Auto Insurance Comparison: Tips That Save You Money

Shopping for auto insurance can feel overwhelming, especially when prices vary so much from one company to another. Understanding how to compare options effectively helps you avoid overpaying and ensures you're getting the right coverage for your needs.

In this post, you’ll learn how to evaluate comparison prices like a pro, avoid common mistakes, and uncover hidden savings opportunities so you can protect your car and your wallet with confidence.

Why Auto Insurance Prices Vary So Dramatically

Insurance companies use complex algorithms to calculate risk and determine your rates. These calculations consider numerous variables, explaining why prices can differ dramatically between providers.

Some primary factors affecting your insurance costs include:

- Your driving history (accidents, tickets, claims)

- Vehicle make, model, and year

- Your location and typical driving environment

- Annual mileage

- Your age, gender, and marital status

- Credit score (in most states)

- Coverage levels and deductibles

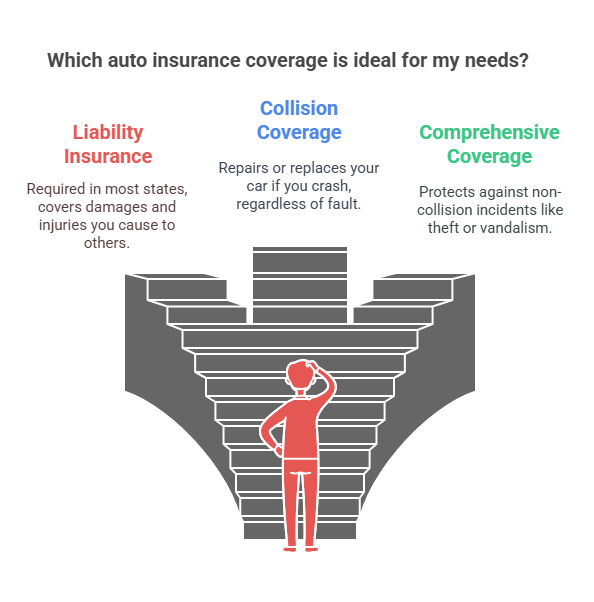

How to Find Your Ideal Coverage Levels

To make smart choices when shopping for auto insurance, you need to understand the different types of coverage available. Each one serves a specific purpose, and the right mix depends on your vehicle, lifestyle, and budget.

Here’s a quick guide to the most common options:

- Liability insurance: This is required in most states. It covers damages and injuries you cause to others in an accident.

- Collision coverage: Pays to repair or replace your car if you crash into another vehicle or object, regardless of who’s at fault.

- Comprehensive coverage: This protects against non-collision incidents like theft, fire, hail, or vandalism.

- Uninsured/underinsured motorist coverage: Steps in when the at-fault driver doesn’t have enough insurance to cover your damages.

- Personal injury protection (PIP): This covers your medical expenses and sometimes lost wages, no matter who caused the accident.

Your ideal coverage depends on several factors. Do you have a new, valuable vehicle? Comprehensive and collision coverage make sense. Driving an older car worth just a few thousand dollars? You might consider liability-only coverage.

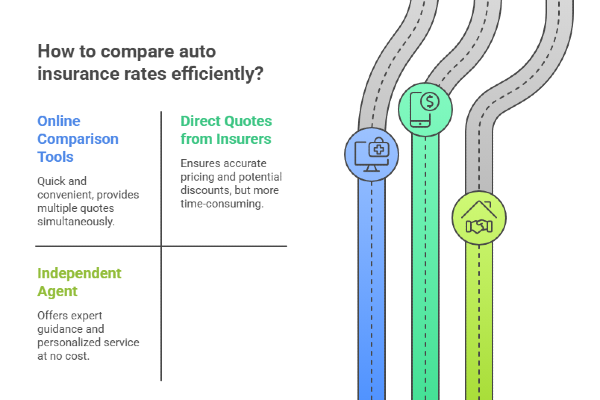

Top Methods for Comparing Auto Insurance Rates

Once you understand your coverage needs, it's time to compare auto insurance quotes efficiently. Thankfully, there are several reliable ways to get accurate comparison prices without wasting hours of your time.

