Auto Insurance for Remote Workers: Save More by Driving Less

Auto Insurance for Remote Workers: Save More by Driving Less

Working remotely has changed how we live, work, and, believe it or not, how we insure our cars. If you're barely using your car compared to before, your current insurance policy might no longer fit your lifestyle.

In this post, you’ll learn how remote work affects auto insurance, what affects your premiums, what options are out there, and how to adjust your coverage without confusion.

Does Working From Home Affect Your Auto Insurance?

Yes, and it starts with how insurers calculate your rate.

Auto insurance companies look at several risk factors when pricing your premium. One of the most important is how often and how far you drive. If you're no longer commuting every day, that detail alone can move you into a different risk category.

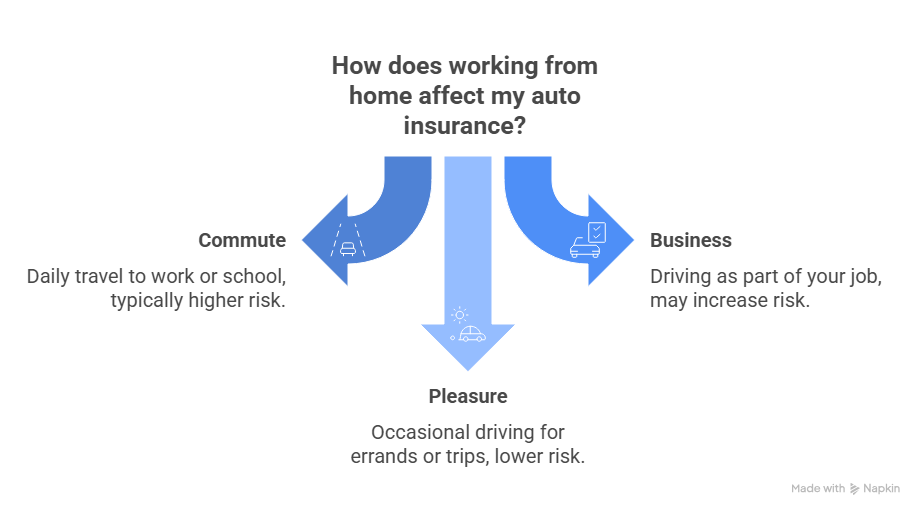

Insurers typically classify vehicle usage into three types:

- Commute: Daily travel to and from work or school.

- Business: Driving as part of your job (e.g., real estate agent, delivery).

- Pleasure: Occasional driving, like errands or weekend trips.

If your driving now falls under "pleasure use" due to remote work, that can result in a lower premium. However, this won’t happen automatically; you’ll need to tell your insurer.

Can You Lower Your Premium by Driving Less?

Yes. Many insurance companies offer low-mileage discounts, especially if you drive under a certain annual threshold (usually 7,500 miles/year or less).

Let’s say, before remote work, you were driving 12,000 miles a year. If that number has dropped to 3,000 or less, you're likely eligible for a discount. Some insurers apply mileage bands with different pricing tiers. The fewer miles you drive, the lower the perceived risk, and the lower your rate.

Examples of potential savings:

- Geico: May offer up to 15% off for low mileage.

- State Farm Drive Safe & Save: Uses app tracking; lighter drivers often save 10–30%.

- Nationwide SmartMiles: Pay-per-mile option that’s ideal for occasional drivers.

It’s worth checking the exact mileage listed on your current policy. If it no longer reflects your usage, update it right away.

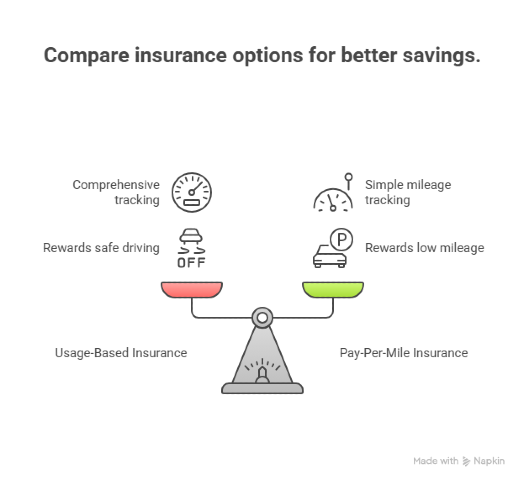

Usage-Based and Pay-Per-Mile Insurance: Is It a Better Fit?

If your driving habits have changed significantly, usage-based insurance (UBI) or pay-per-mile policies might make more sense for you.

How it works:

- You install a device in your car or use a mobile app that tracks your driving behavior.

- Some track only miles driven. Others also monitor speed, braking, acceleration, and phone use.

Who benefits most:

- People who drive less than 8,000 miles per year

- Safe drivers who avoid hard stops or fast acceleration

- Remote workers who mostly use the car for errands or weekend outings

Well-known programs:

- Progressive Snapshot

- Allstate Drivewise

- Liberty Mutual RightTrack

- Nationwide SmartMiles

What to Tell Your Insurance Company

If your job situation has changed, it’s on you to update your insurer. They don’t automatically lower your rate just because you started working remotely.

