Best Auto Insurance for Families with Multiple Cars

Choosing auto insurance for your family can seem confusing at first. Between school runs, weekend getaways, and daily commutes, every car in the household has its role. Finding the right policy is less about paperwork and more about keeping your loved ones protected every time they’re on the road.

In this guide, I’ll walk you through simple ways to pick the best auto insurance for families with more than one car. You’ll learn how multi-car policies work, what features really matter, and how to get coverage that fits your family’s daily life without spending extra.

How to Choose the Best Auto Insurance for Families

Finding the right family car insurance starts with understanding your needs and priorities. Before choosing a company or plan, take a moment to consider your daily driving habits and the people behind the wheeljlkjlkjlkjljljljlkjlkjlklñkñlñkñkñllñklññlññl{ñl{ññlñ{l{l{ñlñl.

1. Know What Your Family Needs

Reviews all the factors that can affect your policy:

- Number of drivers and cars: List who drives and what they drive.

- Usage: Do you use your cars mostly for commuting, road trips, or errands?

- Teen or new drivers: Their presence can change your premium and coverage options.

2. Compare Coverage Types

Different families need different levels of protection:

- Liability coverage: Protects against damages you cause to others.

- Comprehensive and collision: Helps with repairs after accidents, theft, or weather damage.

- Uninsured motorist coverage: Keeps your family safe from drivers without insurance.

3. Look for Family-Friendly Discounts

Many insurers offer:

- Multi-car or multi-driver discounts.

- Bundles with home or renters insurance.

- Rewards for safe driving or good grades (for teens).

4. Check the Company’s Service Reputation

A low premium isn’t everything. Families often value helpful customer service and prompt claims processing. Read reviews and ask friends for recommendations.

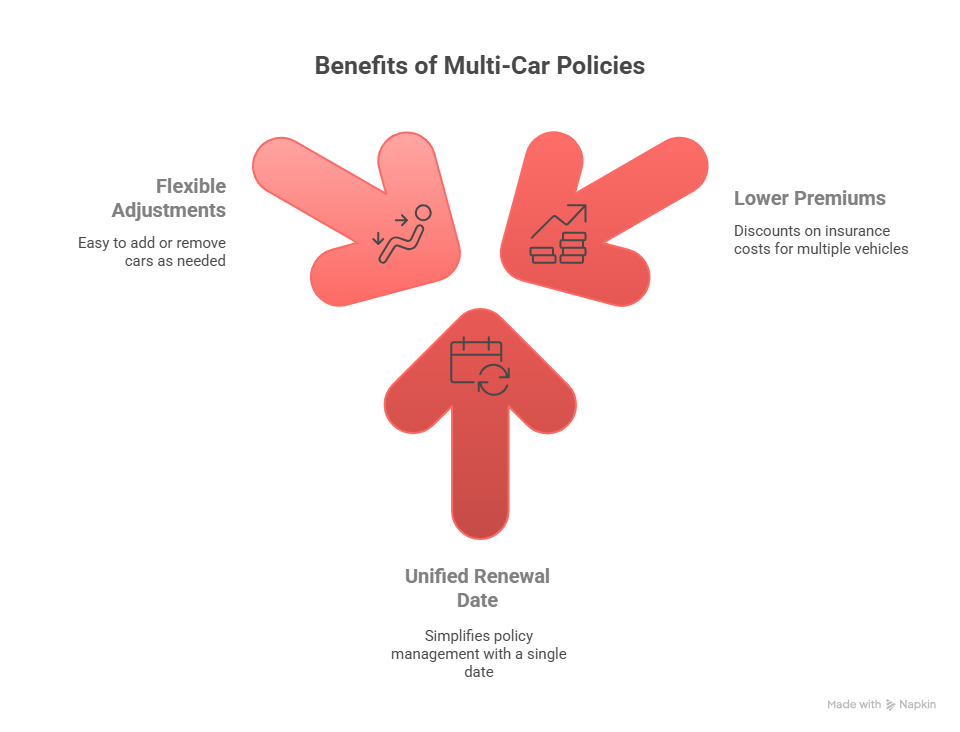

Families appreciate the simplicity. One company, one renewal date, and one payment make it easier to stay organized. Plus, when kids start driving or you buy a new car, adding coverage is faster and often cheaper.

