Need Auto Insurance Today? Here's How to Get Same-Day Coverage

Need auto insurance today? Same-day car insurance lets you get coverage fast, often within minutes. This type of policy begins on the same day you apply, offering immediate protection when you can’t afford to wait. Whether your old policy expired, you just bought a car, or you're in a rush, same-day insurance helps you stay legal and safe on the road.

In this post, you'll learn exactly how to get same-day auto insurance, when you might need it, and how to avoid common pitfalls. Let’s get started.

What Does Same-Day Auto Insurance Mean and How Does It Work?

Same-day auto insurance means your coverage begins the same day you apply. There is no waiting period. This is ideal when you need proof of insurance immediately, such as after buying a car, moving to a new state, or when your old policy lapses. Most major insurers now offer instant policies through digital applications.

This type of insurance works just like traditional auto coverage, but is issued and activated faster. Once you apply, make your payment, and receive confirmation, your policy is in effect that same day.

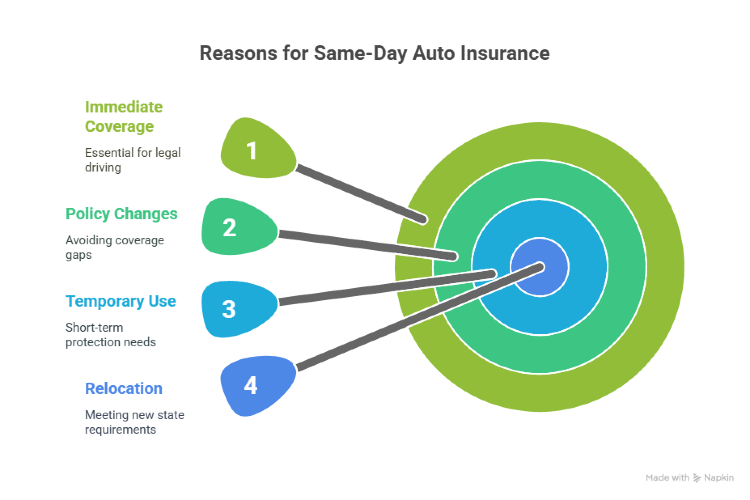

What Are the Most Common Reasons to Get Same-Day Auto Insurance?

You may need same-day auto insurance in situations where immediate coverage is necessary. These are the most common reasons:

- You just bought a car and need insurance to drive it legally.

- Your previous policy was canceled or expired.

- You are switching providers and want to avoid a coverage gap.

- You’re borrowing or renting a car and need short-term protection.

- You moved to a new state and must meet local insurance requirements right away.

Does Same-Day Auto Insurance Cost More Than Regular Policies?

Not always. Same-day auto insurance is not automatically more expensive than traditional coverage. However, some factors can influence the price:

- Limited time to compare: When you're in a rush, you might settle for the first option without shopping around.

- Fewer discounts: Some insurers offer better rates when you buy coverage in advance or bundle with other policies.

- Perceived risk: Applying at the last minute may be seen as a higher-risk behavior by some providers.

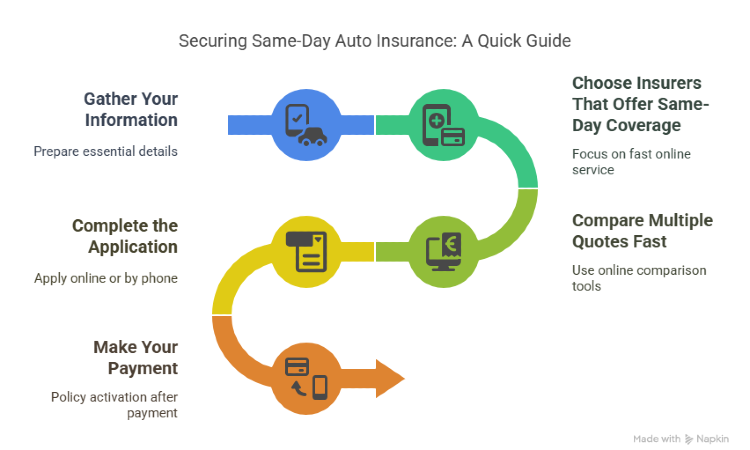

How Can You Get Same-Day Auto Insurance Quickly?

Follow these five steps to secure same-day auto insurance with minimal delays.

1. Gather Your Information

Before applying, make sure you have the following details ready:

- Driver’s license numbers for all drivers

- Vehicle Identification Number (VIN)

- Current odometer reading

- Your address and date of birth

- Payment method (credit card or bank info)

- Driving history, if available

2. Choose Insurers That Offer Same-Day Coverage

Not all providers offer instant activation. Focus on companies that specialize in fast online service. Look for:

- Strong digital platforms with real-time quote tools

- Mobile apps that let you complete the entire process

- Instant ID card generation

- 24/7 customer support or live chat

3. Compare Multiple Quotes Fast

Even when time is limited, try to compare at least three quotes:

- Use online comparison tools like Mila

- Start with your state’s minimum required coverage

- Add optional protections only if needed

- Call providers directly if you have specific questions or complex situations

4. Complete the Application

Once you've chosen a provider, apply online or by phone:

- Online forms are usually the fastest

- Phone calls are helpful if you need assistance

- Avoid in-person applications if you're short on time

5. Make Your Payment

Your policy will only become active after your first payment. Most insurers accept:

- Credit or debit cards

- Bank transfers (EFT)

- Some digital wallets, depending on the company

What Problems Can Delay Same-Day Auto Insurance and How Do You Fix Them?