Here’s what to discuss:

- Your current average weekly mileage

- Whether your driving is mostly personal use or mixed with business

- If your car is now parked in a different location (garage vs. street, new ZIP code)

- If your commute status has changed permanently or temporarily

If you're unsure, ask: “Does my current policy reflect how little I drive now?”

Make these updates during renewal or whenever your situation changes severely. You can also request a mileage review mid-policy if your usage drops.

Insurance Tips for Digital Nomads and Hybrid Workers

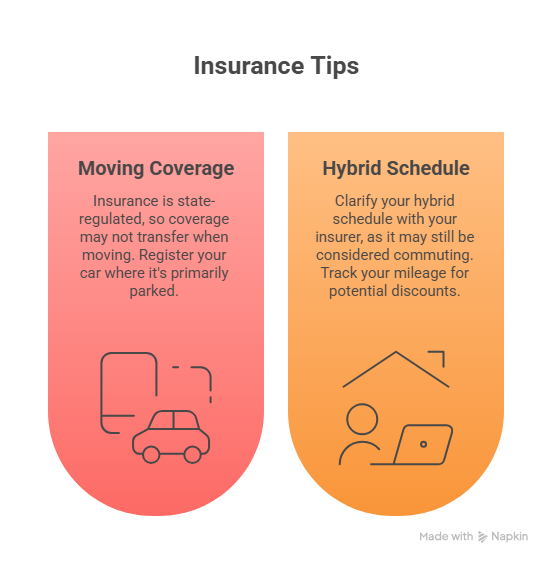

Remote work doesn’t always mean staying home. Maybe you're working from Airbnbs across the country or splitting time between cities. Here’s what to keep in mind:

If you’re on the move:

- Insurance is regulated by state. If you move, even temporarily, your coverage might not follow you.

- Most insurers require you to register the car in the state where it’s primarily parked.

- Long-term travel? Some companies offer non-owner insurance or allow policy flexibility across state lines, but it varies.

If you're hybrid :

- Be clear with your insurer. A hybrid schedule often still counts as "commute" use.

- Track your real mileage to see if you're below discount thresholds.

Don’t assume your policy covers your situation just because it’s remote-friendly. Ask detailed questions, especially if your work setup is non-traditional.

Parking, Location, and Other Factors to Reconsider

You might think driving less is all that matters, but where you park and where you live also affect your rate.

Parking

- Cars parked in garages often have lower premiums than those on the street.

- Your insurer may ask if your vehicle is parked in a secured building, private driveway, or public street

ZIP Code

Even if you don't drive much, your location plays a role:

- High-theft or high-accident ZIP codes mean higher rates.

- Some remote workers have moved from cities to suburbs; this change alone could lead to savings if reported properly.

If you've moved or changed parking situations since switching to remote work, your insurance company should know.

Best Auto Insurance Options for Remote Workers in 2025

Here are some insurers offering good options for people driving less:

Before switching, compare:

- Your actual annual mileage

- Whether you’re okay with being tracked

- Any fees or base rates included

Even if you’re with a major insurer, call and ask about WFH-related discounts; they may not be advertised, but can be applied if you qualify.

Save on Remote Worker Auto Insurance with Mila

If you work remotely and you’re driving less, you shouldn’t keep paying the same as someone who commutes every day. The smartest move is to compare, adjust, and make sure your policy matches your lifestyle today.

With Mila, that process is simple. You’ll get fast, free quotes from trusted providers offering the lowest legal rates, no hidden fees, and no wasted time. At Mila, we help you save money while keeping full protection for whatever the road brings. When it comes to auto insurance that fits your new way of living, Mila is the best choice to find it.

Working remotely means driving less; make sure your insurance reflects that. Compare with Mila today.

Frequently Asked Questions (FAQs) About Auto Insurance for Remote Workers

Does working from home automatically reduce my car insurance?

No. Your insurance company doesn’t adjust your premium unless you report the change. You need to update your annual mileage and how you use your car. Once they have the new details, they may apply a discount or reclassify your policy.

Can I suspend part of my coverage if I barely drive?

You can usually lower coverage levels, but fully pausing isn’t realistic unless you put the car in storage. Liability insurance is required in almost every U.S. state. A better option is asking your insurer about low-mileage or pay-per-mile policies instead of dropping coverage completely.

What happens if I move to another state?

Each state has its own insurance requirements. If you change your permanent residence, you’ll need to update your registration and insurance to match the new state’s minimums. Failing to do so could leave you underinsured—or even driving illegally.

Is usage-based insurance really cheaper?

It is often the case that if you drive very little and have safe habits. For example, if you stay under 7,000 miles a year and avoid sudden braking or speeding, usage-based programs can cut your premium by 10–30%. But if you drive more than expected or have aggressive driving patterns, traditional policies may be cheaper.