How Your Credit Score Affects Auto Insurance

In most states, your credit score directly influences how much you pay for auto insurance. Many insurers use credit-based data to assess risk and set your premium. A low score often signals higher risk, which can result in higher costs, even if you have a clean driving record.

In this post, you’ll learn why credit scores matter to insurers, how different score ranges affect your rate, and what you can do to save. You'll also find real cost examples, tips to improve your credit, and a list of states where credit isn't factored into insurance pricing.

Why Your Credit Score Affects Auto Insurance

Insurance companies don’t just look at your driving history. In most states, they also consider your credit score when setting your premium.

Studies, including one by the Federal Trade Commission, show that drivers with lower credit scores tend to file more claims.

- Low credit score = higher perceived risk

- High credit score = lower perceived risk

This doesn’t mean insurers are judging your finances. They’re using credit-based scoring as a statistical tool to predict risk.

If your credit is low, your premium will likely be higher. That’s why improving your credit can help reduce your auto insurance costs over time.

How Insurers Use Credit-Based Insurance Scores

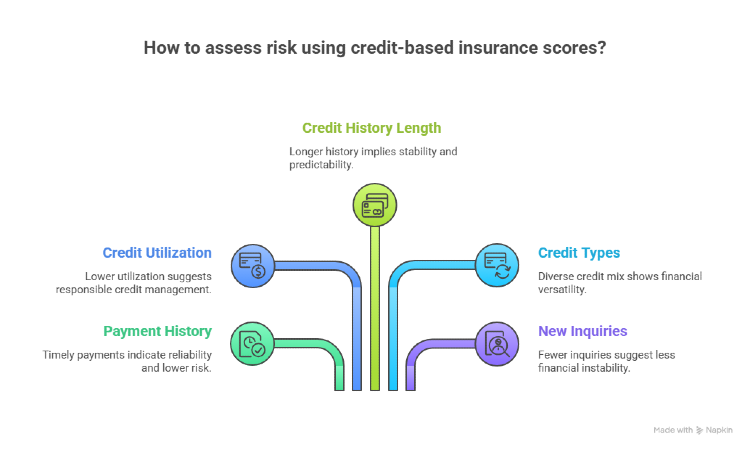

Insurers don’t use your full credit report. Instead, they rely on a credit-based insurance score, which includes specific financial behaviors linked to risk.

Here’s what they usually consider:

- Payment history: Whether you pay bills on time

- Credit utilization: How much of your available credit you use

- Length of credit history: How long your accounts have been active

- Types of credit: Mix of loans, cards, and accounts

- New credit inquiries: How often you apply for credit

These elements help insurers estimate how reliable you are, not just with money, but in general behavior.

A strong score can show financial responsibility, which insurers associate with safer driving habits. This leads to lower auto insurance premiums for many drivers.

Credit Score Ranges and What They Mean for Your Premium

Your credit score can directly influence how much you pay for auto insurance. While scoring models may vary, most follow similar patterns. Here’s a general breakdown:

According to The Zebra’s 2024 Auto Insurance Report, drivers with poor credit can pay up to 61% more than those with excellent credit for identical coverage.

Cost Differences by Credit Score: Real-World Example

Let’s say you live in a state where insurers can use credit scores to set your rate.

Based on 2024 data:

- A driver with excellent credit might pay around $1,200 per year

- A driver with poor credit might pay between $2,000 and $2,500 per year

That’s a difference of $800 to $1,300 for identical coverage, driven solely by credit score.

These numbers highlight how improving your credit can lead to real savings on your auto insurance over time.

States Where Credit Score Doesn’t Affect Auto Insurance

Not every state allows insurers to use your credit score when calculating auto insurance premiums. In these places, companies must rely on other factors like driving history, age, and location.

As of now, these states have banned or restricted credit-based insurance pricing:

- California

- Hawaii

- Massachusetts

- Michigan

- Washington (temporary restriction)

If you live in one of these states, your premium won’t be impacted by your credit. However, keeping a strong credit score still benefits your overall financial health.

How to Get Auto Insurance With Bad Credit

Having bad credit doesn’t mean you can’t get auto insurance, but it can make things more expensive and limit your options.

Here are a few smart strategies:

- Compare multiple quotes, rates vary widely between providers

- Look for insurers that don’t rely heavily on credit

- Ask about available discounts, such as multi-policy, telematics, or good student programs

Even if your credit score is low, a clean driving record or bundling policies can help offset the higher cost. Taking time to shop around can lead to better rates than you might expect.

Tips to Improve Your Credit and Lower Your Insurance Premium

Improving your credit score can lead to lower auto insurance premiums, and better financial opportunities overall. These steps can make a big difference over time:

- ✅ Pay all your bills on time – Payment history has the biggest impact

- ✅ Keep credit utilization low – Stay below 30% of your available credit

- ✅ Avoid opening too many accounts – Too many inquiries can hurt your score

- ✅ Review your credit report regularly – Fix any errors you find

- ✅ Be patient – Improvements take time to reflect on your score

Even small changes to your credit habits can help reduce your insurance rate at your next policy renewal.

Other Factors That Influence Your Auto Insurance Premium

While your credit score matters, it's only one part of how insurers determine your auto insurance rate. These additional factors also play a major role:

- Driving record: Tickets, accidents, and DUI history

- Vehicle type: Make, model, and safety ratings

- Age and gender: Younger drivers typically pay more

- Location: ZIP code, traffic, and local crime rates

- Coverage level: Liability-only vs. full coverage

If your credit isn’t ideal, keeping a clean driving history or choosing a safe vehicle can help reduce your premium.

Compare Auto Insurance Rates Based on Your Credit Score With Mila

Your credit score plays a bigger role in your auto insurance rate than you might expect. At Mila, we make it easy to compare quotes from top insurers, so you can see how your credit impacts pricing and find a policy that works for you. Take control of your insurance costs with the power of informed choice.

Frequently Asked Questions (FAQs) About Credit Score Affect Your Auto Insurance Rate

Will improving my credit lower my auto insurance?

Yes, improving your credit score can help reduce your premium over time. Most insurers review your score during policy renewal, and a better score often signals lower risk. This can lead to a noticeable drop in your insurance rate, especially if your credit has strongly improved since your last renewal.

Is checking my credit for insurance a hard inquiry?

No. When insurers check your credit, it’s considered a soft inquiry, meaning it doesn’t impact your credit score. You can also check your own credit report freely without any penalty or score reduction.

How often do insurance companies check my credit?

Most insurance providers review your credit when you first apply and again at renewal, usually every 6 to 12 months. If your score improves, it’s worth asking your insurer to re-evaluate your rate sooner.