How to Add a Car to Your Auto Insurance Policy

Adding a car to your auto insurance policy is a necessary step to protect your finances and stay compliant with the law. If you recently bought a vehicle or received one as a gift, ensuring it is properly insured helps you avoid legal troubles and unexpected costs.

In this post, we’ll guide you through the right process, explain when you should add a car, and share tips to make smart decisions about your coverage.

Why You Need to Add Your Car Properly

Ensuring your new car is properly listed on your auto insurance policy is highly recommended. Here's why it matters:

1. Legal Compliance

Driving without insurance can lead to:

- Fines

- License suspension

- Legal problems

2. Financial Protection

Proper insurance coverage protects you from:

- Expensive repair costs

- Medical expenses

- Lawsuits after accidents

3. Limited Grace Periods

Some insurance companies offer a short grace period after you buy a car, but:

- It is not guaranteed

- Conditions might limit your coverage

- Claims can be denied if the car is not officially listed

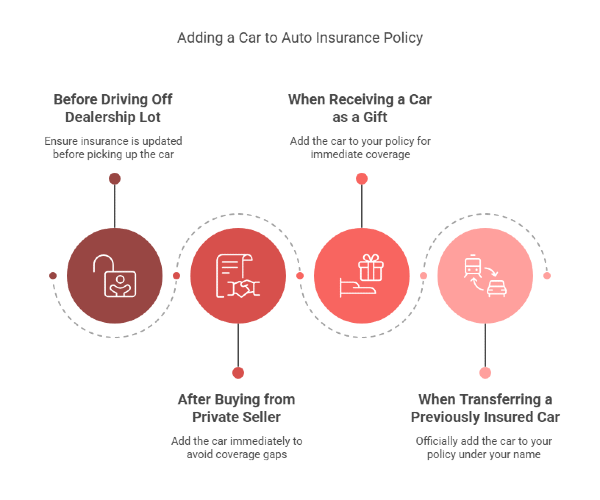

When to Add a Car to Your Auto Insurance Policy

Timing is important when adding a vehicle to your auto insurance. To stay protected and compliant, you should add your car in these situations:

- Before driving off the dealership lot: Most dealerships require proof of insurance before letting you take the car home. Make sure your policy is updated before picking up your new vehicle.

- After buying from a private seller: If you purchase a car from a private party, your existing policy might offer temporary coverage. Still, adding the vehicle immediately is safer to avoid gaps.

- When Receiving a Car as a Gift: Even if you are not paying for the car, insurance responsibilities are still yours. Adding the gifted car to your policy ensures it is covered right away.

- When Transferring a Previously Insured Car: If a car was insured under someone else’s name, you must officially add it to your policy when it becomes yours. These guarantee full coverage under your name and terms.

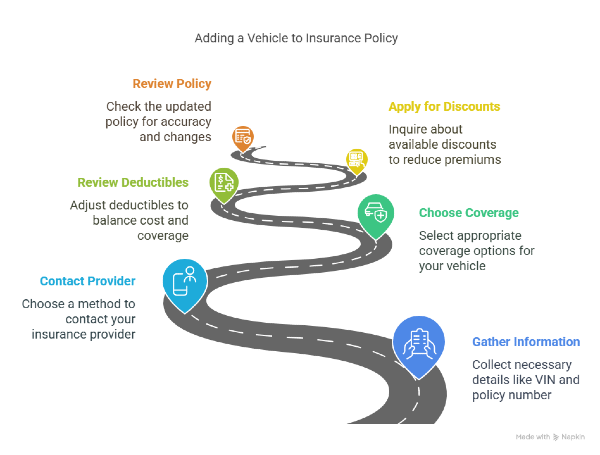

Step-by-Step Process for Adding a Vehicle

Updating your auto insurance policy to include a new car is easy when you follow these clear steps:

Step 1: Gather Your Information

Before contacting your insurance provider, collect these details. Having this information ready will make the process much smoother when you speak with your insurance representative:

- Your policy number

- The vehicle identification number (VIN)

- Make, model, and year of the car

- Approximate annual mileage you expect to drive

- Primary driver information

- Lien holder details (if you're financing or leasing)

- Date you acquired or plan to acquire the vehicle

Step 2: Contact Your Insurance Provider

You have several options for adding your car:

- Call your insurance agent directly

- Use your insurance company's mobile app

- Log in to your online account portal

- Visit a local office in person

Step 3: Choose Your Coverage Options

This is where you'll need to make some important decisions about what types of coverage you want to protect your new vehicle. Standard coverage options include:

- Liability coverage (required in most states)

- Comprehensive coverage (for non-collision damage like theft, weather events)

- Collision coverage (for accidents regardless of fault)

- Uninsured/underinsured motorist protection

- Medical payments or personal injury protection

- Gap insurance (especially important for new, financed vehicles)

Step 4: Review and Adjust Your Deductibles

Your deductible is what you'll pay out-of-pocket before insurance kicks in after a claim. Choose a deductible that you could comfortably afford to pay if you needed to file a claim unexpectedly. Consider how different deductible amounts will affect your premiums:

- Higher deductibles = lower monthly premiums

- Lower deductibles = higher monthly premiums

Step 5: Apply for Discounts

Many people forget to inquire about discounts and end up paying more than necessary. A simple question could save you hundreds annually. Ask about these common discounts when adding your car:

- Multi-vehicle discount

- Safety feature discounts (for anti-theft devices, advanced safety systems)

- Good driver discount

- Bundling with home or renters' insurance

- Payment method discounts (automatic payments, paying in full)

