Why Your Auto Insurance Is Canceled or Not Renewed and What to Do

Few things create as much anxiety for drivers as receiving a notice that their auto insurance is canceled or not renewed. Because nearly every U.S. state requires proof of financial responsibility, losing coverage raises the risk of fines, license suspension, and large out‑of‑pocket costs if you’re in a crash.

Fortunately, termination doesn’t automatically make you uninsurable. State laws guarantee notice and options, and plenty of companies still want your business, even after a lapse. Here you'll learn how to fix what you can today, and line up a policy that keeps you legal, protected, and financially sane.

Cancellation vs. Non-Renewal: Know the Difference

The way your auto insurance ends defines your next steps. Identifying whether your policy was canceled or simply not renewed helps you take quick and informed action.

Key point: Cancellation cuts your protection abruptly. Non-renewal gives you a chance to prepare and switch without a gap.

Why this matters

- A cancellation can leave you exposed to legal and financial risk.

- A non-renewal still requires action, but gives you more flexibility.

Why Policies Get Canceled

A cancellation notice usually means something went wrong. Unlike non-renewals, cancellations tend to reflect specific violations or gaps that need your attention. Here are the most common reasons your auto insurance might end mid-term:

1. Non-payment of premium

Missing a payment is the number one cause. Insurers typically allow a short grace period, about 10 to 14 days, after the due date. If no payment is received by then, the policy is canceled. Some companies will reinstate it if you pay the overdue amount quickly and cover any fees.

2. Driver’s license issues

Auto insurers can’t legally cover a driver with a suspended or revoked license. If you lose your license due to a DUI, reckless driving, unpaid tickets, or too many points, your policy will likely be canceled immediately. In some cases, even having another driver in your household with a suspended license can put your policy at risk.

4. False or missing information

Omitting key details, such as not listing all drivers in your household, underreporting mileage, or using a false address to lower your rate, can be considered fraud. If the insurer discovers it during the term, they can cancel your policy without waiting for renewal.

5. Violations of state laws

Insurance companies must follow state regulations when canceling policies. For example, in Illinois, insurers cannot cancel after 60 days unless you’ve committed specific infractions, like non-payment, fraud, undisclosed accidents, or policy violations. They are required to provide written notice and a valid reason.

📌Always open and read letters from your insurer. Many cancellations can be prevented by acting quickly and resolving simple issues like paperwork or missed payments.

Why Policies Aren’t Renewed

Not receiving a renewal offer doesn’t always mean you did something wrong. In many cases, non-renewals happen due to business shifts or risk reassessments by your insurer. Here's what typically causes a policy not to be renewed:

1. Strategic business decisions

Insurance companies sometimes leave a specific market, stop offering a certain product, or reduce their exposure in high-claim areas. If your zip code sees increased accident rates or costly weather events, your insurer might decide not to renew any policies in that area, even if your driving record is clean.

2. Changes to your risk profile

Considerable changes in how you drive, or your overall risk level, can trigger non-renewal. Examples include:

- A DUI conviction or multiple moving violations.

- A sharp increase in mileage or vehicle use.

- Adding a high-risk driver to your policy.

- Filing multiple at-fault claims within a short time.

3. Shifts in underwriting guidelines

Insurance companies routinely revise the types of drivers or vehicles they want to insure. If your profile no longer fits, they may let your current policy finish without offering a new term.

📌Non-renewals must follow state rules. Most states require the insurer to give written notice at least 30 days before the policy ends, and they must clearly state the reason for their decision.

What to Do When You Receive a Cancellation or Non-Renewal Notice

Acting quickly is the best way to protect from a serious financial risk. If your auto insurance is canceled or not renewed, these are the key actions to take immediately:

- Confirm the reason: Start by contacting your insurer or agent to understand why the policy is ending. Request a written explanation. In many cases, you’ll be able to resolve the issue—especially if it’s based on a missing payment or document.

- Reinstate your policy (if possible): If cancellation was due to non-payment, many companies allow reinstatement within a short window, often up to 30 days. You’ll usually need to pay the overdue amount and possibly a fee. Always wait for official confirmation of reinstatement before driving again.

- Line up a new policy: If reinstatement isn’t an option or your notice is a non-renewal, start shopping immediately. Even if your previous insurer dropped you, others may still offer coverage, especially if the reason wasn’t a serious violation. Schedule your new policy to begin the same day your old one ends to avoid a lapse.

Why You Should Never Drive Uninsured

Driving without auto insurance might feel like a short-term fix—especially if your policy just ended—but the risks far outweigh any convenience. In nearly every U.S. state, it’s illegal to operate a vehicle without active coverage.