Even with digital tools and fast approvals, some issues can slow down your application. Here are the most common roadblocks—and how to handle them.

1. Poor Driving Record

If you have past violations or accidents:

- Be honest when disclosing your history

- Look for insurers that specialize in high-risk drivers

- Ask if they offer accident forgiveness programs

- Consider taking a defensive driving course to improve your profile

2. No Prior Insurance

If you're a new driver or have had a lapse in coverage:

- Search for insurers with first-time driver programs

- Ask about discounts for customers with no previous policy

- Consider joining a family member’s policy temporarily

3. Verification Delays

Some insurers may need to verify your identity or vehicle details:

- Have backup documents ready, like proof of address or past insurance

- Respond quickly to any follow-up requests

- Ask if they offer temporary coverage while verification is pending

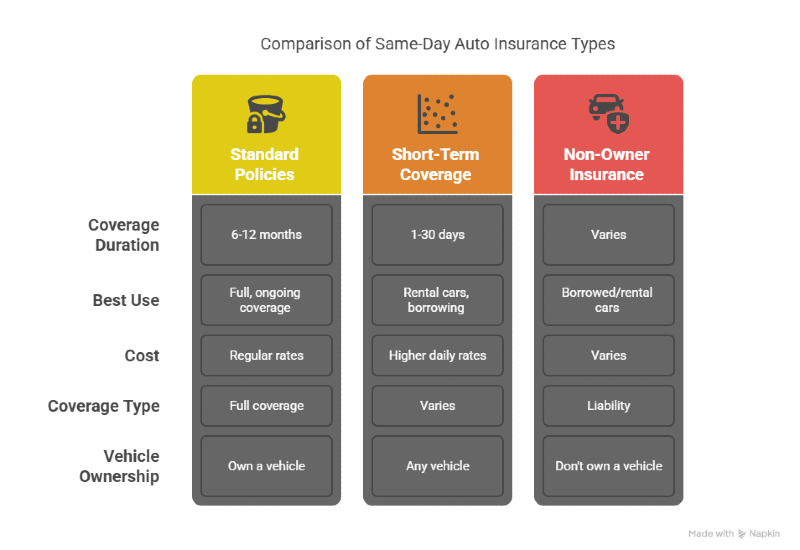

What Types of Same-Day Auto Insurance Can You Get?

Depending on your needs, there are different types of same-day auto insurance available. Here's how they compare:

1. Standard Policies With Immediate Start

These are regular 6- or 12-month auto insurance plans that begin on the same day you apply. They're ideal if you want full, ongoing coverage without delays.

2. Temporary or Short-Term Coverage

Short-term policies are designed for brief periods, typically from one to 30 days.

- Best for rental cars, borrowing a vehicle, or test-driving

- Higher daily rates, but lower total cost for short use

- Flexible and easy to cancel when no longer needed

3. Non-Owner Auto Insurance

This is for drivers who don’t own a vehicle but need coverage:

- Protects you while driving borrowed or rental cars

- Covers liability, not physical damage

- Ideal for occasional or part-time drivers

How Can You Make the Most of Your Same-Day Auto Insurance?

Once your same-day policy is active, take a few extra steps to stay protected and organized.

1. Download the Mobile App

Most insurers provide a mobile app where you can:

- Access your digital ID cards instantly

- File claims quickly if needed

- Make changes to your policy on the go

- Request roadside assistance

2. Review Your Coverage Details

Even if you needed insurance urgently, it’s important to check:

- Liability limits and deductibles

- Accuracy of driver and vehicle information

- Any exclusions or limitations in the policy

3. Plan for Renewal

Avoid another last-minute situation by:

- Setting a reminder 3–4 weeks before your policy expires

- Comparing new quotes when you have more time

- Asking about loyalty or multi-policy discounts with your current insurer

How Can You Save Money on Same-Day Auto Insurance?

Even if you need coverage quickly, there are still ways to reduce your premium without sacrificing protection.

1. Tips to Lower Your Costs

- Bundle policies: Combine auto insurance with renters' or homeowners coverage if available.

- Ask for discounts: Many insurers offer savings for students, military members, safe drivers, or members of professional organizations.

- Increase your deductible: If you can afford a higher deductible, your monthly payment will likely be lower.

- Skip unnecessary add-ons: Avoid paying extra for services like rental reimbursement or roadside assistance if you already have them through a credit card or another provider.

- Consider usage-based insurance: If you drive infrequently, a pay-per-mile policy may be more affordable.

Choose Same-Day Auto Insurance Using Mila

Same-day auto insurance solves urgent situations where you need legal coverage without delay. If you have to drive today, getting insured right away helps you stay compliant and avoid unnecessary risk.

If you're looking for a fast way to compare options and activate your policy the same day, Mila helps you explore top-rated providers in minutes. It's a quick, reliable tool when you need coverage now, and clarity in what you're choosing.

Need insurance today? Use Mila to compare quotes and get same-day coverage in just a few clicks. No delays, no guesswork, just fast, reliable options you can trust.

Frequently Asked Questions (FAQs) About Same-Day Auto Insurance

Can I get same-day auto insurance without a down payment?

Most insurers require an initial payment to activate coverage. However, some may offer low upfront costs or flexible payment plans. You can check this during the quote process to know if you can get auto insurance with no down payment.

Is same-day auto insurance available in every state?

Availability depends on your location and the provider. Most major insurers offer same-day coverage in multiple states, but it's best to verify based on your ZIP code.

Is same-day car insurance legit?

Yes. Same-day auto insurance is offered by reputable providers and works just like traditional coverage, but starts immediately after payment and approval.