6 Best Auto Insurance Comparison Tools

Finding the right car insurance in the United States can be overwhelming, especially for drivers in Florida, where rates frequently fluctuate, and coverage needs vary significantly. With numerous comparison platforms available, knowing which one truly suits your situation is crucial.

This auto insurance comparison breaks down how Mila compares with other well-known platforms, helping you understand features, strengths, and real differences so you can make a confident decision.

How Auto Insurance Comparison Helps Drivers Find Better Rates

An auto insurance comparison allows drivers to review multiple quotes from different insurers at once, instead of contacting companies individually. This approach saves time and helps uncover pricing differences that are easy to miss.

For drivers in Florida and surrounding states, comparing options is especially useful due to higher accident rates, weather risks, and frequent premium adjustments. The right comparison tool helps you see coverage options, prices, and insurer reliability side by side.

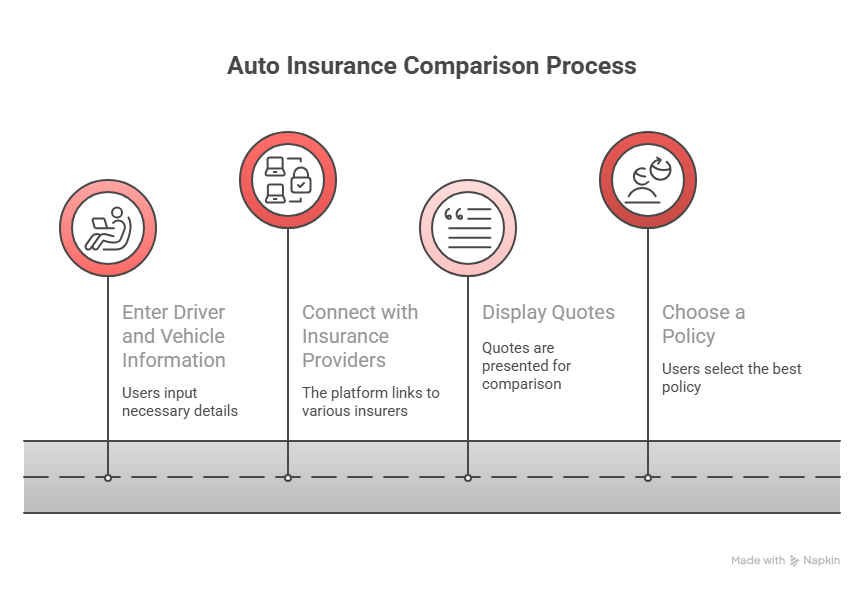

How Auto Insurance Comparison Platforms Work

Most auto insurance comparison platforms follow a similar process:

- You enter basic driver and vehicle information

- The platform connects with multiple insurance providers

- Quotes are displayed for easy comparison

- You choose a policy that fits your budget and coverage needs

The real difference lies in speed, personalization, transparency, and human support.

Top Auto Insurance Comparison Platforms in the USA

Below is a detailed auto insurance comparison with popular platforms used by U.S. drivers.

1. Mila – Smart Auto Insurance Comparison Built for Real Drivers

Mila focuses on simplicity, speed, and real support. The platform allows drivers to compare quotes from over 28 trusted insurance carriers in one place.

Key features of Mila:

- Real-time quotes in minutes

- Side-by-side comparison from top insurers

- Coverage options for standard, high-risk, and first-time drivers

- Licensed advisors available for personalized help

- Mobile-friendly process designed for fast decisions

Mila is especially helpful for drivers who want clarity without pressure or confusing steps.

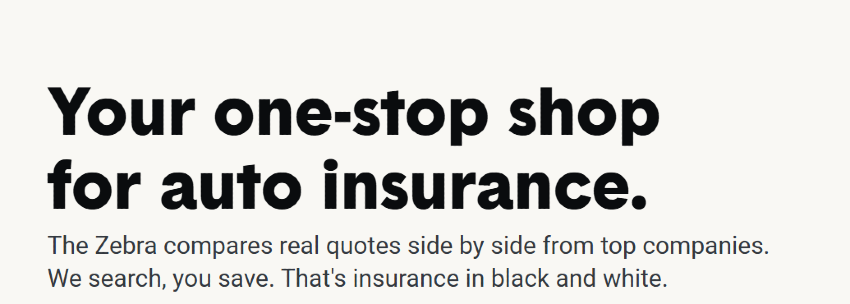

2. The Zebra

The Zebra is one of the most recognized comparison platforms in the U.S.

Main features:

- Quote comparison from national and regional insurers

- Educational content for insurance basics

- Broad availability across states

The experience can feel more automated, with limited personal guidance during the selection process.

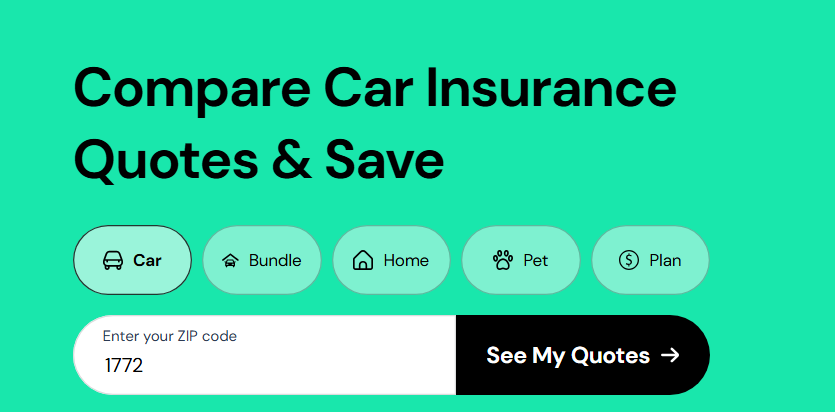

3. Compare.com

Compare.com focuses on offering multiple quotes quickly through a simple form.

