Why Do You Need Auto Insurance? Key Reasons Explained

You need to understand your auto insurance policy to protect yourself financially in case of an accident or unexpected event. Many drivers overlook the details of their coverage, only to face surprises when filing a claim.

When you know exactly what your policy includes, you can make informed decisions, avoid coverage gaps, and ensure you're adequately protected. In this post, you’ll learn everything you need to know about auto insurance, at the end, you'll be comfortable navigating your policy and making any required changes to meet your needs.

What is an Auto Insurance Policy?

An auto insurance is a contract between you and an insurance company that helps protect you financially if something happens to your car. In exchange for paying a monthly or annual premium, your insurer helps cover the costs of accidents, theft, and even natural disasters. It can also cover medical expenses and damage you might cause to other people or property.

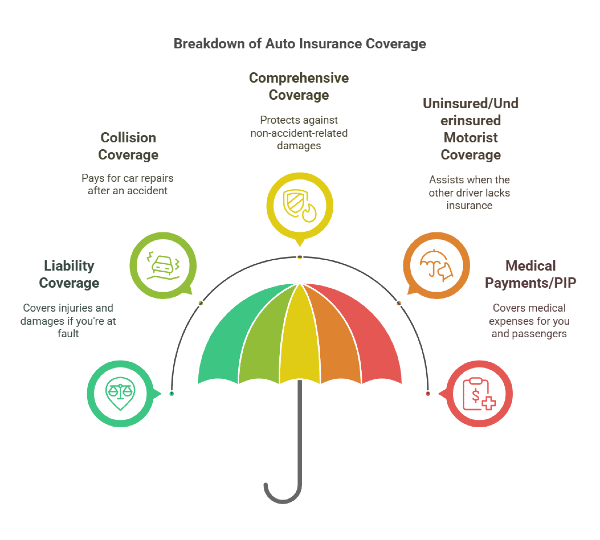

Common Types of Coverage

- Liability Coverage: This is the most basic type of auto insurance and is required in most states. It pays for injuries and property damage if you’re responsible for an accident.

- Collision Coverage: This covers the cost of repairing or replacing your car if it's damaged in an accident, regardless of who is at fault. If you have a car loan or lease, your lender may require this coverage.

- Comprehensive Coverage: Protects your car from things other than accidents, like theft, fire, hail, or vandalism. This coverage is useful if you want extra protection beyond collisions.

- Uninsured/Underinsured Motorist Coverage: If you get into an accident with someone who doesn’t have enough insurance (or any at all), this coverage helps pay for your expenses.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Covers medical bills for you and your passengers after an accident, no matter who was at fault. Some states require PIP, while others make it optional.

Components of an Auto Insurance Policy

Your auto insurance policy is more than just a piece of paper, it’s a contract that outlines what’s covered, what’s not, and what you need to do to keep your coverage active. Understanding its key sections will help you make sure you’re getting the right protection.

1. Policy Declarations

The declarations page is the first section of your policy and gives you a quick overview of your coverage. This is the section you’ll want to check first if you need to confirm what your policy includes. It includes:

- Your name and address

- Your vehicle details (make, model, year, and VIN)

- Policy start and end dates

- Types of coverage and limits

- Your premium (the amount you pay for insurance)

2. Insuring Agreement

This section explains what the insurance company promises to cover in exchange for your premium payments. It lists the specific risks and events your policy covers, like:

- Accidents

- Theft

- Vandalism

- Weather-related damage.

3. Exclusions

Exclusions are things your policy doesn’t cover. Understanding exclusions can help you avoid surprises when filing a claim. Some common ones include:

- Damage from normal wear and tear

- Accidents caused on purpose

- Using your car for business without proper coverage

- Someone driving your car who isn’t listed on your policy

4. Conditions

The conditions section explains your responsibilities as a policyholder, if you don’t follow these conditions, your insurer could deny a claim or even cancel your policy. This includes:

