How to Insure a Car That’s Not Being Driven Regularly

If you have a vehicle that stays parked most of the time, whether due to remote work, seasonal use, or mechanical issues, you might be wondering what kind of auto insurance makes sense.

Even when a car isn’t on the road, it’s still exposed to certain risks. In this post, we’ll explore how to insure a car that’s not being driven regularly, the types of coverage that apply, and how to avoid paying more than necessary.

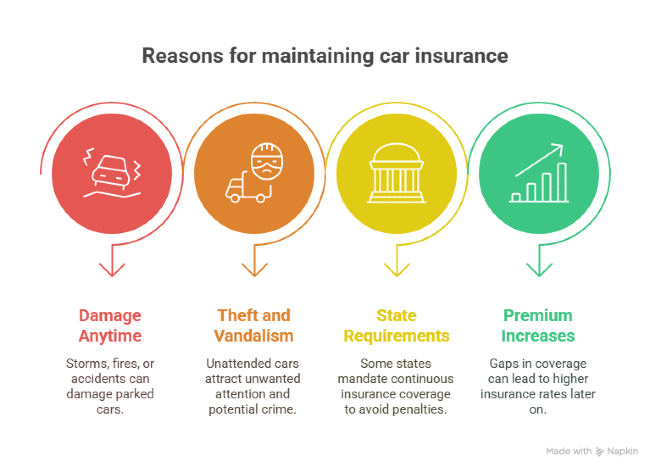

Why You Still Need Insurance for a Car That’s Not Driven Regularly

Just because your car isn’t being used regularly doesn’t mean it’s free from risk. Even if it sits parked for weeks or months, keeping some level of insurance is still important. Here’s why:

- Damage can happen anytime: Storms, fires, falling branches, or someone backing into your parked car, all are possible.

- Theft and vandalism are real risks: A car left unattended for long periods can attract unwanted attention, especially if parked outdoors.

- Some states require continuous coverage: Canceling your auto insurance might lead to fines or penalties, depending on where you live.

- Lapses in coverage can raise future premiums: Insurers often see gaps in coverage as a red flag and may charge more later.

👉 In short: Even if your car isn’t going anywhere, maintaining the right insurance can save you money and stress down the road.

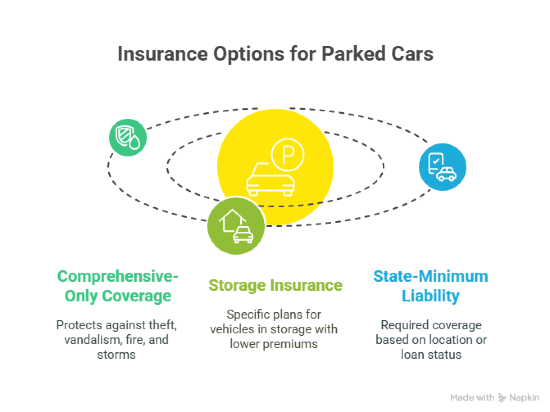

What Kind of Insurance Do You Need for a Car That’s Not Being Used Regularly?

If your car spends most of its time parked, you probably don’t need full coverage. But that doesn’t mean you should cancel your insurance entirely. Instead, you can adjust your policy to match how little the car is used. These are the most common options:

1. Comprehensive-Only Coverage

This type of insurance protects the car against things like:

- Theft

- Vandalism

- Fire

- Storms or falling objects

Since the car isn’t being driven, you don’t need collision or liability coverage. This helps lower the cost while still protecting the vehicle.

2. Storage Insurance

Some insurers offer specific plans for vehicles that aren’t being used at all. These policies usually include just comprehensive protection and come with a lower premium.

To qualify, the car must stay in storage, like a garage or private property, and not be driven during the coverage period.

3. State-Minimum Liability

Depending on where you live or if you’re still paying off the car, you might be required to keep at least the minimum liability coverage.

How to Reduce Insurance Costs When Your Car Isn’t in Use

Paying full price for a car that just sits there doesn’t make much sense. Luckily, there are a few simple ways to lower your insurance bill without leaving your car unprotected.

- Switch to a Lower Coverage Option: If you currently have full coverage, talk to your provider about switching to comprehensive-only or storage insurance. These plans offer protection against non-driving risks and usually cost much less.

- Pause Optional Add-Ons: Some extras, like roadside assistance or rental car reimbursement, might not be necessary if the car isn’t being driven. Removing these can reduce your monthly premium.

- Ask About Low-Mileage Discounts: Many insurance companies offer lower rates if you drive less than a certain number of miles per year. Be honest about your usage, and you might qualify for a better deal.

- Temporarily Remove the Car from Your Policy (If Allowed): Some insurers let you suspend coverage temporarily, especially if the vehicle is in long-term storage. This isn’t always available, but it’s worth asking.

What to Consider Before Canceling Your Insurance Completely

It might be tempting to cancel your policy altogether if your car isn’t being used. But before you take that step, it’s important to understand the possible downsides. Here’s what to keep in mind:

1. Coverage Gaps Can Affect Future Rates

If you cancel your insurance and go without coverage for a while, some insurers may see that as risky. This could lead to higher premiums when you decide to get insured again.

