How to Negotiate Better Auto Insurance Rates with Your Agent

Many drivers pay higher premiums simply because they renew their policies without reviewing them. A short conversation with your agent can help you spot hidden savings and adjust your coverage to fit your current situation.

In this post, I’ll share the same steps I used to lower my own auto insurance costs. You’ll learn how to talk confidently, use real examples, and secure better rates while keeping the protection you truly need.

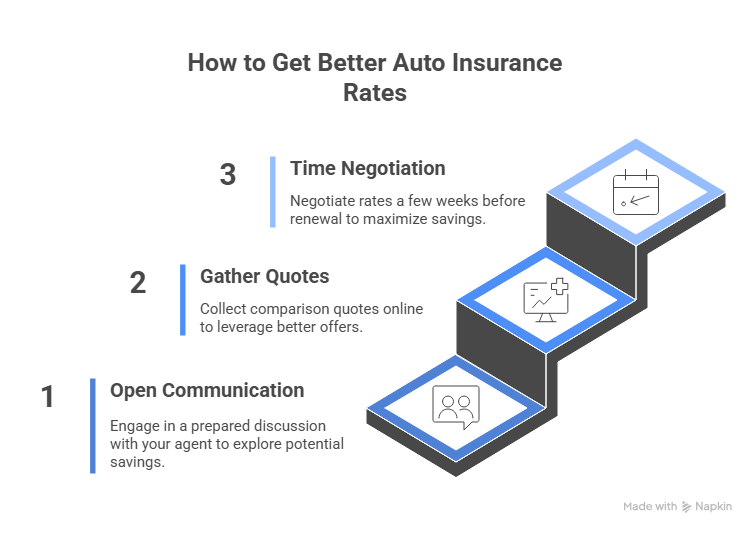

How to Get Better Auto Insurance Rates

Most people think insurance prices are fixed, but they’re not. Agents often have room to adjust rates, apply hidden discounts, or suggest coverage tweaks that can lower your bill. The goal here is to help you start that conversation with confidence and walk away paying less for the same protection.

1. Talk openly and know what to ask

Agents appreciate it when you come prepared. Begin by saying you’d like to review your policy to check for possible savings. Ask about safe-driver rewards, low-mileage programs, or loyalty perks.

2. Bring real numbers and comparison quotes

Information gives you leverage. Before calling your agent, gather a few quotes online; it takes minutes with tools like Milaquote.com. Then you can say, “I found similar coverage for less. Can we revisit my rate?” That simple question often leads to matching or even better offers.

3. Use timing and loyalty to get a better deal

Timing matters. The best moment to negotiate is a few weeks before renewal, when your insurer is more open to keeping your business. Mention your loyalty and clean record; these are solid reasons for a discount.

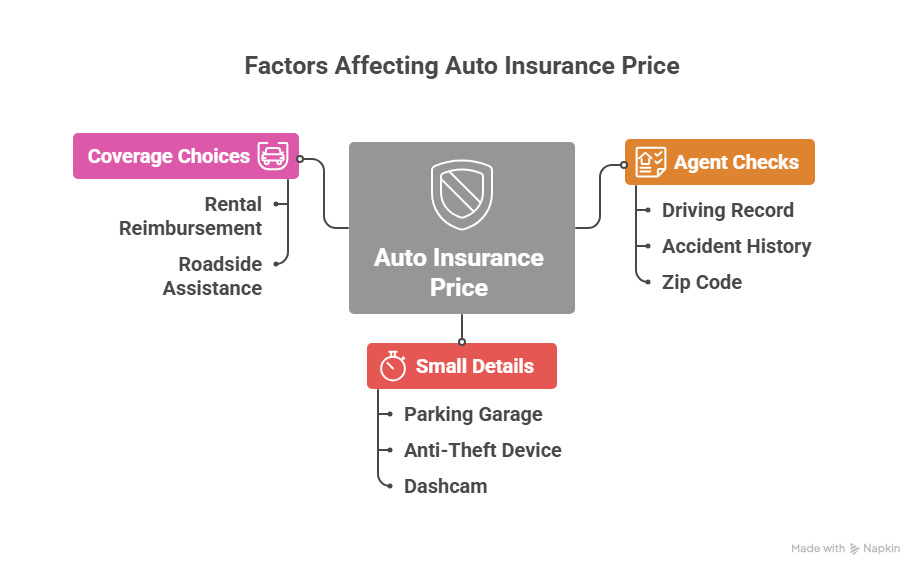

What Affects Your Auto Insurance Price

Every number on your quote tells a story about how your insurer sees your risk. Understanding these factors helps you know where there’s room to negotiate. Once you see how prices are built, it’s easier to challenge parts that don’t match your real driving habits.

1. Factors your agent checks before giving you a quote

Agents look at your driving record, accident history, and even your zip code. Clean records and low mileage usually mean better rates. If you’ve had a recent address change or improved your credit score, mention it; those details can lower your premium more than you’d expect.

2. Small details that raise or lower your rate

Even tiny factors can influence your price. For example, parking in a private garage or installing an anti-theft device can reduce your risk level. When I added a simple dashcam last year, my insurer cut a few dollars off my monthly payment, proof that little things matter.

