Auto Insurance Tips for Drivers in High-Theft Areas

If you live in a neighborhood where car theft is common, getting the right auto insurance is a must. Stolen vehicles mean more than just the loss of your car. They can lead to serious financial headaches, especially if your auto insurance policy doesn’t fully cover you. That’s why choosing the right coverage and taking preventive steps can make all the difference.

Let’s break down the most important steps you can take to protect your vehicle from theft, reduce the chances of a costly insurance claim, and choose the type of coverage that helps when something goes wrong.

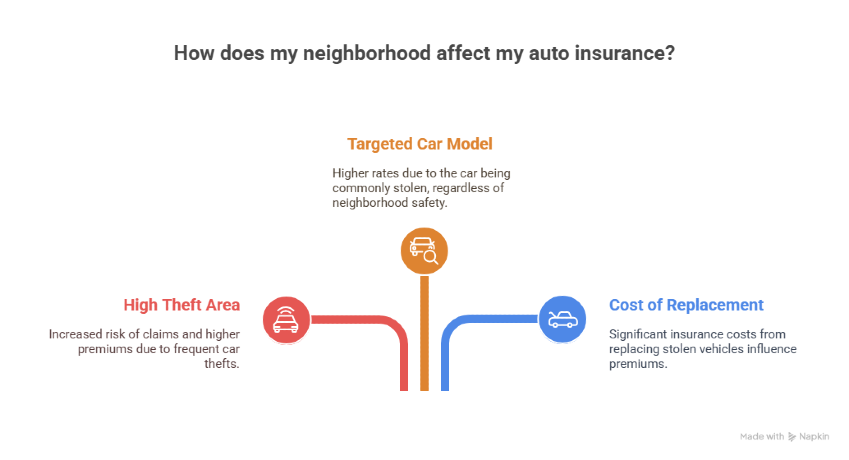

How Your Neighborhood Affects Your Auto Insurance

Where you live plays a bigger role in your insurance costs than many people realize, especially if car theft is a common issue in your area.

Insurance companies keep close track of theft reports by ZIP code. If your neighborhood shows high theft activity, your rates will likely reflect that increased risk, even if you’ve never filed a claim yourself. It’s a way for insurers to prepare for potential losses and balance the cost of future payouts.

Here are some of the main reasons why drivers in high-theft areas often pay more:

- Higher risk of claims: Areas with frequent car thefts are seen as more likely to generate expensive claims.

- The cost of replacing stolen vehicles: When theft leads to full car replacement or major repairs, insurance companies incur significant costs, which influence premiums.

- Targeted car models: Some vehicles are more attractive to thieves. If your car is commonly stolen, it might trigger higher rates even in safer neighborhoods.

📌 Tip: Not sure if your car is on the “most stolen” list? Check the NICB’s annual Hot Wheels report, it’s free and eye-opening.

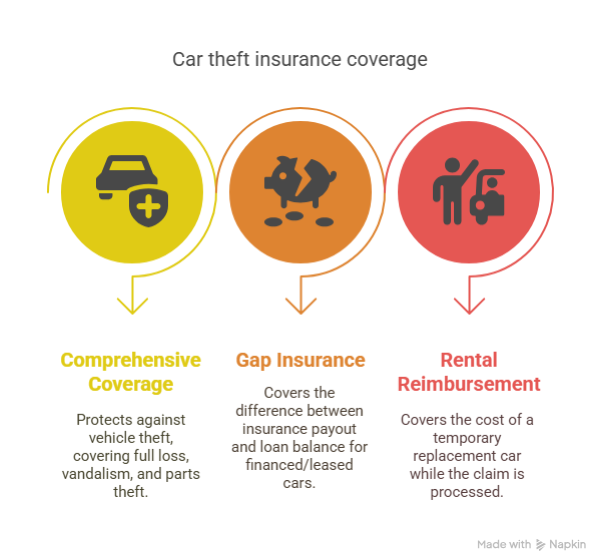

What Kind of Insurance Covers Car Theft?