2. Legal or Loan Requirements

In many states, it’s illegal to own a registered car without insurance, even if it’s not being driven. And if you’re still making payments on the car, your lender likely requires continuous coverage.

3. Unprotected Risks

Without any insurance, you’re fully responsible if something happens to the car, like theft, fire, or storm damage. That could mean paying thousands out of pocket.

4. Reactivation Complex

Reinstating a canceled policy isn’t always quick or simple. Some insurers charge a fee, and you might need to reapply or provide extra documentation. Unless you’re selling the car or taking it off the road permanently, keeping at least basic coverage is usually the safer choice.

How to Reinstate or Adjust Your Insurance When You Start Driving Again

If your car has been off the road for a while and you're ready to use it again, your insurance should reflect that change. Here’s how to get back on track without complications:

1. Contact Your Insurance Provider in Advance

Don’t wait until the day you plan to drive. Reach out to your insurer ahead of time to reactivate or adjust your policy. They can help you:

- Restore full coverage

- Add liability and collision protection

- Update your mileage and usage type

2. Make Sure the Registration Is Active

In some states, lapsed insurance can lead to a suspended registration. Before hitting the road, double-check that everything is valid and up to date.

3. Ask If You Qualify for Any Adjustments

If your driving habits have changed permanently, like switching to remote work or driving fewer miles, you might be eligible for a different rate or plan.

4. Don’t Drive Without Confirmation

Always wait for official confirmation that your coverage is active again. Driving uninsured, even for a quick errand, can result in serious penalties if something happens.

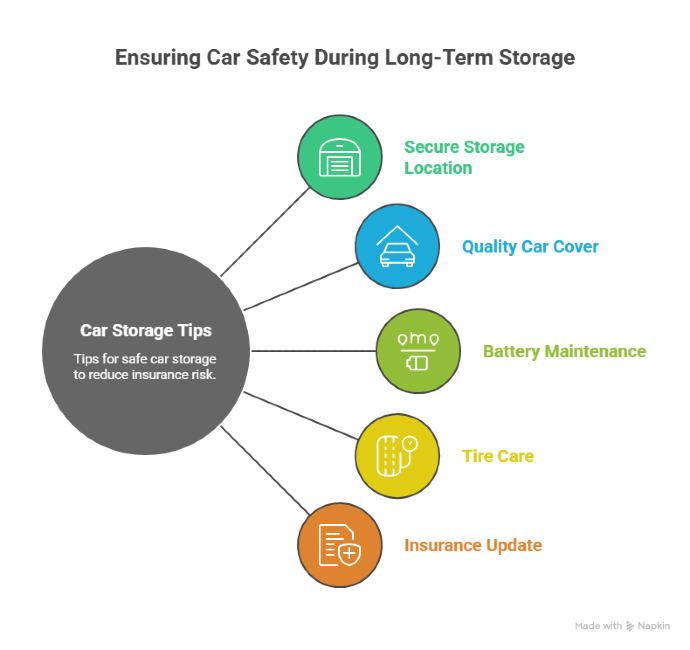

Tips for Storing a Car Long-Term to Reduce Insurance Risk

If you plan to leave your car unused for several weeks or months, proper storage can help protect it and support your insurance coverage in case something goes wrong. Here are some tips to keep your vehicle safe:

- Choose a Secure Storage Location: Whenever possible, store the car in a garage or on private property. This reduces the risk of theft, vandalism, or weather-related damage.

- Use a Quality Car Cover: If you don’t have access to a garage, invest in a waterproof, breathable car cover. It protects the paint, windows, and interior from the sun, rain, and dust.

- Keep the Battery Charged: A car that sits idle for too long can develop battery issues. You can start the engine every couple of weeks, or Use a battery maintainer to keep it in good shape

- Inflate the Tires Properly: Tires can lose pressure over time. Check inflation before storing and again before driving. In some cases, placing the car on jack stands can help avoid flat spots.

- Update Your Insurer: Let your insurance provider know the car will be in long-term storage. Some may offer discounts or suggest changes to your coverage during that time.

From Parked Cars to Occasional Use: Compare with Mila

Even if your car isn’t part of your daily routine, it still deserves the right protection. With a few adjustments, you can ensure it's smart without paying for what you don’t need. And when you're ready to get back on the road, the transition will be easier, safer, and fully covered.

If you’re not sure which insurance option fits your current situation, at MilaQuote we help you compare different policies side by side. Whether your car is parked, lightly used, or going back into regular rotation, finding the right coverage doesn’t have to be complicated.

Take a few minutes to compare, and make sure you’re not overpaying for unused protection.

Frequently Asked Questions (FAQs) About Auto Insurance for a Car That’s Not Being Driven Regularly

Can I pause my auto insurance if I’m not using the vehicle?

It depends on your insurance provider and your state. Some insurers allow you to suspend certain parts of your coverage, like liability or collision, while keeping comprehensive coverage active. Always check before making changes.

What type of insurance is best for a parked car?

Comprehensive-only coverage is usually the best option. It protects against theft, vandalism, weather damage, and more, without paying for coverage you don’t need while the car is off the road.

Will canceling my insurance affect my future rates?

Yes. A coverage gap can raise red flags for insurers and lead to higher premiums later. It’s usually better to reduce coverage than to cancel it entirely.