What to Know About Auto Insurance for a Rental Car

Renting a car can feel like freedom on four wheels, until the person at the rental counter asks, “Do you want to add insurance today?” Suddenly, your quick getaway turns into a head-scratching moment of uncertainty. If you’ve ever been unsure whether you need rental car insurance, you’re not alone.

You might already be covered, and even if you’re not, getting the right protection doesn’t have to be confusing or expensive. In this post, I’ll break down everything you need to know about auto insurance for a rental car, including what’s truly essential, when you should say yes to extra coverage, and how to avoid paying for what you don’t need.

Do You Need Auto Insurance for a Rental Car?

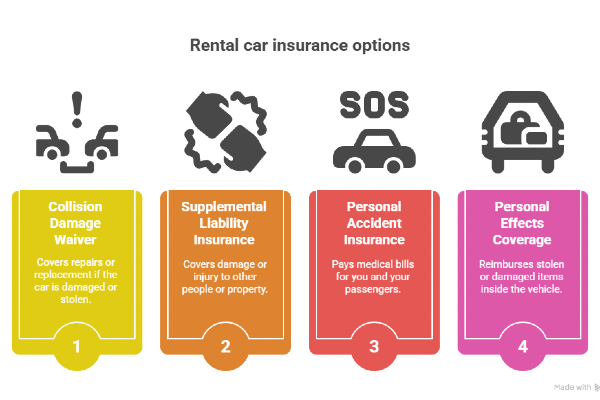

You might not need to buy extra auto insurance for a rental car, but it depends on what protection you already carry. If you have a personal auto policy or certain credit cards, you're likely covered for rentals within the U.S. or Canada. Without either, you'll need to look at the options offered at the rental counter. Here’s what rental companies usually provide:

- Collision Damage Waiver (CDW): Covers repairs or replacement if the car is damaged or stolen.

- Supplemental Liability Insurance (SLI): Covers damage or injury to other people or property.

- Personal Accident Insurance (PAI): Pays medical bills for you and your passengers.

- Personal Effects Coverage (PEC): Reimburses stolen or damaged items inside the vehicle.

📌These protections can double your daily rental cost. If you already have solid coverage from your insurer or credit card, there’s often no need to buy more. Before picking up your rental, a quick check with your provider or card issuer can help you decide what’s worth adding.

Does Your Auto Insurance Cover Rental Cars?

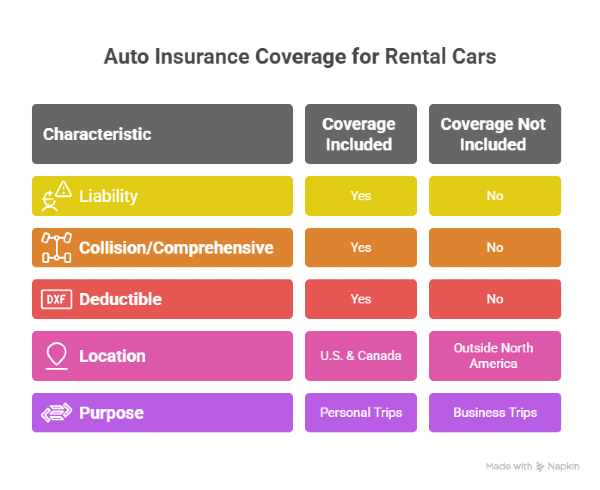

If you already own a car and have an auto insurance policy, it likely extends to rental vehicles used for personal trips within the U.S. or Canada. This means you might not need to purchase extra protection at the rental counter.

Here’s what typically applies:

- Liability coverage from your policy carries over to a rental. This covers damage or injuries you cause to others.

- If your policy includes collision and comprehensive coverage, those will usually apply to a rental car as well.

- You’ll still have to pay your deductible if there's damage or a claim.

- Coverage may not apply to business-related rentals or rentals outside North America.

📌It’s worth calling your insurance provider before renting. They can confirm exactly what’s included and whether any restrictions apply, so you’re not left guessing at the counter.

Does My Credit Card Provide Rental Car Insurance?

Many credit cards include rental car protection when you pay for the rental with the card and decline the rental agency’s CDW or LDW. This coverage is usually secondary, meaning it kicks in after your auto insurance. However, some premium cards offer primary coverage, so you don’t need to involve your insurer at all.

Here’s what to check before relying on your card:

- Coverage typically includes collision damage and theft, but not liability.

- Cards like Chase Sapphire Preferred or Amex Platinum often offer primary protection.

- Restrictions may apply to luxury cars, trucks, or international rentals.

- You must pay for the entire rental with the card and be listed as the main driver.

