Auto Insurance Glossary: Terms Every Driver Should Know

Understanding your car insurance shouldn’t feel like decoding a legal document. Yet, for many drivers, the policy language can sound like a foreign language, full of technical terms and fine print that are easy to overlook.

This Auto Insurance Glossary is here to change that. Below, you’ll find the most common insurance terms explained so you can make informed choices, avoid surprises, and feel confident about your coverage.

Why It’s Important to Know Your Auto Insurance Terms

Having insurance is one thing, understanding it is another. When you know what each term means, you can:

- Choose the right coverage for your car and lifestyle

- Avoid paying for protections you don’t need

- Understand what’s covered (and what’s not) before filing a claim

- Compare quotes from different providers fairly

In short, a good grasp of your insurance vocabulary can save you both money and stress.

Auto Insurance Glossary: Key Terms Explained

Here’s a friendly, easy-to-read guide to the most important words you’ll see in your policy.You don’t need to memorize them, just keep this glossary handy whenever you’re reviewing or renewing your plan.

1. Coverage Basics

Premium

This is the amount you pay for your insurance, usually monthly, quarterly, or yearly.Think of it as your “membership fee” for protection. The higher your coverage or the lower your deductible, the higher your premium will likely be.

Deductible

Your deductible is the part you pay out of pocket before your insurance steps in.For example, if your deductible is $500, and you have $2,000 in damage, your insurer pays $1,500, and you pay $500. Choosing a higher deductible usually means a lower premium, but also a higher cost if an accident happens.

Policy

This is your insurance contract, the document that outlines your coverage, limits, exclusions, and rights as a policyholder.

Claim

A claim is a formal request to your insurer to cover costs after an accident, theft, or other damage.

Liability Coverage

Liability pays for damages or injuries you cause to others in an accident. It’s required in almost every state because it protects other people, not your car.

2. Types of Coverage

Collision Coverage

This coverage pays for repairs to your car if you hit another vehicle or object, no matter who’s at fault. If your car is new or financed, it’s usually required by your lender.

Comprehensive Coverage

Also called “other-than-collision,” this covers damage from events like theft, fire, vandalism, or natural disasters. In short, it protects your car from things you can’t control.

Uninsured / Underinsured Motorist Coverage (UM/UIM)

If another driver causes an accident but doesn’t have enough insurance (or any at all), this coverage helps pay your expenses.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers, no matter who caused the crash. Some states make it mandatory; others offer it as an add-on.

Gap Insurance

If your car is totaled, and you owe more on your loan than the vehicle’s actual value, gap insurance covers that “gap.” It’s especially useful for new cars that lose value quickly.

3. Policy Details

Coverage Limits

Each part of your policy has a limit, the maximum your insurer will pay for a covered claim. Example: a $50,000 limit for bodily injury means your insurer won’t pay more than that per accident.

Exclusions

These are situations your insurance doesn’t cover, like racing, intentional damage, or using your car for delivery without commercial coverage.

Endorsement (or Rider)

An endorsement modifies your policy. It can add, remove, or change coverage terms, for example, adding roadside assistance.

Policy Term

This is the length of time your policy is valid, typically six or twelve months. You can renew it before it expires to avoid a lapse.

Grace Period

A short window after your payment due date, when your coverage stays active. If you don’t pay within this time, your policy could be canceled.

4. Claims and Adjustments

Adjuster

A claims adjuster is the person who inspects the damage, checks reports, and determines how much the insurance company should pay.

Total Loss

If repairing your car costs more than it’s worth, it’s considered a total loss. In that case, your insurer pays the car’s actual cash value instead of repair costs.

Depreciation

Cars lose value over time due to age and wear. Insurance companies use depreciation to calculate how much your car is worth at the time of a claim.

Subrogation

This happens when your insurer pays for your loss and then seeks reimbursement from the at-fault driver’s insurer. It’s behind the scenes; you usually don’t have to do anything.

Claim Settlement

The amount your insurer agrees to pay after reviewing your claim. Understanding your deductible and limits will help you predict your settlement.

5. Discounts and Extras

No-Claim Bonus

If you go a year or more without filing a claim, your insurer might reward you with a discount on your renewal, a nice thank-you for safe driving.

Bundling

You can often save money by combining multiple policies, for example, auto and home insurance, with the same company.

Roadside Assistance

This optional coverage helps if you get stranded with a flat tire, dead battery, or lockout. It’s inexpensive and can be a real lifesaver on long trips.

