SUV vs Sedan: Which Vehicle Is Cheaper to Insure in 2025?

The kind of vehicle you drive plays a bigger role in your finances than most people realize. While the difference in fuel economy between an SUV and a sedan is well known, few drivers consider how this choice impacts their car insurance rates. In 2025, insurance providers are paying even closer attention to vehicle type, tech features, and accident history data.

In this post, we’ll break down how insurance companies evaluate SUVs and sedans, how various factors influence premiums, and when one vehicle type could be cheaper to insure than the other. If you're comparing options or planning a vehicle upgrade, this article will give you clarity and confidence.

Are SUVs More Expensive to Insure Than Sedans?

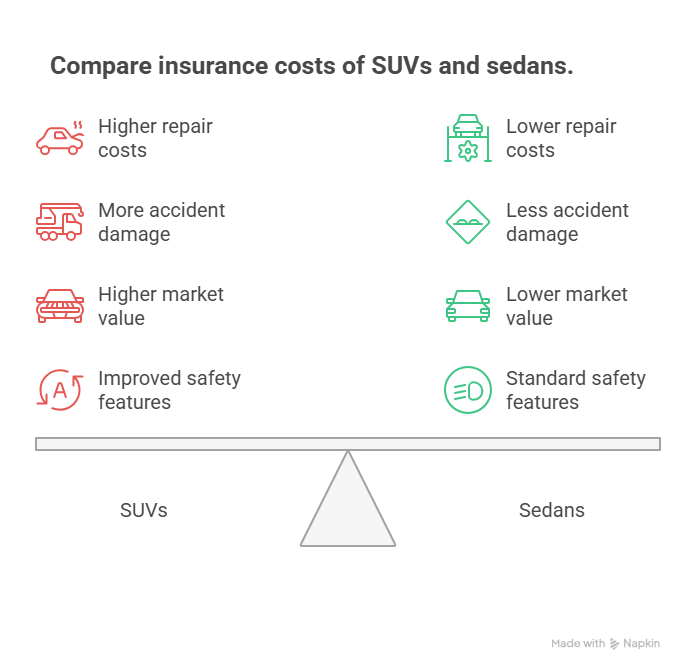

Yes, but not always. On average, SUVs carry slightly higher premiums than sedans. Why?

- They cost more to repair: Larger parts, more sensors, and complex builds.

- More damage in accidents: Due to their size and weight, they can cause more damage to other vehicles.

- Higher market value: Total loss claims cost insurers more with SUVs.

However, many mid-size and compact SUVs defy this trend thanks to improved safety features and lower theft rates. These days, insurers often reward well-rated SUVs with lower-than-expected premiums.

- Example: A base model 2025 Mazda CX-5 may cost less to insure than a high-trim 2025 Nissan Altima, especially if the sedan has sportier features that suggest a higher-risk driver profile.

What Affects Car Insurance Rates for SUVs and Sedans?

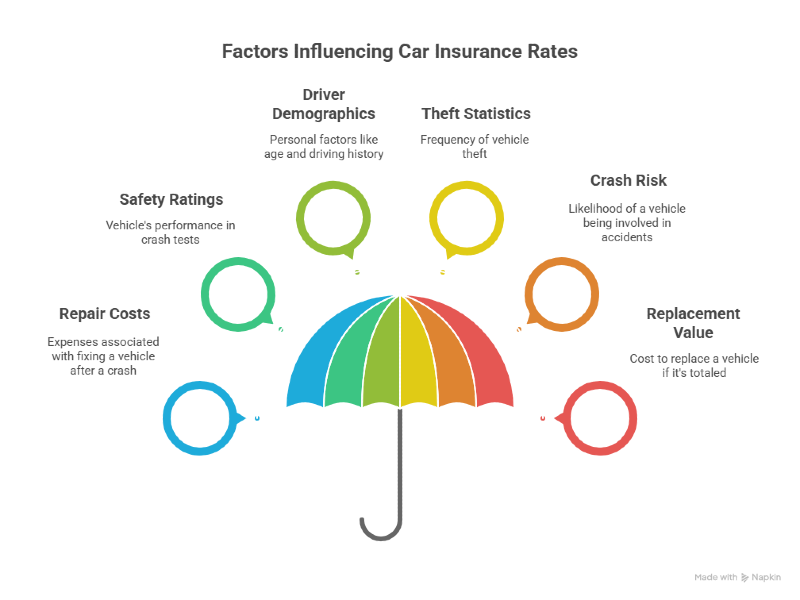

Car insurance premiums are never one-size-fits-all. Insurers calculate your rate based on a combination of:

- Repair costs: How expensive it is to fix your vehicle after a crash.

- Safety ratings: Vehicles with strong crash-test results tend to qualify for lower premiums.

- Driver demographics: Age, location, driving history, and credit score all play a part.

- Theft statistics: Vehicles with higher theft rates are more expensive to insure.

- Crash risk: Some vehicle types are statistically more likely to be involved in severe accidents.

- Replacement value: The more expensive your car is to replace, the more you’ll pay for comprehensive coverage.

📍Sedans are often smaller, lighter, and more affordable to repair or replace, making them attractive to insurers. But SUVs may outperform them in areas like safety and theft prevention, depending on the model.

Why Sedans Might Be Cheaper in Some Cases

Sedans are generally built for practical, daily use, commuting, errands, and city driving. Their simplicity translates into lower repair bills and replacement costs.