1. Online Comparison Tools

The internet has revolutionized insurance shopping. Comparison websites allow you to enter your information once and receive quotes from multiple providers simultaneously.

Popular comparison platforms include:

2. Direct Quotes from Insurers

Contacting insurance companies directly often reveals the most accurate pricing. While more time-consuming than using comparison tools, this method ensures you receive the most current rates and available discounts.

Many insurers offer online quote tools on their websites, making the process relatively painless. For the most personalized experience and potential savings, consider following up your online quote with a phone call to an agent.

3. Working with an Independent Agent

Independent insurance agents represent multiple companies and can do much of the comparison legwork for you. Unlike captive agents who work exclusively with one insurer, independent agents can shop your policy across various providers.

The best part? Their services typically cost you nothing, as they earn commissions from insurance companies.

A knowledgeable agent brings several advantages:

- Expert guidance on coverage options

- Insider knowledge of company-specific discounts

- Assistance with the application process

- Support when filing claims

How to Ensure You're Making Fair Comparisons

One common mistake people make when comparing insurance quotes is focusing solely on the bottom-line premium. However, meaningful comparisons require attention to several details:

1. Match Coverage Limits Exactly

When requesting quotes from different providers, use identical coverage limits and deductibles. Even small variations can impact pricing.

For example, a policy with a $500 deductible will cost more than one with a $1,000 deductible. Similarly, $100,000 in liability coverage will be less expensive than $300,000 in coverage.

2. Consider Company Reputation and Service Quality

The cheapest policy isn't always the best value. Some insurers offer rock-bottom rates but provide frustrating experiences when you need to file a claim.

Research each company's reputation by:

- Checking consumer satisfaction ratings from J.D. Power

- Reading reviews on sites like Trustpilot or Consumer Affairs

- Reviewing complaint ratios through your state's insurance department

- Checking financial strength ratings from organizations like A.M. Best

3. Look Beyond the Premium

Examine the complete picture when evaluating insurance offers. Some companies provide valuable extras that might justify a slightly higher premium:

- Accident forgiveness programs

- Diminishing deductibles

- Roadside assistance

- Rental car coverage

- App-based services and digital tools

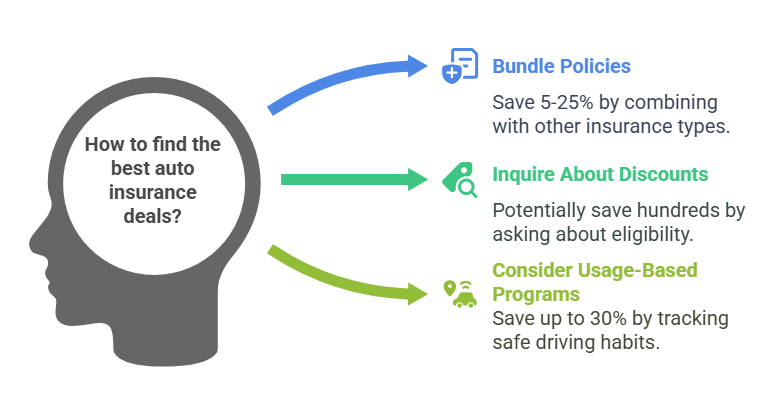

What Strategies You Can Use to Find the Best Auto Insurance Deals

If you want to lower your auto insurance costs without sacrificing quality, a few smart strategies can go a long way. These tips help you uncover savings that many drivers overlook when comparing prices.

1. Bundle Your Policies

Most insurers offer substantial discounts when you purchase multiple policies together. Combining auto insurance with homeowners, renters, or other coverage types frequently results in savings between 5% and 25%.

When comparing options, request quotes both as standalone auto policies and as part of a bundle. The difference might surprise you!

2. Ask About Discounts You Qualify For

Insurance companies offer numerous discounts, but they won't always proactively apply them to your policy. Be proactive and inquire about all available savings opportunities.

