Can You Get Auto Insurance Without a License?

Getting auto insurance without a driver’s license might seem impossible, but it’s more common than you think. Whether your license is suspended, you’re medically unable to drive, or you're insuring a car for someone else, there are ways to stay covered.

Maintaining valid coverage helps protect your vehicle, meet legal requirements, and avoid costly gaps that could raise your future premiums. In this post, you’ll learn how to insure your car without a license, what options are available, and how to choose the right plan for your situation.

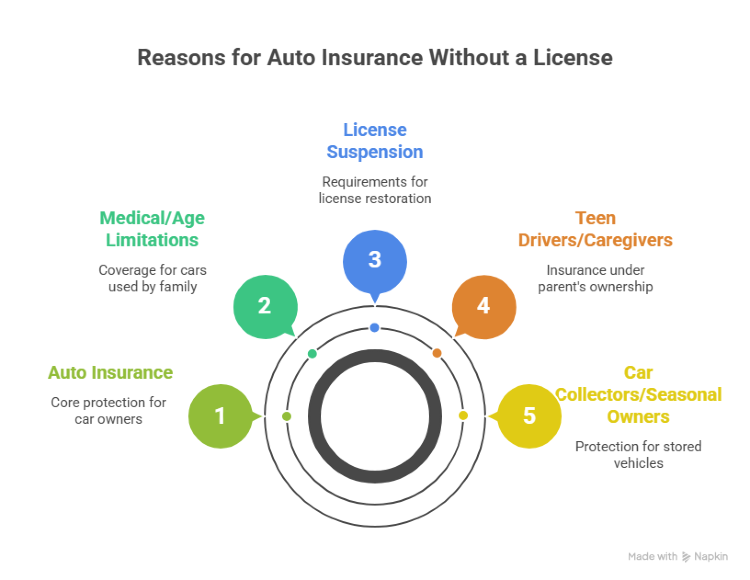

Why You Might Need Auto Insurance Without a License

You don’t need to drive to need insurance. Many unlicensed car owners still require coverage for several valid reasons:

- Medical or age-related limitations: You may no longer drive due to health concerns or age, but still own a car that a family member uses.

- Suspended or revoked license: Even with a suspension, you might need to maintain insurance to file an SR-22 and eventually restore your driving privileges.

- Teen drivers or caregivers: Parents may own the car, but list a licensed teen or hired caregiver as the main driver.

- Car collectors or seasonal owners: Storing a vehicle long-term? Insurance protects it against theft, fire, or vandalism while it’s parked.

Can You Get Auto Insurance Without a License?

Yes, you can get auto insurance without a driver’s license, but it takes a bit more effort. Most major insurance companies allow unlicensed vehicle owners to buy a policy, as long as a licensed individual is listed as the primary driver. However, not every insurer offers this type of policy. You may need to work with:

- An independent insurance agent who can compare options from multiple carriers.

- Non-standard or specialty insurers who are experienced with high-risk or unique profiles.

In both cases, being transparent about your situation is key. Make sure to explain that you are the vehicle owner but will not be driving. This helps avoid any misunderstandings and ensures you get the right kind of policy. With the right approach, even insurance for unlicensed drivers is entirely possible.

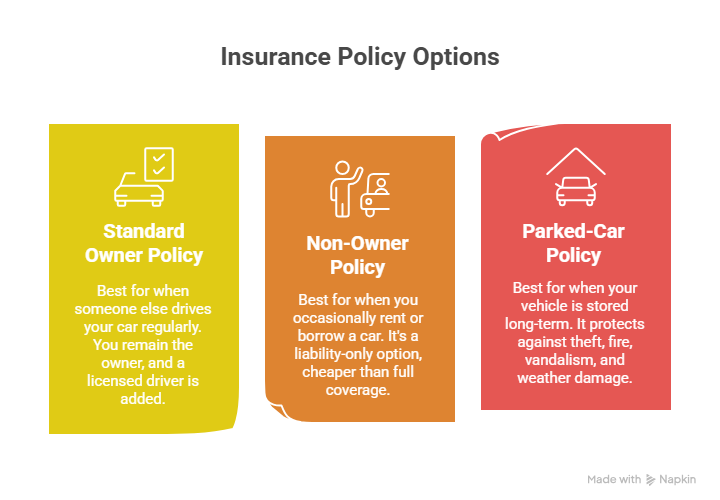

Top 3 Insurance Policy Options for Unlicensed Car Owners

When you need no license auto insurance, choosing the right policy depends on how the car will be used. Here are the three most common options:

1. Standard owner policy with a primary driver

Best for: If you own the car and someone else drives it regularly. You remain listed as the owner, and a licensed driver is added as the primary driver. Most insurers will ask you to exclude yourself from driving to reduce risk.

