Types of Auto Insurance and How to Choose Right

Choosing the right auto insurance isn’t just about meeting legal requirements, it’s about protecting yourself, your passengers, and your finances. With so many types of coverage available, it can be overwhelming to figure out what you need. However, understanding each option helps you build a policy that matches your lifestyle, driving habits, and budget.

Whether you’re insuring your first car or revisiting your current plan, knowing what each coverage type offers puts you in control. In this post, you’ll learn the most common coverages, from the essentials to the extras, so you can feel confident every time you hit the road.

What Are the Different Types of Car Insurance Coverage?

Every auto insurance policy starts with a few essential coverage types. These core protections are usually required by law and are designed to cover the most common risks on the road.

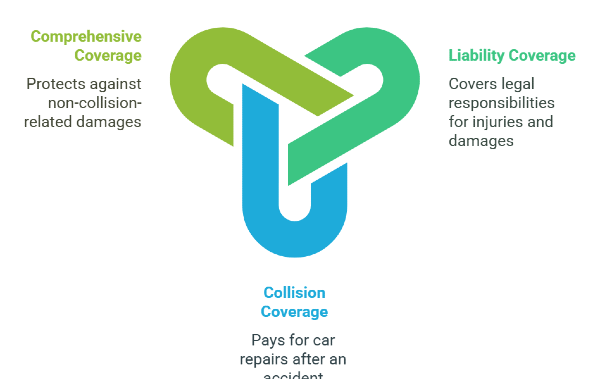

This foundation includes liability coverage, and often, additional protections like collision and comprehensive coverage. Each plays a different role in keeping you financially safe behind the wheel.

In the next sections, we’ll break down exactly what each type of coverage means, so you can make smart choices based on your car, lifestyle, and budget.

Liability Coverage: What You're Legally Required to Have

Liability coverage is the most basic, and often mandatory, part of any auto insurance policy. It’s the minimum protection you need to legally drive in most states.

This coverage comes in two parts:

- Bodily injury liability: Covers medical costs for people injured in an accident you caused.

- Property damage liability: Pays for damage to someone else’s car or property.

While states set minimum limits, those amounts are usually too low to fully protect you. For example, if you're responsible for $100,000 in medical bills, but your policy only covers $50,000, you’d have to pay the rest out of pocket.

That’s why many drivers choose higher limits—because the right liability coverage can protect your savings, your car, and your peace of mind.

Collision Coverage: Protecting Your Car After an Accident

Collision coverage helps pay for damage to your car after an accident, no matter who was at fault. It’s a key part of a well-rounded auto insurance policy, especially if your car is newer or financed. This coverage applies if you:

- Hit another vehicle

- Crash into an object like a tree, pole, or wall

- Flip your car in a single-vehicle accident

If you're leasing or financing your car, your lender will likely require this type of coverage. That’s because it protects their investment in the vehicle.

Unlike liability insurance, which covers other people, collision insurance focuses on your property. It's especially helpful if you can’t afford to pay for major repairs or a full replacement out of pocket.

Comprehensive Coverage: Protection Beyond Collisions

Comprehensive coverage steps in when something damages your car that isn't a crash with another vehicle. It covers many unexpected events that can leave you with costly repairs, or no car at all.

While it's not legally required, comprehensive coverage is often paired with collision insurance. Together, they offer full protection for your vehicle against most physical damage.

If your car is leased or financed, this coverage may be mandatory. But even if you own your car outright, it can be a smart investment—especially if you park outside or live in areas prone to severe weather or theft.

This type of coverage typically includes:

- Theft or attempted theft

- Vandalism

- Fire and explosions

- Natural disasters like floods or hail

- Falling objects, such as tree branches

- Collisions with animals (like hitting a deer)

- Broken or shattered windshields

Extra Coverage Worth Considering: When the Basics Aren’t Enough

Basic auto insurance covers a lot, but not everything. If you want better protection, for yourself, your passengers, or your finances, these additional types of coverage are worth a closer look.