- Paying your premiums on time

- Reporting accidents and claims as soon as they happen

- Cooperating with the insurance company during investigations

- Keeping your vehicle in good condition

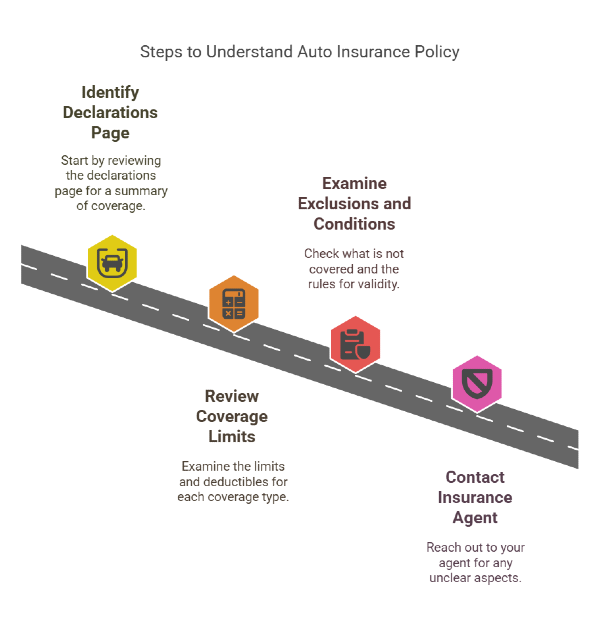

How to Read Your Auto Insurance Policy

Many people don’t read their auto insurance policy until they need to file a claim, but by then, it might be too late to fix coverage gaps. Understanding your policy in advance helps you avoid surprises and make informed decisions. Here’s how to go through it step by step:

1. Focus on the Declarations Page

This is the most important page to review, as it gives a snapshot of your policy, if you ever need to verify your coverage, this page should be your first stop.

- Who and what is covered (your name, insured vehicle, and policy period)

- The types of coverage included and their limits

- Your premium and deductibles

2. Pay Attention to Coverage Limits and Deductibles

Each type of coverage has a limit—the maximum amount your insurer will pay for a claim. Your deductible is what you pay out of pocket before your insurance kicks in. Reviewing these details will help you understand your financial responsibility in case of an accident.

3. Review the Exclusions and Conditions

Every policy has exclusions (what’s not covered) and conditions (rules you must follow to keep your coverage valid). Understanding these sections ensures there are no surprises when filing a claim.

4. Ask Questions When in Doubt

If anything in your policy is unclear, don’t hesitate to contact your insurance agent. They can explain your coverage in simple terms and help you adjust your policy if needed.

Modifications and Endorsements

Your auto insurance policy isn’t set in stone. Life changes, and your coverage should change with it. Whether you get a new car, move to a different state, or want extra protection, you can modify your policy to fit your needs.

How to Modify Your Policy

If you need to update your coverage, follow these steps:

- Contact your insurance provider: Reach out to your agent or insurer to discuss the changes you need.

- Review the impact on your premium: Some modifications may increase or decrease your insurance cost.

- Provide necessary documentation: If you’re adding a new driver or vehicle, you may need to submit paperwork.

- Confirm the changes in writing:Always request a copy of your updated policy to ensure the changes are applied correctly.

Common Endorsements and Their Benefits

Endorsements, also called riders, are add-ons that customize your coverage. Some popular options include:

- Modified Car Coverage: Protects custom parts or enhancements that standard policies may not cover.

- Classic Car Insurance: Provides special coverage for vintage or collector vehicles based on an agreed value.

- Rental Car Reimbursement: This covers the cost of a rental car if your insured vehicle is being repaired after a covered claim.

- Roadside Assistance: Helps with towing, flat tires, battery jump-starts, and other emergency services.

- Additional Insured: Extends coverage to another person who regularly drives your car.

When to Consider a Policy Change

You might need to update your policy if:

- You buy, sell, or lease a car

- You move to a new location

- You start using your vehicle for business purposes

- You want extra protection, such as gap insurance or accident forgiveness

Ensure You Have the Right Auto Insurance Coverage With Mila

Understanding your auto insurance policy is essential to making sure you have the right protection when you need it. By knowing what your policy covers, how to read it, and when to make adjustments, you can avoid surprises and ensure you’re properly insured.

Regularly reviewing your coverage and discussing any questions with your insurance provider can help you stay informed and make smart decisions. If you’re unsure about any part of your policy, take the time to clarify it now rather than later.

With Mila, you can easily compare real-time auto insurance quotes from trusted providers and save up to 30%. We help you find the best coverage without selling your data, just smart, secure options built around your needs. Start comparing now and take control of your coverage.

Frequently Asked Questions When Reviewing Auto Insurance Policies

How is the cost of my auto insurance determined?

Insurance companies consider several factors when calculating your premium, including:

- Your driving record (accidents and traffic violations can increase rates)

- The type of car you drive (newer or high-performance cars usually cost more to insure)

- Your location (urban areas often have higher rates due to increased accident risk)

- Your age and experience (younger drivers typically pay more)

- Your credit history (in some states, insurers use credit scores to determine rates)

What is a deductible?

A deductible is the amount you pay out of pocket before your insurance covers the rest of a claim. If you have a $500 deductible and your repair costs $2,000, you pay the first $500, and your insurer covers the remaining $1,500. Choosing a higher deductible usually lowers your premium, but it also means you'll pay more if you need to file a claim.

Is auto insurance mandatory?

Yes, in most states, at least liability coverage is required by law. Some states also mandate uninsured motorist coverage or personal injury protection (PIP). The exact requirements depend on where you live, so checking your state’s laws is important.