What Auto Insurance Do You Need for a Financed Car?

If you're financing a car, your auto insurance needs will be very different. It's not just about protecting yourself anymore, but also about meeting your lender's conditions. The basic state-minimum policy won’t cut it here.

In this post, you’ll learn what type of auto insurance you need when financing a vehicle, what coverages are required, and how to stay protected without overspending.

Why Financing a Car Affects Your Insurance Coverage Needs

When you finance a car, you’re not the legal owner; your lender is, until the loan is paid off.

Why this matters

- The car is collateral for your loan

- The lender needs to protect that collateral

- Basic insurance doesn't cover their risk

What the Lender Is Worried About

If your car is:

- Stolen

- Totaled in an accident

- Damaged beyond repair

...and you only have state-minimum insurance, that coverage won’t pay for your car’s value. The lender could lose money, and they won’t take that risk.

What This Means for You

You must carry more than just the legal minimums. The required coverage for a financed car is designed to:

- Cover your car’s damage or loss

- Protect the lender’s financial interest

- Keep you compliant with your loan agreement

📌Remember: Financing a car means taking on additional insurance responsibility. It’s not optional, it’s part of the deal.

What State-Minimum Auto Insurance Covers

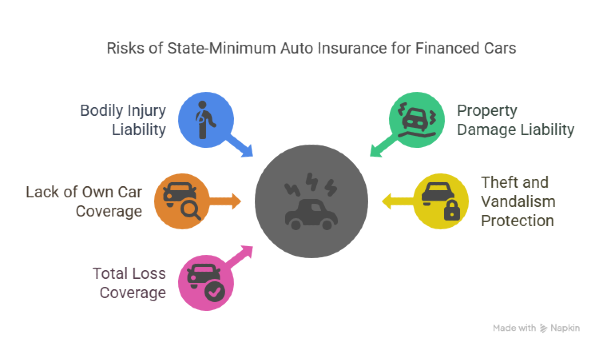

Every state requires drivers to carry a minimum level of liability insurance, but if you're financing a car, this basic coverage won't be enough.

What Does State-Minimum Insurance Usually Include?

- Bodily injury liability: pays for medical expenses if you hurt someone in an accident

- Property damage liability: covers damage you cause to another person's car or property

These are designed to protect other people, not you or your vehicle.

What’s Missing for Financed Cars?

- No coverage for your own car’s damage

- No protection if the car is stolen or vandalized

- No help if the vehicle is totaled

If you rely only on minimum coverage and something happens, you’ll be responsible for paying out of pocket, and your lender won’t be happy.

Why It’s a Problem

- The lender expects the car to be insured against all risks

- Without the right coverage, you’re violating the loan terms

- You could end up paying for a car you no longer have

📌Reminder: State minimums keep you legal on the road, but they don’t fully protect a financed car.

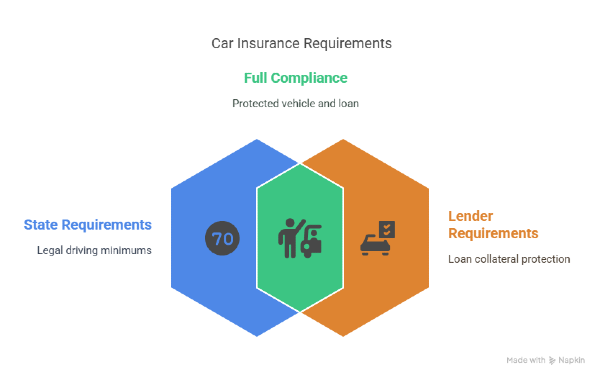

Understanding the Difference: State Requirements vs. Lender Requirements

When you're financing a car, you need to meet two sets of insurance rules. They are not the same, and knowing the difference is essential.

1. State requirements

- Legally required to drive

- Typically includes basic liability coverage

- Vary by state

These laws are designed to protect other drivers and property, not your vehicle.

2. Lender requirements

- Outlined in your financing agreement

- Require extra protections like collision and comprehensive coverage

- Aim to protect the value of the car, which serves as loan collateral

What This Means for You

- Meeting state law alone isn’t enough when your car is financed

- You must also meet your lender’s insurance conditions

- Failing to do so could lead to expensive lender-placed insurance or even repossession

📍Key point: To keep your financed car protected and stay in compliance, you need to meet both sets of requirements.

Gap Insurance for Financed Cars: What It Is and When You Need It

Gap insurance is one of those extras many drivers overlook, but it can be a financial lifesaver if you're still paying off your car.

What Is Gap Insurance?