How Multi-Car Policies Work and When They’re Worth It

If your family owns more than one car, managing insurance for each vehicle separately can get complicated. A multi-car policy helps you bring all your vehicles under one plan — simpler, cheaper, and easier to manage.

What Is a Multi-Car Policy?

A multi-car policy allows you to insure two or more vehicles registered to the same address. Each car can have its own coverage level, but you pay one bill and deal with one insurer. This makes renewals faster and less stressful.

Benefits of Multi-Car Policies

- Lower premiums: Most insurers offer 10–25% discounts per car when grouped.

- One renewal date: No need to track multiple policies or due dates.

- Easier adjustments: Add or remove cars as your family grows or changes.

When It Might Not Be the Best Option

Sometimes, a multi-car policy isn’t ideal. If one driver has a poor driving record or a very expensive car, it might increase the overall rate for everyone on the plan. In that case, compare quotes separately to see which setup saves more.

Example

When I compared options for a family with three cars and two teen drivers, combining all vehicles into one policy saved nearly $450 a year. It also meant fewer renewal reminders, something every busy parent appreciates.

Top Insurance Options for Families with Several Vehicles

Choosing the right insurer can make a big difference in price and peace of mind. Before signing a policy, look for companies that understand family needs and offer flexible coverage for multiple cars.

Comparing Popular Insurers

Many families compare well-known insurance companies before choosing the right one. Focus on those that offer flexible coverage, strong customer support, and useful discounts for multiple vehicles. You can also use online comparison tools like Mila to quickly check different insurers and find the best fit for your family’s needs.

What Features Add Value

- Roadside assistance: Helpful when a family trip doesn’t go as planned.

- Rental car coverage: Keeps you moving while one car is in the shop.

- Accident forgiveness: Prevents one mistake from raising your premium.

- Usage-based discounts: Perfect for families with different driving habits.

When I compared quotes for a family of five, the biggest surprise wasn’t just price, it was service. The insurer that offered a slightly higher rate actually had faster claims and better customer support, which mattered more in the long run.

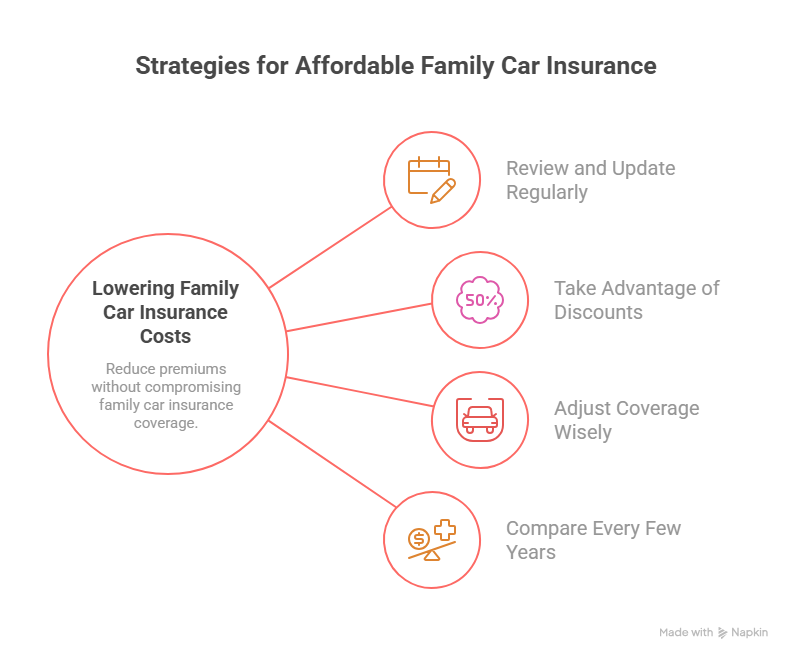

Tips to Lower Family Car Insurance Costs

A few smart moves can help families keep premiums affordable without giving up coverage. The goal is to protect your loved ones and your wallet at the same time.