3. How coverage choices affect your total cost

Many people pay for extras they don’t really use. Review your policy and ask your agent what each coverage does. Maybe you no longer need rental reimbursement or roadside assistance if another plan already covers it. Adjusting these details keeps your premium aligned with your actual needs.

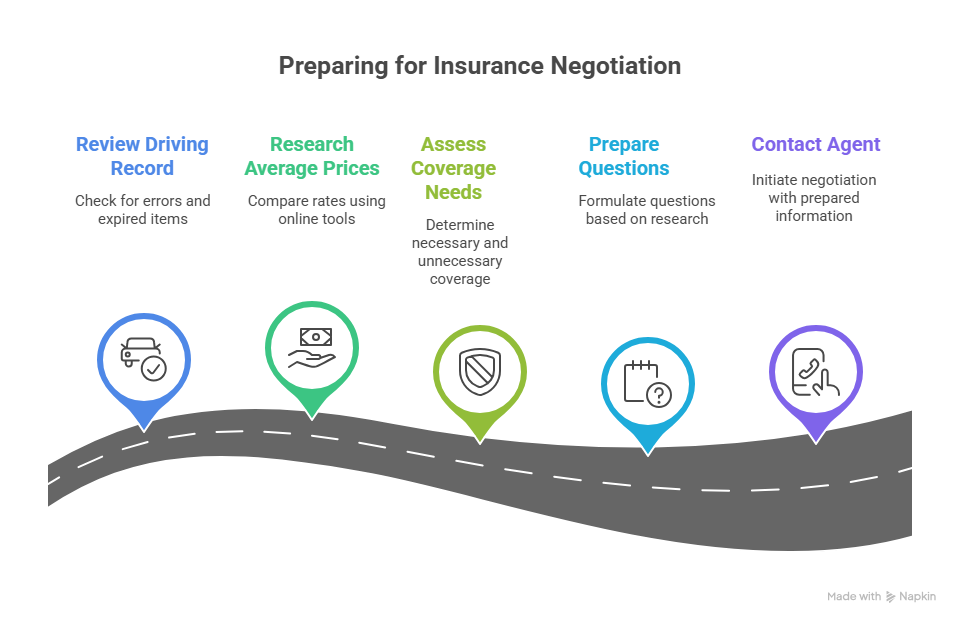

What to Have Ready Before Talking to Your Agent

A good negotiation starts long before you pick up the phone. When you show your agent that you’ve done your homework, the conversation becomes faster, clearer, and more in your favor. Here’s what you should prepare to make sure every minute of that call counts.

1. Your driving record and past claims

Ask for a copy of your driving history or check it online; mistakes sometimes appear on these reports. If a claim was closed or a ticket expired, having proof can help your agent update your file and adjust your rate.

2. Average prices for your coverage type

Before negotiating, look up average rates for drivers with a similar profile. Free quote tools like Milaquote.com let you compare in minutes. This gives you a realistic idea of what others pay, and a reference point to ask, “Why is my premium higher?” That question often opens space for review or discount.

3. Coverage you truly need

Not all coverages fit every stage of life. If your car is older, full coverage may no longer make sense. On the other hand, if you drive long distances, roadside assistance could be worth keeping. Make a list of what matters to you, so your agent can tailor a plan instead of following a template.

Mistakes That Stop You from Getting Better Auto Insurance Rates

Even the best negotiation tips won’t work if you fall into habits that keep your premium high. Most drivers don’t even realize they’re making these small mistakes — but once you spot them, they’re easy to fix.

1. Renewing without comparing

Letting your policy renew automatically might be convenient, but it often locks you into a higher price. Take a few minutes before each renewal to compare quotes online. When I compared mine last year, I discovered another insurer offering almost the same coverage for $20 less per month. My agent matched it immediately.

2. Ignoring deductible options

Your deductible has a direct impact on your premium. A higher deductible usually means a lower monthly cost, but only if you can afford that amount in case of an accident. Many people never review this part of their policy, leaving money on the table. Ask your agent to show you how different deductibles affect your rate, it’s one of the easiest adjustments to test.

2. Forgetting to update your policy after life changes

Moved to a safer neighborhood? Started working from home and driving less? Those changes can reduce your risk profile. If your insurer doesn’t know, they can’t adjust your rate. After I switched to remote work, I told my agent and got a small but steady discount for reduced mileage.

Choose Better Auto Insurance Rates With Mila

Negotiating better auto insurance rates starts with confidence and a bit of preparation. Once you take control of your policy, saving money becomes a routine part of your life.

At Mila, we make that easier for you. Get real-time quotes from top providers, compare options, and choose your best rate, all in seconds. Mila simplifies the process, delivering personalized quotes in just minutes so that you can get covered without the stress.

Compare, choose, and save with Mila. Your better rate is just minutes away.

Frequently Asked Questions (FAQs) About Getting Better Auto Insurance Rates

How often should I review my auto insurance policy?

Once a year is ideal. Rates and personal factors change, so reviewing your policy annually helps you spot new discounts and avoid overpaying for coverage you no longer need.

Does comparing quotes hurt my credit score?

No. Using trusted comparison tools like Mila to check rates is considered a soft inquiry, which doesn’t affect your credit score. You can compare as often as you want.

What’s the fastest way to get better auto insurance rates?

Compare your options through Mila. Get real-time quotes from top providers, adjust your coverage, and choose your best rate, all in a few minutes, without the stress of calling multiple companies.