How to Deduct Auto Insurance from Taxes: Complete Guide for 2025

Many people don’t realize that auto insurance can sometimes offer tax benefits, depending on how a vehicle is used. With rising expenses, it’s helpful to understand what costs might be deductible when filing your return. Personal auto insurance isn’t generally eligible, but if your vehicle serves a business purpose, things change.

In this post, you’ll learn when auto insurance qualifies as a tax deduction, how to claim it correctly, and how to avoid common pitfalls, so you’re better prepared to reduce your tax payments and stay compliant with the latest IRS rules.

The General Rule: Personal vs. Business Use

Here's the quick answer: car insurance for personal use generally isn't tax-deductible. However, if you use your vehicle for business purposes, you may be able to deduct a portion of your insurance costs.

I know that might be disappointing if you're hoping to deduct your auto insurance. But don't worry, we'll dive into all the exceptions and special cases where you might still qualify for some tax benefits.

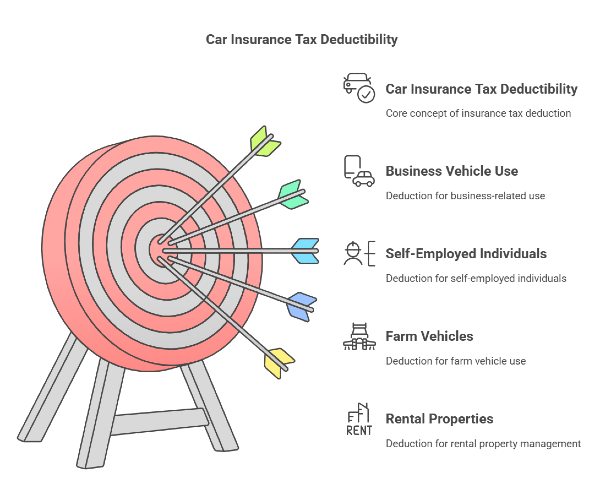

When Is Car Insurance Tax Deductible?

There are specific cases where your auto insurance qualifies as a tax deduction. Here’s when it applies:

1. Business Vehicle Use

If you use your car for business purposes, you're in luck! The IRS allows you to deduct car-related expenses, including insurance premiums, when you use your vehicle for business. This applies whether you're:

- Self-employed

- A business owner

- An independent contractor

- A gig worker (like driving for Uber or DoorDash)

However, there's an important distinction to make: you can only deduct the percentage of your insurance that corresponds to your business use of the vehicle.

- Example: If you use your car 60% for business and 40% for personal trips, you can deduct 60% of your insurance premiums. This means keeping careful records of your mileage and usage is essential.

2. Self-Employed Individuals

If you're self-employed and file Schedule C with your tax return, car insurance premiums can be a valuable deduction. You have two options for calculating your deduction:

- Actual expenses method: You track all car-related costs (insurance, gas, repairs, depreciation) and deduct the business-use percentage.

- Standard mileage rate: For 2024, this is 67 cents per business mile (check IRS updates for 2025 rates). This method is simpler but typically doesn't allow you to deduct insurance separately since it's built into the rate.

It's worth calculating both ways to see which gives you the bigger deduction. Just remember, you can't switch methods year-to-year after using the standard mileage rate in the first year.

3. Farm Vehicles

Do you operate a farm? If so, car insurance for vehicles used in your farming operation can be deductible as a business expense. This applies to trucks, tractors, and other vehicles that are primarily used for farm work rather than personal transportation.

4. Rental Properties

If you own rental properties and use your vehicle to manage them, the portion of your car insurance related to this business activity may be deductible. This includes driving to:

- Collect rent

- Show properties to potential tenants

- Check on maintenance issues

- Purchase supplies for your rental properties

As with other business uses, you'll need to track the percentage of driving dedicated to your rental activity versus personal use.

When Car Insurance Is NOT Tax Deductible

Not every car-related expense can help reduce your taxes. In many common situations, auto insurance remains a personal cost.

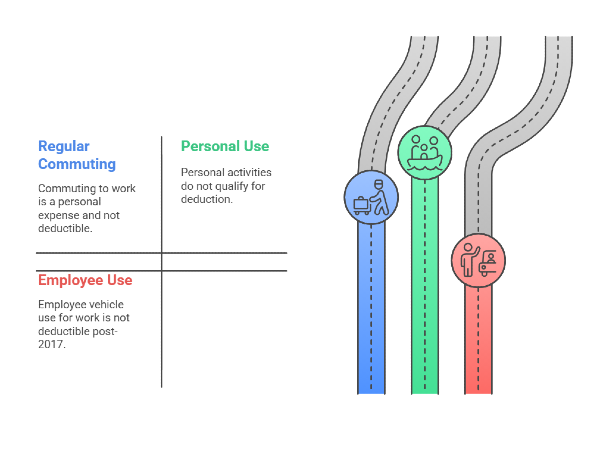

1. Regular Commuting

One common misconception is that driving to and from your regular workplace qualifies for a deduction. Unfortunately, the IRS considers your daily commute a personal expense, not a business one. This means insurance costs related to your commute aren't deductible.

2. Personal Use

If you only use your vehicle for personal activities like:

- Shopping

- Family trips

- Visiting friends

- Running errands

- Taking kids to school

Then your car insurance isn't tax deductible. These are considered personal expenses by the IRS, not business ones.

3. Employees Using Personal Vehicles

If you're an employee who uses your vehicle for work (like visiting clients or traveling between job sites), you might think you can deduct these expenses. However, the Tax Cuts and Jobs Act of 2017 eliminated employee business expense deductions for tax years 2018 through 2025.

This means that even if your employer requires you to use your car for work purposes, you generally can't deduct related expenses, including insurance. The exception would be if your employer reimburses you through an accountable plan.

