How a Car Accident Impacts Your Auto Insurance

A car accident can turn your life upside down, and your auto insurance rates, too. Whether it’s a minor bump or a more serious collision, it’s natural to wonder how much your premium will go up. Understanding what influences these increases can help you prepare and even minimize the impact.

In this post, you'll find everything you need to know about how accidents affect your insurance, what to expect, and smart strategies to keep your coverage affordable.

How an Accident Affects Your Auto Insurance Costs

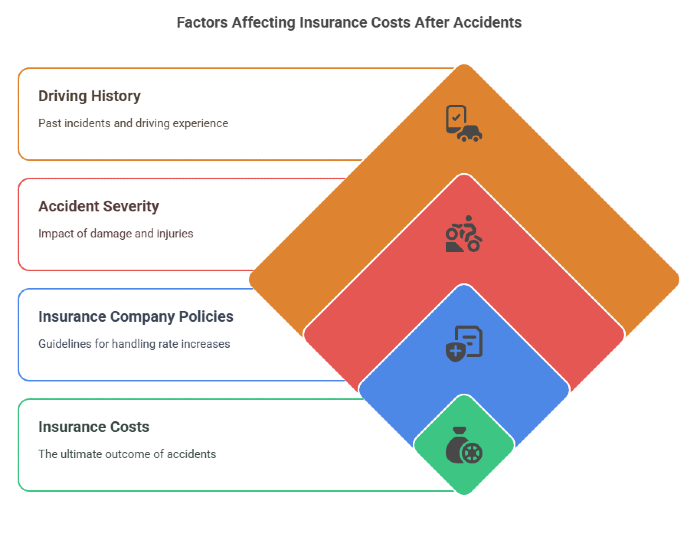

Getting into a car accident can impact your auto insurance in several ways. However, the amount your premium increases depends on specific factors.

Key elements insurers consider

These factors help you anticipate changes and manage your coverage costs more effectively

1. Fault vs. No-Fault

Was the accident your fault? This is perhaps the most significant factor. If you were responsible for the accident, you'll generally see a much higher rate increase than if you weren't at fault.

If the other driver was clearly at fault and their insurance covered the damages, you might not see an increase at all. But don't celebrate just yet, even no-fault accidents sometimes lead to premium hikes, especially if you've had multiple claims.

2. Your Driving History

Your past driving record plays a huge role in determining how severely your rates will increase. Insurance companies look at:

- How many years have you been driving?

- Previous accidents or claims

- Traffic violations and tickets

- How recently have these incidents occurred

If you've had a spotless record for years, your insurance company might be more forgiving about one mistake. But if you've had multiple incidents in a short time, they'll see you as a higher risk.

3. The Severity of the Accident

Not all accidents are created equal in the eyes of insurance companies. A minor scratch might barely affect your rates, while a major collision with significant damage or injuries could cause a substantial increase.

The total claim amount matters a lot here. The more money your insurance company has to pay out, the more your premiums will likely increase.

4. Your Insurance Company's Policies

Every insurance provider has different policies for handling rate increases after accidents. Some companies offer accident forgiveness for your first incident, while others have strict policies about raising rates after any claim.

This is why it's worth shopping around for insurance, different companies might treat the same accident very differently when it comes to premium increases.

How Average Insurance Rate Increases After an Accident

While everyone's situation is unique, we can look at some averages to get a general idea of what to expect. Typically, you might see your insurance premiums increase anywhere from 20% to 50% after an accident where you were at fault.

1. Minor At-Fault Accident (Less than $2,000 in damage)

- Average increase: 20-30%

- Example: $1,200 annual premium could become $1,440-$1,560

2. Major At-Fault Accident (More than $2,000 in damage)

- Average increase: 30-50%

- Example: $1,200 annual premium could become $1,560-$1,800

3. DUI or Reckless Driving Accident

- Average increase: 80-100% (or more)

- Example: $1,200 annual premium could become $2,160-$2,400

How Long Will Higher Rates Last?

