How to Choose the Best Auto Insurance for Gig Workers

Gig driving offers freedom and flexibility, but it also comes with unique risks. Many drivers assume their personal auto policy is enough, only to find out too late that it isn’t. Whether you’re transporting passengers or delivering food, the right auto insurance for gig workers can keep you protected at every stage.

In this post, you’ll learn how coverage works, what gaps to watch out for, and tips to choose a policy that fits your needs.

What Is Auto Insurance for Gig Workers?

Auto insurance for gig workers is specialized coverage designed for people who drive passengers (rideshare) or deliver goods (delivery apps) for money.

Unlike personal car insurance, which assumes your car is used only for personal errands and commuting, gig worker insurance recognizes that:

- You’re driving more hours and miles than average.

- You’re carrying passengers or deliveries.

- You face higher risks of accidents or claims.

To close the gap, many insurers now offer rideshare insurance or delivery driver insurance. These policies ensure you’re protected during every stage of your work, whether you’re waiting for a ride request, picking up a passenger, or delivering food.

Why Personal Auto Insurance Isn’t Enough

Most gig workers assume their personal policy has them covered. Unfortunately, that’s not the case. Here’s why:

- Exclusions for commercial use: Personal policies almost always exclude coverage when you’re using your car for business.

- Denial of claims: If you get into an accident while driving for Uber or DoorDash, your insurer may refuse to pay.

- Risk of cancellation: Worse, your insurance company could cancel your policy entirely if they find out you’re working without disclosure.

How Insurance Coverage Works in Each Driving Stage

When it comes to gig driving, insurance coverage depends on which “period” you’re in. Each stage of your work determines whether you’re protected by your personal auto policy, the app’s limited coverage, or a rideshare/delivery policy.

Period 0: Personal Use Only

- You’re not logged into any app.

- Your personal auto insurance applies here.

Period 1: Waiting for a Request

- You’re logged into Uber, Lyft, or DoorDash but haven’t accepted a ride or delivery yet.

- Coverage from the app is very limited, usually just basic liability.

- This is one of the biggest coverage gaps for gig drivers.

Period 2: En Route to Pick Up

- You’ve accepted a request and are on your way to pick up a passenger or food.

- The app’s liability coverage kicks in, but protection for your own car may not be included.

Period 3: Passenger or Delivery in a Car

- You’re actively transporting a rider or order.

- The app provides the strongest coverage during this stage (typically $1M liability).

- However, deductibles can be high, and damage to your own car may still require extra coverage.

💡 Key takeaway: The biggest coverage gaps happen in Period 1 and Period 2, which is why having dedicated auto insurance for gig workers is so important.

What Coverage Options Do Gig Workers Have?

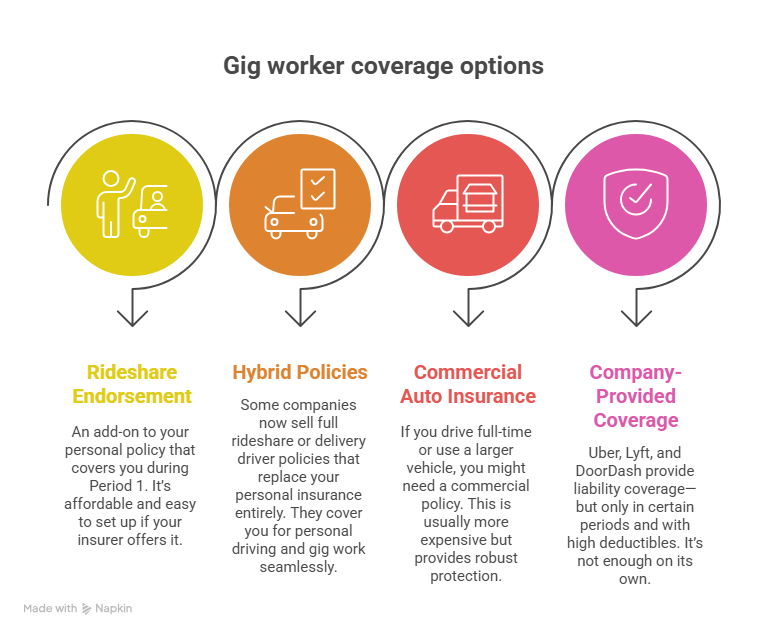

Depending on your state and insurance company, you’ll usually see these options:

1. Rideshare Endorsement

This is an add-on to your personal policy that covers you during Period 1. It’s affordable and easy to set up if your insurer offers it.

2. Hybrid Policies

Some companies now sell full rideshare or delivery driver policies that replace your personal insurance entirely. They cover you for personal driving and gig work seamlessly.

3. Commercial Auto Insurance

If you drive full-time or use a larger vehicle, you might need a commercial policy. This is usually more expensive but provides robust protection.

4. Company-Provided Coverage (Limited)

Uber, Lyft, and DoorDash provide liability coverage—but only in certain periods and with high deductibles. It’s not enough on its own.

Comparing Coverage from Uber, Lyft, and DoorDash

Here’s a simplified breakdown of what the apps offer (U.S. example):

💡Key takeaway: These coverages protect others (liability), but not necessarily your vehicle. That’s where your own gig insurance comes in.

How Much Does Auto Insurance for Gig Workers Cost?

Costs vary depending on your driving history, location, and the insurer you choose. On average:

- Rideshare endorsements: $15–$30 extra per month.

- Hybrid policies: $100–$250 extra per month.

- Commercial policies: $300+ per month.

It may feel like an added expense, but compare that to the thousands of dollars an uncovered accident could cost, and it’s clear why the investment matters.

