What You Need to Know to Insure a Hybrid or Electric Car

Choosing a hybrid or electric car is a smart step toward cleaner, more efficient driving. These vehicles offer long-term savings on fuel and maintenance, along with modern features that increase your experience behind the wheel.

Before making the switch, it’s important to understand what it means to insure a hybrid or electric car. Their advanced technology and unique repair needs can impact your auto insurance rates. In this post, you’ll learn everything you need to know to protect your investment and manage costs effectively in 2025.

How Much Does It Cost to Insure a Hybrid or Electric Car in 2025?

In 2025, the average cost to insure a hybrid or electric vehicle depends on several factors, but electric cars generally have higher premiums than hybrids or gas-powered vehicles.

Recent insurance data shows:

- Hybrid cars: $1,800–$2,100/year

- Electric cars: $2,000–$2,600/year

- Gas-powered cars: $1,500–$1,800/year

That’s a 10%–30% increase if you switch from a gas car to an EV. However, hybrids often sit in the middle, offering cleaner driving without a sudden increase in insurance costs.

Hybrid and Electric Car Insurance: Which One Costs More in 2025?

When comparing how much it costs to insure a hybrid or electric car, electric vehicles usually come out as the most expensive. Their advanced components, higher repair costs, and specialized service requirements raise the overall risk for insurers.

Here’s a breakdown of typical annual premiums by vehicle type:

For example, a 35-year-old driver in California with a clean record might pay $1,600 for a gas sedan, $1,850 for a hybrid, and $2,400 for an electric car, all with the same auto insurance coverage.

This price gap mainly comes from the high-tech nature of EVs. Their batteries alone can cost thousands to replace, and not all repair shops are equipped to handle them, making claims more expensive to process.

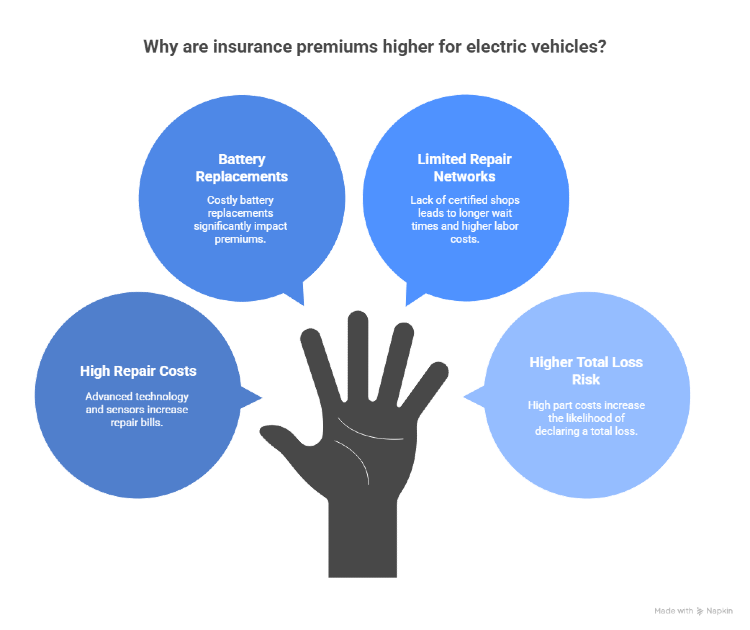

Why Is Insurance Often Higher for Electric Vehicles?

Electric vehicles tend to cost more to insure due to a mix of advanced technology and repair complexity. When insurers calculate your premium, they look closely at the potential cost of claims, and EVs often carry higher risks. Here are the main reasons why:

- High Repair Costs: EVs are built with sensors, cameras, and onboard tech that can drive up repair bills. Even a minor accident might affect multiple systems, leading to expensive fixes.

- Battery Replacements: The battery is the most valuable part of an electric car. If it’s damaged, replacement costs can exceed $10,000, which directly impacts your auto insurance rate.

- Limited Repair Networks: Not all repair shops are certified to work on electric vehicles. This lack of availability can lead to longer wait times and higher labor costs.

- Higher Total Loss Risk: Because of the high cost of parts, especially batteries, insurers are more likely to declare an EV a total loss, even after moderate damage.

In contrast, hybrids still use conventional engines and are easier to repair. This makes them more affordable to insure in most cases, giving drivers a balance between tech and manageable insurance rates.

Key Factors That Affect Insurance Rates for Hybrid and Electric Cars

When you insure a hybrid or electric car, your premium isn’t just about the vehicle type. Insurers evaluate a combination of personal and vehicle-based factors to set your auto insurance rate. Here are the most common elements that influence what you’ll pay:

- Driver’s age and history: Younger drivers or those with accidents usually pay more. A clean record helps lower your premium.

- Location: Living in a city with high traffic or theft rates can raise your cost.

- Vehicle model and price: Luxury or high-tech models, like a Tesla Model Y, cost more to repair and insure than models like the Chevy Bolt.

- Repair costs: EVs often require specialized parts and service, which increases claim expenses.

