How Deductibles Impact Your Auto Insurance Costs

Deductibles are a key part of how your auto insurance works. They determine how much you pay out of pocket before your insurance covers the rest of a claim. The choice you make about your deductible can affect both your monthly premium and how claims are handled if something happens.

In this post, we’ll break down everything you need to know about deductibles, helping you make informed decisions that fit your budget and driving habits.

What Is a Deductible?

A deductible is the amount you pay out of pocket before your auto insurance covers the rest of a claim. It represents your share of the costs when an accident or incident occurs.

How Deductibles Work

For example, if your deductible is $500 and repairs after an accident cost $2,000, you’ll pay $500, and your insurance company will handle the remaining $1,500.

Why Deductibles Matter

Choosing the right deductible affects how much you pay now and how secure you feel if something happens. Deductibles influence both your insurance premiums and the claims process:

- Impact on Premiums: Generally, higher deductibles mean lower premiums, while lower deductibles result in higher premiums.

- Claims Handling: If the damage is less than your deductible, you’ll cover the cost yourself without your insurer’s involvement.

How Deductibles Influence Your Premiums

The size of your deductible has a direct impact on your auto insurance premiums. The general rule is simple:

- Higher Deductible = Lower Premium: When you choose a higher deductible, like $1,000 instead of $500, you take on more financial responsibility if an accident happens. Since you’re covering more of the cost, your insurance company charges you a lower premium.

- Lower Deductible = Higher Premium: A lower deductible, such as $250, means your insurer will cover more expenses sooner. This increases their risk, leading to a higher premium for you.

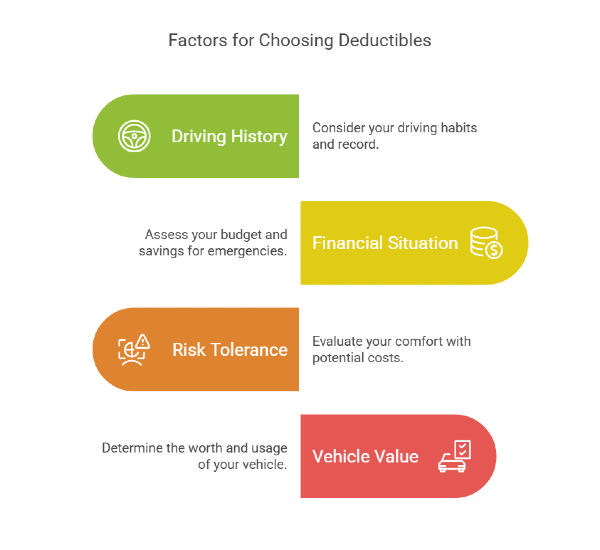

How to Decide What’s Best for You

Choosing the right deductible for your auto insurance depends on your circumstances. To make the best choice, consider these key factors:

1. Driving History and Habits

- Safe Drivers: If you have a clean driving record and rarely file claims, a higher deductible (e.g., $1,000 or more) could help you save on monthly premiums. Since you're less likely to need your insurance, the risk of paying a high out-of-pocket cost is lower.

- Frequent Commuters: If you drive a lot or often navigate through high-traffic areas, you might be more prone to accidents. In this case, a lower deductible (e.g., $250-$500) could reduce the financial impact if you need to file a claim.

2. Financial Situation

- Budget Flexibility: Can you comfortably cover a $1,000 deductible if needed? If an unexpected expense would put you in a tough spot, a lower deductible might be a safer choice.

- Emergency Savings: If you have an emergency fund set aside, a higher deductible might be manageable. This can lead to significant savings on your auto insurance premiums over time.

3. Risk Tolerance

- Prefer Predictable Costs? A lower deductible offers stability, especially if you’d rather pay a bit more monthly than face a big bill after an accident.

- Willing to Take a Risk? A higher deductible lowers your premium but requires you to handle more costs upfront in a claim. This is a good option if you can absorb sudden expenses without stress.

4. Vehicle Value and Usage

- Older or Less Valuable Cars: If your car's value is low, it might not make sense to choose a low deductible with high premiums. Consider whether the payout from a claim justifies the cost.

- New or Financed Vehicles: If your car is newer or financed, a lower deductible might align better with the lender’s requirements and protect your investment.

Making a Decision

Before finalizing your choice, ask yourself:

- What can I comfortably afford out of pocket?

- How often do I drive, and what are my accident risks?

- Do I prefer lower premiums now or lower costs if I need to file a claim?

By evaluating these aspects, you can make an informed decision that balances premium savings with the potential costs of an accident.

How Deductibles Impact Claims

When you file a claim on your auto insurance, your deductible determines how much you’ll need to pay before your insurance covers the rest. Here’s how it works:

Real-Life Example

Imagine your car is damaged, and the repair costs $800. If your deductible is $500, you’ll pay $500, and your insurance will cover the remaining $300.

However, if the repair costs $400, and your deductible is $500, you’ll need to cover the entire amount out of pocket. In this case, it might not be worth filing a claim.

Why Deductible Choice Matters

Choosing the right deductible is crucial to avoid financial surprises and ensure your policy truly supports you when needed.

- Low Deductibles: Good for avoiding high costs during claims, but they usually mean higher monthly premiums.

- High Deductibles: This can save you money on premiums but may lead to larger out-of-pocket costs if an accident happens.