1. Legal penalties

Getting caught without insurance can lead to heavy fines, license suspension, and vehicle impoundment. First-time offenders may face penalties from $50 up to $1,500, depending on the state. Some states also charge daily fines until proof of insurance is provided.

2. Financial exposure

If you cause a crash while uninsured, you’re personally responsible for damages. That includes injuries, repairs, and legal fees—which can easily total tens of thousands of dollars. Even if you're not at fault, you may struggle to claim damages without a valid policy.

3. Long-term consequences

A lapse in coverage shows up on your record and signals a higher risk to future insurers. This can result in significantly higher premiums for years—even if you maintain a clean driving record afterward.

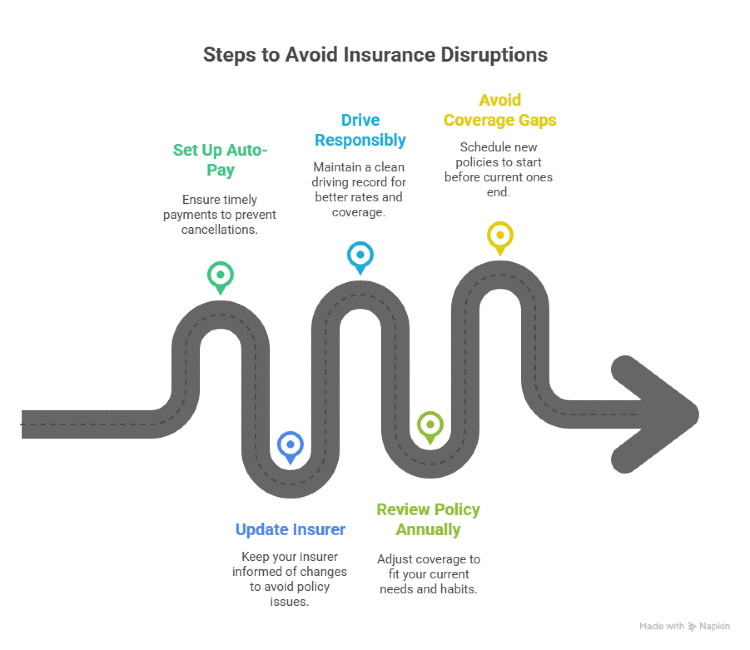

How to Avoid Future Insurance Disruptions

A few simple habits can help you avoid cancellations, non-renewals, and costly lapses in coverage.

- Set up automatic payments: Missed payments remain the most common reason for cancellations. Use auto-pay or calendar reminders to ensure your premium is paid on time every month.

- Keep your insurer updated: Let your insurance company know when you move, add a driver, or change vehicles. Inaccurate or outdated information can trigger policy issues or lead to unexpected cancellations.

- Drive responsibly: A clean driving record helps you qualify for better rates and reduces the risk of non-renewal. Avoid speeding, distracted driving, and impaired driving to protect both your safety and your coverage.

- Review your policy annually: Check your policy at each renewal. If your car’s value has dropped, you may be able to lower your premium by adjusting optional coverages. Make sure your policy still fits your driving habits and needs.

- Avoid coverage gaps when switching: If you change providers, schedule the new policy to begin before your current one ends. Even a one-day gap can raise red flags and increase future premiums.

Stay Protected After a Policy Ends with Mila

A notice stating your auto insurance is canceled or not renewed is not the end of the road. Each state enforces protections, and many insurers remain open to covering you, especially if you respond quickly and clearly. Take control of the situation, follow the right steps, and maintain active coverage to stay legal, safe, and financially protected.

If you're looking for fast, reliable coverage after a cancellation or non-renewal, Mila is a smart place to start. We help drivers compare quotes instantly, including options for high-risk profiles. With an easy online process and no hidden fees, Mila makes it easier to stay insured, even when life gets complicated.

Frequently Asked Questions (FAQs) About Auto Insurance: canceled or not renewed

Can I get new coverage after my auto insurance is canceled?

Yes. Even if your auto insurance is canceled or not renewed, many insurers will still offer coverage, especially if the cancellation wasn’t due to serious violations. Platforms like Mila can help you compare options quickly.

Will a cancellation affect my future insurance rates?

Yes, a cancellation often leads to higher premiums because it’s seen as a lapse in coverage. That’s why it’s important to act quickly to reinstate or replace your auto insurance before the policy officially ends.

Can I drive while between insurance policies?

No. Driving without auto insurance is illegal in nearly all states and can lead to fines, license suspension, and financial liability if you’re in an accident. Always secure a new policy before your current one ends.