Auto Insurance with No Down Payment: What You Need to Know

Finding affordable car insurance can be challenging, especially if you’re trying to keep your expenses low. Many drivers look for ways to start a policy without making a large upfront payment. While completely skipping an initial payment isn’t possible, there are flexible payment options that make coverage more accessible.

In this post, you’ll learn about how car insurance payments work, strategies to minimize upfront costs, and tips for finding the best budget-friendly policy without sacrificing essential coverage.

What is No Down Payment Car Insurance

What people typically mean by no down payment car insurance is coverage that begins without requiring a large initial payment. To understand why this terminology can be misleading, you need to explore how insurance companies structure their payment systems.

Insurance providers operate on a prepaid basis, you pay for coverage before you receive it. This fundamental business model means you'll always need to pay something before your policy becomes active. Companies advertising no down payment policies are usually offering one of these alternatives:

- The first month's premium serves as the initial payment rather than a separate, larger down payment

- The total premium is divided into equal monthly installments instead of front-loading the cost

These options can feel like no down payment because they avoid the traditional larger upfront payment, but you're still paying for the first period of coverage before it begins.

How Traditional Car Insurance Payments Work

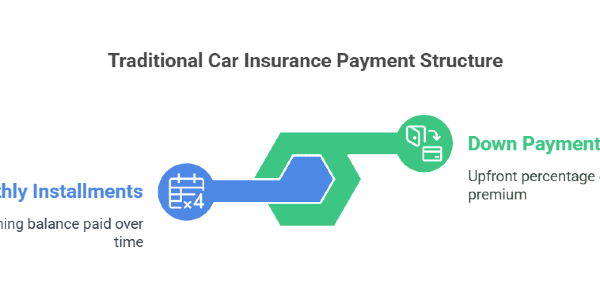

To understand the alternatives, knowing how standard car insurance payments are structured is essential. Most traditional policies require:

- A down payment: Typically 20-30% of the total premium, paid upfront.

- Monthly installments: The remaining balance is split into equal payments over the policy term (usually 6 or 12 months).

For example, if your annual premium is $1,200, a traditional insurer might require:

- $240-$360 upfront as a down payment.

- $80-$96 per month for the rest of the year.

Payment Options That Minimize Upfront Costs

If paying a large sum upfront isn’t ideal, several ways exist to reduce your initial expenses while still getting insured. Here are some options:

1. Pay-Per-Month Plans

Instead of requiring a lump sum down payment, some insurers allow you to activate your policy by paying only the first month’s premium. This makes coverage more accessible, especially if you’re on a tight budget.

- Example: Instead of paying $300 upfront on a $1,200 annual policy, you might pay just $100 for the first month, reducing your initial cost by 67%.

2. Pay-As-You-Go Insurance

Some companies offer usage-based insurance that tracks your driving habits using a mobile app or a device installed in your car. Your premium is based on:

- Miles driven

- Driving behavior (speed, braking, time of day)

This option is ideal if you don’t drive frequently, as it often requires minimal upfront payment and lowers overall costs.

3. Minimum Coverage Policies

Opting for state-minimum liability insurance can significantly lower both your down payment and monthly premiums. However, this comes with less financial protection in case of an accident.

Most states require:

- Bodily injury liability (covers injuries to others)

- Property damage liability (covers damage to others’ property)

Some states also require:

- Personal injury protection (PIP)

- Uninsured motorist coverage

What Factors Affect Your Insurance Costs

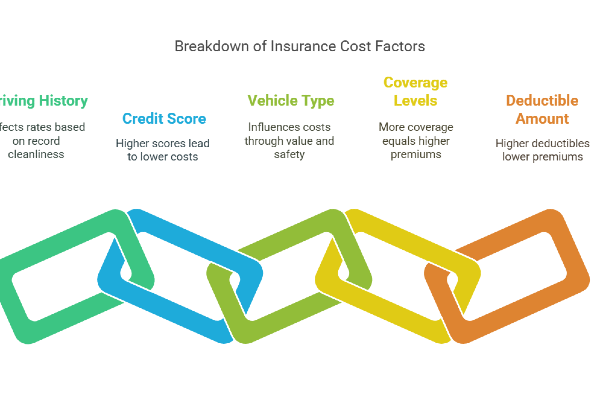

Understanding what influences your premium can help you find more affordable options. Here are the key factors that impact both your down payment and monthly costs:

1. Driving History

Your driving record plays a major role in determining your rates. If you have:

- Accidents or traffic violations → Expect higher premiums.

- A clean record for 3–5 years → You may qualify for lower rates.

2. Credit Score

In most states, insurers use credit-based insurance scores to determine rates. A higher credit score can mean lower insurance costs. To improve your score:

- Pay bills on time.

- Reduce outstanding debt.

- Check for errors on your credit report.

3. Vehicle Type

The make and model of your car affect insurance costs based on:

- Value & repair costs → Expensive cars cost more to insure.

- Safety ratings → Safer cars often have lower premiums.

