A Step-by-Step Guide to Switching Auto Insurance

You're paying more for auto insurance than you need to, and you may not even know it. Many drivers stay with the same insurer for years, assuming switching is too complicated or not worth the trouble. But here's the truth: You can switch providers anytime, and it’s usually quicker and smoother than most people expect.

In this post, you’ll find everything you need to make the switch with confidence, and maybe save a good amount of money along the way.

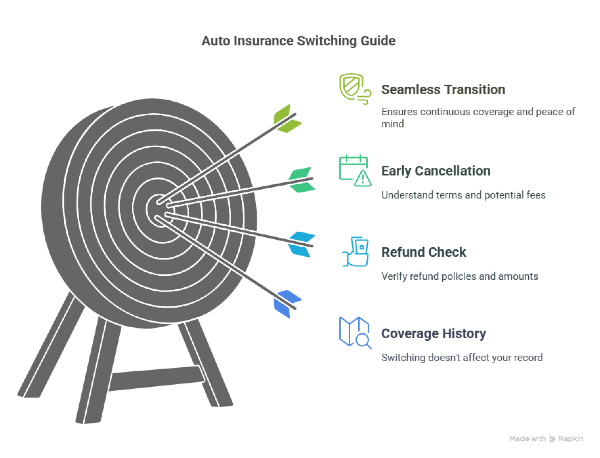

Can You Switch Auto Insurance at Any Time?

Yes, you can switch your auto insurance provider at any time. You don't have to wait until your policy ends. Many drivers change companies mid-policy without any issues. But before you cancel, there are a few things worth checking.

1. Avoid gaps in coverage

The most important step is making sure your new policy starts before your old one ends. Even a one-day gap can result in fines, legal trouble, or a suspended license, depending on your state laws.

2. Early cancellation is allowed

Most insurance companies let you cancel your policy early. Some may charge a small cancellation fee, but many offer refunds for any unused portion of your premium. Review your current contract to understand the terms.

3. Your refund might surprise you

If you paid for your policy upfront, you're likely entitled to a prorated refund. For example, if you cancel halfway through a 12-month policy, you may get back six months’ worth of unused premium.

4. No impact on coverage history

Switching providers doesn’t hurt your coverage record. Many companies are used to people changing insurance and may offer competitive rates to attract new customers.

Why Do People Switch Auto Insurance Companies?

There are several compelling reasons why drivers consider switching their car insurance:

- Cost Savings: The most common motivation is finding a more affordable rate.

- Better Coverage: Some insurers offer more comprehensive protection for similar prices.

- Improved Customer Service: Frustration with the current provider's support can prompt a change.

- Life Changes: Marriage, moving, or buying a new car can impact insurance needs.

- Discount Opportunities: New providers might offer more attractive incentives.

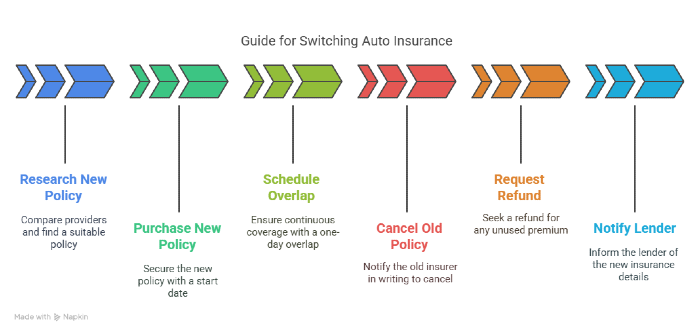

How to Switch Auto Insurance Without a Gap in Coverage

Switching auto insurance is simple, but timing matters. To avoid any legal or financial trouble, follow these steps to ensure a smooth transition.

1. Get your new policy ready first

Start by researching and comparing different providers. Once you find a better rate or more suitable coverage, purchase the new policy. Make sure you have a firm start date, and get written confirmation from the new company. Without this, you risk going uninsured for a while.

2. Schedule a slight overlap

It is always safer to schedule your new policy to begin one day before your current coverage ends. This overlap ensures that, even if there's a processing delay, you remain continuously insured. Some states require proof of uninterrupted coverage to avoid fines or registration issues. Even a one-day lapse can raise red flags for future insurers.

3. Cancel your old policy in writing

After confirming your new coverage is active, contact your old insurer to cancel. Do it in writing, and ask for a cancellation confirmation. This avoids miscommunication or accidental charges if the policy stays open in their system. Also, keep a record of the cancellation date in case questions come up later.

4. Request a refund if applicable

If you paid your premium upfront, you might be entitled to a prorated refund for any unused coverage period. Some insurers process refunds automatically, but others may require you to fill out a form or send a written request. Be sure to ask how long the refund will take and how it will be issued.

5. Notify your lender or local authority

If your car is financed or leased, your lender will require updated proof of insurance to avoid penalties or loan default warnings. Make sure they receive a copy of your new policy declaration. Failing to do so can result in fines or administrative holds on your vehicle paperwork.