Common discounts include:

- Safe driver discounts

- Low mileage discounts

- Good student discounts

- Professional organization memberships

- Military service discounts

- Senior discounts

- Vehicle safety feature discounts

- Paperless billing discounts

A simple conversation about discount eligibility could save you hundreds annually.

3. Consider Usage-Based Insurance Programs

Many insurers now offer technology-based programs that track your driving habits and reward safe behavior with lower rates.

These programs monitor factors like:

- Acceleration and braking patterns

- Speed

- Time of day you drive

- Overall mileage

If you're a careful driver who doesn't travel excessive distances, these programs could yield significant savings. Some customers report discounts of up to 30% through usage-based options.

How Often Should You Compare Auto Insurance Rates?

Price optimization, the practice of gradually increasing premiums for loyal customers who seem unlikely to shop around, is common in the insurance industry. To avoid falling victim to this practice, regular price comparisons are essential.

1. The Ideal Comparison Schedule

Most experts recommend comparing auto insurance rates at least once a year, typically a month before your current policy's renewal date. This timing allows sufficient opportunity to switch providers if you find a better deal.

Each of these situations can substantially impact your insurance costs, potentially creating opportunities for savings:

- Moving to a new address

- Purchasing a new vehicle

- Adding or removing drivers from your policy

- Major changes in your credit score

- Significant changes in your annual mileage

2. The Smart Way to Switch Insurers

If you discover a better rate elsewhere, consider these important steps before making the switch:

- Verify the new company's reputation before committing

- Time the transition carefully to avoid coverage gaps

- Ask your current insurer about matching the competitor's rate

- Check for cancellation fees or refunds of prepaid premiums

- Ensure your new policy is active before canceling the old one

Common Mistakes to Avoid When Comparing Insurance

Comparing auto insurance quotes is smart, but only if you do it right. Many people make avoidable mistakes that lead to poor decisions or missed savings.

- Focusing Exclusively on Price: While finding affordable coverage is important, remember that quality matters tremendously when you need to file a claim. The cheapest policy might cost you significantly more in frustration and out-of-pocket expenses later.

- Failing to Disclose Relevant Information: Honesty is crucial when applying for insurance quotes. Omitting accidents, tickets, or other relevant information might initially result in lower quoted rates but can lead to denied claims or policy cancellation when discovered.

- Setting Deductibles Too High: While increasing your deductible lowers your premium, be careful not to set it higher than you could comfortably pay in an emergency. An unaffordable deductible defeats the purpose of having insurance.

- Overlooking Discounts and Bundling Opportunities: As mentioned earlier, failing to inquire about all available discounts can cost you significantly over time. Always ask for a complete list of potential savings opportunities.

Compare Auto Insurance with Confidence with Mila

Comparing auto insurance isn’t just about getting a cheaper premium; it’s about making confident decisions that suit your real needs. When you take the time to understand your coverage options, compare policies fairly, and avoid common pitfalls, you set yourself up for better protection, smarter spending, and long-term peace of mind behind the wheel.

If you want a fast, reliable way to compare auto insurance rates, Milaquote is a top choice. It connects you with over 55 trusted insurance providers nationwide, offering access to real-time comparison prices adapted to your profile. Mila’s platform is easy to use, transparent, and designed to help you find the best policy in minutes.

Start comparing with Mila today and find your perfect policy in minutes.

Frequently Asked Questions (FAQs) About Comparing Auto Insurance Prices

What’s the best way to compare auto insurance prices?

Start with trusted online comparison platforms like Milaquotes, which connects you to multiple top-rated insurers in minutes. Mila is known for making the process fast, transparent, and user-friendly. You can also check quotes directly on insurer websites or consult an independent agent for personalized recommendations.

How often should I compare auto insurance quotes?

Ideally, once a year or when major life changes occur, moving, buying a car, or adding a driver. Insurance rates change, and staying updated helps you find better comparison prices regularly.

Are cheaper insurance policies always a good deal?

Not always. Low prices can mean limited coverage or less reliable service. Focus on value: the right balance of price, protection, and company reputation.