Traditional Auto Insurance vs Pay Per Mile: Which One Saves You More?

Insurance prices vary widely across drivers because of location, vehicle type, driving record, and annual mileage. That means two people with similar cars can pay very different amounts. Auto insurance often comes with large yearly bills, confusing discounts, and the worry that you may be paying for miles you don't drive.

This post provides a clear comparison of traditional auto insurance vs. pay-per-mile insurance, including a concise verdict, practical examples, a straightforward break-even method, and tips on privacy and claims to help you decide which option is likely to be more cost-effective and better fit your driving habits.

Traditional Auto Insurance vs Pay Per Mile: Which is cheaper?

Pay-per-mile insurance is typically more affordable for low-mileage drivers, while traditional insurance is often more cost-effective for high-mileage drivers or those who prefer stable monthly costs.

Insurance cost comes from two main parts: a base charge (what the insurer charges simply to hold the policy) and a usage-related charge (either baked into the premium or tracked per mile). If your annual miles are far below the average for your area, pay-per-mile often wins. If you’re on the road a lot, or if you need broader coverage options and predictable payments, traditional policies typically cost less overall.

How Traditional and Pay‑Per‑Mile Insurance Work

Both systems translate your driving and risk into price, but they do it in different ways. This short section explains what each policy type covers and how insurers turn miles, habits, and your profile into the numbers on your bill.

What traditional auto insurance covers

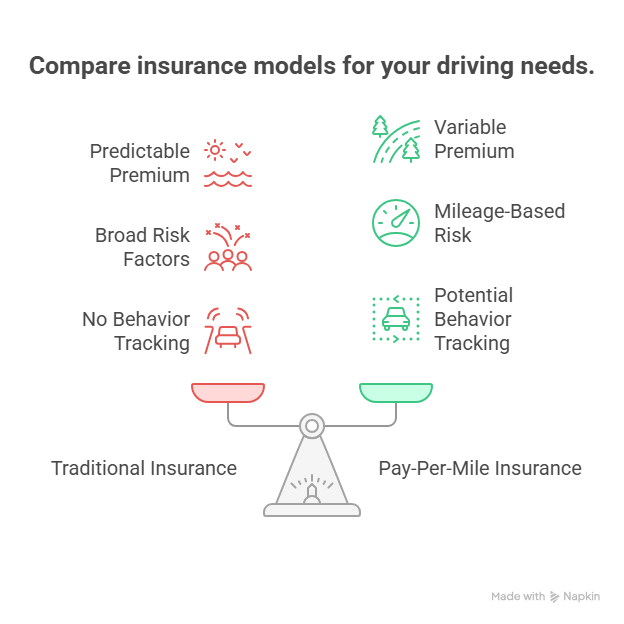

Traditional auto insurance charges a periodic premium (monthly, quarterly, or annually). That premium reflects your risk factors: driving record, age, vehicle make/model, where you live, coverage limits, and chosen deductible. Discounts (multi-policy, safety features, good student) reduce the premium.

What you pay doesn’t usually change based on the miles you drive during the policy term. In my case, switching between insurers as my life changed, I noticed that traditional policies gave me predictable bills, useful when I had a tight budget and preferred certainty.

How pay-per-mile insurance calculates cost

Pay-per-mile (or usage-based) insurance combines a fixed base charge with a per-mile rate. Insurers typically track miles using a small telematics device or a phone app. The final bill at the end of the month or policy term equals the base charge plus (miles driven × per-mile rate), sometimes with a cap or discount tiers.

Pay-per-mile can also reward safer driving behavior if the plan tracks braking, acceleration, or time-of-day driving, but not all plans include those features.

Real Cost Comparison: Examples to Help You Decide

Numbers vary by provider and state, but these example scenarios illustrate the break-even points and real-world outcomes.

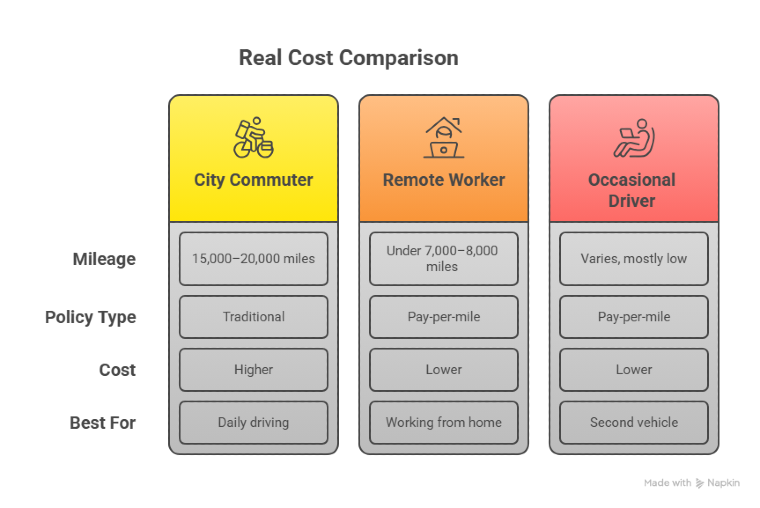

1. City commuter (high miles, daily drive)

If you drive 15,000–20,000 miles a year commuting through traffic, traditional policies usually spread risk and cost more efficiently. The per-mile charges add up quickly under pay-per-mile, and the convenience of a set monthly premium helps with budgeting.