2. Non-owner policy

Best for: If you don’t own a car, but occasionally rent or borrow one. This liability-only option offers minimal coverage and is cheaper than full coverage insurance. It doesn't include collision or comprehensive protection, but satisfies state requirements if needed for an SR-22.

3. Parked-car (storage) policy

Best for: If your vehicle is stored long-term in a garage or driveway. This type of policy doesn’t include liability coverage since the car isn’t being driven. It protects against theft, fire, vandalism, and weather damage.

These plans allow flexibility depending on your needs, and many insurers are open to customizing the policy based on your situation. Be sure to compare options to find the best fit for your circumstances.

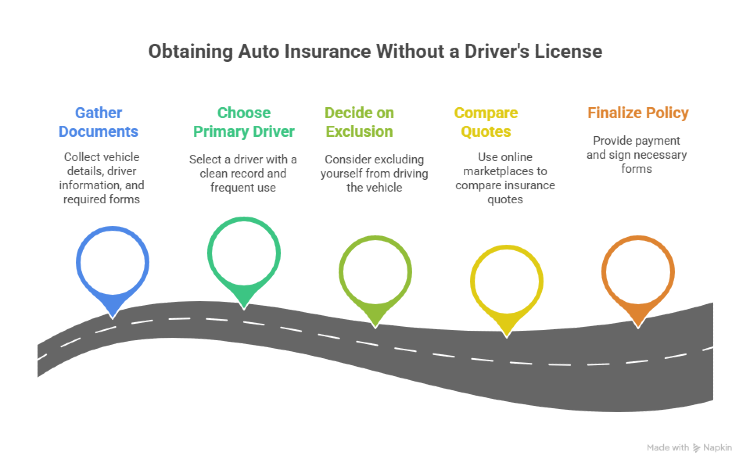

Step-by-Step Guide to Getting Auto Insurance Without a Driver’s License

Getting auto insurance without a driver’s license requires a few extra steps, but it’s manageable if you follow this process:

1. Gather your documents

- Vehicle details: VIN, current mileage, and how the car is used or stored.

- Driver information: The primary driver's license and driving history.

- Required forms: If your license is suspended, you may need an SR-22 to prove future financial responsibility.

2. Choose the primary driver

Pick someone who has a clean driving record, lives at your address if required by your state, and uses the car most often. If more than one person shares the car, list the safest driver as the primary and others as secondary drivers.

3. Decide whether to exclude yourself

Most insurers will require a "named driver exclusion" that officially states you will not be driving the vehicle. Signing this can help lower your premium and reduce risk for the insurer.

4. Compare quotes

Use online comparison sites, as Mila, to compare at least three quotes. Not all insurers advertise this kind of coverage, so ask specifically whether they allow unlicensed owners. Rates can vary up to 40 percent.

5. Finalize your policy

Provide payment, sign any required forms, and have your insurer file the SR-22 electronically if needed. Keep proof of insurance in the vehicle. Your policy will include your name as the owner and the licensed driver as the primary operator.

What Mistakes Should You Avoid When Getting Insurance Without a License?

When securing no-license auto insurance, avoid these common errors that could cost you:

- Putting the title in someone else's name: This might seem like a shortcut, but it can trigger fraud concerns and legal issues.

- Driving while excluded: If you're listed as an excluded driver and still operate the vehicle, any claims could be denied entirely.

- Letting the policy lapse: Especially if you need an SR-22, a lapse resets the coverage timeline and raises future premiums.

- Providing incorrect driver info: Insurers verify details like mileage and driver usage. Inaccurate data may lead to policy cancellation.

Compare with Mila and Get Auto Insurance Without a Driver’s License

Even without a license, you have the right to protect your vehicle and stay compliant. Focus on finding the right primary driver and policy type that fits your situation. Don’t skip coverage; it could cost more in the long run. With the right approach, auto insurance without a driver’s license becomes not only possible but smart.

At Mila, we believe everyone deserves the right coverage, license or not. Whether you’re insuring a family vehicle or keeping a car stored safely, our platform helps you compare the best options quickly and confidently. Explore smart, personalized solutions for auto insurance without a driver’s license at Mila and protect what matters most.

Frequently Asked Questions About Auto Insurance Without a License?

Can I insure the car under my spouse’s name instead of mine?

You could transfer ownership, but doing so may lead to complications with taxes, loans, or registration. It’s often more practical to keep the title in your name and list your spouse as the primary driver.

Does insurance automatically reinstate my suspended license?

No. Purchasing insurance allows the provider to file an SR-22 if required, but the DMV handles reinstatement only after all legal and financial conditions are met.

Can I get short-term insurance if I’m selling the vehicle?

Yes, some specialty carriers offer one-month or temporary “binder” policies. They’re useful when you need legal coverage while finalizing a sale.

Is this coverage more expensive than regular policies?

Typically, yes. Premiums are about 10 to 25 percent higher, mainly due to the risk profile of the listed driver. However, storage-only policies may cost less than standard coverage.