If you live in an area where car theft is a real concern, having the right insurance coverage is key. A basic liability policy won’t help if your car is stolen or damaged in an attempted break-in. To stay protected, you'll need to add specific types of coverage that deal directly with theft-related risks. Here’s what to look for:

1. Comprehensive Coverage

This is the main protection against vehicle theft. It covers:

- The full loss of your car if it’s stolen and not recovered

- Vandalism and damage caused during a break-in

- Theft of parts, like catalytic converters or wheels

📌Keep in mind: without this coverage, your insurer won’t pay for a stolen car, even if the theft wasn’t your fault.

2. Gap Insurance

If you’re financing or leasing a new car, gap insurance covers the difference between what your insurer pays (the car’s market value) and what you still owe on your loan. This prevents you from being stuck with debt for a car you no longer have.

3. Rental Reimbursement

Having your car stolen can leave you without transportation for days or even weeks. Rental reimbursement helps cover the cost of a temporary replacement while your claim is being processed.

📌Suggestion: Not sure what’s in your policy? Take a few minutes to review it with your insurance agent. If theft is a real threat in your area, these coverages are worth every penny.

How Can You Prevent Car Theft in High-Risk Areas?

Insurance is important, but prevention is your first line of defense. If you live in a high-theft area, taking a few extra steps to secure your car can make a big difference, not only in keeping your vehicle safe but also in potentially lowering your insurance premium. Here are some effective ways to reduce the risk:

1. Use Visible Deterrents

Thieves look for easy targets. Tools like steering wheel locks, brake locks, or window decals warning of a security system can make them think twice. Even if they don’t stop all attempts, they often deter casual or opportunistic theft.

2. Install a GPS Tracking Device

If your car is ever stolen, a GPS tracker increases the chances of recovery. Some devices even alert you in real time if your vehicle is moved without authorization.

- Many modern insurers offer discounts if you install one.

- Some tracking systems can be connected to a mobile app for instant updates.

3. Park Smart

Try to park in well-lit areas, preferably near security cameras or in busy spots. If you have a garage at home, always use it—even if you're just staying in for the night.

4. Avoid Leaving Valuables in Sight

Don’t leave laptops, bags, or visible electronics inside your car. Even spare change can tempt someone to break in. Keep your vehicle as empty as possible when parked.

5. Lock It Every Time

It may sound obvious, but a surprising number of thefts happen when cars are left unlocked or running. Always double-check your doors, even when you're just stepping away for a minute.

📌 Extra tip: Some apps let you remotely lock and locate your car; check if your vehicle’s manufacturer offers one.

Can Theft Prevention Help You Save on Auto Insurance?

Yes, and in more ways than you might think. Insurance companies often reward drivers who take extra steps to protect their vehicles. If you live in a high-theft area, installing anti-theft devices or adopting safe habits can not only reduce the chances of a claim but also lower your premium. Here’s how you might qualify for savings:

1. Anti-Theft Device Discounts

If your vehicle has built-in security features or you install approved anti-theft devices, you may be eligible for a discount. This includes:

- Alarm systems

- Steering wheel or brake locks

- GPS tracking devices

- Immobilizers or kill switches

Be sure to let your insurer know about any device you've added. They usually won’t apply the discount unless you report it.

2. Insurance Apps and Smart Features

Some insurers offer discounts if you use their mobile apps with theft-alert features or connected car technology. These apps can:

- Alert you if your vehicle moves unexpectedly

- Track your driving habits

- Help locate your car if it's stolen

3. Bundling and Usage-Based Programs

If you bundle your auto insurance with home or renters insurance, or sign up for a usage-based program that monitors safe driving habits, you might receive additional savings, especially valuable in high-risk areas.

💡 Reminder: Not all discounts are advertised. Ask your provider directly about theft-related savings you might qualify for based on where you live and the devices you use.

