How to Choose Auto Insurance if You Share Your Car

Sharing a car with someone, whether it’s your partner, a roommate, or even a close friend, can be convenient and cost-effective. But when it comes to auto insurance, things can get a little tricky. Who’s responsible for what? Do both drivers need to be on the policy? And how do you make sure you’re covered if one of you has an accident?

Choosing the right auto insurance if you share your car isn’t just about finding the lowest premium; it’s about protecting both the people and the vehicle involved. In this post, you’ll learn how to select the right coverage, understand who should be included on the policy, and avoid common mistakes that could cost you later.

Why Sharing a Car Affects Your Insurance Coverage

When only one person drives a car, auto insurance is pretty straightforward. You insure yourself as the main driver and the car you use. But when two or more people regularly use the same vehicle, insurance companies want to know. Why? Because each driver adds a different level of risk.

If your roommate, spouse, or partner borrows your car frequently, your insurer expects them to be listed on your policy. Otherwise, you could face problems if they get into an accident, even if you gave them permission to drive.

What Are the Risks of Not Listing All Drivers

It might be tempting to “keep things simple” and only list one person on the policy. But that can backfire fast. If someone who isn’t on your policy has an accident while driving your car:

- Your insurer may deny coverage.

- You might have to pay for repairs and damages out of pocket.

- It could even be considered insurance fraud if you intentionally left the person off to save money.

That’s why it’s always better to be upfront. Most insurers allow multiple drivers on one policy, and sometimes, adding them doesn’t increase your premium much at all.

Who Should Be Listed on the Policy

As a rule of thumb:

- All regular drivers of the shared car should be listed on the policy.

- Household members (people living with you) should be disclosed, even if they don’t drive the car often.

- Occasional drivers, like a friend visiting for the weekend, don’t always need to be added, as long as you give them permission. But if they drive frequently, they should be listed.

💡 Tip: Most insurers define a “regular driver” as anyone who drives the car more than 10–12 times per month.

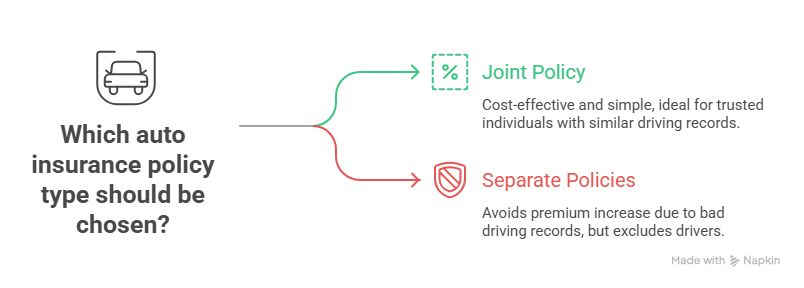

Deciding Between Joint or Individual Policies

If you share the same address, for example, with your spouse or roommates, you have two main options:

Option 1: A Joint Policy

A joint auto insurance policy covers multiple drivers and their vehicles under one plan. It’s often cheaper and simpler because:

- Everyone shares one premium.

- You can qualify for multi-driver or multi-car discounts.

- It avoids confusion about who’s covered.

This works best if:

- You trust each other completely.

- You have similar driving records.

- You agree on how to split costs.

Option 2: Separate Policies

Sometimes, it’s smarter to keep things separate, especially if one of you has a bad driving record or a history of claims. In that case:

- Their risk could raise the premium for everyone.

- You can exclude them from your policy, with their consent, to keep your rate lower.

However, excluding someone means they’re not covered at all when driving your car. So make sure everyone understands the risks.

Understanding the Main vs. Secondary Driver

When sharing a car, insurance companies will ask who the primary driver is, that is, the person who uses the car most often. The others are considered secondary or occasional drivers.

Why it matters:

- The primary driver’s driving record and habits influence the premium the most.

- Secondary drivers are still covered, but their risk profile affects the overall cost too.

Example

If your partner commutes daily using the shared car while you only use it on weekends, they should be listed as the main driver. Being honest here prevents claim denials later.

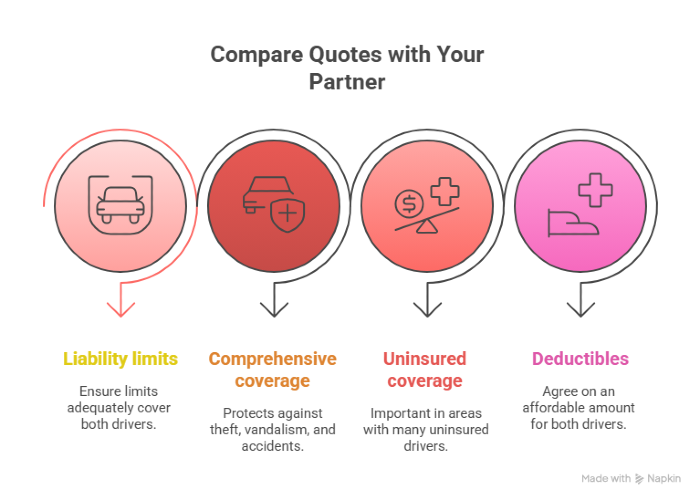

Compare Quotes Together

When choosing auto insurance if you share your car, don’t rush into the first policy that sounds good. Sit down together and compare quotes.

