Everything You Need to Know About Auto Insurance for Teens

Everything You Need to Know About Auto Insurance for Teens

Teen drivers are among the most expensive to insure, and for good reason: their inexperience and high-risk driving behavior contribute to elevated accident rates. Teen drivers (16–19 years old) are almost 3 times more likely than drivers 20 and older to be in a fatal crash per mile driven, based on data from CDC.gov.

This guide breaks down all you need to know about auto insurance for teens, from what impacts insurance costs to smart strategies for reducing premiums, making the process easier and more affordable.

Why Is Auto Insurance for Teenagers So Expensive?

Teenagers are among the most expensive drivers to insure, and it's not just about age. Insurance companies see them as high-risk due to several reasons tied to behavior and experience. Here’s why premiums are higher:

- Inexperience behind the wheel

- Increased likelihood of distracted driving

- Tendency to drive during high-risk hours (nights, weekends)

- Statistically higher accident rates

Insurance companies use actuarial data to calculate premiums, and those statistics don't favor teen drivers. As a result, the average cost of adding a teen to a family policy can considerably raise your monthly insurance bill.

What Options Do You Have for Insuring a Teen Driver

You have two main options when it comes to getting auto insurance for your teen. The right choice depends on your teen’s car ownership status and your household budget.

1. Add the Teen to an Existing Family Policy

This is typically the most cost-effective choice. Insurance companies often offer multi-car and multi-driver discounts that can reduce the overall cost. Additionally, coverage under an existing policy ensures consistent protection for the household.

2. Purchase a Separate Policy

A separate policy might be required if the teen owns the vehicle in their name. However, this route usually comes with higher premiums since it doesn’t benefit from bundling discounts.

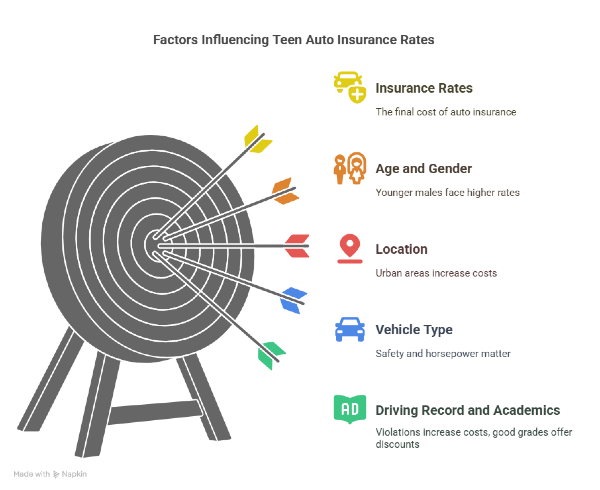

Which Factors Influence Teen Auto Insurance Rates

Not all teen drivers pay the same for auto insurance, and that’s because insurers consider multiple personal and external factors when calculating premiums. Here’s what makes the biggest difference:

- Age and gender: Younger teens, especially males, face the highest rates.

- Location: Urban areas with high traffic and accident rates tend to cost more.

- Vehicle type: Cars with high safety ratings and lower horsepower are cheaper to insure.

- Driving record: Even a single traffic violation can increase costs.

- Academic performance: Teens with good grades often qualify for discounts.

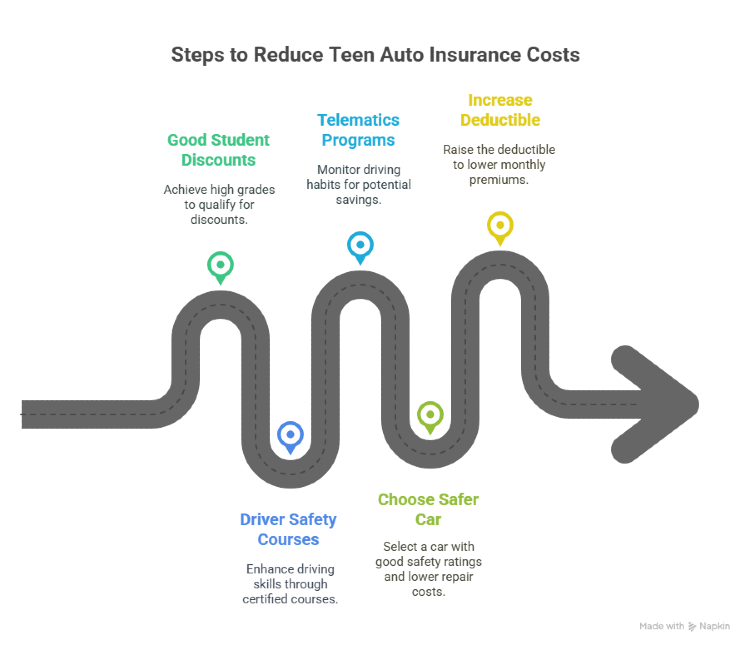

How Can I Reduce How Can I Reduce the Cost of Teen Auto Insurance?

Paying for auto insurance doesn’t have to strain your budget. There are proven methods that help lower the premium while keeping solid coverage in place. Try these strategies to make teen insurance more affordable:

- Good Student Discounts: Many insurers offer discounts to students maintaining a B average or higher. Providing a copy of the report card can qualify the teen for up to 15% off.