2. Remote worker / low-mileage driver

If you work remotely and drive under about 7,000–8,000 miles per year, pay-per-mile often reduces your total spend. The per-mile fees plus base charge can be significantly less than a traditional annual premium. When I worked from home several years ago and drove only for errands and weekend trips, switching to a usage-based plan cut my bills noticeably.

3. Occasional driver/weekend car

For cars that sit most of the week, a second vehicle, a vintage car, or a seasonal driver pay-per-mile is commonly the cheaper option. You’re literally not paying for miles you never use.

When to choose traditional insurance

Choose traditional insurance when:

- You drive a lot each year (commute-heavy or long-distance jobs).

- You prefer predictable monthly or annual payments for budgeting.

- You need broad coverage features (e.g., rental reimbursement, gap coverage) that some pay-per-mile plans don’t offer.

Traditional policies also tend to provide a wide network for claims and established customer service processes, which I’ve found useful after a stressful accident — having a known claims flow makes recovery simpler.

When pay-per-mile is the smarter pick

Pay-per-mile makes sense when:

- Your annual miles are low compared to local averages.

- You’re comfortable with telematics tracking or an app device.

- You want to directly convert low use into lower cost.

Estimating your break-even mileage: roughly speaking, calculate your annual traditional premium, subtract the annualized base fee of a pay-per-mile policy, then divide the difference by the insurer’s per-mile rate. That gives a rough number of miles where both options cost the same. Different companies and states make the exact math move around, but the method stays useful.

Other important factors beyond price

1. Tracking & privacy concerns

Pay-per-mile requires mileage data. Some plans send only odometer-style mileage counts; others track GPS, time of day, and driving behavior. If privacy matters to you, check what data is collected, how long it’s stored, and whether it’s shared.

2. Claims handling, discounts, and policy flexibility

Traditional insurers often have more established discounts and add-ons. Pay-per-mile providers are improving here, but if you rely on niche discounts (multi-car, veteran, bundling) compare carefully.

Also consider how claims are handled. A lower-cost policy is not worth it if it’s slow or difficult when you need it most.

My practical advice

- Estimate your mileage honestly. Look at the last 12 months of gas receipts, trips, or your car’s odometer to get a real number.

- Run the numbers. Use the break-even method above with quotes from at least two traditional insurers and two pay-per-mile providers.

- Check caps and surges. Some pay-per-mile plans have monthly minimums or caps that change the math for occasional long trips.

- Read the privacy terms. Know what telematics captures and whether you can opt out later.

When I compared policies before a long move, getting three quotes saved me time and uncovered a pay-per-mile plan that was a clear winner for my low-mileage year.

Compare Auto Insurance and Save Money with Mila

If you drive less than the local average, pay-per-mile can cut your insurance bill, but only after you check base fees, per-mile rates, and privacy terms. If you drive a lot or prioritize predictable payments and wide coverage choices, traditional insurance still makes sense.

For a quick comparison of quotes tailored to your mileage and profile, use Mila to see personalized options and estimate savings. Try getting quotes from a couple of providers today, and you’ll know which path saves you money.

Compare quotes now using Mila and pick the plan that fits how you actually drive.

Frequently Asked Questions (FAQs) About Traditional Insurance vs Pay Per Call

Can a high-risk driver still save with pay-per-mile?

Possibly. If the main issue is mileage rather than past-at-fault claims, low miles can offset risk. But many insurers still price risk heavily, so get personalized quotes.

Will insurers raise my rate if my mileage suddenly increases?

With pay-per-mile, you pay for those miles directly; your per-mile cost doesn’t always change, but your total payment will increase. For traditional policies, a history of higher mileage can raise renewal premiums.

Who is pay-per-mile auto insurance best for?

It’s typically best for low-mileage drivers—people who work from home, retirees, students, occasional drivers, or anyone who drives significantly less than average.

Does pay-per-mile insurance provide the same coverage as traditional auto insurance?

In many cases, yes—you can still choose liability, collision, comprehensive, and other options. The difference is how the premium is calculated, not necessarily what the policy covers.