How to Save on Auto Insurance: A New Driver’s Guide

Getting behind the wheel for the first time is an exciting moment in anyone's life. That sense of freedom and independence is truly incomparable. But along with this newfound freedom comes a serious responsibility, especially regarding insurance.

If you're a new driver or helping someone who's just gotten their license, you've noticed something rather demoralizing: car insurance for new drivers can be surprisingly expensive. In this post, you’ll learn about car insurance for new drivers, why costs are higher, how to find affordable options, and what coverage you need.

Why Is Car Insurance More Expensive for New Drivers?

Insurance companies base their premiums on statistical risk, and unfortunately, the statistics aren't in favor of new drivers. Research consistently shows that inexperienced drivers are more likely to be involved in accidents. Injuryfacts Report that drivers aged 16-19 are nearly three times more likely to be in a fatal crash than drivers aged 20 and above.

This increased risk isn't because new drivers are careless, it's simply because driving is a skill that improves with experience. When you're new to driving, you're still developing the reflexes, judgment, and anticipation skills that help experienced drivers avoid accidents. Insurance companies know this, and they price policies accordingly.

What Types of Coverage New Drivers Should Consider

Before we get into saving money, let's make sure you understand what coverage options exist and which ones you might need:

- Liability Coverage: This is the minimum required by most states and covers damage you cause to other people and their property. It doesn't cover your own vehicle.

- Collision Coverage: This pays for damage to your car after an accident, regardless of who was at fault.

- Comprehensive Coverage: This covers damage to your car that isn't from a collision—things like theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of who caused the accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough coverage.

As a new driver, you might be tempted to go with just the minimum required coverage to save money, but that could be a costly mistake in the long run. If you cause a serious accident, minimum liability limits might not be enough to cover all the damages, leaving you personally responsible for the difference.

How Can I Lower My Insurance Premium as a New Driver?

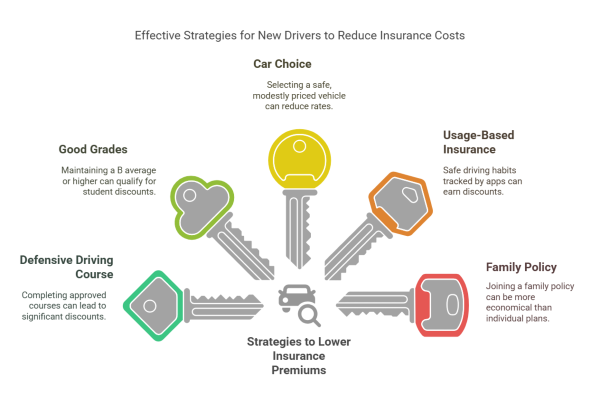

Now that we understand why insurance costs more for new drivers, let's explore some effective strategies to bring those costs down:

1. Take a Defensive Driving Course

Many insurance companies offer discounts to new drivers who complete approved defensive driving or driver's education courses. These courses teach valuable skills that can help you avoid accidents, and insurers recognize this by reducing your premium. Some courses can be completed online in just a few hours, and the discount often more than pays for the cost of the course.

2. Maintain Good Grades

If you're a student, your academic performance could help you save on insurance. Many insurers offer good student discounts to drivers who maintain at least a B average in high school or college. This discount is based on research suggesting that students who are responsible in the classroom tend to be responsible behind the wheel as well.

3. Choose the Right Car

The car you drive impacts your insurance rates. Sports cars and luxury vehicles are expensive to insure, especially for new drivers. Consider starting with a modestly priced, safe vehicle with good safety ratings. Cars equipped with advanced safety features might qualify for additional discounts.

4. Consider Usage-Based Insurance

Many insurance companies now offer programs that track your driving habits through a mobile app or a device installed in your car. If you drive safely, avoiding hard braking, rapid acceleration, and late-night driving, you could earn significant discounts. These programs can be especially beneficial for new drivers who are committed to safe driving practices.

5. Join a Family Policy

If you're a young driver living with family members, being added to their existing policy is often less expensive than getting your own. The experienced driver's good record can help offset the risk of having a new driver on the policy.

6. Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in after a claim. Choosing a higher deductible can lower your premium, but make sure you can afford to pay that amount if you need to file a claim.

How the Claims Process Works

Knowing how to handle an accident and file a claim is just as important as having the right coverage. Here's a simple guide to the claims process:

- Immediately After an Accident: Check for injuries, move to a safe location if possible, and call emergency services if needed.

- Document Everything: Take photos of the accident scene, gather contact and insurance information from other drivers, and collect statements from witnesses.

- Contact Your Insurance Company: Report the accident as soon as possible, even if you weren't at fault.

- Work with the Claims Adjuster: Your insurance company will assign an adjuster to evaluate damages and determine coverage.

- Get Repairs: Once your claim is approved, you can proceed with repairs. Your insurance might work directly with the repair shop or reimburse you after repairs are complete.

Remember, even minor accidents can affect your insurance rates, so drive carefully and defensively, especially during your first few years on the road.

Special Considerations for Different Types of New Drivers

Not all new drivers are teenagers just getting their licenses. Let's look at some specific considerations for different types of new drivers:

1. New Teen Drivers

Parents of teen drivers face some of the highest insurance costs. Beyond the strategies mentioned above, consider setting clear rules about when and where your teen can drive. Many serious teen accidents happen at night and with passengers, so limiting these situations can help keep your teen safe and potentially qualify you for lower rates.

2. New Adult Drivers

If you're an adult getting your license for the first time, you might face high rates despite your age. However, other factors like your credit history and homeownership status might help offset the "new driver" factor. Shop around and make sure insurers are considering all relevant factors.

3. New Immigrant Drivers

If you've moved to a new country and need to get licensed there, you might be considered a new driver even if you have years of experience elsewhere. Some insurance companies will consider your driving history from your home country, so be sure to bring documentation of your driving record and previous insurance if possible.

What Common Mistakes New Drivers Make with Insurance

Avoid these common pitfalls when shopping for and using your car insurance:

- Not Shopping Around: Rates can vary dramatically between insurers, especially for new drivers. Get quotes from at least three different companies.

- Ignoring Discounts: Always ask about all available discounts. Many people miss out on savings simply because they don't know certain discounts exist.

- Lying on Your Application: It might be tempting to omit information to get a lower rate, but this can lead to denied claims or canceled policies.

- Not Adjusting Coverage as Needs Change: As you gain experience and your financial situation changes, your insurance needs will change too. Review your policy annually to make sure it still meets your needs.

The Path Forward: Building a Good Driving Record

The most effective way to lower your insurance costs over time is to build a good driving record. Each year you drive without accidents or violations, you demonstrate to insurers that you're less of a risk, which can lead to lower premiums.

Be patient with yourself as you develop your driving skills, but always prioritize safety. Avoid distractions like phone use, be extra cautious in challenging conditions like bad weather, and never drive under the influence of alcohol or drugs.

Get Affordable Coverage and Stay Safe With Mila

Being a new driver doesn't mean you're doomed to pay astronomical insurance rates forever. By understanding how insurance works, choosing the right coverage, taking advantage of discounts, and, most importantly, developing safe driving habits, you can gradually reduce your costs while staying well-protected on the road.

The open road is waiting for you! With the right insurance knowledge and safe driving practices, you're well-equipped for whatever adventures lie ahead. Happy and safe driving! Mila lets you compare real-time auto insurance quotes from trusted providers and save up to 30%. Compare now and take charge of your insurance.

Photos via Freepik