Step 6: Review the Updated Policy Details

Once you've provided all information and selected your coverage, carefully review the updated policy. Pay particular attention to:

- Coverage limits

- Listed drivers

- Premium changes

- Policy effective dates

- Any exclusions or limitations

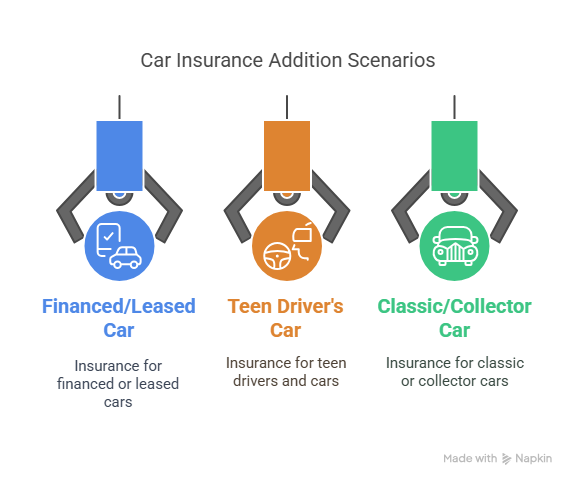

Special Cases When Adding a Car to Your Auto Insurance

Depending on your situation, adding a car to your auto insurance policy might involve extra steps. Here are key scenarios to keep in mind:

1. Adding a Financed or Leased Vehicle

When you're financing or leasing, you'll typically need to meet specific insurance requirements from your lender:

- Full coverage (comprehensive and collision)

- Lower deductibles (often $500 or less)

- The lender is listed as a loss payee or additional interested party

Your lender might request proof of insurance, so be prepared to provide this documentation promptly.

2. Adding a Teen Driver with a New Car

Adding both a young driver and their vehicle requires special consideration:

- Insurance costs typically increase significantly

- Some companies offer good student discounts

- Driver training discounts might be available

- Consider whether the teen needs their policy or should join yours

3. Adding a Classic or Collector Car

Specialty vehicles often require specialized coverage:

- Agreed value policies (rather than actual cash value)

- Usage restrictions (limited mileage)

- Special storage requirements

- Documentation of the vehicle's condition and value

Standard policies might not adequately cover collectible vehicles, so discuss specialized options with your insurer.

How Adding a Car Affects Your Premium

Adding a vehicle to your auto insurance policy almost always changes your premium. Several factors influence whether your payment will increase or decrease:

1. Factors That Can Raise Your Premium

- The car’s make, model, and year

- A high replacement or repair cost

- Lack of safety features

- A higher risk of theft based on the car’s brand or type

2. Factors That Can Lower Your Premium

- Good crash-test ratings

- Built-in safety technology like anti-lock brakes and airbags

- Anti-theft systems

- A history of safe driving

3. Other Elements Insurers Consider

- Where you live and where the car is parked

- How much you plan to drive annually

- Your driving history and credit score (in many states)

Best Temporary Auto Insurance Options for New Cars

Sometimes, you do not need long-term auto insurance coverage for a vehicle. If you only need protection for a short period, consider these options:

- Temporary addition to an existing policy: If you already have a policy, some insurers allow you to add a vehicle temporarily. This option is ideal if you plan to use the car for only a few weeks or months.

- Purchasing a short-term policy: Some companies offer short-term policies, usually lasting between 30 to 90 days. However, short-term insurance can be more expensive than standard six-month policies.

- Getting a non-owner policy: If you are borrowing a car but do not own one, a non-owner car insurance policy provides liability coverage. This is a smart solution if you regularly drive cars you do not own.

Short-term policies are not available in every state. Always check with your insurance provider to confirm availability and requirements before making a decision.

What Mistakes Should You Avoid When Adding a Car to Your Auto Insurance?

When updating your auto insurance policy, avoid these common mistakes that can cost you time and money:

- Delaying the update: Waiting too long after buying the car can leave you without coverage. Always add the vehicle to your policy as soon as possible.

- Relying on the dealership: Dealerships do not handle your insurance. It is your responsibility to contact your insurer and update your policy.

- Choosing minimal coverage: Selecting only the minimum required insurance can expose you to major financial risks after an accident.

- Forgetting to remove old cars: Leaving a sold or traded car on your policy can increase your premium unnecessarily. Make sure to remove vehicles you no longer own.

- Overlooking discounts: Not asking about available discounts means you could pay much more than needed for your updated car insurance.

Find the Best Auto Insurance Coverage with Mila

Keeping your vehicle properly covered under your auto insurance policy protects your finances and keeps you legally compliant. Acting quickly and making informed choices ensures you stay protected from day one.

If you want personalized and complete coverage, Mila connects you with top-rated auto insurance providers nationwide. You can easily compare quotes from multiple trusted insurers in one place and find the protection that fits your needs and budget.

Get the protection you need at the price you deserve for your new car. Start with Mila today and easily compare auto insurance options from top-rated providers.

Frequently Asked Questions (FAQ) About Adding a Car to Your Insurance Policy

Do I need to add a car to my policy if I’m just borrowing it?

If you’re borrowing a car temporarily, the owner’s insurance usually covers it. But if you’re using it regularly, you’ll need to add it to your policy.

Can I add a car to my policy at any time?

Yes, you can update your policy at any moment. Keep in mind that adding a new car might change your premium.

What happens if I drive without adding my new car to my insurance?

Driving without listing your car can result in denied claims, fines, or license suspension. Always update your car insurance before you start using the vehicle regularly.