Can You Temporarily Suspend Your Auto Insurance?

Temporarily suspending your Auto insurance can be a smart move if you're not planning to use your vehicle for a while. Whether your car is going into storage, you're traveling abroad, or dealing with a temporary medical issue, pausing your policy may help you save money.

Still, it’s not as simple as just stopping payments, there are specific steps, rules, and risks involved. In this post, you’ll understand how suspension works and when it might be the right solution for you.

What Does It Mean to Suspend Auto Insurance?

Suspending your auto insurance means putting your policy on hold without canceling it completely. During this pause:

- You don’t have active coverage

- You don’t pay premiums

- Your policy remains valid in the system

Suspension is ideal when you're sure the car won't be used at all. If there's any chance you’ll need to drive, consider other options instead.

When Can You Suspend Your Auto Insurance?

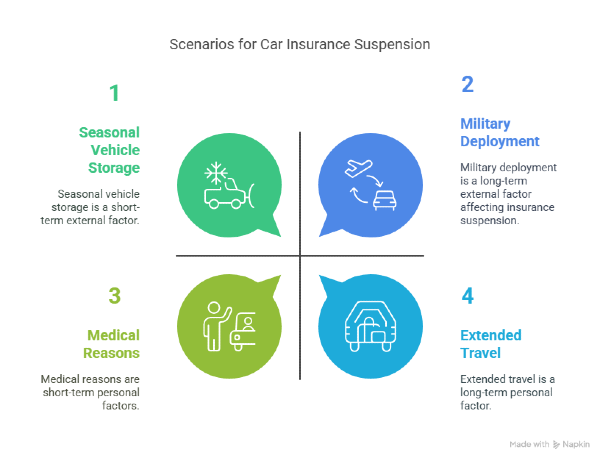

Not every situation qualifies for a suspension. However, insurers often allow it under specific conditions, especially when the vehicle won’t be driven at all. Here are the most common scenarios:

Military Deployment

If you're deployed overseas, many insurers provide suspension options for active-duty military members. Some even guarantee reinstatement at the same or similar rates once you return. Just be ready to provide deployment orders as documentation.

Seasonal Vehicle Storage

Have a convertible or RV you only use during certain months? If it's stored in a garage or facility for an extended period, it may qualify for a suspension. This is a popular option for vehicles that are off the road for winter or summer seasons.

Extended Travel or Working Abroad

Planning to travel for several months or taking a job assignment overseas? If your vehicle will be parked safely during your absence, suspension could save you money. Make sure your trip is long enough to justify the administrative effort and any potential fees.

Medical Reasons

If a health condition prevents you from driving temporarily, some insurers allow you to pause your policy. You'll likely need a statement from your doctor confirming the situation. This can be a helpful solution while you focus on recovery.

How to Suspend Your Auto Insurance

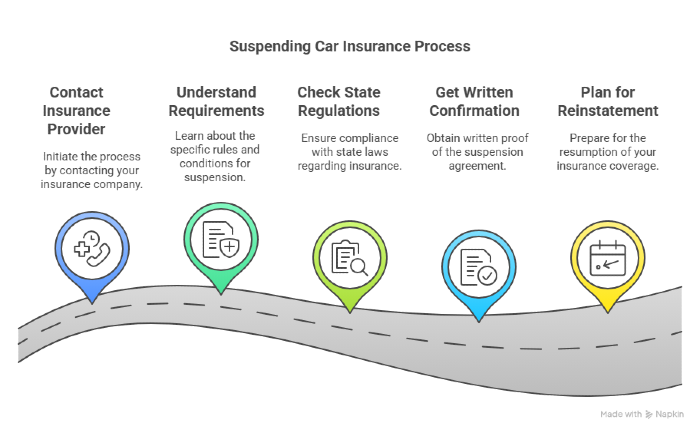

If you’ve decided that suspension is the right move, follow these steps to do it correctly:

1. Contact Your Insurance Provider

Start by calling your insurer. Ask specifically about suspension options, requirements, and possible fees. Be clear about your situation and ask what documentation they'll need.

2. Understand the Requirements

Each company sets its own rules. Common conditions include:

- A minimum suspension period, often 30 days

- A maximum duration, usually up to 12 monthsty

- Proof like deployment orders, travel plans, or medical records

- Vehicle storage requirements, such as being parked in a garage

Make sure you meet all these before moving forward.

3. Check State Regulations

Some states require minimum coverage for registered vehicles, even if not in use. You may need to:

- File an affidavit of non-use

- Temporarily surrender your license plates

- Prove your car is stored off public roads

4. Get Everything in Writing

Once approved, ask for written confirmation that includes:

- Suspension start and end datesfjfj

- What coverage remains, if any

- Reinstatement process

- Any rate protections or applicable fees

5. Plan for Reinstatement

Mark your calendar for when your policy needs to be reactivated. Most insurers require 24–48 hours’ notice. Plan to avoid driving without coverage.

