Everything You Should Know About GAP Insurance

If your car is stolen or declared a total loss while you're still making payments, you might end up owing more than the car is worth. Gap insurance helps you cover that difference, so you're not left paying for something you no longer have.

This guide will walk you through exactly what gap insurance is, how it works, and when it makes sense to add it to your policy. Whether you're leasing, financing, or just exploring your options, having the right information can help you make a smart and confident decision.

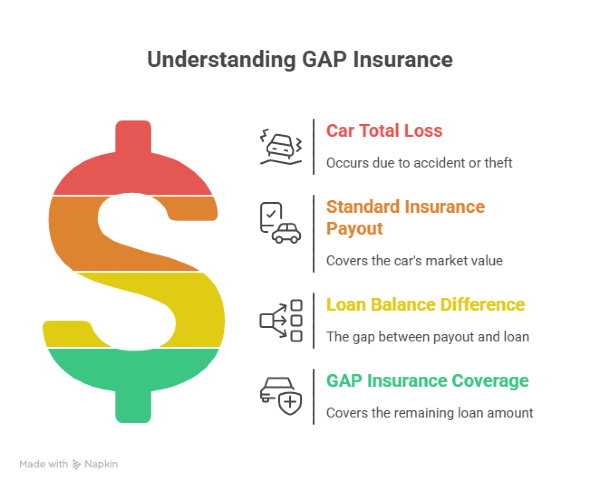

What Is GAP Insurance?

GAP stands for Guaranteed Asset Protection. It’s a type of optional car insurance that covers the financial gap between what your car is worth and what you still owe on your loan or lease if the vehicle is totaled or stolen.

Here’s how it works in real life:

- Your car is declared a total loss after an accident or theft.

- Your standard auto insurance pays the vehicle’s current market value.

- If your loan balance is higher than that payout, you’re responsible for the difference.

- GAP insurance covers that remaining amount, so you’re not left paying for a car you no longer have.

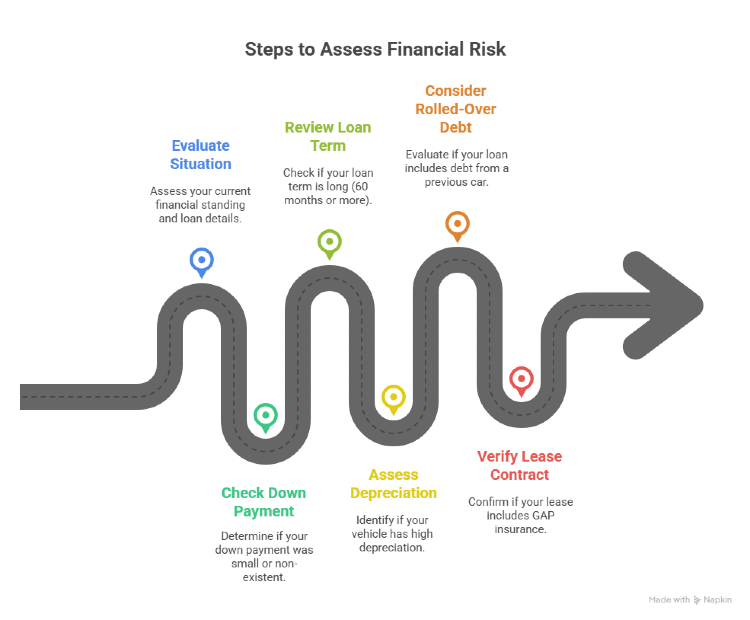

How to Know If You're at Risk

Start by evaluating your current situation and reviewing a few key details that directly affect your risk.

Check These Indicators

If any of these apply to you, there’s a strong chance you’re at financial risk in case of a total loss. GAP insurance is designed specifically for situations like these:

- You made a small or no down payment: The less you put down, the bigger the chance you owe more than the car is worth.

- Your loan term is long (60 months or more): Longer terms take longer to build equity.

- You drive a vehicle with high depreciation: Some brands and models lose value faster than others, especially in the first year.

- You rolled over debt from a previous car: If your current loan includes money from a trade-in with negative equity, you’re starting behind.

- You’re leasing: Most lease contracts already include GAP insurance, but you should verify it.

Who Should Get It

GAP insurance isn’t a luxury; it’s a smart tool for certain car buyers. If you fall into any of these categories, adding it to your policy can save you from major financial stress later.

1. New Car Buyers With Financing

If you just bought a new car with a loan, you’re in the highest risk period. New vehicles lose value quickly, and your loan balance likely hasn’t caught up yet. One accident early on could leave you owing thousands.