- Theft risk → High-theft models can be pricier to insure.

4. Coverage Levels

The more coverage you choose, the higher your premium. While minimum coverage reduces costs, it also provides less financial protection in case of an accident.

5. Deductible Amount

Your deductible is what you pay out-of-pocket before insurance covers a claim.

- Higher deductible = Lower monthly premium

- Lower deductible = Higher monthly premium

Strategies to Find More Affordable Insurance

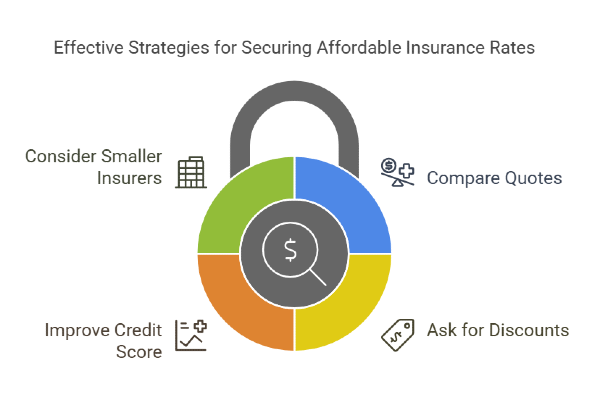

If you're looking to lower your initial payment and monthly costs, these strategies can help:

1. Compare Multiple Quotes

Insurance rates can vary significantly between providers. Getting at least three quotes can help you find the best deal. Many websites offer free comparison tools to simplify the process.

2. Ask About Discounts

Most insurers offer discounts that can reduce your premium. Common options include:

- Multi-policy discount (bundling auto with home or renters insurance).

- Safe driver discount (for those with a clean record).

- Good student discount (available for young drivers with high grades).

- Military or professional organization discounts.

- Paperless billing and automatic payment discounts.

3. Improve Your Credit Score

Since credit affects insurance rates in most states, improving your score can lead to lower premiums over time. Focus on:

- Paying bills on time.

- Reducing debt.

- Checking your credit report for errors.

4. Consider Regional or Smaller Insurers

While big-name companies dominate advertising, local and regional insurers sometimes offer lower rates or more flexible payment options. These companies may also have better customer service tailored to your area.

What to Watch Out for with Low Down Payment Insurance

While minimizing upfront costs can be helpful, there are a few trade-offs to consider:

- Higher Total Cost: Many insurers charge installment fees or interest when you spread payments over time. This can add 5-10% to your total premium, making the policy more expensive in the long run.

- Limited Carrier Options: Not all insurance companies offer low down payment plans, which means you might have fewer choices when selecting a provider. This could result in missing out on better coverage options or lower overall rates.

- Higher Monthly Payments: Lowering the initial cost often means higher monthly payments. Make sure these fit within your budget to avoid missed payments, which could lead to policy cancellation.

Who Should Consider Low Down Payment Options?

Low upfront payment plans can be helpful for certain drivers, especially those facing financial constraints. This option might be a good fit if you:

- Are a new driver: Young or first-time drivers often face high insurance rates and may struggle to afford a large down payment.

- Have limited savings: If paying a lump sum upfront isn’t possible, spreading costs into monthly payments can make insurance more accessible.

- Experience seasonal income fluctuations: If your income varies throughout the year, a lower initial payment might help manage cash flow.

- Just purchased a car: Buying a car comes with multiple expenses (down payment, registration, taxes), so minimizing upfront insurance costs can help balance your budget.

Find Your Best Insurance Option With Mila

Remember that insurance is a critical financial protection for both you and other drivers. While minimizing upfront costs is important when money is tight, make sure you maintain adequate coverage to protect yourself from the potentially devastating financial consequences of an accident.

By taking the time to explore all your options and understand how payment structures work, you can find car insurance that provides the protection you need without requiring an overwhelming initial payment. Take control of your coverage with Mila. Compare live quotes from trusted insurers, save up to 30%, and choose the plan that fits your life on your terms.

Frequently Asked Questions (FAQs) About Car Insurance with No Down Payment?

Is it possible to get car insurance with no upfront payment?

No, all insurance companies require some form of payment before coverage begins. However, some insurers allow you to start a policy by paying only the first month’s premium rather than a larger down payment.

Why do insurance companies require a down payment?

Insurance operates on a prepaid model, meaning you pay for coverage before using it. The down payment reduces risk for insurers and ensures that they receive some payment if you cancel early.

Which insurance companies offer low down payment options?

Many national and regional insurers offer monthly payment plans or pay-as-you-go policies. To find the best option, compare quotes from multiple providers and ask about flexible payment structures.

Does my credit score affect my ability to get low down payment insurance?

Yes, in most states, insurers use credit-based insurance scores to determine premiums. A higher credit score can help you qualify for lower initial payments and better overall rates.

What is the cheapest type of car insurance?

The most affordable option is typically minimum liability coverage, which meets your state’s legal requirements. However, it offers less protection in case of an accident. If you can afford it, consider adding coverage to protect yourself financially.