Here’s what to look at:

- Liability limits: Make sure they’re high enough to cover both drivers.

- Comprehensive and collision coverage: Protects against theft, vandalism, and accidents, no matter who’s driving.

- Uninsured motorist coverage: Important if you live in an area where many drivers don’t have insurance.

- Deductibles: Agree on an amount both of you can afford if there’s a claim.

👉 Use comparison sites such as Mila that allow you to input multiple drivers. This gives you a realistic estimate for shared-car insurance rates.

What You Need to Know About Payment and Responsibility

Money can get awkward between partners or housemates, especially when it involves a shared car. So, discuss early on:

- Who pays the insurance premium.

- How you’ll handle repairs, fuel, or tickets.

- What happens if one person damages the car.

Creating a simple written agreement or shared budget can help prevent future conflicts. Think of it like setting “house rules” for your car.

What Kind of Discounts Apply to Both Drivers

Insurers offer various discounts that might make a joint policy more affordable. When comparing, check if you can qualify for:

- Multi-driver or multi-car discounts.

- Good driver discounts if both have clean records.

- Bundling discounts if you combine car + renter’s or home insurance.

- Usage-based or telematics discounts if you both drive safely

You can even install an app or a small tracking device that monitors your driving habits and rewards safe behavior with lower premiums.

Review and Update Your Policy Regularly

Life changes, and your insurance should too.

You should update your policy if:

- Someone moves out or stops using the car.

- You buy a new vehicle.

- You change addresses or get married.

- A new person starts driving the car regularly.

Set a reminder to review your policy every six months to make sure it still fits your situation.

How to Handle an Accident When You Share a Car

Accidents happen, even when you’re careful. If your shared car is involved in one:

- Stay calm and check that everyone is safe.

- Collect details: photos, license numbers, insurance info, and witness contacts.

- Report the accident to your insurer, no matter who was driving.

- Be honest about who was behind the wheel. Lying could void your coverage.

If both of you are listed on the policy, the claim process will be smoother, and both of your records will reflect the incident properly.

Common Mistakes to Avoid

Here are a few pitfalls to watch for when choosing auto insurance if you share your car:

❌ Forgetting to list all drivers

❌ Assuming occasional drivers are automatically covered

❌ Choosing the cheapest policy without checking coverage

❌ Ignoring differences in driving records

❌ Not updating the policy after life changes

Example: How Shared Car Insurance Works in Real Life

Let’s say you and your partner share one car. You drive mostly on weekends, and your partner drives daily to work.

You’d list your partner as the primary driver, yourself as the secondary driver, and you’d both be named on the insurance. If your roommate occasionally borrows the car to go grocery shopping, they might not need to be on the policy — but if it becomes frequent, it’s safer to add them.

When comparing quotes, you find that a joint policy gives you a 10% discount, and since both of you have clean records, your premium is lower than expected. You also add roadside assistance because you travel often.

That’s the kind of thoughtful setup that saves money and avoids headaches later.

Protect What You Share with Mila

Sharing a car means sharing responsibility, and that includes choosing the right coverage. The best policy is one that keeps everyone protected and fits your shared lifestyle.

At Mila, you can easily compare quotes from top-rated auto insurance providers nationwide to find the perfect balance between coverage and cost. Enjoy peace of mind knowing you’re protected, no matter who’s behind the wheel.

Protect what you share. Get your free quote with Mila today.

Frequently Asked Questions (FAQs) About Auto Insurance if You Share Your Car

Do both drivers need to be on the same auto insurance policy if we share a car?

Yes. If two or more people regularly drive the same vehicle, all of them should be listed on the policy. This ensures everyone is properly covered in case of an accident and prevents claim denials.

Can I share my car with my partner without changing my insurance?

If your partner drives your car occasionally, they may be covered under your existing policy as a permissive driver. But if they use it frequently, it’s best to add them to your policy to avoid coverage issues.

Will my premium increase if I add another driver?

It depends on their driving history. If your partner or housemate has a clean record, the increase might be small or even negligible. But if they have accidents or violations, your rate could rise.