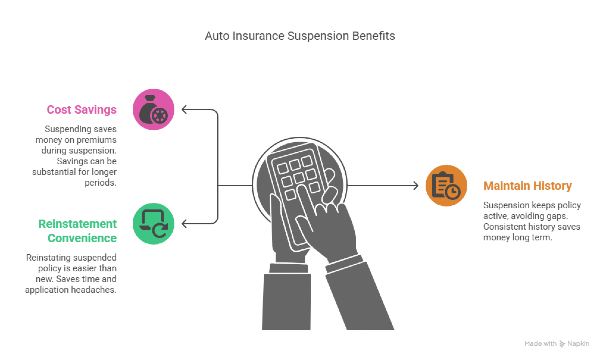

Benefits of Suspending Your Auto Insurance

If your car sits unused for a while, suspending your insurance can offer several advantages:

1. Cost Savings

You stop paying your monthly premium during the suspension period, which can add up quickly. For example, if your premium is $150 and you suspend coverage for six months, you could save around $900, minus any small administrative fees.

2. Maintain Your Insurance History

Unlike canceling your policy, suspension keeps your insurance history intact. This helps avoid gaps that could lead to higher premiums later. Insurers often view continuous coverage as a sign of responsibility.

3. Easier Reinstatement

Reactivating a suspended policy is usually simpler than buying a new one. Your insurer already has your information, so there’s no need to shop around or fill out new applications. It’s a smoother process when you’re ready to get back on the road.

Disadvantages of Suspending Insurance

Before you pause your coverage, consider the possible downsides. Suspension isn’t always the perfect solution.

- Your Vehicle Won’t Be Protected: During suspension, your car has no insurance at all. If it’s stolen, vandalized, or damaged by weather, you’ll have to cover the costs yourself. This risk increases if the car is stored outdoors or in a high-risk area.

- You Might Face Legal Issues: In some states, having an uninsured but still-registered vehicle is illegal. You could face fines or penalties if you don’t meet state requirements like filing an affidavit of non-use or returning your plates.

- Not All Insurers Allow It: Some insurance companies offer suspension only for certain situations like military deployment. Others might not offer it at all. It’s important to check your provider’s rules before making plans.

- Rates Might Change: Reinstating your policy might come with a higher premium. Some insurers treat it like starting a new policy, especially if market rates have increased during your suspension.

What Alternatives Can You Consider?

If full suspension doesn’t fit your situation, there are other ways to reduce costs while your vehicle isn’t being used:

1. Comprehensive-Only Coverage

Also known as storage insurance, this option removes liability and collision coverage but keeps comprehensive protection. It covers incidents like theft, fire, vandalism, and weather damage. It’s a great balance between saving money and keeping your car protected.

For example, switching to comprehensive-only can cut your premium by 50% or more, depending on your insurer.

2. Usage-Based Insurance

If you’re driving very little but not storing your car completely, usage-based insurance could help. These policies charge based on how much you drive, so minimal use equals lower costs. Some insurers even offer pay-per-mile plans, perfect for people who still need their car occasionally.

3. Policy Adjustments

Another option is to raise your deductibles or lower your coverage temporarily. This keeps your policy active while reducing your premium. It’s useful if your driving is limited but not completely stopped.

Frequently Asked Questions About Insurance Suspension

Will suspending my insurance affect my credit score?

No, suspending your insurance won't directly impact your credit score. However, if your insurer bills you for fees you weren't expecting and you don't pay them, that could eventually affect your credit.

Can I suspend insurance on just one vehicle?

Yes, if you have a multi-car policy, most insurers allow you to suspend coverage on specific vehicles while maintaining coverage on others.

What happens if I drive my car during the suspension period?

Driving without insurance is illegal in most states and extremely risky. If you're caught, you could face fines, license suspension, and even vehicle impoundment. If you cause an accident, you'd be personally liable for all damages.

How long can I suspend my car insurance?

This varies by insurer, but most companies limit suspension periods to 6-12 months. Extended deployments for military personnel sometimes qualify for longer suspensions.

Manage Your Car Insurance Smarter with Suspension

Suspending your car insurance can be a smart financial move in the right circumstances, potentially saving you hundreds of dollars during periods when your vehicle sits unused. However, it's not a decision to make lightly.

Always talk directly with your insurance provider about your specific situation and options. What works for one person might not be the best choice for another, and your insurance company can provide guidance tailored to your policy and circumstances.

Need to pause your car insurance? Mila helps you compare flexible options and find the coverage that fits your life. Get started today.