Rental Reimbursement

If your car is being repaired after a covered accident, this add-on covers the cost of a rental car so you can stay mobile.

Usage-Based or Pay-Per-Mile Insurance

Some insurers now offer coverage based on how much and how safely you drive. It’s a modern, flexible way to save if you don’t use your car often.

How These Terms Work in Real Life

Let’s imagine a simple story.

You’re driving to work when a truck rear-ends your car. You file a claim with your insurer. The adjuster estimates $3,000 in damage. Since your deductible is $500, your insurance pays $2,500.

Later, your insurer uses subrogation to recover the cost from the other driver’s insurance.Because the repairs are below your car’s total loss threshold, your car is fixed instead of replaced.

This little chain of events shows how the most common terms in this Auto Insurance Glossary work together, and why understanding them helps you feel more in control.

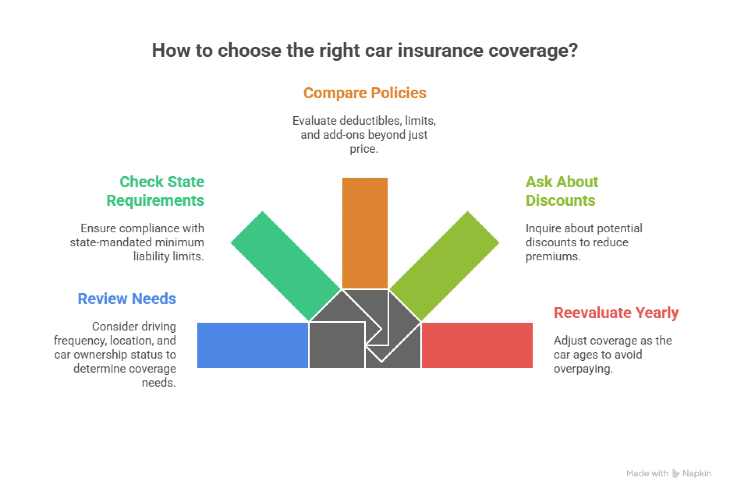

How to Choose the Right Coverage for You

Knowing the vocabulary is just the first step. Here’s how to put it to use:

- Review your needs: Do you drive daily or only on weekends? Live in a high-traffic area? Own or lease your car?

- Check your state’s requirements: Each state has its own minimum liability limits.

- Compare policies: Don’t just look at price; compare deductibles, limits, and add-ons.

- Ask about discounts: Good driver, low mileage, student, or multi-car discounts can make a big difference.

- Reevaluate yearly: As your car ages, you may not need full coverage forever.

Common Mistakes Drivers Make with Insurance Terms

Even experienced drivers sometimes slip up. Here are a few common misconceptions this Auto Insurance Glossary can help clear up:

- “Full coverage” doesn’t mean everything is covered: It usually refers to liability, collision, and comprehensive, but there are still exclusions.

- The lowest premium isn’t always best: A cheap policy with low limits or high deductibles can cost more after an accident.

- Your policy doesn’t automatically cover other drivers: Always check if friends or relatives are listed before lending your car.

- Insurance follows the car, not the driver: In most cases, the coverage applies to whoever drives your vehicle with permission.

Confidence Starts with Understanding

Auto insurance can seem intimidating, but once you learn the language, it gets much simpler. You don’t need to be an expert, just informed enough to ask the right questions and recognize what each part of your policy means.

If you’re ready to see which coverage options fit your needs, Mila can help. We connect you with top-rated auto insurance providers nationwide, allowing you to compare quotes side by side and understand exactly what each policy includes. It’s the easiest way to turn knowledge into action and make sure you’re getting fair coverage at the right price.

Take what you’ve learned today and find the coverage that truly protects you. Compare with Mila and drive with confidence knowing you made an informed choice.

Frequently Asked Questions (FAQs) About Auto Insurance Glossary

What is an Auto Insurance Glossary?

An Auto Insurance Glossary is a list of common insurance terms explained in simple language. It helps drivers understand what’s written in their policies — things like premiums, deductibles, liability, and coverage limits — so they can make better decisions when buying or renewing insurance.

Why should I learn insurance terms before buying a policy?

Knowing key insurance terms helps you compare quotes more accurately and avoid paying for coverage you don’t need. It also makes it easier to understand what’s included (and what’s excluded) in your policy before an accident happens.

What happens if I don’t understand a term in my insurance policy?

If a term confuses you, don’t hesitate to ask your insurance agent to explain it in plain language. You can also refer to this Auto Insurance Glossary anytime — it’s designed to make those tricky words simple and clea