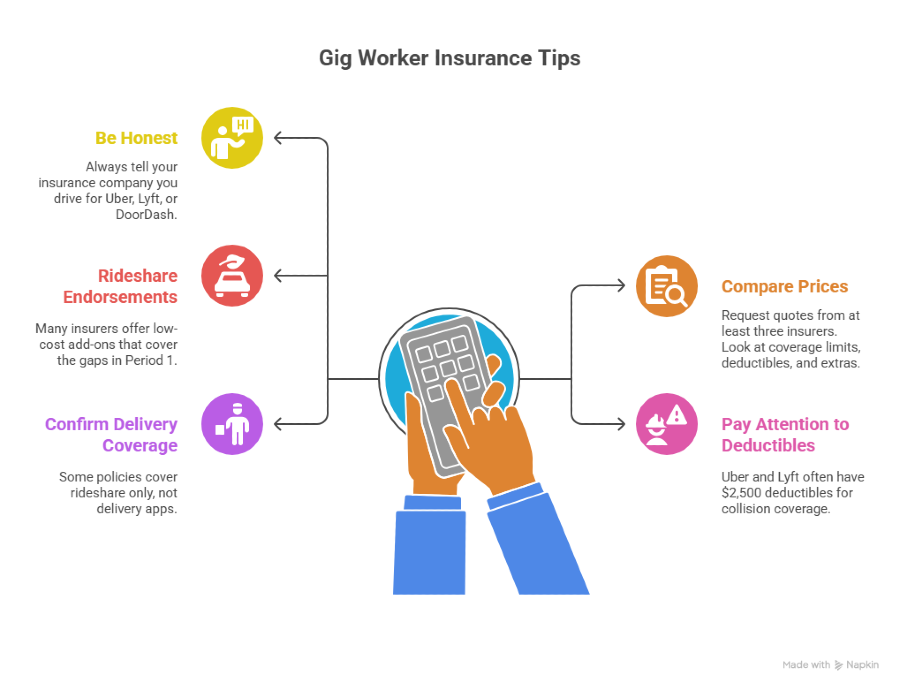

Tips for Choosing the Right Gig Worker Policy

Finding the right auto insurance for gig workers isn’t just about price; it’s about making sure you’re fully covered at every stage of your work. Here are key things to look for:

1. Be Honest with Your Insurer

- Always tell your insurance company you drive for Uber, Lyft, or DoorDash.

- If you hide it, your policy could be canceled or claims denied.

2. Compare More Than Just Price

- Request quotes from at least three insurers.

- Look at coverage limits, deductibles, and extras, not just the monthly premium.

3. Ask About Rideshare or Delivery Endorsements

- Many insurers offer low-cost add-ons that cover the gaps in Period 1.

- This is usually cheaper than buying a full commercial policy.

4. Pay Attention to Deductibles

- Uber and Lyft often have $2,500 deductibles for collision coverage.

- A hybrid or extended policy can lower that amount and save you thousands after an accident.

5. Confirm Delivery Coverage

- Some policies cover rideshare only, not delivery apps.

- If you drive for both Uber and DoorDash, make sure your policy clearly states coverage for both passenger and food delivery work.

💡 Pro tip: Keep a copy of your insurance policy in your car or app dashboard. If an accident happens, you’ll know exactly what’s covered, no surprises.

Common Mistakes Gig Workers Make with Insurance

Even experienced gig drivers sometimes overlook important details about insurance. These are the most common mistakes, and how to avoid them:

1. Relying Only on Uber, Lyft, or DoorDash Coverage

- The coverage provided by the apps is limited and conditional.

- For example, liability may apply while driving a passenger, but damage to your own car often isn’t included.

- Without extra protection, a single accident could cost you thousands.

2. Not Telling Their Insurer

- Some drivers think it’s safer to “keep quiet” about their gig work.

- In reality, hiding it can lead to denied claims or even cancellation of your policy if the insurer finds out.

3. Skipping Comprehensive and Collision Coverage

- Liability insurance only pays for damage to other people and their property.

- If your own car is damaged in an accident, fire, theft, or even hail, you’ll be left paying out of pocket unless you add comprehensive and collision coverage.

4. Assuming All States Have the Same Rules

- Insurance laws vary by state. For example, some require higher liability limits, while others may not mandate rideshare endorsements.

- Always check your state-specific requirements before choosing a policy.

5. Ignoring Deductibles and Fine Print

- Even when coverage exists, deductibles can be very high—Uber and Lyft often set theirs at $2,500.

- Many drivers only realize this after an accident, when it’s too late to adjust their policy.

Stay Covered, Stay Confident Behind the Wheel with Mila

As a gig worker, your car isn’t just transportation, it’s your income. Without proper insurance, one accident could erase weeks of earnings. Choosing the right policy, whether a rideshare endorsement, hybrid plan, or commercial coverage, ensures you stay protected on and off the app.

That’s why drivers trust Mila. With fast and free quotes, affordable rates, and full protection, including Collision, Liability, and Injury, Mila makes finding auto insurance for gig workers simple and stress-free. Don’t settle for gaps in coverage; compare today and keep your business moving with confidence.

👉 Get your free quote with Mila today and start saving on auto insurance for gig workers.

Frequently Asked Questions (FAQs) About Auto Insurance for Gig Workers

Do gig workers really need special auto insurance?

Yes. Standard personal policies usually exclude business use. If you drive for Uber, Lyft, or DoorDash, you need auto insurance for gig workers to avoid denied claims or canceled policies.

What happens if I only rely on Uber or Lyft’s insurance?

App-provided coverage is limited. It may protect passengers and third parties, but it often leaves gaps for your own vehicle repairs and has high deductibles.

Can I switch insurers if my current provider doesn’t offer rideshare coverage?

Absolutely. Many drivers move to insurers that specialize in gig worker insurance. Platforms like Mila make it easy to compare rates quickly.