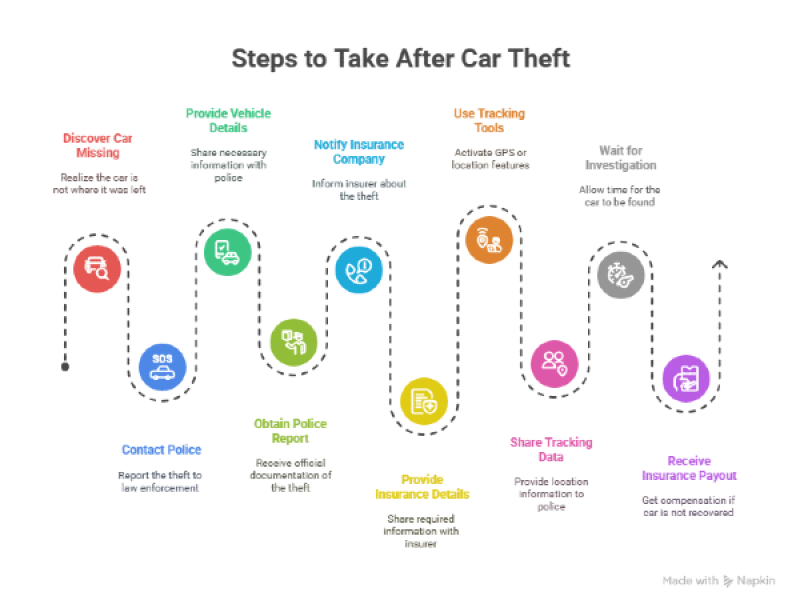

What Should You Do If Your Car Gets Stolen?

Discovering your car is missing is a stressful experience, but knowing what steps to take can help you act quickly and keep your claim on track. The sooner you move, the better your chances of recovering the vehicle or getting properly reimbursed. Here’s what you should do right away:

1. Contact the Police

Report the theft as soon as you confirm the car isn’t simply towed or moved. Provide:

- The vehicle’s make, model, year, and color

- License plate number

- VIN (Vehicle Identification Number), if available

- Time and location where you last saw the car

- Any tracking information if you have a GPS device

📌Get a copy of the police report, it’s required for your insurance claim.

2. Call Your Insurance Company

Once the police report is filed, notify your insurer. They’ll ask for:

- The police report number

- A list of personal items in the vehicle

- Details about your car’s condition and mileage

- Information about any installed anti-theft devices

3. Use Tracking Tools If Available

If your car has a GPS tracker or built-in vehicle location feature, use it immediately. Share the data with the police to help them locate the car faster.

4. Wait for the Investigation

Your insurer may take 2–3 weeks to declare the vehicle a total loss if it's not recovered. After that, they’ll move forward with the payout according to your coverage (comprehensive or gap insurance, if applicable).

Choose the Right Insurance With Mila

If car theft is common where you live, your coverage should reflect that reality. Review your policy, explore anti-theft options, and ask your insurer about available upgrades or discounts. A few small changes can make a big difference when it matters most.

If you need help finding coverage that fits your needs in your area, at Mila, you can compare auto insurance options side by side and choose the one that offers the right balance of protection and price, especially important if you live in a high-theft zone. Smart decisions start with the right information, and Mila makes that easier.

Start your search with Mila and discover auto insurance that works for you.

Frequently Asked Questions (FAQs) About Auto Insurance for Drivers in High-Theft Areas

What type of insurance covers car theft?

Comprehensive coverage is the policy that protects you in case of vehicle theft. It also covers vandalism, broken windows, and damage caused during a break-in. Liability coverage alone does not protect you from theft.

Do I need comprehensive coverage if I live in a high-theft area?

Yes. If your neighborhood has high theft rates, comprehensive coverage is essential. Without it, your insurer won’t pay for a stolen vehicle or related damages.

Can anti-theft devices lower my insurance rate?

In many cases, yes. Insurers often offer discounts for devices like alarms, GPS trackers, and steering wheel locks. Always inform your provider when you install one to ensure the discount is applied.