📌Always review your card’s benefit guide or call customer service. Don’t assume all cards include this—it varies widely. If your card offers solid protection, it can save you $20–$30 per day and avoid a claim on your auto policy.

What If I Don’t Have Auto Insurance?

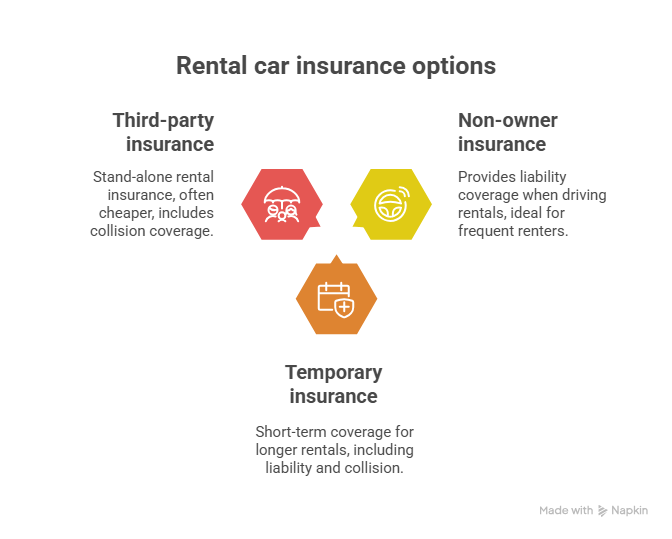

If you don’t own a car and have no auto insurance, you still have a few smart ways to stay protected when renting:

- Non-owner car insurance: This policy provides liability coverage when you drive cars you don’t own, including rentals. It’s ideal if you rent frequently or use car-sharing services. It does not include collision or comprehensive coverage unless added as an endorsement.

- Temporary auto insurance: Some insurers offer short-term coverage for a few days or weeks. This can include liability, collision, and more. It’s useful for long rentals, but not available in all states.

- Third-party insurance: Sites like Bonzah or InsureMyRentalCar sell stand-alone rental insurance, often for less than what rental agencies charge. These typically include collision coverage and sometimes liability.

When Should I Accept Rental Car Insurance?

There are situations where it’s a good idea to accept rental car insurance from the agency, especially if:

- You don’t have a personal auto policy

- Your credit card doesn’t offer rental coverage

- You’re renting outside the U.S. or Canada

- The car is luxury, exotic, or high value

- You prefer to avoid dealing with your insurer in case of damage

📌If you’re unsure, it’s better to pay for coverage than risk a large bill later. Even if it adds to your rental cost, it can protect you from major financial surprises.

How Much Does Rental Car Insurance Cost?

Adding auto insurance for a rental car can increase your daily rate. Here’s what you might pay per day:

- Collision Damage Waiver (CDW): $20–$30

- Supplemental Liability Insurance (SLI): $10–$15

- Personal Accident Insurance (PAI): $5–$7

- Personal Effects Coverage (PEC): $2–$5

If you accept all options, you could pay an extra $40–$60 daily. That’s why it’s important to compare this with your existing auto policy, credit card benefits, or third-party options. Many travelers overpay simply because they didn’t check before booking.

How to Save Money on Rental Car Insurance

To avoid overspending on rental car insurance, follow these simple steps before your trip:

- Call your auto insurance provider: Ask if your current policy covers rentals, including liability and collision.

- Contact your credit card company: Confirm if rental protection is included and whether it's primary or secondary.

- Compare third-party coverage: Sites like Milaquotes offer comparison options with better prices than rental counters.

- Take photos of the car: Document the car’s condition before and after your rental to avoid false damage claims.

- Read the terms carefully: Know what's covered and what's excluded before declining any protection.

Make Sure You're Covered with the Best Rental Insurance

Many drivers spend more than they should on auto insurance for a rental car. With Mila, you can review trusted providers and secure the lowest legal rates before your trip. Coverage includes liability, collision, and injury, with no hidden fees. It takes just minutes and helps you avoid extra costs at the rental counter.

Frequently Asked Questions (FAQ) about Auto Insurance for a Rental Car

What happens if I decline all insurance at the rental desk?

If you decline coverage and don’t have protection through a policy or card, you’ll be fully responsible for any damage or liability. Always confirm your coverage before renting.

Can I get insurance if I don’t own a car?

Yes. You can use non-owner car insurance, temporary insurance, or a third-party policy. These options provide coverage even if you don’t have a personal auto policy.

Do I need insurance for a one-day rental?

Yes, even for short rentals, having liability and damage protection is important. Check if your existing coverage or credit card applies, or consider a one-day third-party policy.