Liability vs. Collision: What’s the Difference in 2025?

The debate of liability vs. collision often comes up when selecting auto insurance. While both relate to accidents, they protect different things. Liability pays for damage or injury you cause to others, while collision covers your car if it’s damaged in a crash.

In this post, you’ll learn about what each option includes, outline their differences, compare costs, and explore when each type makes more sense. Drivers with older cars, new vehicles, or loans may need different coverage depending on risk and budget. Clear comparisons follow below to help clarify the best option for your auto insurance.

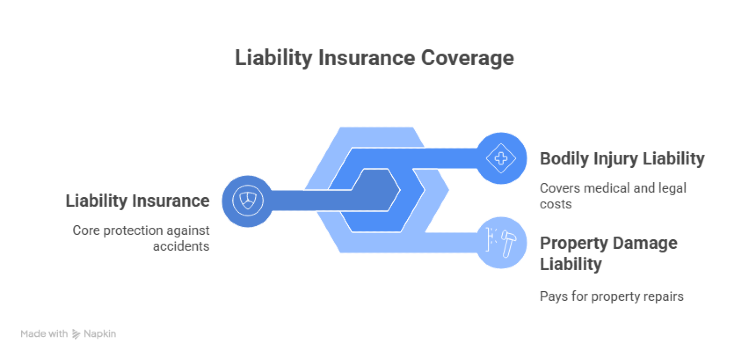

What Is Liability Insurance?

Liability insurance covers damage or injury caused to other people or their property in an accident. It applies when the policyholder is considered at fault. Most states require drivers to carry this type of insurance to drive legally. There are two main components:

- Bodily injury liability: Covers medical expenses, legal fees, and lost wages for others injured in the accident.

- Property damage liability: Pays for repairs to another person’s car or property.

Liability insurance can be a cost-effective option for older cars, but it offers limited protection. If the goal is to meet legal requirements and keep monthly costs low, it usually works, as long as repairs to your vehicle are not a concern.

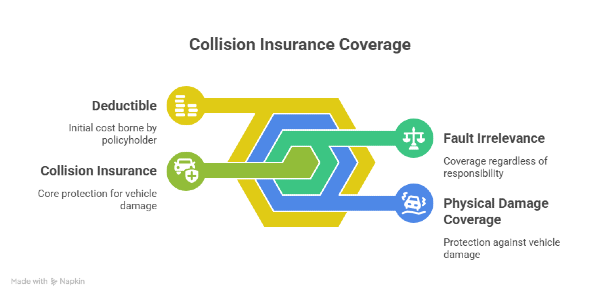

What Is Collision Insurance?

Collision insurance covers damage to the policyholder’s vehicle after a crash, no matter who is responsible. It applies in cases where the car hits another vehicle, a fixed object, or flips without a collision with another driver. There are several key features:

- Applies regardless of fault: Even if the driver caused the accident, the policy still pays for repairs.

- Covers physical damage to your vehicle: Unlike liability, it does not protect others.

- Usually includes a deductible: The policyholder pays a set amount before the insurance covers the rest.

This type of coverage is not required by law, but it’s often included in loan or lease contracts. It’s commonly selected for vehicles that still have high value or for drivers who want broader protection.

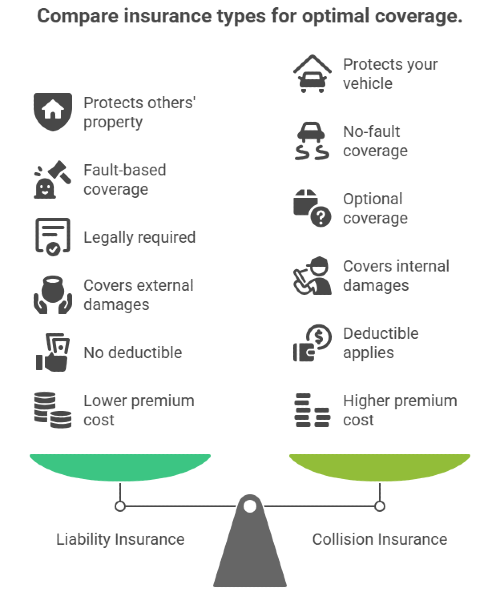

Key Differences Between Liability and Collision Coverage

Although both relate to vehicle accidents, liability insurance and collision insurance offer protection in very different ways. The table below outlines how they compare across the most important areas:

Each option serves a specific role in a policy. Drivers often choose based on the value of their car, financial risk tolerance, and loan obligations.