- Driver Safety and Defensive Driving Courses: Certified driving courses improve skills and can lead to insurance discounts. Some states even mandate driver education for teens, making it a win-win.

- Telematics and Usage-Based Insurance: Insurance companies now offer telematics programs, apps, or devices that monitor driving behavior like speed, braking, and phone use. Safe driving habits over a period can earn significant premium reductions.

- Choosing the Right Car: Insurers base part of the premium on the car itself. Safer, older models with good crash-test ratings and lower repair costs are more economical to insure.

- Increasing the Deductible: Raising the deductible, the amount paid out-of-pocket before insurance kicks in, can reduce the monthly premium. Just ensure there are savings set aside to cover it in case of an accident.

What Coverage Should Teen Drivers Have?

Choosing the minimum required by your state might seem like a way to save, but it often leaves gaps in protection. Teen drivers need coverage that goes beyond the basics. Here are the main types you should consider:

- Liability coverage: Covers damage and injuries to others.

- Collision coverage: Pays for damage to the teen’s vehicle after an accident.

- Comprehensive coverage: Covers theft, vandalism, and natural disasters.

- Uninsured/Underinsured motorist: Protection against drivers with little or no coverage.

How Do I Choose the Right Insurer for a Teen Driver?

Price matters, but it's not the only thing you should look at when picking an insurer for your teen. A good provider offers support, flexibility, and extras that make a real difference for young drivers. Look for insurers that offer:

- Teen-friendly discounts and incentives

- Strong mobile app features for monitoring and claims

- High customer satisfaction scores

- Responsive claims service

To make comparing providers easier, platforms like Mila can help you find and compare auto insurance quotes quickly from trusted companies.

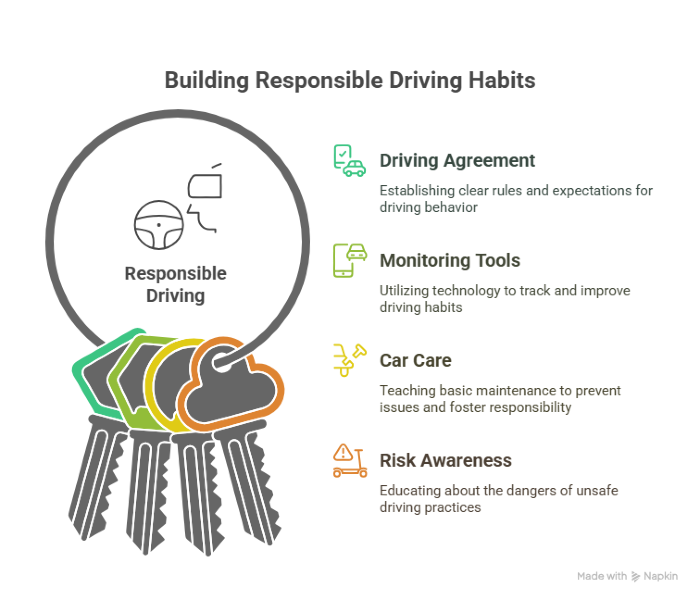

How Can I Teach My Teen Responsibility Behind the Wheel?

Getting auto insurance is just one part of keeping your teen safe. Teaching them to drive responsibly has a lasting impact on their safety, confidence, and even their premium. Here are some ways to build responsible habits:

- Create a driving agreement: Set clear rules about curfews, number of passengers, and phone use while driving. Review it together and update as needed.

- Use monitoring tools: Many insurance apps let you keep an eye on speed, braking, and distracted driving. This can encourage safer habits.

- Promote regular car care: Teach your teen to check tire pressure, oil levels, and schedule basic maintenance. It builds responsibility and prevents avoidable issues.

- Talk about real risks: Be direct about the dangers of texting and driving, speeding, and not wearing a seatbelt.

Smart Moves to Protect Your Teen Driver With Mila

Auto insurance for teens requires a balance between safety, coverage, and cost. When you guide your teen, choose the right policy, and explore smart savings options, protecting them becomes a smoother process, both financially and emotionally.

To make the process easier, consider using comparison tools like Mila. It helps you quickly review multiple quotes from trusted providers, so you can find the best fit for your teen without overpaying or dealing with unnecessary stress.

Compare quotes in minutes with Mila and start saving on auto insurance for teens today. It’s fast, free, and adapted to your needs. Download our Guide

Frequently Asked Questions (FAQs) About Auto Insurance for Teens

What age do teens need to be to get car insurance?

Teens can be insured as soon as they get a driver’s license or permit, typically between the ages of 16–18. In most cases, they’re added to a parent’s policy.

Can teens get full coverage insurance?

Yes, teens can be included in a full coverage policy, which typically includes liability, collision, and comprehensive protection. While it costs more than minimum coverage, it offers better protection, especially helpful for new drivers who are more likely to face accidents or unexpected events.

What happens if my teen gets into an accident?

If your teen is on your policy, the accident will be covered under your plan, but it may increase your future premiums. That’s why having adequate liability and collision coverage is important.