Gap stands for Guaranteed Asset Protection. It covers the difference between:

- What your car is worth in the market

- What you still owe on your loan

Example

- You owe 20,000 dollars on your auto loan

- Your car gets totaled

- Your insurance pays out 16,000 dollars based on market value

- You are still responsible for 4,000 dollars

Gap insurance would cover that gap, so you don’t pay out of pocket for a car you no longer have.

When Is Gap Insurance Recommended?

You should strongly consider it if:

- You made a small down payment

- Your loan term is over 60 months

- You’re financing a car that depreciates quickly, like a luxury model

📍Key takeaway: Gap insurance isn’t always required, but for many financed cars, it’s a smart layer of protection.

What Can Happen If You Don’t Maintain Required Coverage on a Financed Vehicle

If you drop or fail to update your insurance, your lender will take action — and not in your favor.

Possible consequences

- Force-placed insurance: The lender adds their insurance to your loan It’s usually more expensive and offers less protection for you

- Higher monthly payments: Since the insurance cost is added to your loan balance, your monthly bill increases

- Credit impact: Falling behind on these new costs can hurt your credit score

- Risk of repossession: In serious cases, the lender can take back the vehicle

Why This Happens

When you signed the loan agreement, you agreed to carry specific insurance. If you don’t, the lender steps in to protect their asset, but you lose control and pay more.

📍Lesson: Always keep the right coverage active. It saves money and avoids major headaches.

How to Reduce Insurance Costs While Meeting Loan Requirements

Full coverage costs more than liability-only, but that doesn't mean you can't lower your premium. Here are smart ways to save money without breaking your loan agreement.

- Compare multiple quotes: Not all insurers offer the same rates. Some specialize in financed vehicles and may offer better deals.

- Bundle your policies: If you have renters' or homeowners insurance, bundling it with your auto policy can lead to discounts.

- Increase your deductible: Raising your deductible lowers your monthly premium. Just make sure you can afford the out-of-pocket cost if needed.

- Maintain a good credit score: In many states, your credit score affects your insurance rate. Paying bills on time and reducing debt can help you save.

- Ask about discounts: You might qualify for: Safe driver discounts, low mileage discounts, and student or multi-car discounts

📍Tip: Review your policy regularly. You might find new savings opportunities as your situation changes.

What Full Coverage Means When Your Car Is Financed

Many people think full coverage means everything is protected, but the term is not an official insurance type. It simply refers to a combination of coverages that lenders usually require.

What Full Coverage Typically Includes:

- Liability insurance: Covers injuries or damages you cause to others

- Collision coverage: Pays for repairs to your car after an accident

- Comprehensive coverage: Covers non-accident events like theft, fire, or natural disasters

What It Does Not Include

- Gap insurance

- Uninsured or underinsured motorist coverage

- Medical payments or personal injury protection in some states

Why This Matters for Financed Cars

Your lender expects full coverage to protect the car itself. But if you want complete peace of mind, you may need to add extra protections beyond what they require.

📝Important: Always read your policy carefully and ask your agent what is and isn't included.

Can You Switch to Liability-Only Insurance After Paying Off Your Car Loan?

Once your car loan is paid in full, you’re the official owner. That means you can decide how much insurance to keep, including switching to liability-only coverage.

When Liability-Only Might Work

- Your car is older and has a low market value

- You can afford to replace or repair the vehicle yourself

- You want to lower your monthly premium

But Keep This in Mind

- If your car is still valuable, dropping full coverage is risky

- Accidents, theft, or natural damage would no longer be covered

- One bad event could cost you thousands

What To Do Before Switching

- Get an updated value of your vehicle

- Consider how much risk you can take

- Talk to your insurance agent about smart options

📍Advice: Just because full coverage is no longer required doesn’t mean it’s not useful. Make your decision based on protection, not just price.

Protect Your Financed Car Smarter with Mila

Financing a car means you need more than basic insurance. Mila helps you meet lender requirements and protect your investment with full coverage at the best price. Instantly compare quotes, avoid costly gaps, and get insured in minutes. Start with Mila and get smarter auto insurance for financed vehicles in just a few clicks.

Frequently Asked Questions (FAQs) About Auto Insurance for a Financed Car

Frequently Asked Questions (FAQs)

What kind of auto insurance do I need for a financed car?

You need more than the state minimum. Most lenders require full coverage, which includes collision and comprehensive insurance, to protect the vehicle.

What happens if I cancel my insurance on a financed car?

Your lender may add force-placed insurance to your loan, which is usually more expensive and offers less protection for you.

Can I use liability-only insurance if my car is financed?

No. Liability-only insurance does not meet lender requirements. Until the loan is paid off, full coverage is mandatory to protect the lender's investment.