Main features:

- Fast quote generation

- Partnerships with major insurance carriers

- Straightforward comparison layout

Customization options may feel limited for drivers with complex insurance needs.

4. Policygenius

Policygenius is known for offering multiple insurance products, including auto, home, and life insurance.

Main features:

- Multi-product insurance comparison

- Licensed agents available for consultation

- Educational tools and calculators

The platform is broader in scope, which can make the auto insurance experience less focused.

5. Insurify

Insurify emphasizes automation and AI-driven quote matching.

Main features:

- Automated quote matching

- Mobile-first design

- Quick quote display

Human assistance is limited, which may be a drawback for drivers who want personalized advice.

6. NerdWallet Auto Insurance Comparison

NerdWallet offers insurance comparison as part of its larger personal finance ecosystem.

Main features:

- Trusted financial content

- Insurance education resources

- Comparison tools linked to financial advice

The platform focuses more on education than on guided quote selection.

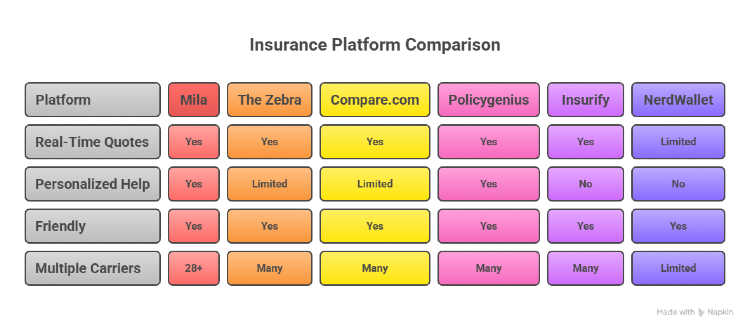

Side-by-Side Auto Insurance Comparison Overview

The table below presents a side-by-side auto insurance comparison of these leading insurance platforms in the U.S. It highlights practical differences such as real-time quotes, access to personalized help, carrier availability, and overall ease of use.

Why Mila Fits Florida Drivers Particularly Well

Florida drivers face unique challenges such as uninsured motorists, weather-related claims, and rising premiums. Mila’s platform accounts for these realities by offering:

- Clear comparisons without confusing steps

- Coverage options aligned with Florida requirements

- Human advisors who explain options in plain language

- A fast process designed for busy drivers

Instead of guessing which policy fits your lifestyle, Mila helps narrow options based on real needs.

What to Look for in an Auto Insurance Comparison Tool

When choosing an auto insurance comparison platform, it helps to focus on how the experience supports your decision, not just how many prices appear on the screen.

- Speed of quote delivery: Getting real-time results quickly lets you review current pricing without repeating forms or waiting for follow-ups.

- Number of insurance providers: Access to multiple carriers gives you a clearer view of available options, which can make it easier to find coverage that fits your budget and situation.

- Clear coverage comparison: Being able to compare deductibles, liability limits, and protections side by side helps you understand what you’re actually paying for.

- Availability of human assistance: If questions come up, having access to licensed advisors can help you feel more confident about coverage choices and state requirements.

- Mobile-friendly experience: A smooth mobile process allows you to compare quotes and review options whenever it’s convenient for you.

Before choosing a platform, ask yourself one simple question: Does this tool help me understand my coverage options, or does it only show prices without context?

Get the Best Auto Insurance quotes with Mila

Choosing the right policy starts with choosing the right comparison tool. While many platforms offer quotes, the experience, clarity, and guidance vary widely.

Milaquote.com stands out as a trusted resource for auto insurance comparison, especially if you driver in Florida and nearby states who want fast quotes, real guidance, and clear choices.

Get your personalized auto insurance quotes today with Mila and find coverage that fits your life. Start comparing now.

Frequently Asked Questions (FAQs) About Auto Insurance Comparison

How does an auto insurance comparison help me save money?

An auto insurance comparison lets you see quotes from multiple insurers at the same time. Since prices can vary widely for the same driver and vehicle, comparing options helps you spot better rates without contacting each company individually.

Is using an auto insurance comparison tool free?

Yes, most auto insurance comparison platforms are free to use. You can review quotes, compare coverage options, and explore policies without any obligation to purchase.

How accurate are auto insurance comparison quotes?

Quotes shown through comparison platforms are based on the information you provide. They are typically very close to final pricing, though small adjustments can occur once coverage details are confirmed.

Can I compare coverage, not just prices?

Yes. A good auto insurance comparison allows you to review coverage details such as liability limits, deductibles, and optional protections, helping you understand what each policy includes.

How long does an auto insurance comparison take?

In most cases, you can see multiple quotes within a few minutes after entering your information, making it one of the fastest ways to review your options.