Real-Life Scenarios: When to Choose One or Both

Choosing between liability and collision insurance depends on several personal factors, including the value of the car, budget limits, and driving habits. Below are typical cases that help clarify when one option may be more suitable than the other:

- Older vehicle, low resale value: Many drivers skip collision coverage if repairs would exceed the car’s worth. Liability alone often makes more sense in this case.

- New car or high market value: Vehicles with a higher value or still under financing usually benefit from adding collision coverage to avoid costly repairs.

- Urban driving, high mileage, or dense traffic areas: More time on the road increases the chance of accidents. In these cases, having both liability and collision provides better protection.

- Limited monthly budget: Drivers often start with liability-only to meet legal requirements while keeping premium costs lower.

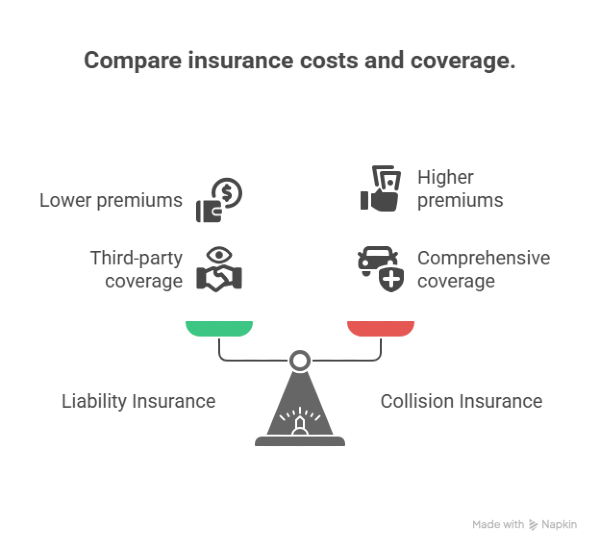

Which One Is More Affordable: Cost Comparison

In most cases, liability insurance costs less than collision insurance. Since liability only covers third-party damage and doesn’t apply to the policyholder’s vehicle, premiums are generally lower.

Collision insurance represents higher risk for insurers because it covers your car regardless of fault. As a result, this coverage adds more to the monthly or yearly payment. Here’s a general breakdown of average costs:

- Liability-only policy: $400 to $700 per year, depending on the driver’s record, location, and vehicle.

- Liability + Collision package: $900 to $1,500 per year, with the final rate based on deductible amounts and car value.

I had to pay nearly $2,000 out of pocket for repairs. That experience changed how I looked at insurance. Liability seemed cheaper at first, but the cost of a single accident easily erased any savings.

Choosing coverage based solely on price can lead to bigger expenses later, especially if the car still holds significant value.

How to Decide the Right Coverage for You

Selecting between liability and collision comes down to personal circumstances. There’s no universal rule, but the following factors can help narrow the choice:

- Vehicle age and condition: Older cars with low resale value often don’t need collision. If repairs cost more than the car is worth, liability is usually enough.

- Loan or lease status: Cars still under financing usually require collision as part of the agreement.

- Budget flexibility: Monthly premium differences matter. Some drivers trade coverage for lower costs, others prefer full protection even at a higher rate.

- Driving habits and environment: High-mileage drivers or those in dense traffic areas are exposed to more risk and may benefit from broader coverage.

Make Better Insurance Decisions with Mila

Using tools like Mila to compare insurance options side by side can simplify the process. It helps spot gaps between plans and see how different coverage types affect price and protection.

Car insurance decisions often require more than just picking a price. Choosing between liability and collision means thinking about risk, vehicle value, and how much financial responsibility you're willing to carry after an accident.

Mila make it easier to compare options and see which policies actually match your situation. With a clear side-by-side view, it’s easier to avoid gaps in coverage or unnecessary extras. A few extra minutes spent with the right comparison tool can prevent expensive mistakes down the road.

Ready to find the coverage that actually fits your needs? Use Mila to compare liability and collision options in seconds, no hidden steps, just clear results.

Frequently Asked Questions (FAQs) About Liability vs Collision

What’s the main difference between liability and collision insurance?

Liability insurance covers damage or injury you cause to other people or their property. Collision insurance pays for damage to your own car after an accident, regardless of fault.

Is liability insurance required by law?

Yes. Most U.S. states require drivers to carry a minimum level of liability insurance to register and operate a vehicle legally.

Do I need collision insurance if I already have liability?

It depends. Liability won’t pay for repairs to your own vehicle. If your car still has value, or you can't afford out-of-pocket repairs, adding collision coverage may be a smart move.