1. Uninsured/Underinsured Motorist Coverage

What if someone hits you, and they don’t have enough insurance or none at all? This coverage helps when:

- You’re hit by an uninsured driver

- The at-fault driver’s limits are too low

- You’re the victim of a hit-and-run

2. Personal Injury Protection (PIP)

Often called no-fault coverage, PIP pays for your medical costs regardless of who caused the accident. Required in many no-fault states, PIP speeds up the claims process and gets you to care quickly. It may also cover:

- Lost income if you can’t work

- Funeral expenses

- Household help (like cleaning or childcare)

3. Medical Payments Coverage (MedPay)

Similar to PIP, but more limited. MedPay strictly covers medical expenses for you and your passengers after an accident. Consider MedPay if you have high health insurance deductibles or frequently drive with passengers. It can help with:

- Emergency treatment

- Health insurance deductibles and copays

- Dental injuries from a crash

Specialized Coverage Add-Ons: Adapt Your Policy to Your Life

Sometimes, standard auto insurance coverage isn’t enough, especially if you rely heavily on your vehicle or have a loan. These add-ons offer personalized protection for specific situations.

1. Gap Insurance: Covering What You Still Owe

If your car is totaled, insurance only pays its current value, not what you still owe. Gap coverage pays the difference. This is a must-have if you financed or leased a vehicle with little to no down payment.

Example: You owe $28,000 on a car now worth $25,000. Without gap insurance, you'd pay $3,000 out of pocket.

2. Rental Reimbursement Coverage

If your car is in the shop after an accident, this coverage helps pay for a rental car or alternative transport.

- Covers daily rental costs (up to your policy limit)

- Ideal if you don’t have a backup vehicle

3. Roadside Assistance Coverage

Breakdowns happen. This coverage gives you peace of mind with services like:

- Towing

- Jump-starts

- Flat tire changes

- Emergency fuel delivery

- Lockout assistance

Special Circumstances: Coverage for Unique Situations

Some driving situations require more than traditional auto insurance. If you fall into one of these categories, specialized coverage can give you the protection standard policies won’t.

1. Classic Car Insurance

If you own a vintage or collector car, regular insurance may not reflect its true value. Classic car coverage offers:

- Agreed value payouts (pre-set value for claims)

- Coverage for rare parts and restorations

- Lower premiums due to limited use

- Flexible terms recognizing you don’t drive it daily

2. Rideshare Insurance

Driving for Uber or Lyft? Personal policies usually exclude commercial use—and company policies don’t cover every phase of your work. Rideshare coverage fills the gap when:

- You’re online but haven’t accepted a ride

- You're waiting for a passenger

- You want full coverage between trips

3. SR-22 Insurance

An SR-22 isn’t coverage—it’s a certificate proving you carry the minimum required insurance. Your insurer files the SR-22 with your state, ensuring you stay continuously insured as required by law. It’s usually required after:

- DUI or DWI convictions

- Driving without insurance

- Multiple at-fault accidents

How to Build the Right Auto Insurance Policy for You

Creating the ideal auto insurance policy isn’t about picking the cheapest option—it’s about choosing the right coverage for your needs. Here's how to do it:

Start with Your State Requirements: Every state has minimum insurance laws. Start by meeting those requirements, usually liability coverage—and sometimes PIP or uninsured motorist coverage.

Know Your Car’s Value: If your car is worth less than a few thousand dollars, full coverage (collision + comprehensive) might not be cost-effective. But for newer or financed cars, it’s essential.

Check Your Financial Situation: Could you afford to repair or replace your car out of pocket? If not, adding collision and comprehensive coverage is a smart move.

Consider Your Health Insurance: Strong health coverage may reduce your need for MedPay or PIP. But if your health plan has high deductibles, extra medical coverage can help.

Think About Your Driving Habits: Long commutes, city traffic, or frequent road trips increase your risk. Consider extras like rental reimbursement, roadside assistance, or higher liability limits.

Get Auto Insurance and Gain Peace of Mind on the Road With Mila

The right combination of coverages creates a safety net that allows you to drive with confidence. At the end of the day, the best car insurance policy is one that leaves you feeling secure every time you turn the key in the ignition, knowing you're protected against whatever the road might bring your way.

Skip the complications. Mila gives you instant access to real-time auto insurance quotes from reliable providers. Compare, save up to 30%, and get covered in minutes. Ready to start? Compare now.

Frequently Asked Questions (FAQs) About Types of Auto Insurance Coverage

Do I need both collision and comprehensive coverage?

It depends on your car’s value and financial situation. If your vehicle is newer or financed, both are highly recommended.

What’s the difference between PIP and MedPay?

PIP offers broader benefits like lost wages and essential services. MedPay only covers medical expenses after an accident.

Is uninsured motorist coverage required?

In some states, yes. Even when optional, it’s worth having extra protection against underinsured drivers.

Can I drop full coverage on an old car?

Yes, if your car’s value is low, and you could afford to replace it, dropping full coverage might save you money.