Higher auto insurance premiums after a car accident are not permanent, but they will remain around for a while.

What to expect:

- Most insurers consider an accident part of your driving record for three to five years.

- During this time, your premium reflects the increased risk based on the accident.

- Each year without new claims or violations can slowly reduce the impact on your rates.

Some companies gradually decrease the penalty after the first year of clean driving. Others may offer loyalty discounts that help offset the higher premium over time. Maintaining a clean record and practicing safe driving habits are key to returning to more affordable coverage as quickly as possible.

Ways to Reduce Insurance Costs After an Accident

Facing higher auto insurance premiums after a car accident can feel overwhelming, but there are effective ways to manage and even lower your costs.

1. Take Advantage of Discounts

Many insurance companies offer various discounts that could help offset the increase from an accident:

- Bundle your home and auto insurance

- Install anti-theft devices

- Complete a defensive driving course

- Enroll in a safe driver program

- Pay your premium in full rather than monthly

2. Consider Adjusting Your Coverage

While you shouldn't skimp on essential coverage, there might be some adjustments you can make:

- Increase your deductible (if you can afford to pay more out-of-pocket in case of another accident)

- Review optional coverages to see if you need them all

- If you have an older vehicle, consider dropping comprehensive and collision coverage

3. Shop Around for Better Rates

- Compare multiple quotes: Each insurance company uses a different formula to calculate risk, which can lead to significant premium differences after an accident.

- Time it right: Start shopping when your current policy is close to expiring to avoid cancellation penalties.

- Look for specialized providers: Some insurers focus on drivers with recent accidents and may offer better rates tailored to your situation.

When to File a Claim vs. Pay Out of Pocket

Sometimes, handling minor accident costs yourself can save you more money over time than filing a claim with your auto insurance. Evaluate each situation carefully, ensure you protect your coverage, and avoid unnecessary expenses.

When it makes sense to pay out of pocket

- Repair costs are close to your deductible: If the cost of repairs is only slightly higher than your deductible, filing a claim might not be worth it.

- Potential premium increases: Filing a claim could raise your premium by hundreds of dollars annually for several years. Paying for small repairs yourself avoids this long-term extra cost.

- Simple, low-risk accidents: Incidents like minor scratches or dents without injuries are often better handled privately, as long as both parties agree.

When filing a claim is necessary

- High repair costs: If damages are significant, relying on your insurance is the safest financial move.

- Possible injuries: Always file a claim if there’s any chance of injury, even minor, to protect yourself legally and financially.

Protect Your Budget After a Car Accident with Mila

Your auto insurance may be impacted by an accident, but it doesn't have to break the bank. You can reduce the financial impact by learning how rates fluctuate and taking measures to safeguard your coverage. Be prepared, drive carefully, and keep in mind that you can get less insurance with each year of spotless driving.

Protecting your budget after a car accident is easier with Mila. You get fast, free quotes from trusted providers, full protection without hidden fees, and the lowest legal rates. Mila cuts out the middleman to pass real savings to you, making your auto insurance more affordable and reliable when you need it most.

Don’t overpay for your auto insurance. Compare quotes with Mila now and find the best coverage at the lowest legal rates.

FAQs About How a Car Accident Impacts Your Auto Insurance

How much does auto insurance typically increase after a car accident?

On average, auto insurance rates increase between 20% and 50% after an at-fault car accident. The exact amount depends on the accident's severity, your driving history, and your insurance provider’s policies.

Will my insurance go up if the car accident wasn’t my fault?

It depends on your insurance company and state laws. In some cases, even a no-fault car accident can lead to a slight premium increase, especially if you have multiple previous claims.

How long will a car accident stay on my insurance record?

Most accidents affect your coverage and rates for three to five years. Maintaining a clean driving record during this period can gradually lower your premiums.