- Annual mileage: Driving fewer miles per year may qualify you for discounts.

- Safety features: Advanced safety systems can reduce risk and lead to insurance savings.

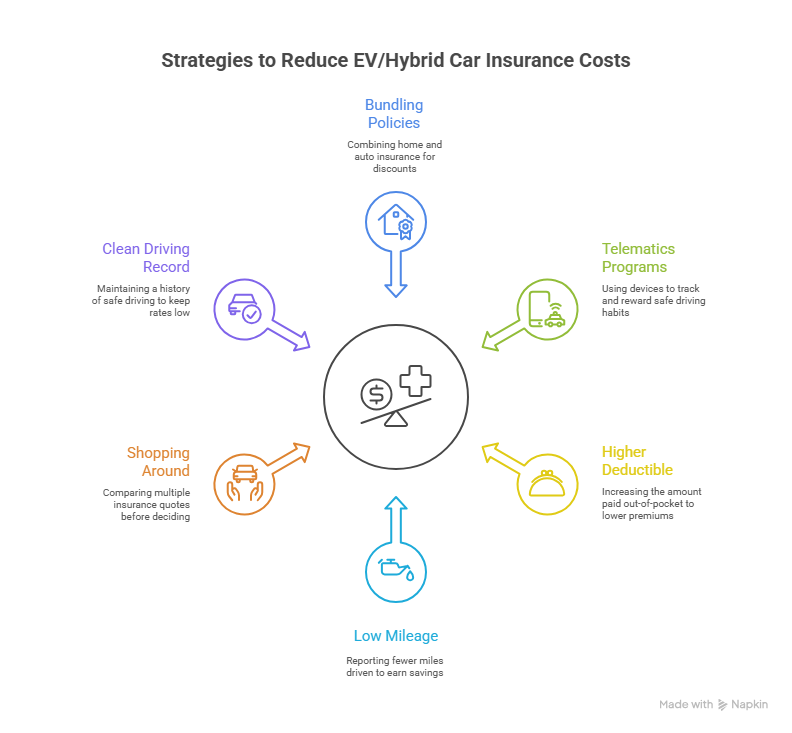

How to Save Money on EV or Hybrid Car Insurance

Even if it’s more expensive to insure a hybrid or electric car, there are proven strategies to reduce your auto insurance costs. Many of these savings come down to how and where you drive, plus how you structure your policy.

Smart ways to lower your premium

- Bundle your policies: Combine home and auto coverage to unlock multi-policy discounts.

- Use telematics: Programs like State Farm’s Drive Safe or GEICO’s DriveEasy reward safe habits.

- Raise your deductible: A higher deductible lowers your monthly rate—just be sure you can cover it in an emergency.

- Drive less: Reporting low annual mileage can earn you additional savings.

- Shop around: Compare at least three quotes before committing to a policy.

- Maintain a clean record: Avoiding accidents and violations keeps your rates down long-term.

Some states also offer incentives for green vehicle drivers, such as rebates or insurance credits for installing home chargers. These extras can make eco-friendly driving even more affordable.

Is Owning a Hybrid or Electric Car Worth It in 2025?

Even with higher auto insurance costs, owning a hybrid or electric vehicle can still make financial sense. When you look beyond the premium, long-term savings become clear.

Over time, the lower fuel and maintenance costs of EVs and hybrids often outweigh the difference in insurance. If you're planning to keep your vehicle for several years, the total cost of ownership usually favors electric models, especially when fuel prices rise or when you qualify for federal or state tax credits.

Make the Right Choice for Your Hybrid or Electric Car with Mila

When you decide to insure a hybrid or electric car, you're choosing how to protect a smarter, more sustainable way of driving. Insurance costs may be higher for EVs, but understanding your options and comparing quotes can make a big difference. It's not only about price, but also about getting coverage that truly fits how you drive.

At Mila, we know insurance can feel overwhelming. That’s why we’ve built a simpler way to protect your vehicle, with honest advice and support at every step. We work with top carriers to give you real options, backed by smart tech and real people. Whether you're insuring your first EV or updating your current plan, we make the process easy and built around you.

Ready to insure your hybrid or EV? Let Mila guide you with real guidance and real savings.

Frequently Asked Questions (FAQs) About Insuring a Hybrid or Electric Car

Can I switch insurance providers mid-policy if I buy a new EV?

Yes, you can change providers at any time—even mid-policy. Just make sure there’s no lapse in coverage. Mila can help you compare quotes quickly so your new EV stays protected from day one.

Are EVs harder to insure in rural areas?

In some cases, yes. Fewer repair facilities and limited access to EV-certified mechanics can increase costs in less populated areas. Comparing providers is especially important if you live outside major cities.

Is usage-based insurance a good fit for EV or hybrid drivers?

Absolutely. Many EV and hybrid owners drive fewer miles, and usage-based insurance (like telematics programs) rewards them with lower rates. It’s a great way to align your driving habits with your