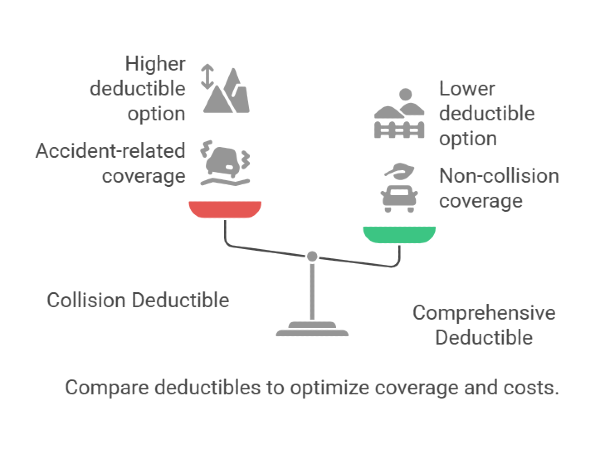

Types of Deductibles in Auto Insurance

Not all deductibles are the same. Depending on your auto insurance policy, you might encounter different types of deductibles, each covering specific scenarios.

1. Collision Deductible

- What It Covers: Damage from accidents, such as collisions with another vehicle or hitting an object like a fence or guardrail.

- When It Applies: If you’re at fault in an accident, your collision deductible will apply to the cost of repairs.

Example: If you collide with a tree and the repair costs are $3,000, with a $500 deductible, you’ll pay $500, and your insurer will cover $2,500.

2. Comprehensive Deductible

- What It Covers: Non-collision events like theft, vandalism, natural disasters, or damage from falling objects.

- When It Applies: This deductible kicks in when your vehicle is damaged by something other than a collision.

Example: If a branch falls on your parked car causing $1,200 in damage and your deductible is $250, you’ll pay $250, and insurance will handle the rest.

3. Mixing and Matching Deductibles

Some policies let you set different deductibles for collision and comprehensive coverage. For instance:

- You could choose a $1,000 collision deductible to lower your premium.

- At the same time, opt for a $250 comprehensive deductible, as these claims might be less frequent.

How to Choose the Right Deductible

Choosing the right deductible for your auto insurance isn’t a one-size-fits-all decision. It depends on your financial situation, driving habits, and how much risk you’re comfortable taking on. Taking the time to analyze these factors will help you make a choice that balances immediate savings with long-term security.

1. Review Your Financial Situation

- What Can You Afford Out of Pocket?If paying $1,000 after an accident would strain your budget, a lower deductible might be worth the higher premium.

- Emergency Fund: Having $500-$1,000 set aside for emergencies can make a higher deductible more manageable.

2. Consider Your Driving Habits

- Safe Drivers: If you rarely file claims and have a safe driving history, a higher deductible could help you save on premiums.

- High-Risk Areas: If you live in a high-traffic or accident-prone area, a lower deductible might provide better protection.

3. Evaluate Your Risk Tolerance

- Do You Prefer Predictability?A lower deductible offers more financial stability, especially if you’re not comfortable with potentially large expenses.

- Are You Willing to Take a Risk?Choosing a higher deductible can reduce monthly costs, but you need to be ready to pay more if an accident happens.

Tips to Optimize Your Deductible Choice

Choosing the right deductible for your auto insurance is just the first step. There are practical strategies to make sure your choice truly benefits your budget and coverage.

1. Build an Emergency Fund

- Set aside $500-$1,000 to cover your deductible if needed.

- Having this cushion can make a higher deductible less intimidating and help you save on premiums.

2. Reassess Your Deductible Annually

- Review your policy at least once a year.

- Life changes like paying off your car or moving to a safer neighborhood might mean it’s time to adjust your deductible.

3. Take Advantage of Discounts

- Many insurers offer discounts for safe driving, bundling policies, or using safety features in your vehicle.

- These discounts can help reduce your premium costs, giving you more flexibility when choosing a deductible.

4. Avoid Filing Small Claims

- Paying out of pocket for minor repairs can help keep your insurance premiums stable.

- Frequent claims, even small ones, might lead to higher premiums over time.

Choose the Right Deductible for Your Auto Insurance with Mila

Choosing the right deductible is all about finding the balance between what you save on your premium and what you might pay out of pocket after an accident. Whether you want lower monthly costs or more peace of mind, your deductible should match your budget and driving habits.

Want to see how your deductible affects your rate? At Mila, we make it easy.

Compare real-time quotes from top insurance providers, all in one place.

✅ Save up to 30%

✅ 1,000+ positive reviews

✅ Fast, personalized quotes

👉 Enter your ZIP code to get started.

Frequently Asked Questions (FAQ’s) About Deductibles on Your Auto Insurance

What happens if my claim is lower than my deductible?

If the cost of the damage is less than your deductible, you’ll need to cover the entire expense out of pocket. For example, if your deductible is $500 and the repair costs $300, your insurance won’t contribute.

Can I change my deductible mid-policy?

Yes, most insurance companies allow you to adjust your deductible at any time. However, changes might affect your premium, so it’s worth checking with your insurer to understand how it will impact your costs.

Are there deductibles for all types of auto insurance coverage?

No, not all coverages have deductibles. Collision and comprehensive coverage typically require a deductible, but liability insurance, which covers damages to others, usually does not have a deductible.

How often should I reassess my deductible choice?

It’s a good idea to review your deductible annually or when you experience significant changes, such as paying off your vehicle, moving to a safer area, or improving your financial situation.

Is it better to have a high or low deductible?

It depends on your budget and risk tolerance. A high deductible can lower your premium, which is great if you’re a safe driver and have an emergency fund. A low deductible is helpful if you want to avoid high out-of-pocket costs when filing a claim.