2. People With Long-Term Loans

If your financing plan stretches 60, 72, or even 84 months, your equity builds slowly. That makes you vulnerable for a longer time and increases the chances of a coverage gap after a total loss.

3. Buyers With Little or No Down Payment

The smaller the down payment, the bigger the gap between the loan and the car’s value in the first few years. GAP insurance protects you during that high-risk window.

3. Drivers in High-Theft or High-Accident Areas

If the odds of losing your car are higher where you live, this type of coverage gives you added peace of mind.

Who Can Skip It

GAP insurance isn’t necessary for everyone. In fact, for many car owners, it adds cost without much benefit. Here’s how to know if you can safely skip it.

1. You Made a Large Down Payment

If you paid at least 20 percent upfront, your loan balance is likely well below the car’s value. That gives you equity from day one, reducing the chance of ending up with a gap.

2. Your Loan Is Short Term

Financing your car over 36 or 48 months helps you pay down the balance faster. This limits the time you’re at risk of owing more than the car is worth.

3. Your Car Is Already Paid Off

If there’s no loan or lease involved, there’s no gap to cover. Standard insurance will be enough to handle a total loss payout.

4. You’re Buying a Used Car With Strong Value Retention

Some vehicles depreciate slowly, especially certified used models with good resale value. If your loan aligns closely with the car’s market price, gap insurance may not be necessary.

How Much Does It Cost?

One of the biggest misconceptions about GAP insurance is that it’s expensive. In reality, it’s often one of the most affordable add-ons you can include with your vehicle coverage.

Typical Price Ranges

If you buy GAP insurance through a dealership or lender, it’s usually offered as a one-time fee. This can range between 400 and 700 dollars, and is often rolled into your loan. While convenient, this option is almost always the most expensive.

If you add it through your auto insurance provider, it usually costs between 20 and 40 dollars per year. This is billed as part of your premium, making it easier to manage and cancel if needed.

What Affects the Price

Your loan amount, vehicle type, and insurance provider all play a role in determining the cost. High-value vehicles and longer loan terms may increase your rate slightly, but overall, the coverage stays affordable for most drivers.

If you’re comparing offers, always ask whether the price is a one-time fee or an annual charge. That helps you understand the real cost over time.

What Gap Insurance Doesn’t Cover

GAP insurance has a very specific purpose, and it’s important to understand what it doesn’t include. This helps you avoid surprises if you ever need to use it.

- It Doesn’t Cover Repairs: If your car is damaged but not declared a total loss, GAP insurance won’t pay for repairs. That’s handled by your standard collision or comprehensive coverage.

- It Doesn’t Pay Missed Loan Payments: If you’ve fallen behind on your auto loan, GAP insurance won’t cover overdue amounts or late fees. It only applies to the balance at the time of a total loss.

- It Doesn’t Replace Personal Belongings: Any items inside your vehicle, like electronics, bags, or tools, are not covered by GAP insurance. Some may be covered by your homeowners or renters insurance, but not this policy.

- It Doesn’t Apply Once You’re No Longer Upside Down: Once your loan balance is lower than your car’s value, the coverage becomes unnecessary. At that point, continuing to pay for it adds no value.

Control Your Car Loan Risk With GAP Insurance

If you want real protection from an unexpected loan balance after a total loss, GAP insurance is one of the simplest tools available. It’s not about covering everything, just that specific moment when things go wrong and the numbers don’t add up. Knowing when it matters puts you in control of your financial decisions.

To explore affordable and flexible GAP insurance options, you can check out Mila. Our platform makes it easy to compare quotes and find coverage that fits your loan and your budget, all in just a few minutes.

Frequently Asked Questions About Gap Insurance

Is GAP insurance included in my auto policy?

GAP insurance is not included by default. You need to request it separately through your insurer, dealership, or lender. Always check your policy documents or ask your provider directly.

Do I need GAP insurance if I have full coverage?

Yes, full coverage only pays the current market value of your car. If your loan balance is higher, full coverage won’t cover the remaining amount. GAP insurance fills that gap.

Can I add GAP insurance after buying the car?

Yes, in most cases, you can add GAP insurance within the first one to two years of ownership, as long as the vehicle still qualifies. Check with your insurer or financing company for eligibility.

When should I cancel GAP insurance?

You should cancel GAP insurance once your loan balance is equal to or less than your vehicle’s value. At that point, the coverage no longer provides financial benefit.