer for Accident Prevention?

Many insurance companies provide tools to help policyholders drive safely and potentially lower their premiums. Check if your provider offers:

- Safe driving apps: Some insurers use telematics to track driving habits and reward safe drivers with discounts.

- Educational materials: Tips on defensive driving, accident prevention, and road safety.

- Defensive driving discounts: Savings for completing certified driving courses.

Take Control of Your Coverage con Mila

Tired of guessing which car insurance is best? With Mila, you can compare real-time quotes from top providers and save up to 30%. We never sell your data, just smart, secure choices that fit your life. Start now and take control

Photos via Freepik