Insurers often categorize sedans as “low-risk” vehicles, especially when driven by mature or experienced drivers.

Cost Advantage

- Lower parts and labor costs

- Less vehicle mass → Less crash damage

- Better fuel efficiency → Lower mileage claims

Example: The 2025 Toyota Corolla averages $1,420/year in insurance, compared to $1,580 for the similarly priced Toyota RAV4.

When SUVs Can Be the Better Deal for Insurance

While sedans often win on base cost, there are many cases where SUVs come out ahead, especially in 2025, as technology continues to improve.

Situations Where SUVs May Be Cheaper

- Safer than sedans in crash testing

- Lower theft risk, especially for non-luxury models

- Family-oriented use → viewed as more responsible

Insurance companies love data. And the data says that SUVs like the Subaru Forester or Hyundai Tucson, especially with lane-keeping assist and blind-spot monitoring, are involved in fewer serious accidents than some compact sedans.

SUVs with modern safety packages may qualify for multi-point insurance discounts, including accident-avoidance tech and low-mileage use.

Real-World Insurance Cost Comparison (SUV vs Sedan)

Below is a table with updated average premiums for popular 2025 models:

Note: These figures are based on a 35-year-old driver with a clean record, moderate coverage, and average annual mileage.

While sedans are still generally cheaper, the gap is narrowing, especially for SUV models with strong safety records.

How Vehicle Safety Ratings Affect Insurance Premiums

In 2025, insurers are more influenced by safety scores than ever. Modern insurance algorithms consider:

- Crash-test performance (from IIHS and NHTSA)

- Availability of ADAS (Advanced Driver Assistance Systems)

- Accident statistics per model

High safety ratings reduce the likelihood and severity of claims—something insurers value. Sedans and SUVs that earn a "Top Safety Pick+" rating can enjoy premium reductions of up to 10–15%, depending on the provider.

Example: The 2025 Subaru Legacy and Subaru Outback both received top safety awards, helping reduce premiums despite different body types.

How Does Impact on Your Premium Repair Costs?

Larger vehicles often mean higher repair costs, especially for bumper replacements, suspension work, and panel damage. SUVs also frequently come with more electronics and cameras, which means:

- More time in the shop

- More expensive parts

- Greater complexity for even minor repairs

Comparison: A side mirror replacement on a sedan might cost $250–$400. On an SUV with blind-spot detection, it can easily exceed $800. Insurance companies factor in this repair risk when setting rates, especially for collision and comprehensive coverage.

The Role of Theft Rates in Car Insurance

Insurers track theft trends by model and region. Some sedans consistently rank high in theft reports, especially older models with fewer anti-theft features.

Example: The Honda Accord and Nissan Altima remain top targets, according to 2025 NICB data.

SUVs tend to have lower theft rates overall, particularly in suburban or rural areas, and newer models come with better theft-deterrent systems. This can reduce your comprehensive coverage premium, even if the vehicle is more expensive.

Should You Switch from a Sedan to an SUV?

The best vehicle depends on your needs, but it’s important to factor in total ownership cost, not just sticker price or MPG.

You may prefer a sedan if:

- You drive mostly in urban areas.

- You prioritize fuel savings and low premiums.

- You’re buying your first car or leasing short-term.

You may prefer an SUV if:

- You value space, comfort, and visibility.

- You need a family-friendly or adventure-ready vehicle.

- You're willing to pay slightly more for greater safety features.

📌Always get a quote first. Insurance surprises can turn a “good deal” into a costly regret.

Tips to Lower Insurance Premiums Regardless of Vehicle Type

No matter what you drive, here are simple strategies to save:

- Shop around annually, rates change!

- Bundle with renters' or home insurance

- Install security devices (dash cams, GPS)

- Enroll in usage-based insurance (UBI) programs

- Avoid optional coverage if the vehicle is older

- Raise your deductible if you can afford higher out-of-pocket costs

Making the Smartest Insurance Choice for Your Next Vehicle With Mila

Choosing between an SUV and a sedan isn’t just about comfort or style; it’s a decision that directly affects your long-term costs. Sedans often have lower insurance premiums due to repair affordability and risk profiles, while SUVs can offer more safety features that insurers reward. The real difference depends on your personal situation, driving habits, and the model you choose.

If you're unsure where to start, use Mila. We make it easy to compare real-time auto insurance quotes from top-rated providers, all in one place. Our mission is to help you find the right coverage at the right price, without the stress or confusion. A few clicks can save you hundreds.

Try Mila today and see how much you could save in just a few minutes.

Frequently Asked Questions (FAQs) About Comparing SUV vs Sedan Insurance Rates

Is it more expensive to insure an SUV or a sedan?

In general, SUVs tend to be slightly more expensive to insure than sedans due to higher repair and replacement costs. However, if the SUV has high safety ratings and lower theft risk, it may actually cost less to insure than certain sedans. It depends on the specific model, driver profile, and coverage.

Does the size of the vehicle affect insurance rates?

Yes. Larger vehicles like SUVs can cause more damage in accidents and often cost more to repair, which can lead to higher premiums. However, their safety performance may offset these costs depending on the model and features.

What is the best way to compare SUV and sedan insurance costs?

The most effective way is to use an insurance comparison tool like Mila, which provides real-time quotes from multiple top-rated insurers. This allows you to compare coverage options side-by-side and choose the best rate for your needs.