1. Review and Update Regularly

Life changes fast — maybe you added a new driver or your teen now drives less. Update your policy once a year to make sure it still fits your family’s needs.

2. Take Advantage of Discounts

- Bundle your policies: Combine auto and home insurance for extra savings.

- Use telematics apps: Many insurers offer discounts for safe driving habits.

- Good student rewards: Teens with high grades often qualify for lower premiums.

3. Adjust Coverage Wisely

If one car is older, consider lowering its collision coverage to save money. Just be sure you keep enough liability coverage for peace of mind.

3. Compare Every Few Years

Even if you like your insurer, it’s worth checking new quotes. You can find a better rate from a company with better family coverage.

Common Mistakes Families Make When Choosing Auto Insurance

Even the most organized families can overlook small details that end up costing more in the long run. Here are some of the most frequent mistakes and how to avoid them.

- Ignoring Coverage Details: It’s tempting to pick the cheapest option, but low-cost plans often come with gaps in protection. Always read what’s included and excluded before you sign.

- Not Updating the Policy: When a teen starts driving, or you add a new car, forgetting to update your policy can leave you underinsured. Review your coverage after any major change in your household.

- Skipping the Fine Print: Some policies limit benefits such as roadside assistance or rental coverage. Take a few minutes to understand each clause so there are no surprises when filing a claim.

- Focusing Only on Price: While saving money matters, good customer service and a reliable claims process are just as important. A slightly higher premium from a trustworthy company can save time and stress later.

How to Find the Right Policy for Your Family

Finding the perfect auto insurance for your family starts with research and clarity. The best plan balances protection, cost, and convenience.

1. Start with Your Family’s Priorities

Make a short list of what matters most: low premiums, easy claims, flexible payments, or strong customer service. This helps you filter options faster.

2. Compare and Ask Questions

Look beyond price. Ask insurers about:

- Claim response times

- Roadside assistance availability

- Discounts for safe or low-mileage drivers

- Options for adding new drivers easily

3. Read the Fine Print

Take a few minutes to check what’s covered and what’s not. Make sure liability limits, medical payments, and collision coverage match your family’s needs.

4. Use Online Tools

Websites like Mila make comparison simple by showing different quotes in one place. It’s a quick way to find the right balance between cost and coverage without spending hours on research.

Protect Your Family and Compare Plans with Mila

Finding the best auto insurance for families doesn’t have to be complicated. Once you know what coverage fits your lifestyle, comparing options becomes much easier and even rewarding. A plan designed around your family’s needs means fewer surprises and more peace of mind on every drive.

If you want a simple way to compare quotes, explore Mila, our platform built to help families like yours find the best coverage. In just a few clicks, you can see personalized options, compare plans, and choose the protection that keeps your loved ones safe on every drive.

FAQs About Auto Insurance for Families

What is the main benefit of family or multi-car insurance?

The biggest advantage is convenience and savings. Families can cover all their vehicles under one plan, which means managing fewer bills and enjoying a lower rate per car. This approach simplifies renewals and keeps protection consistent for everyone at home.

How many cars can be added to a family policy?

Most insurers let you include between two and five vehicles, but some providers allow even more. The key is that all cars must be registered at the same address. Combining them often leads to valuable multi-car discounts that help cut costs over time.

Does adding a teen driver raise the premium?

Adding a young driver usually increases the premium, since insurers consider them higher risk. However, families can offset this with safe-driving programs, telematics apps, or good student discounts. Keeping all cars under one plan often helps manage these costs better.