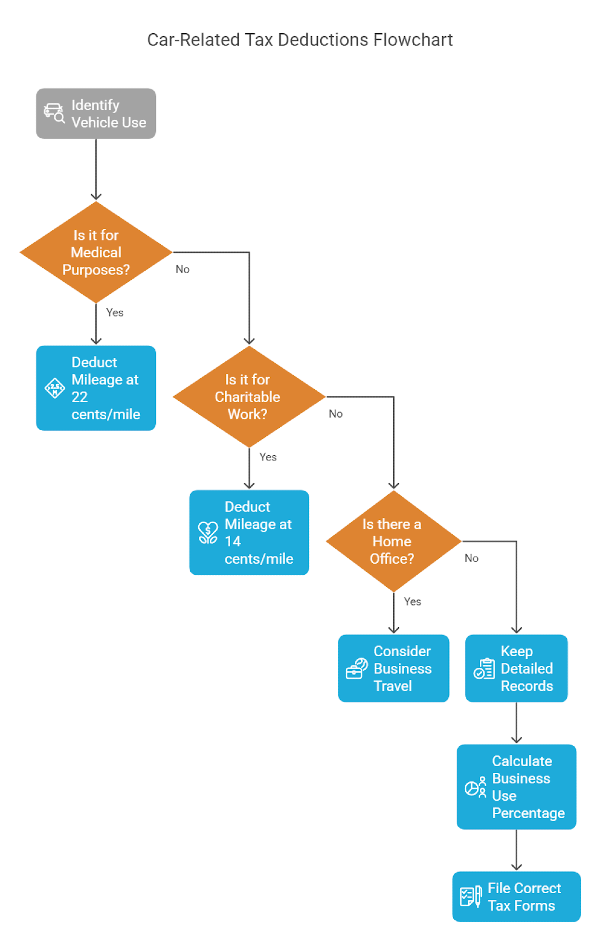

What Are Special Situations and Exceptions

While you might not deduct auto insurance directly, certain vehicle uses related to other deductible categories can offer indirect savings.

1. Medical Transportation

While not directly a car insurance deduction, if you use your vehicle to travel to and from medical appointments, you may be able to deduct the mileage as part of your medical expenses. For 2024, the medical mileage rate is 22 cents per mile.

However, total medical expenses (including this mileage) must exceed 7.5% of your adjusted gross income to qualify for a deduction, and you must itemize deductions rather than taking the standard deduction.

2. Charitable Work

Similarly, if you volunteer for a qualified charitable organization and use your car in your volunteer work, you may deduct either your actual gas and oil expenses or a standard mileage rate (14 cents per mile in 2024) for charitable driving.

Again, this isn't a direct deduction of your insurance, but it's another way your vehicle usage might provide some tax benefits.

3. Home Office Deduction

If you have a qualifying home office for your business, trips from your home office to other work locations can be considered business travel rather than commuting. This increases your business use percentage, potentially allowing you to deduct more of your car insurance.

How to Claim Car Insurance Deductions

If your auto insurance qualifies as a deduction, the next step is claiming it correctly. Here’s how to do it right:

1. Keep Detailed Records

Documentation is crucial when claiming car-related deductions. Keep records of:

- Your total mileage for the year

- Business mileage with dates, destinations, and purpose

- All car-related expenses, including insurance premiums

- Receipts and proof of payment

A mileage log app on your phone can make this much easier, or you can use a traditional mileage logbook.

2. Calculate Your Business Use Percentage

At the end of the year, divide your business miles by your total miles to find your business use percentage.

- Example: 10,000 business miles ÷ 15,000 total miles = 66.7% business use. You can then apply this percentage to your car insurance premiums and other vehicle expenses (if using the actual expense method).

2. File the Correct Forms

Within these forms, you'll need to provide information about your vehicle, how you use it, and your method for calculating deductions. Depending on your situation:

- Schedule C – If you're self-employed

- Schedule F – For farming operations

- Schedule E – For rental property activities

What Common Mistakes You Have to Avoid

Even if you're eligible to deduct part of your auto insurance, common mistakes can cost you the deduction, or worse, trigger an audit. Here are the most frequent errors to avoid:

- Deducting 100% of Insurance for a Part-Business Vehicle: Unless your vehicle is used exclusively for business (which is rare), you can't deduct 100% of your insurance premiums. Only the business-use percentage is deductible.

- Poor Record-Keeping: The IRS may ask for documentation to support your vehicle deductions. Without proper records, your deductions could be disallowed, and you might face penalties.

- Double-Dipping: If you use the standard mileage rate, you cannot also deduct actual expenses like insurance, gas, or maintenance, as these are already factored into the rate.

- Not Consulting a Tax Professional: Vehicle deductions can be complex. When in doubt, consult with a tax professional who can provide guidance specific to your situation.

Ways to Save on Car Insurance Regardless of Tax Status

Even if your car insurance isn't tax-deductible, there are other ways to reduce your costs:

- Shop around and compare quotes annually

- Bundle policies with the same insurer

- Ask about discounts for safe driving, low mileage, or security features

- Consider a higher deductible if you have adequate savings

- Maintain a good credit score

- Take defensive driving courses

Be Prepared for Your Auto Insurance Deductible with Mila

Remember that tax laws change periodically, so it's always a good idea to consult with a tax professional about your specific situation. They can help you maximize your eligible deductions while staying compliant with current tax regulations.

By understanding when and how car insurance can be deducted, you'll be better prepared to make the most of your tax return and save hundreds or even thousands of dollars.

Have you been missing out on car insurance deductions you qualify for? With Mila, you can easily compare real-time auto insurance quotes from trusted providers and save up to 30%. Start comparing now and take control of your coverage.