Why Consider Switching Auto Insurance Providers

Knowing when to switch auto insurance can help you save money, improve your coverage, and make your overall experience much smoother. Switching providers gives you the chance to align your coverage with your current lifestyle, needs, and expectations. Here are the most common reasons drivers decide to make a change.

When is the right time to switch?

1. Before your policy renews Most auto insurance policies renew automatically. Reviewing your options 7 to 10 days before the renewal date gives you time to compare quotes and avoid unwanted changes.

2. After a major life event Big transitions often affect your insurance needs. For example:

- Getting married

- Moving to a new state or city

- Buying a new vehicle

- Driving more or less than before

- Improving your credit score

3. When rates go up unexpectedly If your premium increases without a clear reason, it’s worth getting new quotes. Rates vary widely between companies, and switching could save you hundreds each year.

2. Other reasons to consider switching

1. Better coverage at a better price Some providers offer more comprehensive protection for the same or even lower cost.

2. Stronger customer service If you’ve had frustrating experiences with claims or communication, another company may serve you better.

3. Access to better technology Modern insurers often include:

- Easy-to-use mobile apps

- Usage-based pricing

- Digital claims processing

- Real-time driving safety tracking

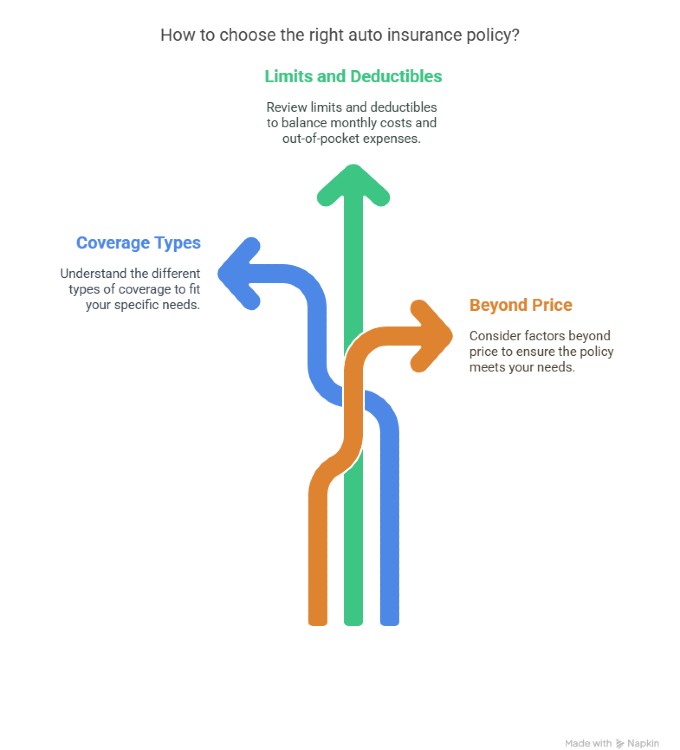

What to Look for in a New Auto Insurance Policy

Not all auto insurance policies are the same. If you're thinking about switching, it is worth looking closely at what each provider offers beyond the monthly cost.

1. Understand the types of coverage

A good policy should fit your specific coverage. Liability coverage helps pay for damage you cause to other people or property. Collision coverage covers damage to your vehicle after an accident. Comprehensive protection applies to events like theft, weather damage, or falling objects.

2. Review limits and deductibles

Lower monthly payments often come with higher deductibles. Make sure you understand how much you would pay out of pocket in case of a claim. Also, check the coverage limits. These are the maximum amounts the insurer will pay for different types of claims. Choosing the right combination can make a big difference when an accident happens.

3. Look beyond the price

You’re not locked into your current auto insurance. If your rates feel too high or your policy no longer fits your needs, making a switch is completely within your reach. And with the right steps, it can be quick, smooth, and even rewarding.

Simplify Your Auto Insurance Switch with Mila

At Mila, we make comparing auto insurance easier than ever. Our licensed agents help you understand your options, and our quote tool searches top-rated providers in real time, so you get competitive prices without jumping from site to site. In just a few minutes, you can review multiple quotes side by side and find the policy that fits your budget and lifestyle.

If you’re thinking about switching, now’s the perfect time to explore what’s out there. Mila’s here to help you do it simply, affordably, and with confidence. Compare now and see how much you can save.

Frequently Asked Questions About Switching Auto Insurance

1. Will switching auto insurance affect my credit score?

No. Shopping for quotes or switching providers does not impact your credit score. Some insurers do use a soft credit check to help determine your premium, but this type of inquiry does not hurt your credit in any way.

2. Can I switch auto insurance if I have an open claim?

Yes, you can, but it is not always the best idea. Your current insurer will still handle the claim, but switching during the process may lead to delays or confusion. If possible, wait until the claim is closed before making the move.

3. Do I get a refund if I cancel my policy early?

In most cases, yes. If you paid in advance, your insurer will typically refund the unused portion of your premium. Always request a written confirmation and ask how the refund will be processed and how long it will take to receive it.